RVNL Gains on Nagpur Metro Deal

- 17th December 2024

Aaj Ka Bazaar

Indian benchmark indices, Sensex and Nifty, are likely to open on a cautious note, following Gift Nifty cues which is trading 24.50 points down. Investors in the Indian stock markets are likely to stay cautious as they wait for the US Federal Reserve’s upcoming decision on interest rates and any clues about its plans for next year. However, the strong performance of the Nasdaq and S&P 500 on Wall Street may help boost some stocks in India. While South Korean markets are down due to political uncertainties, most markets in the Asia-Pacific region are rising ahead of the Federal Reserve’s decision. In stock-specific news, Vedanta will be in focus after announcing its fourth interim dividend, and Varun Beverages is making news after acquiring a 39.93% stake in Lunarmech.

Markets Around Us

BSE Sensex –81,511.81 (-0.29%)

Nifty 50 – 24,584.80 (-0.34%)

Bank Nifty – 53,394.10 (-0.35%)

Dow Jones – 43,701.82 (-0.04%)

Nasdaq – 20,161.15 (1.18%)

FTSE – 8,262.05 (-0.46%)

Nikkei 225 – 39,510.88 (0.14%)

Hang Seng – 19,698.57 (-0.49%)

Sector: Constructions

RVNL Wins ₹270Cr Maharashtra Metro Contract

RVNL shares rose 2.5% to ₹482 after winning a ₹270-crore contract from Maharashtra Metro Rail Corporation. The project includes constructing 10 elevated stations for Nagpur Metro’s Phase II, targeting completion in 30 months. Seven stations are planned in Reach 3A, including Rajiv Nagar and APMC, while three stations are in Reach 4A, like Pardi and Transport Nagar. This follows RVNL’s recent ₹186.76-crore project win for East Central Railway. Despite Q2 profit declining 27% due to margin pressure, RVNL shares have surged 159% in 2023.

Why it Matters:

RVNL’s ₹270-crore Nagpur Metro contract win underscores its growing role in India’s infrastructure sector, boosting its project pipeline. This comes amid recent financial challenges, including profit declines and operational margin pressures. Despite this, RVNL’s strong performance in 2023, with shares up 159% year-to-date, reflects investor confidence in its long-term growth prospects.

NIFTY 50 GAINERS

CIPLA – 1475.80 (1.89%)

TATAMOTORS – 789.25 (0.57%)

NTPC – 353.60 (0.20%)

NIFTY 50 LOSERS

SHRIRAMFIN – 3096.05 (-1.32%)

INFY – 1961.40 (-0.94%)

EICHERMOT – 4794.00 (-0.92%)

Sector: IT

Wipro Secure $40M Deal for US Acquisition

Wipro’s shares rose to ₹312 after announcing a $40 million deal to acquire US-based Applied Value Technologies and its affiliates. This acquisition is aimed at enhancing Wipro’s enterprise application services and attracting new clients. The deal involves cash payments and a performance-based earnout, with completion expected by December 2024. While Applied Value’s revenue surged from $0.8 million in 2021 to $19.4 million in 2023, analysts believe its small scale will have minimal financial impact on Wipro in FY25-FY26. The acquisition strengthens Wipro’s growth strategy in the IT services sector.

Why it Matters:

Wipro’s $40 million acquisition of Applied Value Technologies boosts its application services capabilities, expands its client base, and strengthens its growth strategy despite limited near-term financial impact.

Around the World

Asian markets were mixed on Tuesday, awaiting interest rate decisions from major central banks this week. The U.S. Federal Reserve is expected to cut rates by 25 basis points, with markets also watching the long-term outlook. Stock futures in the U.S. fell slightly, though tech stocks rose. Japan’s Nikkei gained ahead of the Bank of Japan’s meeting, while Indonesia and Thailand’s markets were flat, awaiting key rate decisions. In the Philippines, the stock index fell on expectations of another rate cut. Weak economic data from China added to market caution, with retail sales growth slowing despite a rise in industrial output. South Korea’s market fell amid political uncertainty, while Australian stocks rose.

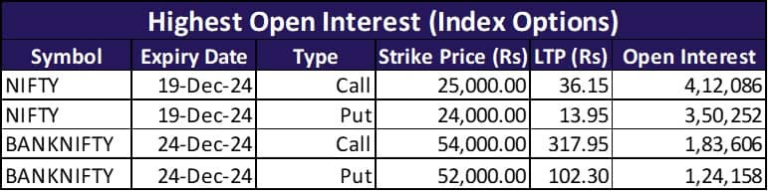

Option Traders Corner

Max Pain

Nifty 50 – 24,650

Bank Nifty – 53,300

Nifty 50 – 24,683 (Pivot)

Support – 24,586, 24,504, 24,406

Resistance – 24,765, 24,863, 24,945

Bank Nifty – 53,551 (Pivot)

Support – 53,364, 53,147, 52,960

Resistance – 53,768, 53,955, 54,172

Did you know?

Indian Digital Milestone Achieved

India has generated over 138 crore Aadhaar numbers, transforming digital identity verification. DigiLocker now serves 37 crore users, securely storing 776 crore documents. The DIKSHA platform has facilitated 556 crore learning sessions and achieved nearly 18 crore course enrollments.