Concept of Value Brokers

In the realm of investment, the allure of safe havens like Gold, Real Estate, Insurance, and Fixed Deposits has long been an entrenched tradition. However, amidst these traditional options lies a powerful yet often overlooked asset class: equities. Often deemed riskier, equities have proven their mettle over the long-term by delivering substantial returns, outpacing other asset classes. The key to unlocking their potential lies in the hands of a novel concept: the Value Broker.

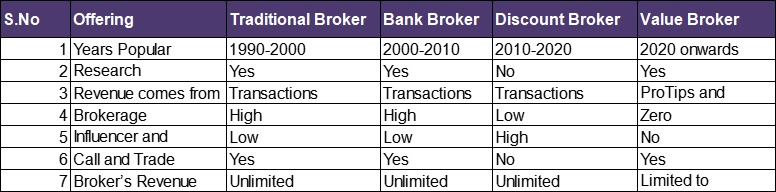

In our journey towards investment prosperity, the role of intermediaries cannot be underestimated. Yet, the choices among these intermediaries have traditionally revolved around Traditional Brokers, Bank Brokers, and Discount Brokers. These entities primarily focus on providing transactional platforms, relegating equity research to a secondary role. However, a refreshing paradigm shift is ushered in by the emergence of the Value Broker, exemplified by pioneering leaders such as StoxBox. For value brokers the business model is unique and customer centric. We believe the future of Indian stock broking is creating value for the customers and not transactional brokerage. Our aim is to help the Indian investors and traders to access only the SEBI-registered quality research and create wealth from stock markets.

An interesting study done by the market regulator SEBI, came out with interesting facts about traders that came into light, which were eye openers for all. Some interesting facts came out, which suggests:

- 89% of the individual traders (i.e. 9 out of 10 individual traders) in equity F&O segment incurred losses6, with an average loss of Rs 1.1 lakh during FY22, whereas, 90% of the active traders incurred average losses of Rs 1.25 lakh during the same period.

- For the group of active traders (excluding outliers7), on average, loss makers registered net trading losses close to Rs 50,000 in FY22.

- For the group of active traders (excluding outliers), the average loss of a loss maker was over 15 times the average profit by a profit maker during FY22.

The distinguishing factor that sets StoxBox apart lies in its unwavering commitment to cultivating value. Rather than treating transactions as the core revenue stream, StoxBox adopts a distinctive approach. It positions itself as a trusted partner, offering personalised guidance to empower investors in their decision-making process and bolster their success in the share markets. The crux of their business centres around the subscription-based product “StoxCalls,” a flagship offering that provides cutting-edge research and insightful advisories. This approach ensures that research remains unbiased, solely aimed at aiding investors in reaping profits.

The Value Broker model encourages financial inclusion by offering free transaction platforms. This unique stance underscores our dedication to imparting knowledge and wealth-building strategies without the undue burden of transactional costs. StoxCalls extends beyond conventional research, empowering investors to leverage tools such as technical analysis, futures trading, and option strategies through specialised courses known as “MentorBox.”

MentorBox is a groundbreaking initiative that takes education to the next level. Combining theoretical coursework with live trading mentorship, it equips users with real-time insights into expert trading practices. Participants gain first hand exposure to how seasoned traders leverage StoxCalls and other tools during live market hours, driving profitable outcomes. Diversifying portfolios, crafting strategic investment approaches, and navigating the nuances of intraday trading tactics are all part of StoxBox’s comprehensive mentoring ecosystem.

Central to the Value Broker model is the ethos of empowerment through knowledge. Unlike the plethora of free information available from various sources, StoxBox’s approach transcends unsolicited advice. They provide strategic guidance on entry and exit points, duration of holdings, and risk management, minimising the impact of impulse-driven decisions. This customer-centric approach aligns StoxBox’s earnings with the success of its clients. The crux lies in ensuring customers perceive tangible value in the services, driving long-term commitment and subscription renewals.

Value Brokers emerge as an indispensable link in the investment value chain. They bridge the gap between financial information and actionable insights, transforming raw data into meaningful strategies. By aligning their revenue with the profitability of their clients, Value Brokers dispel the scepticism often associated with transaction-focused brokers. This symbiotic relationship is based on a simple premise: customers stay engaged and renew subscriptions when their investments yield profits.

The StoxBox model represents a quantum leap in the financial services landscape. It heralds a new era where success is not measured solely by transactions conducted, but by the positive impact on investors’ financial well-being. The essence of value broking is not confined to a transactional interaction; it embodies a holistic approach that guides investors towards a more secure and prosperous future.

The rise of Value Brokers like StoxBox redefines the landscape of investment intermediaries. They transcend the conventional transaction-focused model by prioritising knowledge sharing, personalised advisories, and skill development. In a world inundated with financial information, Value Brokers stand as beacons of clarity and strategic direction, helping investors navigate the complex realm of equities with confidence. The era of value-driven broking is upon us, where the true measure of success is measured not only in financial gains but in the empowerment and prosperity of each investor they serve.

Key Takeaway:

- Value Brokers will always provide unbiased research recommendations.

- For value brokers the business model is unique and customer centric.

- Central to the Value Broker model is the ethos of empowerment through knowledge

You might also Like.

Union Budget 2026-27 Impact on Sectors

Edit Announcement Companies Impact Rare earth permanent magnet manufacturing programme...