The “top-down” and “bottom-up” methods are two ways of judging and picking a stock for investment. Learn how these investment modes differ and which one you should choose.

Introduction

When investing money in stocks, you need to pick the right stocks that can generate the maximum returns on your investments. To do so, different qualitative and quantitative analysis tools help you analyse stocks. Two such tools are the “top-down” and the “bottom-up” analysis of investing.

Do you know what they are? Let’s explore.

What is “top-down” investing?

“top-down” investing involves starting the analysis from a broader perspective and then moving down to other, specific factors. In the “top-down” approach, investors first assess the macroeconomic factors that affect the markets. Then, they identify the sectors that would perform well given the assessed macroeconomic factors. Lastly, they filter down to stocks belonging to such sectors that they believe would perform well and then invest in the stock market.

So, in a “top-down” investing approach, you move from the top to the bottom –

For example, during the COVID pandemic, the economy entered a slowdown, and the health segment was very much in demand. So, given the macroeconomic trend of the pandemic, the pharmaceutical sector is performing well, and so, you can invest in pharma stocks for good returns.

The “top-down” model of investing uses the following factors when picking stocks –

- GDP of India and the world

- Economic growth of India and other countries

- RBI’s monetary policy

- Economic inflation and the movement in commodity prices

- Prices of bonds and their current and expected yields

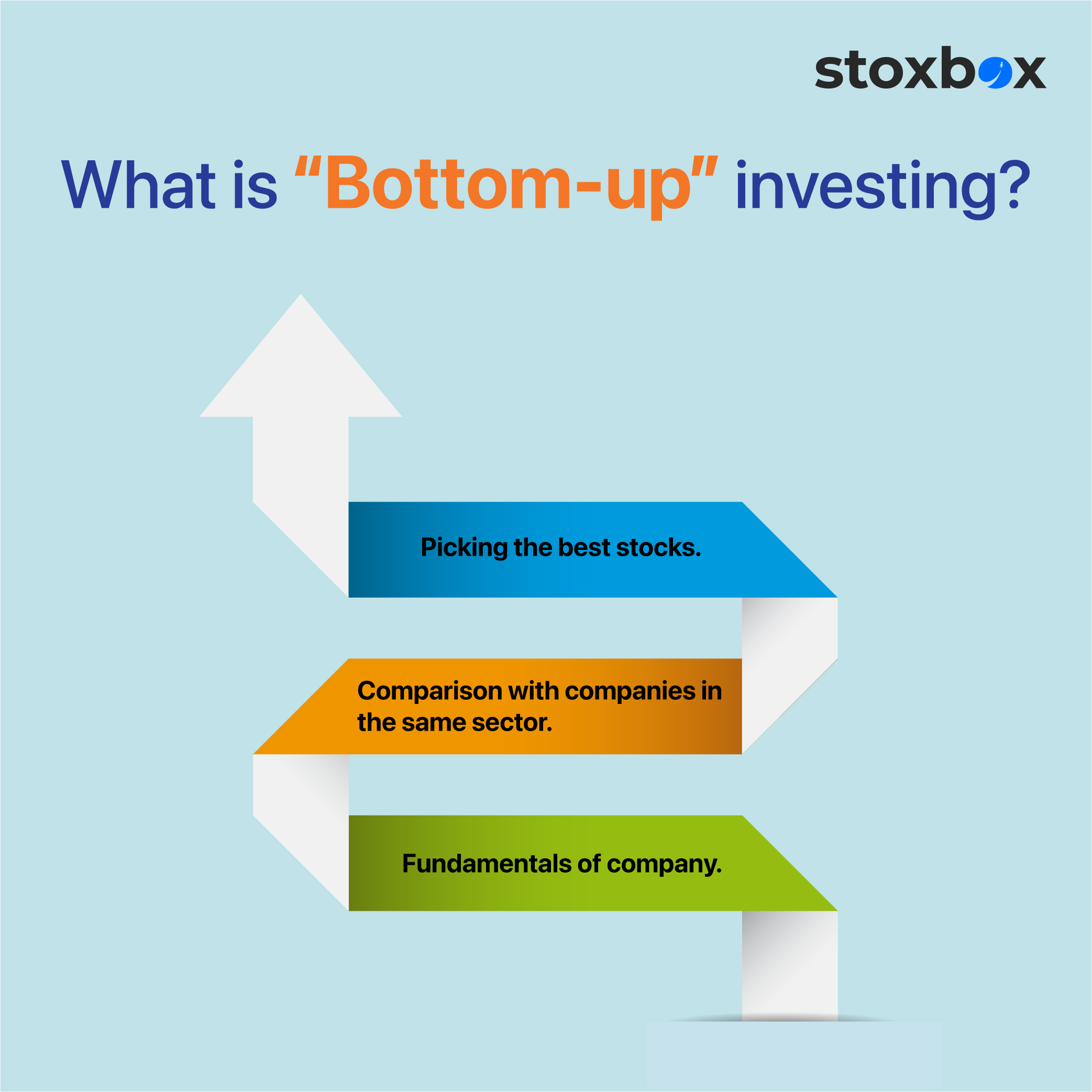

What is “bottom-up” investing?

The “bottom-up” investing approach is the complete opposite of the “top-down” method of investing. Under the “bottom-up” analysis, you start by assessing a particular company’s fundamentals, comparing these fundamentals with its competitors, and then assessing if the stock is worth investing in. In “bottom-up” investing, investors assess and pick specific stocks rather than checking the broader macroeconomic factors.

Under the “bottom-up” pyramid, the investing options approach you. Therefore, move from the bottom to the top.

For the “bottom-up” investing analysis, the following factors are assessed by investors and analysts –

- Financial ratios of a company calculated using the company’s financial statements. Important ratios include the Price-Earnings Ratio, return on capital employed, profit margins, current ratio, etc.

- Current and expected earnings.

- Revenue of the company.

- Trend analysis of the company’s turnover.

- Cash flow analysis of the company.

- The products offered by the company, their demand, market share, and its USP

- The management of the company.

- The company’s performance vis-a-vis its competitors

If the fundamental and technical analysis of a company comes out positive using the factors mentioned above, investors invest in the company’s stocks irrespective of the market movements.

How do “top-down” and “bottom-up” investing differ from one another?

The comparative difference between the “top-down” and “bottom-up” approach of investing can be assessed through the following table –

Points of difference | Top-down investing | Bottom-up investing |

Method of analysis | The wider macroeconomic trends are assessed which, then help in identifying the top-performing sectors of the market. Then, stocks of companies belonging to the top-performing sectors are chosen. | The fundamental and technical analysis of a particular stock is conducted and then compared with stocks of other companies. Then, the best stock is picked. |

Factors considered | Trends in the economy, global trends, monetary policies, GDP, etc | Company’s financial ratios, quality of its management, type of product and market share, etc |

Alignment with market performance | Under this investing, stocks are picked based on the market sentiments. | Under this investing, stocks are picked if the company’s fundamental and technical analysis yields a favourable picture irrespective of the prevalent market sentiments. |

Performance of the overall sector | If the macroeconomic trends are favourable towards a particular sector, all companies’ stocks are expected to perform well. Thus, investors can pick stocks of any company in the specific industry and expect growth. | If the stocks of a company perform well, it does not guarantee that the overall sector would also perform well. Investors try to pick stocks of such companies that are expected to outperform their competitors. |

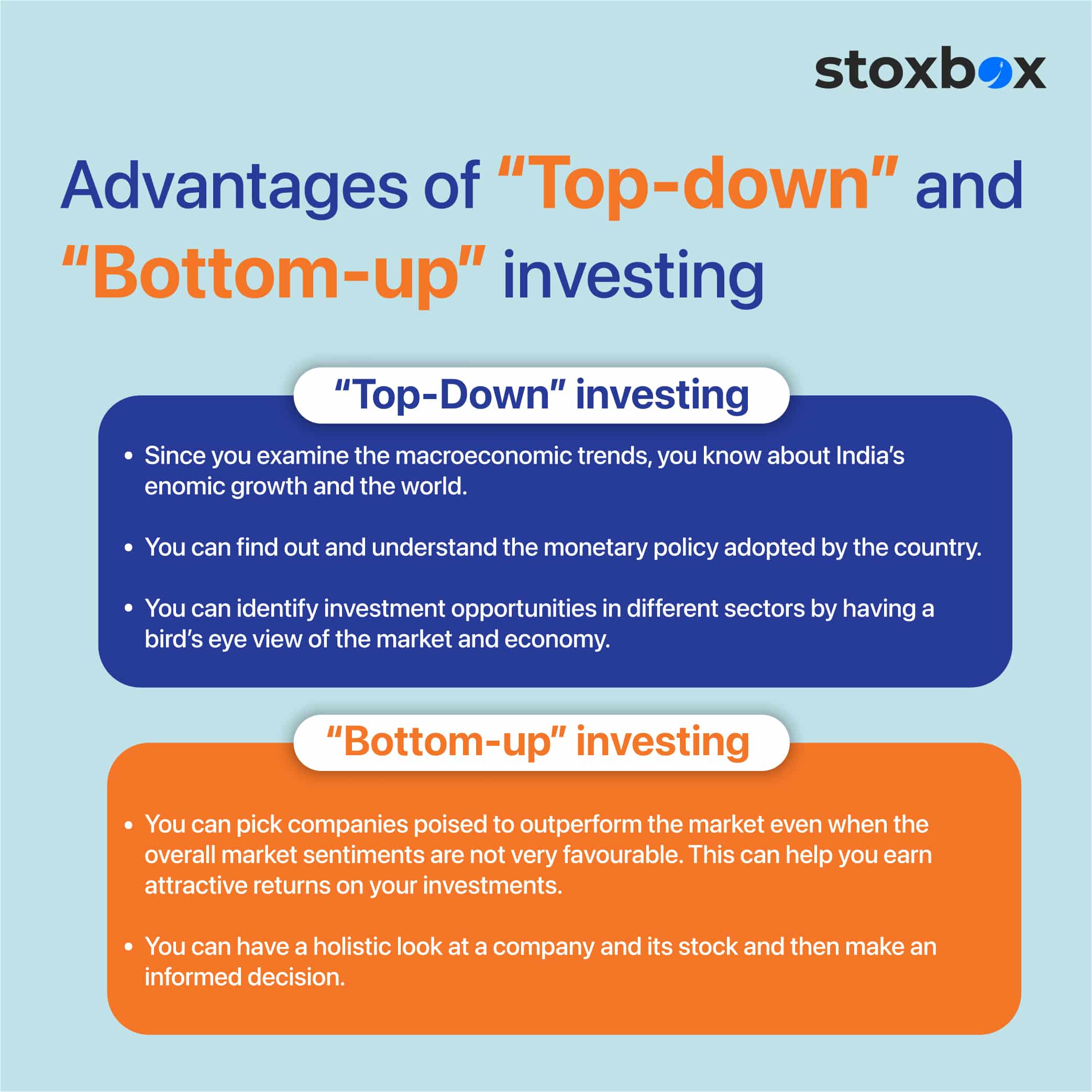

Advantages of “top-down” and “bottom-up” investing

Both these investing techniques have their respective advantages. Let’s have a look-

- Advantages of “top-down” investing

- Since you examine the macroeconomic trends, you know about India’s economic growth and the world.

- You can find out and understand the monetary policy adopted by the country.

- You can identify investment opportunities in different sectors by having a bird’s eye view of the market and economy.

- Advantages of “bottom-up” investing

- You can pick companies poised to outperform the market even when the overall market sentiments are not very favourable. This can help you earn attractive returns on your investments.

- You can have a holistic look at a company and its stock and then make an informed decision.

Which one should you choose?

If it comes to choosing between these investment strategies, there cannot be one answer. Both these strategies have their respective pros and cons, so using them would be the ideal solution.

You should, therefore, combine both “top-down” and “bottom-up” approaches to stock investing and pick stocks that show the potential of growth on both these approaches. While the “top-down” approach can help you pinpoint the sector you can pick, the “bottom-up” method can help you choose the best companies in the said sector. So, the stocks on which these investing techniques overlap would be the best bet.

If you are wondering where to invest money so that both these techniques are used, you can opt for Stoxbox. Stoxbox is a ready-made portfolio that gives you a basket of different types of investment assets. Out of the different investment options in India, Stoxbox also contains quality stocks that are selected using both fundamental and technical analysis. Moreover, through Stoxbox, you can also benefit from diversification as Stoxbox has a combination of the best 2021 investments in India.

Furthermore, before investing in stocks, you need a complete understanding of the stock market. Stocks are not safe investments as their value fluctuates continuously. Read this beginner’s guide to stock trading to understand how the market works. Also, be knowledgeable about the rules of stock trading to generate profits on your investments.

So, when indulging in stock market investing, don’t forget to look out for both these investing strategies. Assess and analyse stocks on different parameters to make an informed investment.

You might also Like.

No posts found!