Rajkot Blaze Sparks Decline

- 12th December 2024

Aaj Ka Bazaar

Wall Street indices closed mostly higher, with the S&P 500 gaining 0.82% and the Nasdaq Composite surging 1.77% to hit the 20,000 mark for the first time. The rally in tech stocks, driven by hopes of looser regulations under Donald Trump’s presidency and optimism around AI-driven earnings growth in the coming quarters, showed no signs of slowing. However, the Dow Jones edged down by 0.22%. These movements were supported by the US inflation report, which solidified expectations of a Federal Reserve rate cut next week. Asian markets largely tracked the gains from the US markets, closing in positive territory. Japan’s Nikkei rose by 1.5%, while Hong Kong’s Hang Seng and China’s CSI 300 added 0.12% and 0.14%, respectively. Indian benchmark indices are expected to open on a muted note but may gain momentum and turn positive, reflecting the global cues. In stock-specific news, ACME Solar Holdings secured the 250 MW FDRE Project W Firm and Dispatchable Renewable Energy in an e-reverse auction conducted by NHPC at a Rs. 4.56 per unit tariff. Additionally, a greenshoe option could potentially double the project’s capacity to 500 MW, increasing ACME Solar’s total capacity to 6,970 MW.

Markets Around Us

BSE Sensex –81,506.27 (0.02%)

Nifty 50 – 24,615.75 (-0.11%)

Bank Nifty – 53,382.50 (-0.02%)

Dow Jones – 44,030.80 (-0.26%)

Nasdaq – 20,032.76 (1.76%)

FTSE – 8,301.62 (0.26%)

Nikkei 225 – 39,899.82 (1.34%)

Hang Seng – 20,501.14 (1.69%)

Sector: Packaged Foods

Rajkot Factory Fire Hits Gopal Snacks

On December 12, Gopal Snacks shares fell following a major fire at its snacks manufacturing unit near Rajkot, Gujarat. The fire, which broke out on December 11, required 14 fire tenders to contain, with no injuries reported as the site had minimal staff due to a holiday. To mitigate the impact, the company has scaled up production at its facilities in Modasa and Nagpur and is collaborating with third-party manufacturers to meet demand. All assets are insured, and critical systems remain operational with no data loss or IT disruptions, ensuring smooth business continuity. Efforts are underway to restore operations at the affected unit quickly, and the management anticipates no long-term impact on financial performance. The company continues to maintain its position in the market, with its stock trading between its 52-week high and low range.

Why it Matters:

This incident highlights the importance of operational risk management for manufacturers. Despite the fire, Gopal Snacks showcased resilience by leveraging backup facilities and ensuring business continuity. It reassures investors that the company is prepared to handle disruptions without significant long-term financial impact.

NIFTY 50 GAINERS

TECHM – 1793.80 (1.76%)

INFY – 1994.75 (1.04%)

TCS – 4469.25 (0.94%)

NIFTY 50 LOSERS

TATACONSUM – 920.20 (-1.59%)

COALINDIA – 410.90 (-1.45%)

APOLLOHOSP – 7240.00 (-1.37%)

Sector: Pharmaceuticals

Neuland Shares Slide After Block Deal

Neuland Laboratories shares dropped 8% on December 12 after a ₹780 crore block deal, with Smallcap World Fund reportedly selling its 3.8% stake. Around 4.9 lakh shares exchanged hands at ₹15,900 each, a 6% discount to the previous close, causing a sharp rise in trading volumes far above the monthly average. Reports suggest the deal was aimed at raising ₹747 crore for the fund, signaling its exit from the stock. This comes amid a 10% decline in Neuland Labs’ stock over the past week, driven by uncertainty around the US Biosecure Act. The Act, crucial for boosting demand for Indian CDMO firms under the China+1 strategy, failed to pass through a key defence bill, tempering optimism for the sector.

Why it Matters:

The block deal and Smallcap World Fund’s exit highlight significant investor activity, which can impact market sentiment. The broader decline in Neuland Labs’ stock reflects growing concerns over the stalled US Biosecure Act, a potential catalyst for Indian CDMO growth. This uncertainty could affect long-term prospects for the sector.

Around the World

Asian stocks mostly rose on Thursday, driven by gains in U.S. technology stocks after inflation data boosted expectations of a Federal Reserve interest rate cut next week. U.S. consumer prices grew as expected in November, leading markets to price in a 98% chance of a 0.25% rate cut. Chinese markets gained as investors awaited economic stimulus details from the Central Economic Work Conference. Japan and South Korea saw tech-driven rallies, while Australia’s shares dipped as strong jobs data reduced chances of near-term rate cuts. Mixed performances were seen in other Asian markets, with investor focus split between local and global economic cues.

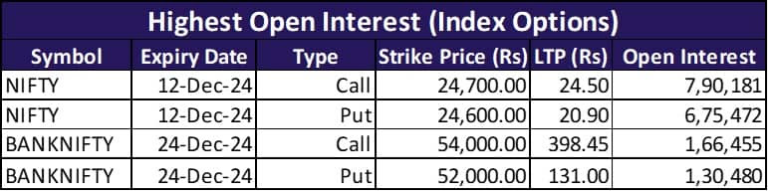

Option Traders Corner

Max Pain

Nifty 50 – 24,600

Bank Nifty – 53,400

Nifty 50 – 24,639 (Pivot)

Support – 24,585, 24,531, 24,478

Resistance – 24,694, 24,747, 24,803

Bank Nifty – 53,501 (Pivot)

Support – 53,378, 53,180, 53,057

Resistance – 53,447, 53,246, 53,210

Did you know?

Indian Digital Milestone Achieved

India has generated over 138 crore Aadhaar numbers, transforming digital identity verification. DigiLocker now serves 37 crore users, securely storing 776 crore documents. The DIKSHA platform has facilitated 556 crore learning sessions and achieved nearly 18 crore course enrollments.