Eastern Growth for Hatsun Dairy

- 21st January 2025

Aaj Ka Bazaar

The U.S. markets remained closed on Monday for the Martin Luther King Jr. Day holiday. Meanwhile, most Asia-Pacific markets were trading higher as U.S. President Donald Trump refrained from imposing trade tariffs during his inaugural speech and promised a “golden age” for America. However, oil prices declined following Trump’s plans to invoke emergency powers to boost domestic crude production, while holding off on tariffs that could have restricted supplies. Indian markets are expected to open on a subdued note, as indicated by GIFT Nifty. On the stock-specific front, TCS, India’s largest IT company, has inaugurated a state-of-the-art delivery center in Toulouse, France. This facility aims to support clients in the aerospace, manufacturing, and defense sectors by leveraging advanced technologies such as artificial intelligence, generative AI, machine learning, and data analytics to deliver innovative, tailored solutions.

Markets Around Us

BSE Sensex –77,154.13 (0.10%)

Nifty 50 – 23,396.95 (0.22%)

Bank Nifty – 49,344.90 (-0.01%)

Dow Jones – 43,648.91 (0.37%)

Nasdaq – 19,627.01 (1.49%)

FTSE – 8,531.14 (0.30%)

Nikkei 225 – 38,902.50 (1.16%)

Hang Seng – 19,925.81 (1.72%)

Sector: Dairy Products

Hatsun Expands East with Milk Mantra

Hatsun Agro, a leading private dairy company, is acquiring Milk Mantra Dairy for ₹233 crore to expand its presence in Odisha and Eastern India. This acquisition aligns with Hatsun’s strategy to enter new markets, adding Milk Mantra’s ‘Milky Moo’ brand to its portfolio, which includes Arun, IBACO, Hatsun, and Arokya. Milk Mantra reported a turnaround in FY24, with ₹276 crore in revenue, ₹16.1 crore EBITDA, and ₹9.78 crore net profit, after recovering from a ₹12.3 crore loss in FY23. The deal strengthens Hatsun’s foothold in North Andhra Pradesh and potential markets like West Bengal. This move reflects a growing trend of expansion in India’s dairy industry, as companies like Danone also invest heavily in facilities and training programs to improve milk production and farmer income. For traders, this signals Hatsun’s focus on long-term growth by leveraging complementary businesses and targeting broader market opportunities.

Why it Matters:

This acquisition helps Hatsun Agro expand into the high-potential markets of Odisha and Eastern India, boosting its regional presence. Adding the ‘Milky Moo’ brand enhances Hatsun’s product portfolio, offering growth opportunities in dairy consumption. For traders, it signals Hatsun’s strategic focus on scaling operations and strengthening market position in India’s evolving dairy sector.

NIFTY 50 GAINERS

APOLLOHOSP – 6939.90 (2.35%)

ULTRACEMCO – 10869.85 (2.31%)

WIPRO – 304.40 (1.38%)

NIFTY 50 LOSERS

ADANIENT – 2422.50 (-0.83%)

ONGC – 267.16 (-0.82%)

TRENT– 6042.00 (-0.79%)

Sector: Quick-commerce

Blinkit Expansion Pressures Zomato

Zomato’s Q3 earnings took a hit due to aggressive investments in expanding Blinkit, its quick commerce business, leading to higher costs and squeezing profits. The company’s net profit dropped 57% to ₹59 crore, down from ₹138 crore last year, despite a 22% growth in food delivery revenue and a twofold increase in Blinkit’s revenue. Shares plunged 9% in a single session, reflecting investor concerns over rising losses. However, brokerages like Nomura, Jefferies, and Bernstein remain optimistic about Blinkit’s long-term potential, highlighting strong execution and market positioning. While upfront costs for expanding Blinkit’s dark store network are impacting short-term profitability, analysts believe this will drive higher growth and profits as the new stores mature. Zomato aims to double Blinkit’s store count to 2,000 by December 2025, which could strengthen its position in the competitive quick commerce market, even as it delays profitability in the near term.

Why it Matters:

Zomato’s aggressive Blinkit expansion shows its focus on dominating the growing quick commerce market. While short-term profitability is under pressure, analysts see long-term growth potential as new stores mature. For traders, this signals a balance of near-term risks with promising future returns.

Around the World

Asian stocks traded mixed as investors reacted to U.S. President Donald Trump’s initial policies, with no tariffs imposed on China, Mexico, or Canada on his first day in office, though he signaled potential future duties, including a 25% tariff on imports from Canada and Mexico. Markets remained volatile as Trump emphasized an “America First” trade policy, raising concerns about global trade disruptions and a potential trade war. Chinese and Hong Kong markets saw slight declines, while Australia’s ASX 200 gained, and South Korea’s KOSPI fell modestly. Japan’s Nikkei was muted ahead of a Bank of Japan meeting, where potential interest rate hikes could pressure markets but signal confidence in domestic economic growth. Amid uncertainty, China may boost economic stimulus to counter any trade war impacts, offering some optimism for regional growth.

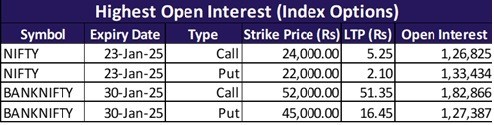

Option Traders Corner

Max Pain

Nifty 50 – 23,500

Bank Nifty – 50,000

Nifty 50 – 23,302 (Pivot)

Support – 23,213, 23,081, 22,922

Resistance – 23,433, 23,522, 23,654

Bank Nifty – 49,228 (Pivot)

Support – 48,806, 48,261, 47,839

Resistance – 49,773, 50,193, 50,740

Did you know?

2 Million Indian Travelled to USA

The number of Indians who travelled to the United States in the first 11 months of 2024, up 26% from the same period last year.