Where to invest money is always a confusing question for most of us. You want safe investments that offer good returns. Mutual funds are one such option that combines the expertise of professionals and allows you to invest in stock markets without the need to track them constantly.

Mutual funds pool money from investors and are managed by a fund house. The fund manager, appointed by the fund house, is a qualified professional who purchases stocks, bonds, commodities, and debentures as per the investment mandate. There are some great investing options and apps for beginners that can help you in your decision-making.

10 Myths Mutual Funds 2021

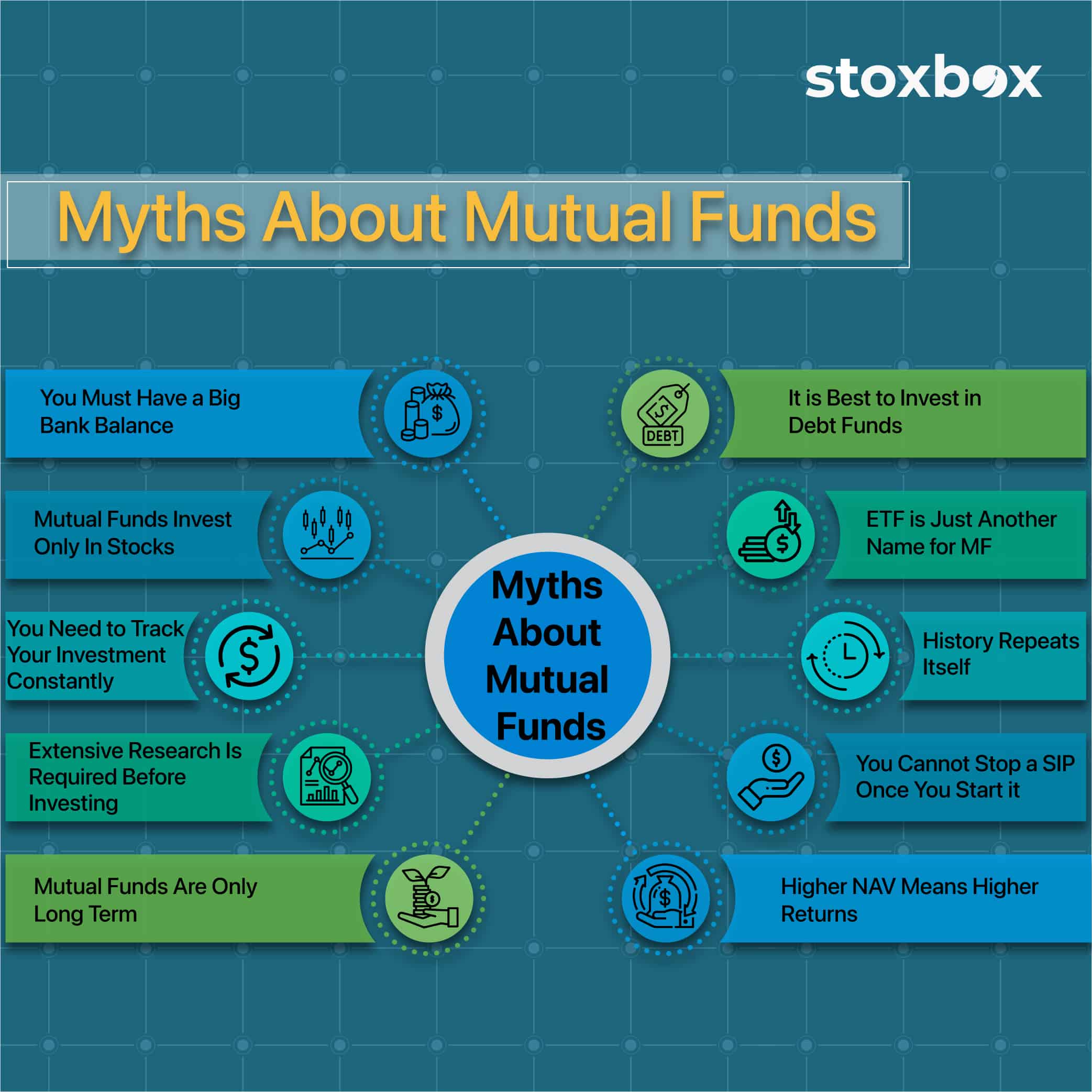

Myths About Mutual Funds

If you want to invest in a mutual fund and are hesitant to do so because of something you heard or read, we are here to help you debunk some myths.

- You Must Have a Big Bank Balance

You do not require a large amount of money to start investing in mutual funds. You have many options to choose from and can begin with as low as Rs. 500 monthly. Mutual funds offer you a chance to start small and then increase your investment. You can also invest as and when you like depending upon available funds or your financial goals. You could make a one-time investment or invest a fixed amount (big or small) every month through Systematic Investment Plans.

Tip: Start early, even if you can invest only a little, to benefit from the magic of compounding.

10 Myths Mutual Funds 2021

- Mutual Funds Invest Only In Stocks

Mutual funds offer you a lot of diversity. You can choose a fund depending on your risk appetite or financial goals. You could invest in stocks (of course!); you could choose to invest in MFs that have bonds, commodities, real estate, or currencies in their portfolio.

Tip: Diversify your portfolio across asset classes; diversification will hedge your risk.

10 Myths Mutual Funds 2021

- You Need to Track Your Investments Constantly:

Do you think that if you invest in an MF, you will have to track it constantly? Then we have good news for you. Tracking your mutual funds on an everyday basis is not required. Mutual funds have professionals who manage the fund as per the fund objective; it is their job to monitor the portfolio closely.

Tip: It is a good idea to review your mutual fund investments periodically to assess if you need to make changes to them.

- Extensive Research Is Required Before Investing

Investing in a mutual fund does not require you to research complicated balance sheets or make complicated calculations. Depending on your financial goal and risk appetite, you can choose funds with 1ready-made portfolios as per your requirements. Quick research for investment options in India can help you zero down on the best funds based on the parameters set by you.

Tip: You can use the Stoxbox to research and choose a fund based on your requirements.

- Mutual Funds Are Only Long Term

One of the advantages of investing in an MF is that they offer a lot of choice and flexibility. You can invest for the long term as well as for the short term in mutual funds. Categories to look out for investing for the short term or medium term are liquid funds or short-term debt funds.

Tip: Investing in funds for different durations has advantages; choose carefully after looking at the mutual fund objective and your requirements.

10 Myths Mutual Funds 2022

- It is Best to Invest in Debt Funds

Investing in debt and fixed income mutual funds gives you stable returns but, the returns will not be very high. Investing in equity-based funds can help you create wealth by beating inflation.

If you are young and are willing to take some risk, you could choose a thematic fund. Thematic investment is choosing funds that invest in equities tied to a theme like an infrastructure or information technology fund.

If you have a slightly lower risk appetite, hybrid funds that combine debt and equity are an option to consider.

Tip: Choose the fund that matches your risk appetite, beginning at a young age allows you to take more risks.

- ETF is Just Another Name for MF

Exchange-traded funds (ETF) are sometimes mistaken to be the same as mutual funds. While both do have similarities, there are some fundamental differences between them. An ETF is passively managed, while an MF is managed actively by a fund manager who has expertise. ETFs can be actively traded, unlike MFs. You can buy or sell the mutual fund unit at the end of the trading day, while you can buy or sell an ETF throughout the day. ETFs offer more tax benefits owing to the manner of their creation and redemption.

Tip: It is a good idea to have both MFs and ETFs in your portfolio as each has its unique advantages.

- History Repeats Itself

The past performance of a fund is not always sustained in the future. If the IT sector was booming a decade back, the same might not be the case in the current scenario. You cannot invest in an IT-based fund expecting the same kind of returns. The converse is also true; if a fund has not done well in the past, the same may not happen in the future too.

Tip: Check for ratings and research offered by experts before making a choice.

- You Cannot Stop a SIP Once You Start it.

Systematic Investment Plans (SIPs) are a flexible option to invest in MFs. You can invest a fixed amount every month in the fund of your choice. You can stop the SIP if you want to by contacting the fund house and completing the required formalities. The fund house will not charge any penalty if you stop investing in a SIP.

Tip: It is advisable to continue with a SIP if you have started one as investing regularly offers benefits of rupee cost averaging and the power of compounding.

- Higher NAV Means Higher Returns.

Higher Net Asset Value (NAV) is not an indicator of high returns. NAV is an indicator of the fund’s intrinsic value but is not an indicator of the fund’s performance. NAV for older funds is higher than newer funds as the NAV increases with time.

Tip: Look for consistency in performance, expense ratio, investment objective, etc., when choosing the fund to invest

Conclusion

You can choose from various types of investment options depending on your requirements. Mutual funds are amongst the most versatile options, so do not let some myth dissuade you from investing in them. Choose wisely; BP Wealth offers some great insights for beginners and the experienced as well.

You might also Like.

No posts found!