Polycab Bounces Back Strong

- 23rd January 2025

Aaj Ka Bazaar

Wall Street indices gained on Wednesday, driven by optimism surrounding President Donald Trump’s private-sector investment plan for AI infrastructure, which bolstered technology stocks. The S&P 500 rose by 0.61%, the Dow Jones Industrial Average climbed 0.30%, and the tech-heavy Nasdaq Composite climbed 1.28%. In the Asia-Pacific markets, stocks opened on a mixed note as investors reacted to varying regional economic data. Indian benchmark indices are expected to open slightly lower, as suggested by the GIFT Nifty trading marginally in the red, reflecting mixed global cues. On the stock-specific front, Bharat Petroleum Corporation Ltd. (BPCL) announced that its board has approved the submission of a development plan for the Nunukan block’s oil and gas reserves to the Indonesian regulator, with an estimated investment of $121 million. Additionally, BPCL’s board approved the formation of a joint venture with Praj Industries Ltd. to set up Compressed Bio Gas (CBG) plants across India.

Markets Around Us

BSE Sensex –76,318.43 (-0.11%)

Nifty 50 – 23,112.85 (-0.18%)

Bank Nifty – 48,568.45 (-0.32%)

Dow Jones – 44,1584.78 (0.01%)

Nasdaq – 20,015.54 (0.61%)

FTSE – 8,545.13 (-0.04%)

Nikkei 225 – 39,907.32 (0.65%)

Hang Seng – 19,821.26 (0.21%)

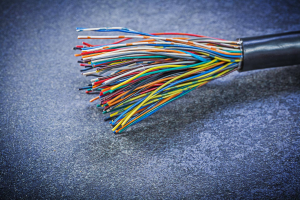

Sector: Cables-Electricals

Polycab Gains 3% After Strong Q3

Polycab India’s shares rose over 3% to ₹6,380 in early trade on January 23, bouncing back after a two-day losing streak, driven by its Q3 results. The company reported an 11% increase in net profit to ₹457.57 crore and a 20% rise in revenue to ₹5,226 crore compared to the same period last year, marking its highest-ever Q3 revenue. Despite slightly missing revenue estimates, its EBITDA exceeded expectations, supported by better margins in the wires and cables segment and reduced losses in the FMEG business. Brokerages like UBS, Citi, Jefferies, and Macquarie remain bullish on the stock, with price targets ranging from ₹7,537 to ₹9,220, citing its strong medium-term growth potential in capex and housing. Polycab has already exceeded its FY26 revenue goal and projects a steady revenue and profit growth trajectory. Shares are still down 15% year-to-date but show promising recovery signs.

Why it Matters:

Polycab India’s strong Q3 results and improved margins signal robust business performance, making it a promising stock for traders and investors. Major brokerages remain bullish with high target prices, indicating significant growth potential. Its success in exceeding revenue targets ahead of schedule highlights its leadership in the wires and cables market, despite near-term challenges.

NIFTY 50 GAINERS

WIPRO – 314.45 (1.73%)

ULTRACEMCO – 10865.85 (1.61%)

TECHM – 1699.90 (0.95%)

NIFTY 50 LOSERS

HINDUNILVR – 2267.50 (-3.22%)

NESTLEIND – 2170.00 (-1.71%)

LT– 3483.60 (-0.98%)

Sector: Computers-software & Consulting

Persistent Jumps 7% Amid Mixed Review

Persistent Systems surged over 7% after the company reported strong Q3 results, with a 15% sequential and 30% year-on-year rise in net profit to ₹372.99 crore. Revenue grew 6% QoQ and 23% YoY to ₹3,062.3 crore. The IT firm impressed with improved margins and a robust order pipeline exceeding $1 billion, backed by large deals in the energy sector. However, brokerages offered mixed views. Nuvama and Motilal Oswal are bullish, citing strong growth potential despite high valuations, with targets of ₹7,000 and above. Meanwhile, Nomura and HSBC took a cautious approach, highlighting valuation concerns but acknowledging steady deal wins. Citi remained bearish, raising its target to ₹5,000 but maintaining a sell rating due to stretched valuations. Despite the mixed outlook, Persistent’s strong execution and growth in non-healthcare verticals stand out, making it a stock to watch.

Why it Matters:

Persistent Systems’ strong Q3 results highlight its solid growth trajectory, improved margins, and robust deal pipeline exceeding $1 billion. Despite mixed brokerage views, its ability to secure large deals and expand into new verticals showcases long-term potential. The stock’s surge indicates market confidence, making it a key player to watch in the IT sector.

Around the World

Most Asian markets rose on Thursday, led by gains in Japan and China. Japanese stocks, up 0.5%, gained ahead of an expected Bank of Japan rate hike, which is largely priced in, while inflation and PMI data are due Friday. Chinese markets rebounded, with the Shanghai Composite rising 0.7%, boosted by Beijing’s plans to direct state insurers to invest in local stocks, signaling more government support amid trade tariff challenges. South Korea’s KOSPI fell 0.9% on weak GDP data and profit-taking in tech stocks like SK Hynix, despite its record profits. Broader Asian markets saw mixed performance, with Australia’s ASX 200 falling 0.6% and Singapore’s Straits Times index gaining 0.6%. Wall Street futures cooled in Asian trade after a rally on Wednesday fueled by AI investment announcements and strong earnings, with the S&P 500 briefly hitting record highs.

Option Traders Corner

Max Pain

Nifty 50 – 23,250

Bank Nifty – 49,600

Nifty 50 – 23,102 (Pivot)

Support – 23,034, 22,913, 22,846

Resistance – 23,222, 23,290, 23,411

Bank Nifty – 48,526 (Pivot)

Support – 48,271, 47,819, 47,564

Resistance – 48,879, 49,234, 49,687

Did you know?

2 Million Indian Travelled to USA

The number of Indians who travelled to the United States in the first 11 months of 2024, up 26% from the same period last year.