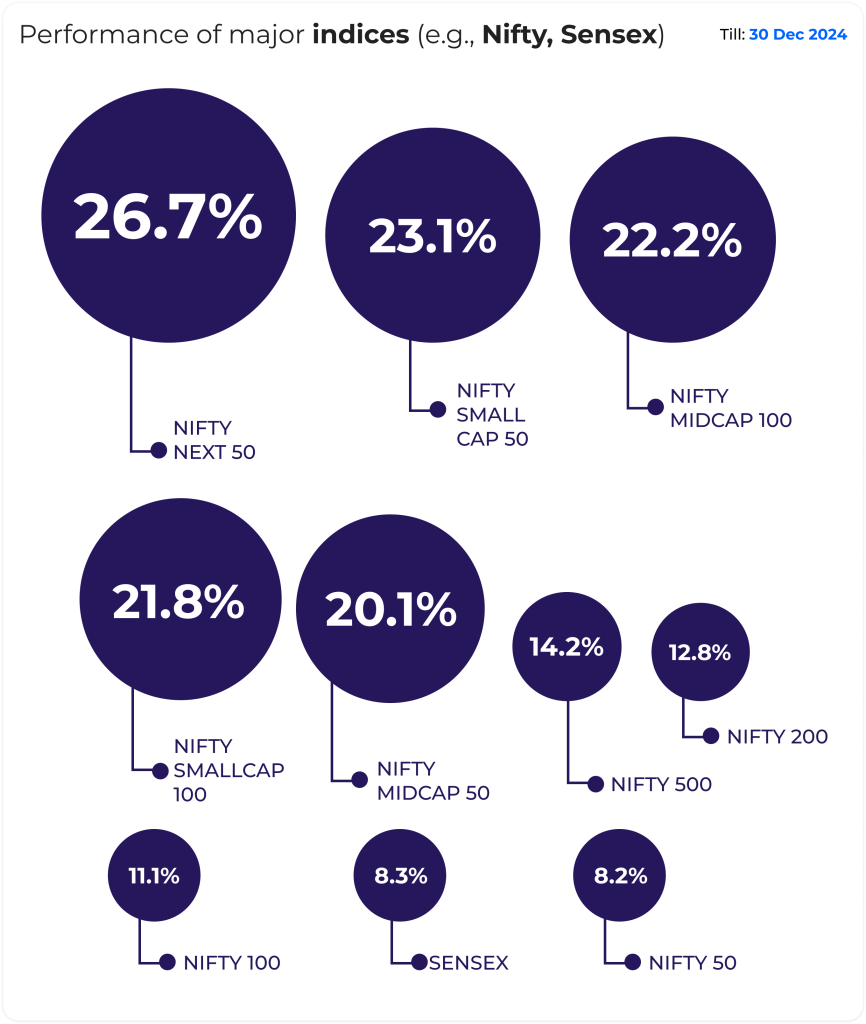

Major economic updates

Source: NSE/BSE

- India’s economy continued its robust recovery in 2024, recording a 7% gross domestic product (GDP) growth, making it the world’s fastest-growing major economy. The growth was driven by a surge in foreign direct investment (FDI), which crossed USD 1 trillion between April 2000 and September 2024. The country continues to be the fifth-largest economy in the world.

- The Ministry of Defence was allocated Rs 6.22 trillion, its highest budget to date, up by 4.79% from the previous financial year.

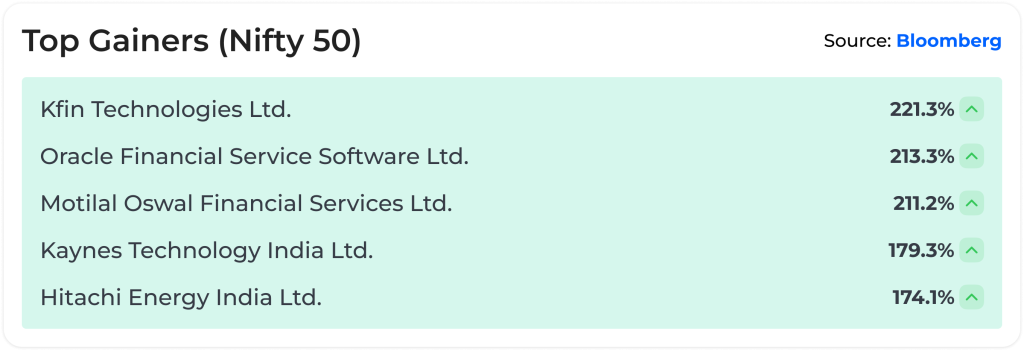

- In the first half of 2024, India’s stock market indices, Nifty 50 and Sensex, posted an impressive 10.5% gain, reflecting strong momentum.

- The July-September quarter saw India’s GDP growth rate fall unexpectedly to 5.4%, its slowest pace in seven quarters, while inflation remains well over 4%.

- India’s EV sales surged 26.5% in 2024, reaching 1.94 million units, despite petrol vehicles dominating the market.

- The mutual fund industry in India experienced a significant growth of 39.59% in its assets, reaching USD 798.15 billion (Rs. 68,05,000 crore) in November 2024, compared to USD 571.78 billion (Rs. 48,75,000 crore) in November 2023, according to the latest data from the Association for Mutual Funds in India (AMFI). This growth is largely driven by increased investments from retail investors, particularly in equity schemes. Contributions via Systematic Investment Plans (SIPs) surged by 48%, rising from USD 2 billion (Rs. 17,073 crore) in November 2023 to USD 2.97 billion (Rs. 25,320 crore) in November 2024.

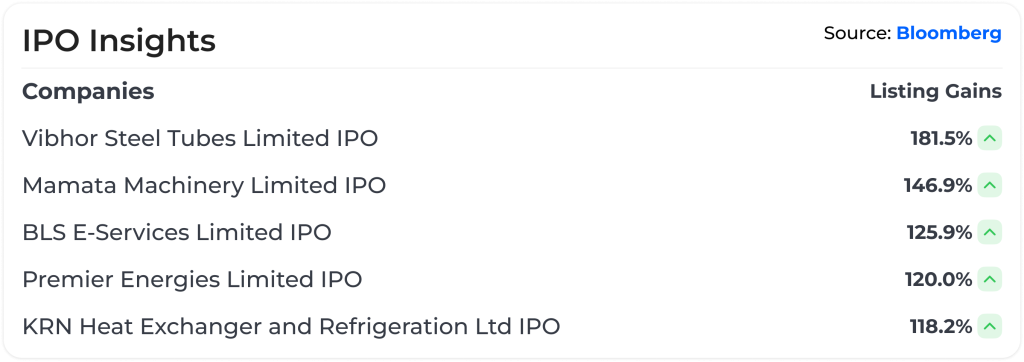

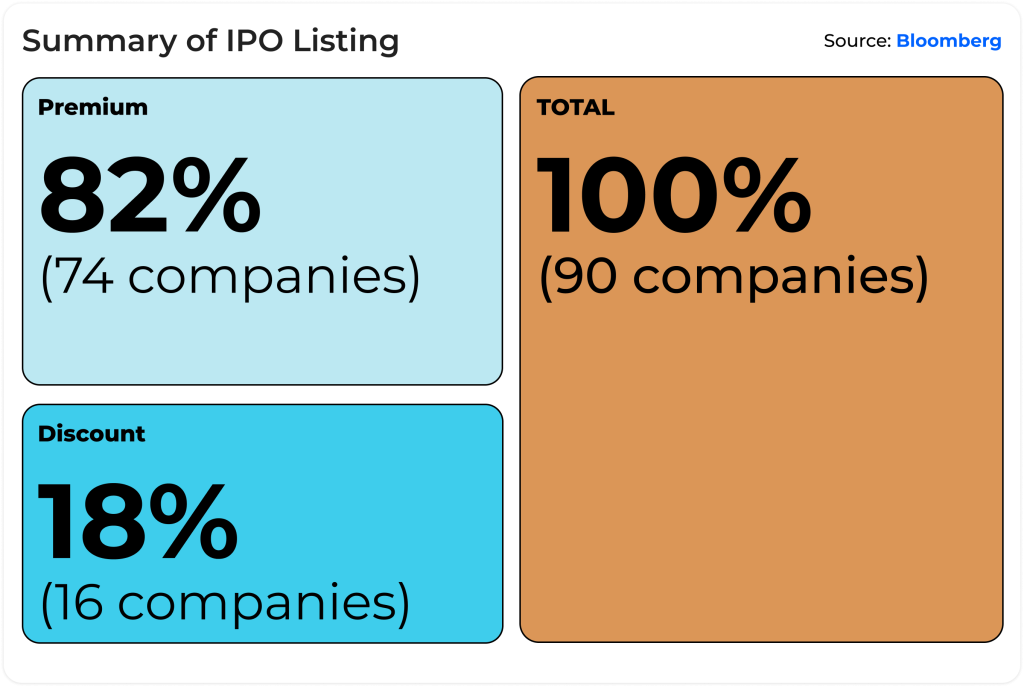

- India has emerged as the global leader in Initial Public Offerings (IPOs), hosting twice as many IPOs as the United States and 2.5 times more than Europe, according to data analysed by Pantomath Group. In the first 11 months of 2024, 76 companies raised USD 15.25 billion (Rs. 1,30,000 crore).

- Foreign portfolio investors sold Rs. 1,20,598.42 crores in the secondary markets in 2024, according to NSDL, making it the second worst year in a decade after 2023.

- Amid the Russia-Ukraine war, Prime Minister Narendra Modi became the first Indian PM to visit Ukraine, while President Droupadi Murmu became the first Indian head of state to visit Fiji.

Sector-wise Investment Trends and Growth

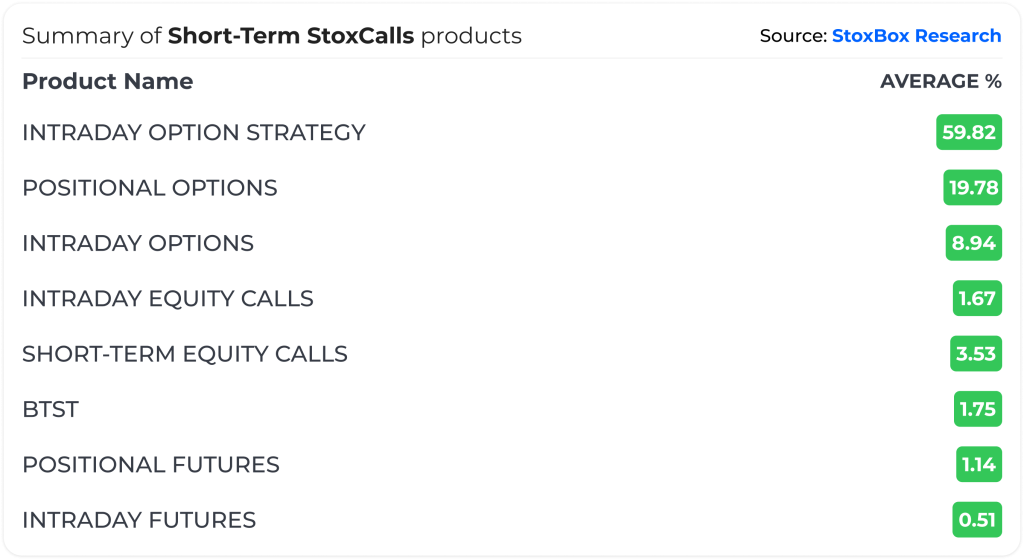

Source: StoxBox Research

- Banking: Focus on Bad Loans – In 2025, banks will focus on managing bad loans, especially in microfinance and retail loans. Big private banks are in better shape with extra provisions and strong deposits. Expected rate cuts will help banks with fixed-rate loans. Credit growth will likely hit double digits, growing faster than deposits.

- Cement: Growth Picking Up – The cement sector is recovering after a tough year. More government spending and real estate activity will boost production to 550-600 million tons. New factories will be built, and exports to regions like Africa and the Middle East will grow. Profits will improve as costs fall.

- Chemicals: Set for a Recovery – The chemical industry is bouncing back from supply chain issues and price pressures. Demand is growing, and companies are increasing production and improving efficiency. The sector may grow 8-10% as India becomes a bigger supplier to global markets, focusing on innovation and cost savings.

- Information Technology: Strong Demand – Indian IT companies are seeing steady growth. Easier global policies and demand for new technologies, like AI, are boosting profits. BFSI (banking and finance) projects are key drivers. Revenue is expected to grow in mid to low teens, though global economic uncertainties remain.

- Pharmaceuticals: Growing Fast – The pharma industry is doing well, driven by demand for new drugs and strong US sales. Companies are focusing on chronic diseases and specialty drugs. India’s role in global drug supply is growing, helped by investment in advanced production methods and strong USFDA approval rates. Growth of 12-15% is expected.

You might also Like.

Union Budget 2026-27 Impact on Sectors

Edit Announcement Companies Impact Rare earth permanent magnet manufacturing programme...