Defence Orders Fuel BEL

- 28th March 2025

Aaj Ka Bazaar

The US market closed lower overnight as investors remained cautious about President Trump’s tariff policies. However, economic data provided some relief, showing that the US economy grew slightly faster than previously estimated in the fourth quarter of 2024. Additionally, weekly jobless claims decreased last week, and pending home sales rebounded in February. In Asia, markets were mostly down this morning, with Japan and South Korea experiencing the most significant losses due to President Trump’s announcement of a 25% tariff on automotive imports. This policy particularly affected Japanese and South Korean markets, with Japan’s Nikkei index declining by 1% and South Korea’s KOSPI falling by 1.3%. Major automakers such as Toyota, Mazda, and Subaru saw notable decreases in their stock prices. The Indian market is expected to have a muted start on Friday, as global sentiment remains fragile due to tariff concerns and ongoing caution ahead of the upcoming quarterly earnings season. Eyes are on the US-India trade meeting, which began on Wednesday and will conclude on Saturday. This meeting involves negotiations over a bilateral trade agreement between the two countries.

Markets Around Us

BSE Sensex – 77,625.66 (0.02%)

Nifty 50 – 23,604.90 (0.05%)

Bank Nifty – 51,789.25 (0.41%)

Dow Jones – 42,374.21 (0.18%)

Nasdaq – 17,804.03 (-0.53%)

FTSE – 8,662.12 (-0.27%)

Nikkei 225 – 36,963.86 (-2.21%)

Hang Seng – 23,353.57 (-0.98%)

Sector: Defense

Bharat Electronics secure ₹1385 Cr in orders

Bharat Electronics Ltd (BEL) shares rose over 1% to ₹305 on March 28 after announcing fresh orders worth ₹1,385 crore since March 12. These new orders include a wide range of defence and electronic systems like radar upgrades, simulators, navigation tools, tank stabilisers, and communication equipment. Notably, BEL has developed advanced AESA radars in partnership with DRDO, showcasing strong Make in India capabilities. Over the past month, BEL’s stock has jumped 22%, outperforming the Nifty’s 6% gain. Analysts remain positive, with JPMorgan maintaining a target of ₹343, seeing the recent dip as a good buying opportunity. BEL is well-placed to benefit from India’s growing defence spending, with expected annual growth of 15-17% in revenue, profits, and operating performance till FY27. The company is also expected to consistently deliver strong returns, making it a reliable stock for both experienced traders and young investors exploring the defence sector.

Why it Matters:

Bharat Electronics is winning big defence contracts, strengthening its revenue pipeline and growth outlook. Its strong stock performance and bullish analyst views make it a reliable pick in the defence sector. With India ramping up defence spending, BEL stands out as a key beneficiary of the Make in India push.

NIFTY 50 GAINERS

TATA CONSUMER – 1007.45 (3.59%)

ONGC– 246.90 (1.95%)

HUL – 2273.40 (1.28%)

NIFTY 50 LOSERS

M&M – 2641.95 (-3.33%)

CIPLA – 1453.00 (-2.02%)

POWER GRID – 290.25 (-5.50%)

Sector :Cement

Ultratech Cement Boosts Capacity with Expanisons

Ultratech Cement shares rose to ₹11,639 on March 27 after the company announced the successful commissioning of several brownfield expansions, boosting its production capacity. The company added 3.35 million tonnes per annum (mtpa) of clinker capacity and 2.7 mtpa of cement capacity at its Maihar plant in Madhya Pradesh, with a second mill expected by Q1 FY26. It also expanded grinding units in Dhule (1.2 mtpa) and Durgapur (0.6 mtpa), and launched a new bulk terminal in Lucknow with a 1.8 mtpa capacity. These moves have increased its domestic grey cement capacity to 183.36 mtpa and global capacity to 188.76 mtpa. The stock is up 14% in a month, beating Nifty’s 6% gain. UBS upgraded Ultratech, setting a ₹13,000 target, citing its strong execution and leadership in the cement space. With sector challenges now priced in, analysts expect an earnings rebound in FY26, making Ultratech a key player to watch.

Why it Matters:

UltraTech’s latest capacity expansions reinforce its position as a market leader, ready to meet future demand growth. Investor confidence is rising, backed by a 14% stock rally and bullish analyst upgrades. As the cement sector gears up for a rebound by FY26, UltraTech is well-placed to lead the charge.

Around the World

Most Asian stock markets fell on Friday as investors remained cautious over U.S. President Trump’s planned tariffs, especially on the auto sector. Japan’s Nikkei and TOPIX dropped over 2% after Tokyo’s inflation data came in higher than expected, raising fears of an early interest rate hike by the Bank of Japan. Auto and tech stocks led the decline, with major names like Toyota, Honda, SK Hynix, and TSMC falling sharply. Concerns about oversupply in AI data centers hit chip stocks hard, especially after reports that Microsoft canceled several data center leases. South Korea’s KOSPI dropped 1.7%, while Taiwan stocks also dipped. Chinese markets saw smaller losses but remain strong in 2025 on optimism around AI and government stimulus. Australia’s ASX 200 gained 0.2% ahead of the RBA meeting next week, and Singapore’s index inched up 0.1%. Indian markets looked set for a flat open, with focus now shifting to upcoming economic data from China.

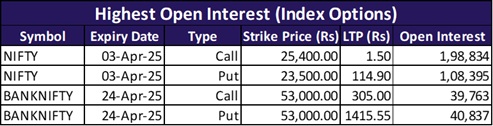

Option Traders Corner

Nifty 50 – 23500

Bank Nifty – 54000

Nifty 50 – 23550 (Pivot)

Support – 23,453, 23,315, 23,219

Resistance – 23,688, 23,784, 23,922

Bank Nifty – 51477 (Pivot)

Support – 51,179, 50,783, 50,516

Resistance – 51,843, 52,110, 52,506

Have you checked our latest YouTube Video

Did you know?

India’s Retail Investor Surge: Market Participation Hits Record Highs in 2024

India’s stock market has seen a 36% rise in retail participation, with over 50 million investors active by 2024. This surge is driven by increased financial literacy, digital trading platforms, and government initiatives. Systematic Investment Plans (SIPs) have also gained popularity, with monthly contributions hitting ₹14,000 crore in early 2025. These trends reflect growing confidence in India’s equity markets.