Why you should add them to your portfolio

The Indian investment market is full of money-making opportunities, with investors increasingly commonly investing in stocks and mutual funds. However, for investors looking to better their portfolio health by diversifying and lowering the risk exposure, the capital market offers a gem: ETFs. Exchange-traded funds (or ETFs) are a type of investment tool that involves a collection of securities – such as stocks, debts, bonds, etc. and are directed towards a certain type of industry, sector, index (NIFTY, Sensex) or asset classes such as gold or silver.

How Do ETFs Work?

Most ETFs are registered with the Securities and Exchange Board of India and include characteristics of both stocks and mutual funds. Similar to stocks, units of ETFs are listed on the Indian stock exchanges such as NSE and BSE but are managed by Asset Management Companies that also manage Mutual Funds. ETFs follow the same principle of price fluctuation: If the price of any of the assets in the basket rises, the price of the ETF also rises as a result, and vice versa. For example, if a gold ETF is priced at 300 Rupees and the absolute price of gold rises, the ETF’s price will also rise over 300 Rupees until it reaches the current price position of gold in the open market.

The investors also earn dividends on the ETFs they hold. If an ETF includes a stock that has declared a dividend, the same is provided to you as per the invested amount.

From an investors perspective, managing ETFs can be done in two ways: Actively and Passively. Actively managed ETFs are supervised by expert portfolio managers. They invest in companies with high profit-making potential after deeply analyzing past patterns and current market conditions. On the other hand, passively managed ETFs are created to invest in the stocks of companies that are listed in specific market indices, such as the NIFTY 50 or NIFTY Next 50.

Types of ETFs

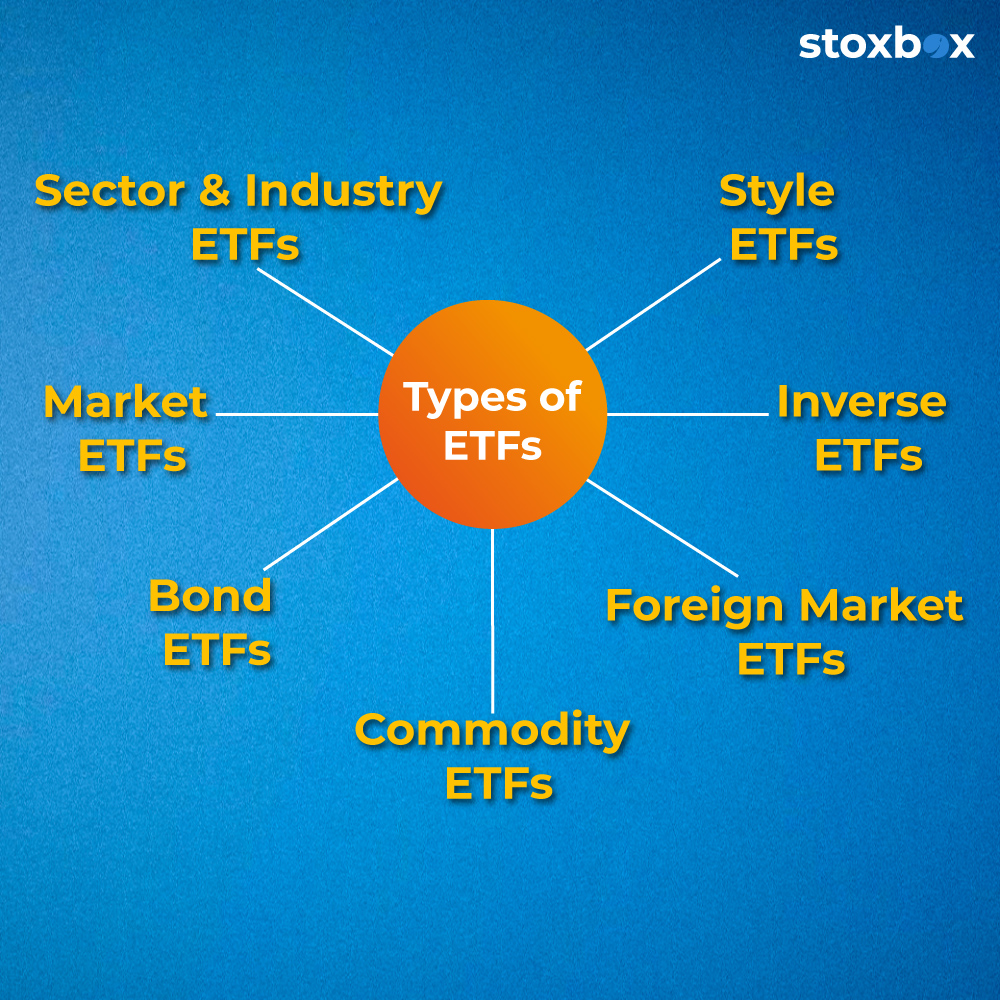

As ETFs are created to track specific industries or investment strategies, investors can invest in the following ETFs as per their preference and investment goals:

Market ETFs: Created to track and mirror a specific index such as BSE Sensex, NIFTY 50, NIFTY NEXT 50, etc. As they diversify within numerous stocks, the risk is low to moderate.

Bond ETFs: Created to provide an option to investors to invest in virtually any available bond; Central government, corporate, international, state government (SDLs), etc. Excluding corporate bond ETFs which can be highly risky at times, bond ETFs offered by the government is the least risky in nature.

Sector and Industry ETFs: Designed to allow investors to invest in specific industries such as oil and natural gas, energy, pharma, telecom, etc. As industries are subject to government laws and external factors, they carry moderate to high risk.

Commodity ETFs: Created to provide investment opportunities to investors by tracking the price of various commodities such as gold, silver, aluminium, corn, pulses, etc. Commodity ETFs see a high level of price fluctuation, making them an investment tool with moderate to high risk.

Style ETFs: Created and operated in a way to mirror a particular investing style or focus on a specific capitalization segment such as blue-chip, large-cap, or mid-cap. As style ETFs can be analyzed based on past performance or data, they offer a low to moderate level of risk.

Foreign Market ETFs: Designed to track and allow investors to invest in non-Indian markets such as the US’s S&P 500 Index, Australia’s S&P/ASX 200, or Hong Kong’s Hang Seng index. Foreign market ETFs are known to be volatile and thus carry moderate to high risk.

Inverse ETFs: Designed to work on the principle of short selling, they operate to profit due to the decline in the price of the underlying asset or the market index. The risk level varies depending on the asset or the index, however, inverse ETFs are generally considered to carry high risk.

Advantages of ETFs

High Returns, less risk: Chances of loss in ETFs are considerably lower than other investment tools. As the risk exposure is divided among several stocks or securities, the loss realized from a single security is covered by the profits of others. Most ETFs that mirror the high potential market indices are known for providing high returns on the investment as the securities tracked are financially sound with high growth potential.

Easy to Trade: ETFs differ from Mutual Funds as they can be bought and sold with ease. Unlike Mutual Funds that can only be traded once a day after the market’s closure, an investor can trade ETFs more actively by placing their orders any time before the market closes. Apart from having no lock-in period, ETFs offer a faster settlement ratio when compared to Mutual funds. Furthermore, ETFs also provide the facility to do intraday trading, where they can be bought and sold in a single day.

Portfolio Diversification: Unlike investing in stocks where the profits are limited to a single company’s performance, ETFs provide the opportunity to spread the risk and profit-making potential over various different securities and asset classes. This type of diversification allows the investors to earn high returns along with considerably lowering their risk exposure by way of the law of averages.

Lower Costs: ETFs are considered to be far more cost-efficient than other investment tools of the same category. Unlike Mutual funds, ETFs carry no exit or entry load and offer investors a tool where they end up paying lower taxes in both short term and long term categories.

ETFs industry has been a platform for innovation since they were first introduced in 2001. As India is witnessing a major stock market revolution with the Sensex touching the 50,000 mark, investors are provided with a golden opportunity to invest in high yielding ETFs. However, choosing an ETF includes a deep understanding of the market along with a high-risk level attached to some types of ETFs. Stoxbox provides the ideal solution in its ETF box called the Aver Growth Box. The product is a basket of ETFs with a CAGR of 46.76% aimed at providing superior risk-adjusted returns. Investing in high potential companies listed in NIFTY 50, it is the perfect investment solution for investors looking to buy high yielding ETFs.

You might also Like.

Beginners Guide to Candlesticks and Candlestick Patterns

When you invest in the stock market, you need to look...