Easy way for understanding market dynamics and Stock recommendations by StoxBox

Table of Contents

In today’s dynamic and volatile stock market, stock recommendations have become an essential tool for traders and investors alike. Stock recommendations are typically provided by financial analysts, research firms, or stockbrokers who analyse various factors such as a company’s financial performance, economic trends, and market sentiment to provide advice on which stocks to buy, hold, or sell. These recommendations can provide valuable insights for investors looking to make informed decisions, especially in a fast-moving market like the stock market in India.

While stock recommendations are helpful, it’s crucial to understand that they should be used as part of a broader investment strategy. In this article, we’ll dive deep into how to use stock recommendations effectively, the advantages of following them, common mistakes to avoid, risk management strategies, and more.

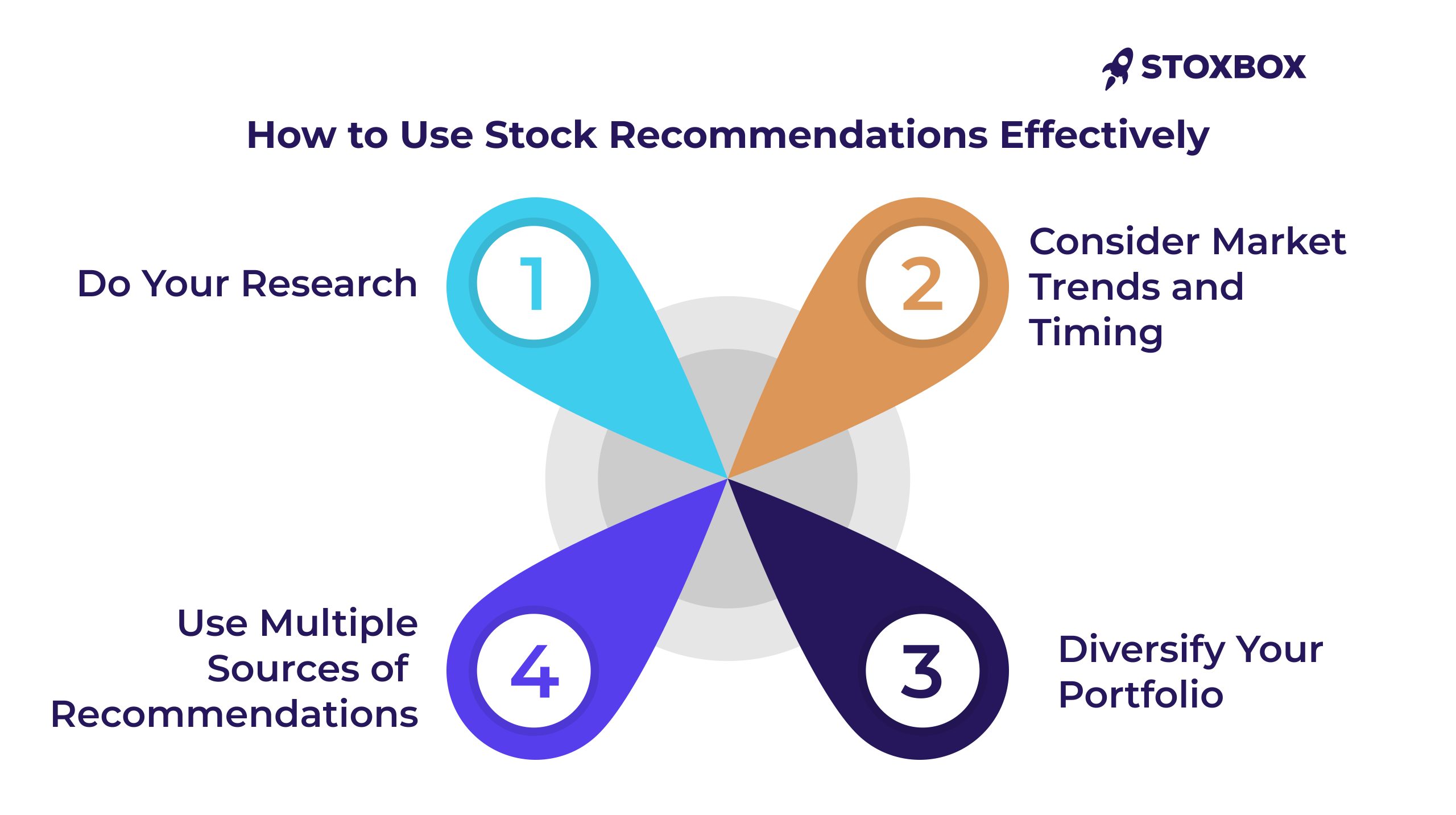

How to Use Stock Recommendations Effectively

Using stock recommendations effectively requires a balanced approach, combining them with personal research and risk assessment. Here’s how you can make the most out of stock recommendations:

1. Do Your Research

Even though stock recommendations can offer valuable insights, it’s essential to conduct your own research. Analysts’ predictions, such as stocks to buy, are based on specific financial models and market conditions, but personal financial goals, risk tolerance, and time horizons should also influence your decision.

Some stocks may fit perfectly into your long-term portfolio, while others may only be suitable for short-term gains. Ensure you analyze key financial metrics, company fundamentals, and broader market trends before jumping into any trades.

2. Consider Market Trends and Timing

Stock market conditions play a significant role in stock performance. For example, a market prediction may show a bearish or bullish sentiment, which could affect the price movement of the stocks. Look at how market trends align with the stock recommendations before making a purchase.

For instance, during volatile markets, intraday stocks may offer quick profit opportunities, but they come with higher risk. If you’re a day trader, focusing on intraday stocks can help identify short-term plays. However, if you’re a long-term investor, you might be more interested in blue-chip stocks for the long term.

3. Diversify Your Portfolio

Stock recommendations often focus on individual picks, but it’s crucial to maintain a well-diversified portfolio. Don’t invest all your funds into one or two stocks based on recommendations alone. Instead, consider spreading your investments across various sectors and asset classes to minimize risk and maximize returns.

4. Use Multiple Sources of Recommendations

Relying on one source for stock recommendations can limit your perspective. Leverage multiple analysts’ insights, from brokerage firms, financial news outlets, and independent researchers. Cross-referencing different opinions can give you a clearer picture of which stocks might be the best to buy.

Advantages of Following Stock Recommendations

Following stock recommendations has several benefits, especially if you’re new to the stock market or don’t have the time to conduct in-depth research. Here are some advantages:

1. Expert Insights

One of the most significant advantages of following stock recommendations is gaining access to expert insights. Professional analysts have access to detailed corporate reports, earnings data, and industry-specific trends that are often not easily accessible to individual investors. These analysts use sophisticated tools and models to evaluate a company’s performance and potential, assessing factors such as financial health, growth prospects, and market conditions.

By leveraging their expertise, investors can make more informed decisions on which shares are best to buy. This can help investors avoid the pitfalls of emotional or uninformed trading, allowing them to focus on high-quality opportunities vetted by professionals. For example, an analyst may highlight today’s best share by analyzing a company’s earnings growth, competitive advantage, and broader economic factors that might not be immediately obvious to the average investor.

2. Time Efficiency

The stock market operates at a rapid pace, with prices fluctuating throughout the trading day. Keeping up with the market’s movements can be overwhelming, especially for those with busy schedules or limited time to spend on research. Following stock recommendations provides a more time-efficient approach, allowing investors to make quick, well-informed decisions without having to constantly monitor market data. By relying on expert recommendations for shares, you can save time while still making timely investment decisions.

This is especially beneficial for part-time investors or individuals who have other professional or personal commitments but want to participate in the stock market. Rather than spending hours researching financial reports, trends, and earnings, you can focus on the vetted suggestions provided by experts. This can also help you capitalize on fast-moving opportunities, such as intraday stocks.

3. Reduced Research Burden

Conducting thorough research on individual stocks requires not only time but also a certain level of expertise. For new or less-experienced investors, the amount of data available can be overwhelming, and understanding metrics like P/E ratios, debt-to-equity ratios, and profit margins may be challenging. Stock recommendations help to simplify this process. Professionals have already done the heavy lifting, providing you with a filtered list of the best shares to buy today, based on their in-depth analysis.

For example, an analyst might recommend the best share to buy today for intraday, offering a short-term trading opportunity based on technical analysis, trends, and volume data. This reduces the need for investors to have in-depth financial knowledge, while still benefiting from well-researched investment choices. Relying on recommendations also helps investors avoid the common mistake of getting bogged down in too much data or analysis paralysis.

4. Confidence in Decision Making

Making investment decisions can be intimidating, especially in a volatile or unpredictable market. Following expert stock recommendations can instill greater confidence in your decisions, as they are backed by detailed research and analysis. Knowing that experienced professionals have evaluated today’s best share to buy can help you feel more secure in your choices. This is particularly important for new investors who may otherwise second-guess their trades or be hesitant to invest due to fear of loss.

Even seasoned investors can benefit from the confidence that comes with following expert advice, as it provides an extra layer of validation for their strategies. Recommendations on stocks can act as a guide, providing investors with a sense of direction in a rapidly changing market. While no recommendation is foolproof, having a solid basis for your decisions can reduce anxiety and help you stick to your investment strategy, especially when market volatility increases.

5. Diversification Assistance

In addition to providing specific stock recommendations, professional analysts often suggest a diversified set of investment options that help spread risk. Whether it’s finding the best penny stocks to buy for high-risk, high-reward strategies or identifying the best stocks to buy in India for short-term gains, following expert recommendations can help investors achieve a balanced portfolio. A well-diversified portfolio reduces risk, as gains in one area can offset losses in another.

Recommendations can include stocks from various sectors, industries, or asset classes, ensuring that your investments are not overly concentrated in one area. By following expert recommendations, you can easily gain exposure to different segments of the market, further enhancing your ability to manage risk and achieve steady returns.

6. Access to Specialized Knowledge

Analysts often specialize in certain sectors, industries, or markets. By following their recommendations, investors can tap into specialized knowledge that they might not possess themselves. For instance, an analyst with deep expertise in the technology sector might suggest the best intraday stocks within that industry, providing insights into emerging technologies or companies poised for growth.

Similarly, experts in sectors such as pharmaceuticals, real estate, or financials can offer targeted recommendations that help investors diversify their portfolios with high-potential stocks that align with broader market trends.

7. Adapting to Market Changes

Market conditions can change rapidly due to economic events, political developments, or unexpected global crises. Stock recommendations are often updated to reflect these changes, helping investors stay ahead of the curve. For example, analysts might suggest different stocks based on the latest earnings reports, market sentiment, or government policies.

By staying attuned to these expert updates, investors can quickly adapt their strategies to changing conditions, whether it means buying new stocks or selling off underperforming ones. This agility is essential in today’s fast-paced market, where the ability to respond to new information can significantly impact investment outcomes.

By combining these advantages, stock recommendations provide both new and experienced investors with the tools they need to make informed, confident, and timely decisions in the stock market.

Common Mistakes to Avoid and Risk Management Strategies

Stock recommendations can be beneficial, but they also come with certain risks. To make the most out of these insights, it’s important to be aware of common pitfalls while implementing solid risk management strategies. Here’s a combined approach to avoid mistakes and manage your risk effectively:

Avoid Blindly Following Recommendations

One of the biggest mistakes investors make is acting on a recommendation without understanding the rationale behind it. Just because an analyst suggests a particular stock doesn’t mean it’s suitable for your risk profile or overall investment strategy.

- Risk Management Tip: Always conduct your own research to understand why a recommendation was made. Assess how it fits your financial goals, risk tolerance, and portfolio structure before acting.

Don’t Over-rely on Short-Term Picks

Many investors in India get caught up in short-term predictions like intraday recommendations without thinking about their broader portfolio. While short-term gains can be enticing, they also come with increased risk and volatility.

- Risk Management Tip: Diversify your investments across short-term and long-term opportunities. Relying solely on short-term intraday stocks can be risky. Instead, allocate only a portion of your capital for short-term plays while keeping a balanced approach with long-term investments.

Consider Market Conditions

It’s a common mistake to overlook broader market trends. During times of high volatility, recommendations for intraday or highly speculative stocks might seem promising but could be highly risky depending on the current market environment.

- Risk Management Tip: Always analyze broader market trends and current economic indicators before making a move. In India, keeping track of important indices like NIFTY 50 and Sensex, and staying updated on news regarding RBI policies or geopolitical events, will help you determine if the timing is right for executing the recommended trade.

Avoid Focusing Solely on Price Movements

Many traders make the mistake of buying stocks based solely on recent price movements, without evaluating the company’s fundamentals. Price alone doesn’t provide a complete picture of a stock’s value or future performance.

- Balanced Evaluation: Look beyond price movements. Evaluate the company’s revenue growth, earnings stability, industry positioning, and overall financial health. Recommendations make more sense when paired with strong fundamentals, especially in sectors like IT, banking, or pharmaceuticals, which are major players in the Indian market.

Set Stop Losses to Protect Your Investments

No matter how promising a stock recommendation seems, risk is always present. Using stop losses can help safeguard against significant downturns.

- Actionable Strategy: Set stop losses at a fixed percentage below the purchase price, such as 5-10%. This approach ensures that losses are limited if the stock’s price starts to move in the wrong direction. For Indian investors, setting stop losses is particularly crucial during times of market volatility driven by global economic events or policy announcements by the government.

Practice Proper Position Sizing

Allocating too much of your portfolio to a single stock is risky, even if highly recommended. If that one stock underperforms, it could drastically impact your overall returns.

- Actionable Strategy: Use proper position sizing by limiting the amount invested in each individual stock. Diversification across different sectors, such as FMCG, banking, and energy, can help minimize the risk of significant portfolio damage from a single underperforming stock.

Stay Informed About Market Changes

The market environment can change rapidly due to political events, economic shifts, or company-specific news. Relying solely on static recommendations can lead to missed opportunities or misinformed decisions.

- Risk Management Tip: Stay updated with news related to your investments and the broader market. Use news platforms like Moneycontrol, Economic Times, or NDTV Profit to ensure you’re informed about any developments that may impact your stocks.

Diversify Across Sectors

Diversification is key to reducing risk. Putting all your money into a single sector could expose you to higher risks if that sector underperforms.

- Actionable Strategy: Spread your investments across different sectors and asset classes. For example, if you invest in technology stocks, also consider adding exposure to other industries such as healthcare, banking, or consumer goods. This helps stabilize returns and manage risk more effectively, especially in the Indian market where certain sectors might outperform others based on government policies or budget announcements.

Conclusion

Stock recommendations can be an invaluable tool for investors looking to navigate the complexities of the stock market. Whether you’re eyeing intraday stocks or searching for the best shares to invest in long-term, following expert advice can provide actionable insights. However, it’s crucial to approach these recommendations with a clear strategy, conduct personal research, and manage risks effectively.

As you explore the stocks, remember that successful investing requires patience, due diligence, and a well-diversified portfolio. By leveraging stock recommendations thoughtfully and avoiding common mistakes, you can improve your investment outcomes while protecting your capital.

Always balance expert advice with your risk tolerance and personal financial goals, and you’ll be well-equipped to make informed decisions in today’s fast-moving stock market.

Frequently Asked Questions

Can Stock Recommendations Guarantee Investment Success?

No, stock recommendations cannot guarantee success. While based on expert analysis, the stock market is influenced by unpredictable factors like volatility, economic changes, and geopolitical events. Blue-chip stocks may offer opportunities, but they should be used as guidance alongside your own research. There are no guarantees in the stock market.

Can Stock Recommendations Help in Long-Term Investment Planning?

Yes, stock recommendations can help with long-term planning. Experts analyze growth potential, financial health, and market trends to suggest stocks with strong future prospects. However, align recommendations with your financial goals, risk appetite, and time horizon. Always review if recommended stocks fit within your long-term strategy.

How Do Market Conditions Impact the Effectiveness of Stock Recommendations?

Market conditions greatly impact recommendations. Factors like economic cycles, interest rates, and geopolitical events influence stock prices. A recommendation may perform well in a bullish market but struggle during a downturn. Understanding current market conditions is crucial before investing.

What Should I Consider Before Following a Stock Recommendation?

Consider your financial objectives, risk tolerance, and investment timeline. Ensure the recommended stocks align with your portfolio and meet your short-term or long-term goals.

How Do Experts Determine the Top Stocks to Buy Today?

Experts use financial statements, earnings reports, industry performance, and market trends to identify top stocks. They also use technical analysis and sentiment to pinpoint stocks with growth potential or undervaluation. The goal is to find good opportunities based on both short-term and long-term potential.

How Can I Tailor Stock Recommendations to Fit My Personal Investment Goals?

Assess your risk tolerance, investment timeframe, and objectives. If you seek long-term stability, focus on blue-chip stocks. For short-term goals, consider recommendations for intraday stocks.

How Should I Treat Conflicting Stock Recommendations from Different Analysts?

Evaluate the data behind each recommendation, including the analyst’s track record and the type of analysis used (technical vs. fundamental). Diversify if multiple stocks have solid fundamentals to balance potential risks.

Your Wealth-Building Journey Starts Here