Start Investing with ZERO Brokerage

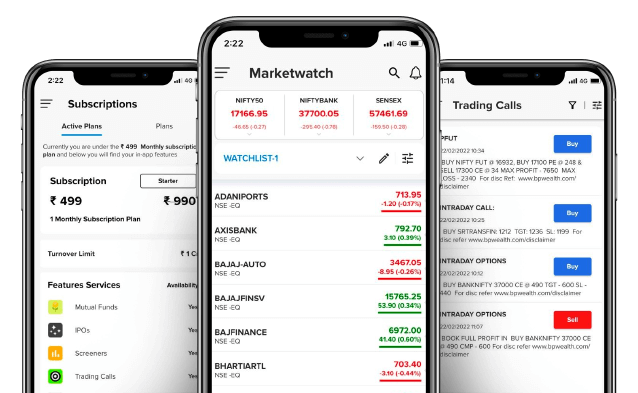

What is StoxBox

StoxBox is a subscription-based stockbroking platform for retail investors, aimed towards client centricity and making wealth creation simple. We believe in educating people about the stock market and teaching them the skills required to ace the stock market and make their own trading calls confidently and independently.

Explore Portfolios

Ready-Made portfolios only with StoxBox

Momentum 500 Box

Passively Managed Advisory Product 21Y CAGR: 32.38%

Digital

Box

Passively Managed Advisory Product 21Y CAGR: 33.05%

Public Sector Box

Actively Managed Advisory Product 2Y CAGR: 38.39%

Chemical

Box

Passively Managed Advisory Product 21Y CAGR: 40.04%

Pharma

Box

Passively Managed Advisory Product 21Y CAGR: 22.53%

Why Go Anywhere Else, When You Have StoxBox

Research Recommendations

Institutional grade research quality at Your Fingertips, only with StoxBox. Our analysts’ coverage extends across asset classes, providing all the insights.

ProTips

With our award-winning research, you get the best of our ProTips across Options Strategies, Momentum Picks and much more.

IPO Recommendations

At StoxBox, we do in-depth analysis of each IPO based on finely distilled metrics and tell you whether a particular IPO is a ‘Go’ or a ‘No Go’.

Ready-made portfolios

Each Ready-Made portfolio is powered by top quality research and investment strategy, created and managed by qualified SEBI registered professionals.

50+ Stock Screeners

With StoxBox, you will now be able to sort through and execute over 50+ of your favourite technical & fundamental screeners.

0 Brokerage

Join now and avail 0 brokerage on Turnover of up to 1 Cr.

Everyone Has a Plan

So Do We 🙂

Introductory

Subscription Plan

-

1 Cr Monthly Turnover

-

Unlimited ProTips

-

Ready-Made Portfolios

-

50+ Stock Screeners

Introductory

Subscription Plan

-

12 Cr Yearly Turnover

-

Unlimited ProTips

-

Ready-Made Portfolios

-

50+ Stock Screeners

Standard

Rates Applied

-

Standard Brokerage as defined

-

Unlimited ProTips

-

Ready-Made Portfolios

-

50+ Stock Screeners

Research Trusted By Institutions

Here are a few reasons to love StoxBox

Frequently Asked Questions

- Address proof

- Permanent Account Number (PAN) card

- Passport-sized colour photographs

Subscribe to the plans and avail 0 brokerage on Turnover of up to 1 Cr.

Unlimited ProTips

With our award-winning research, you get the best of our ProTips across Options Strategies, Momentum Picks and much more.

Timely Exit Calls

Keep pace with the market movements and get notified on the right time to exit.

Trading workstation

Get access to technical platform and dashboard to make the most of every opportunity

50+ Stock Screeners

Sort through and execute over 50+ of your favourite technical & fundamental screeners.

Podcast every morning on twitter Spaces

Be upto date with the daily morning podcast

© 2023 BP Group All Rights Reserved

*All subscription pricing plans mentioned across the website are exclusive of 18% GST

By signing up, you agree to receive transactional messages on WhatsApp. You may also receive a call from a BP Wealth representative to help you with the account opening process

Disclosures and Disclaimer: Investment in securities markets are subject to market risks; please read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Past performance is not indicative of future results. Details provided in the above newsletter are for educational purposes and should not be construed as investment advice by BP Equities Pvt. Ltd. Investors should consult their investment advisor before making any investment decision. BP Equities Pvt Ltd – SEBI Regn No: INZ000176539 (BSE/NSE), IN-DP-CDSL-183-2002 (CDSL), INH000000974 (Research Analyst), CIN: U45200MH1994PTC081564. Please ensure you carefully read the Risk Disclosure Document as prescribed by SEBI | ICF

Attention Investors

- Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020.

- Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

- Pay 20% upfront margin of the transaction value to trade in cash market segment.

- Investors may please refer to the Exchange’s Frequently Asked Questions (FAQs) issued vide circular reference NSE/INSP/45191 dated July 31, 2020 and NSE/INSP/45534 dated August 31, 2020 and other guidelines issued from time to time in this regard.

- Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month.

Issued in the interest of Investors

Communications: When You use the Website or send emails or other data, information or communication to us, You agree and understand that You are communicating with Us through electronic records and You consent to receive communications via electronic records from Us periodically and as and when required. We may communicate with you by email or by such other mode of communication, electronic or otherwise.

Investor Alert:

- Prevent Unauthorised Transactions in your demat account –> Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from CDSL on the same day………………….issued in the interest of investors.

- KYC is one time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

- No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account.

BP Equities Pvt Ltd – SEBI Regn No: INZ000176539 (BSE/NSE), INZ000030431 (MCX/NCDEX), IN-DP-CDSL-183-2002 (CDSL),

INH000000974 (Research Analyst) CIN: U45200MH1994PTC081564

BP Comtrade Pvt Ltd – SEBI Regn No: INZ000030431 CIN: U45200MH1994PTC081564

For complaints, send email on investor@bpwealth.com

Copyrights © 2023 BP Group All Rights Reserved