The Reserve Bank of India uses two key interest rates to manage the economy: the bank rate and repo rate. These rates serve as important monetary policy instruments that influence lending costs, investment decisions, and overall economic activity.

The RBI recently reduced the repo rate to 6% in April 2025 and adopted an accommodative monetary stance. This change provided relief to millions of borrowers through lower interest costs. Many investors and borrowers remain unclear about how these two rates differ and why they matter for financial planning.

Understanding these rates is essential for making informed financial decisions. Interest rate changes can trigger significant market movements and affect the financial well-being of over 1.4 billion people. The bank rate and repo rate function differently in the financial system, and their effects reach different sectors of the economy at different times.

What is the Bank Rate?

The bank rate is the rate of interest at which the Reserve Bank of India lends money to commercial banks for a longer period of time. This rate serves more than just lending purposes and is an important monetary policy tool that conveys the central bank’s economic views and policy plans.

Commercial banks approach the RBI when they need funds for a period that exceeds overnight borrowing, using the bank rate. The RBI makes changes to this rate infrequently, so every change has a significant impact on financial markets and economic policy interpretation.

The bank rate operates as more than just a lending tool. While it is not a strict upper limit or ceiling for the repo rate, it serves as an important monetary policy signal and benchmark. The bank rate influences the broader interest rate structure in the economy and helps guide the cost of long-term borrowing for commercial banks.

When the RBI wants to control inflation, it increases the bank rate because this makes borrowing costlier throughout the entire financial system. When economic stimulus is needed, the RBI achieves this by lowering the bank rate, which results in more lending and increased economic activity.

The bank rate serves as a reference point for commercial banks when determining prices of various financial products. It influences home loan rates, business loan prices, and credit card interest rates because it indicates the RBI’s general monetary policy direction.

What is the Repo Rate?

The repo rate is the RBI’s most important monetary policy instrument, known as the repurchase agreement. This rate establishes the interest cost for commercial banks to borrow from the central bank through short-term arrangements to meet their daily liquidity needs.

When banks need immediate funds for operational requirements, they can obtain them by selling government securities to the RBI under a repurchase agreement for a specified time period, usually overnight to 14 days. The interest cost for this transaction reflects the prevailing repo rate.

The repo mechanism involves a formal process that provides both liquidity and transaction security. Banks use government securities as collateral when borrowing from the RBI, establishing a secure lending arrangement.

The repo rate establishes the base interest rate that affects all financial institutions throughout the Indian economy. When the RBI alters the repo rate, it produces effects that impact bank lending rates, deposit rates, and market liquidity conditions.

The RBI’s Monetary Policy Committee reviews the repo rate every two months during scheduled policy meetings. This six-member committee makes decisions by evaluating comprehensive economic data, including projected inflation rates, forecasted growth, and global economic situations.

The current repo rate stands at 6.00%, which indicates the RBI’s current accommodative monetary policy approach. For detailed information, check the RBI Money Market Operations Page.

Key Differences Between Bank Rate and Repo Rate

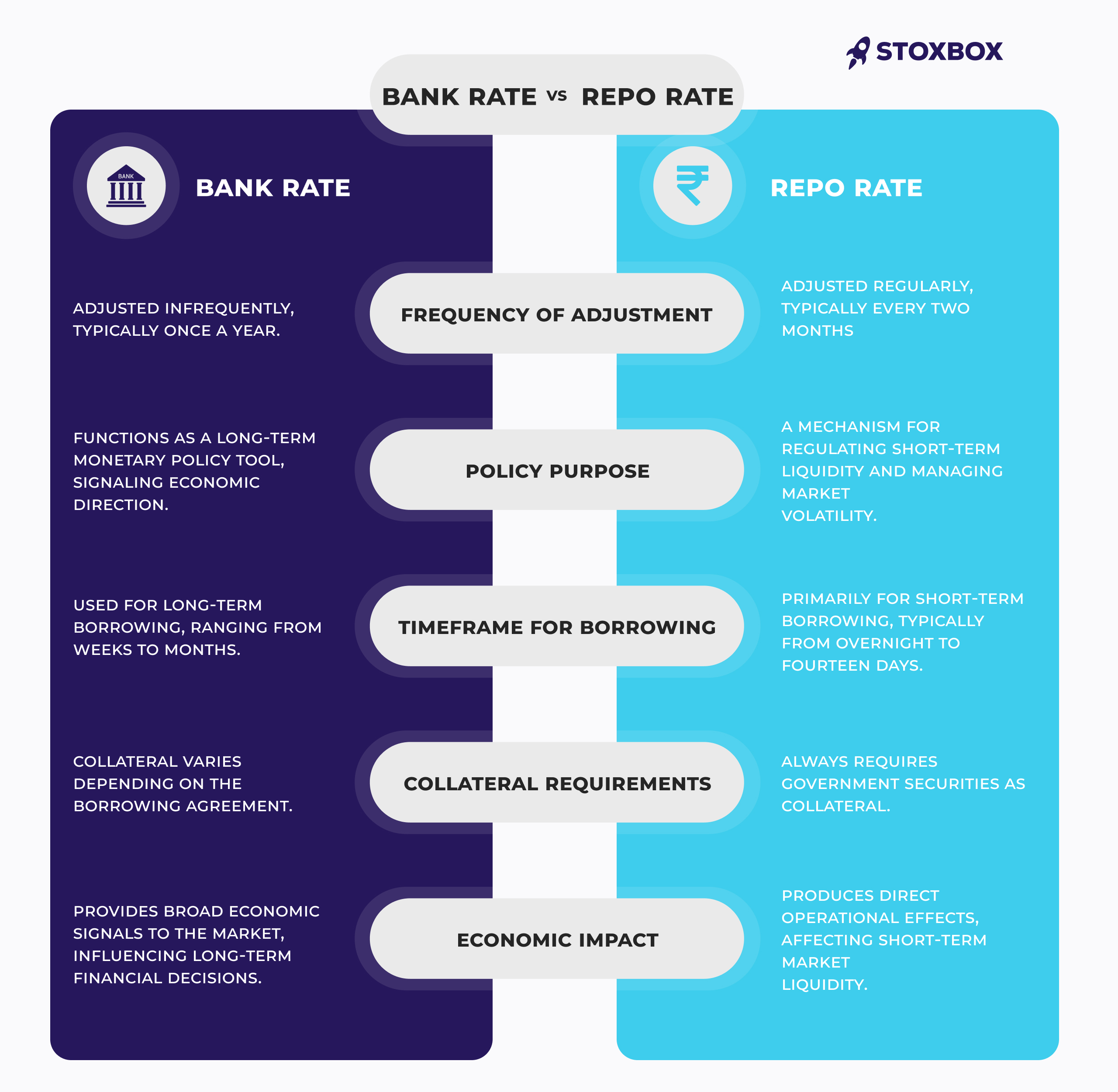

To understand the differences between these two rates, we must analyze their operational features, policy uses, and economic effects. The bank rate functions as a long-term policy indicator, whereas the repo rate operates as a short-term monetary policy tool.

Operational Comparison:

- The RBI adjusts the bank rate infrequently (annually at most) while conducting regular repo rate assessments every two months

- The bank rate functions as a tool for long-term policy indication, while the repo rate operates as a mechanism to regulate short-term liquidity

- The bank rate applies to financial periods extending from weeks to months, while the repo rate applies to short-term borrowing from overnight to fourteen days

- Collateral requirements under the bank rate system vary, while the repo rate system always requires government securities

- The bank rate provides broad economic signaling to the market, while the repo rate produces direct operational effects

The bank rate primarily serves as a communication tool through its long-term economic assessments and policy direction. In contrast, the repo rate functions as an active policy tool that directly affects banking system liquidity and leads to quick adjustments in lending and deposit rates.

Impact on Individuals and Businesses

Bank rate and repo rate changes produce measurable effects on both individual financial situations and business operations.

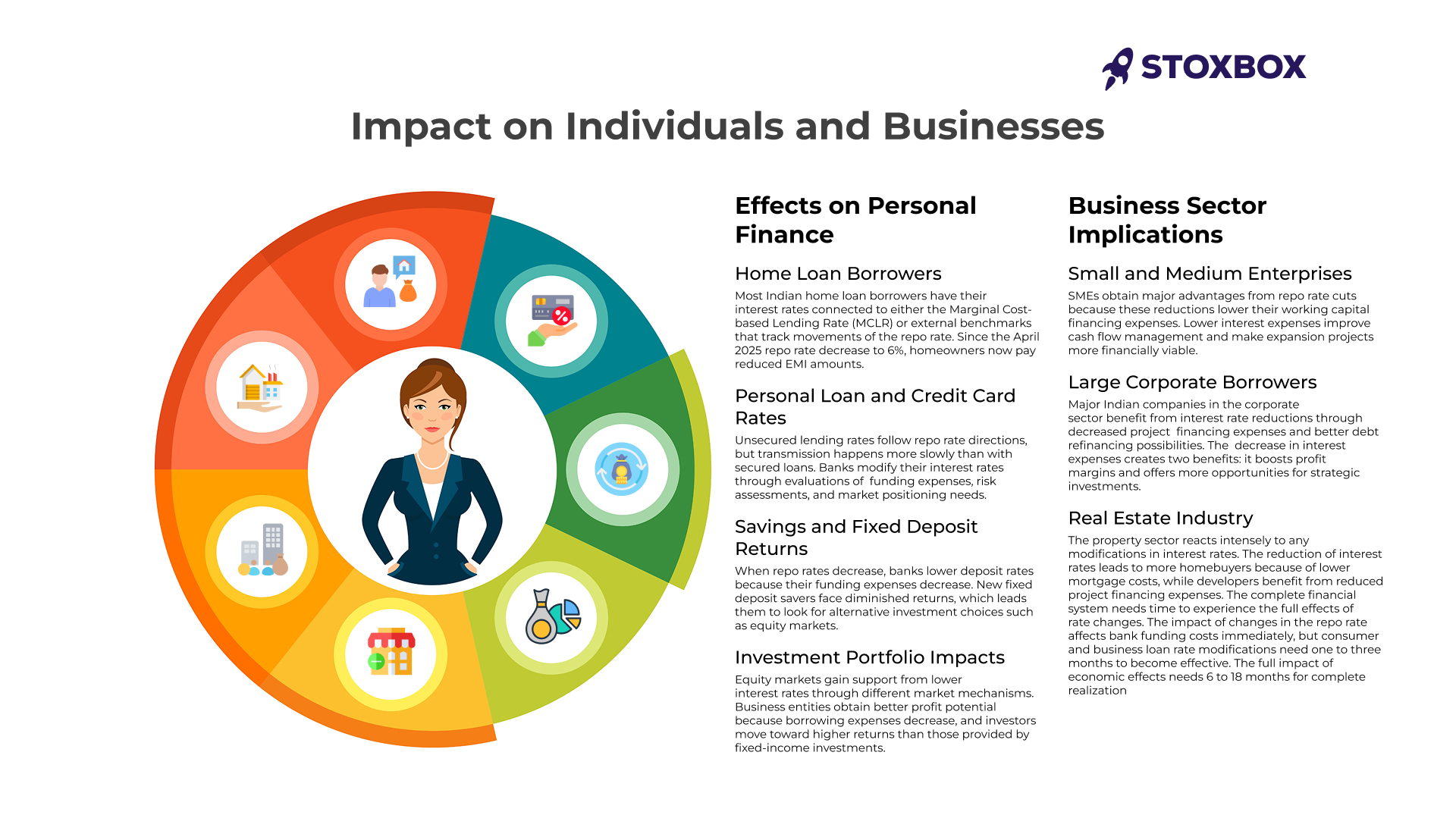

Effects on Personal Finance

Home Loan Borrowers: Most Indian home loan borrowers have their interest rates connected to either the Marginal Cost-based Lending Rate (MCLR) or external benchmarks that track movements of the repo rate. Since the April 2025 repo rate decrease to 6%, homeowners now pay reduced EMI amounts. A 0.25% decrease in the repo rate on a ₹50 lakh home loan enables borrowers to save around ₹700-800 per month, which amounts to yearly savings of nearly ₹10,000.

Personal Loan and Credit Card Rates: Unsecured lending rates follow repo rate directions, but transmission happens more slowly than with secured loans. Banks modify their interest rates through evaluations of funding expenses, risk assessments, and market positioning needs.

Savings and Fixed Deposit Returns: When repo rates decrease, banks lower deposit rates because their funding expenses decrease. New fixed deposit savers face diminished returns, which leads them to look for alternative investment choices such as equity markets.

Investment Portfolio Impacts: Equity markets gain support from lower interest rates through different market mechanisms. Business entities obtain better profit potential because borrowing expenses decrease, and investors move toward higher returns than those provided by fixed-income investments.

Business Sector Implications

Small and Medium Enterprises: SMEs obtain major advantages from repo rate cuts because these reductions lower their working capital financing expenses. Lower interest expenses improve cash flow management and make expansion projects more financially viable.

Large Corporate Borrowers: Major Indian companies in the corporate sector benefit from interest rate reductions through decreased project financing expenses and better debt refinancing possibilities. The decrease in interest expenses creates two benefits: it boosts profit margins and offers more opportunities for strategic investments.

Real Estate Industry: The property sector reacts intensely to any modifications in interest rates. The reduction of interest rates leads to more homebuyers because of lower mortgage costs, while developers benefit from reduced project financing expenses.

The complete financial system needs time to experience the full effects of rate changes. The impact of changes in the repo rate affects bank funding costs immediately, but consumer and business loan rate modifications need one to three months to become effective. The full impact of economic effects needs 6 to 18 months for complete realization.

How These Rates Affect the Indian Economy

The bank rate and repo rate act as essential tools that the RBI uses to achieve its goals of economic stability and sustainable economic growth.

When the RBI increases the repo rate, borrowing expenses increase, which decreases both consumer purchasing and business capital spending, leading to lower market prices. The RBI uses interest rate adjustments to demonstrate its dedication to achieving price stability targets, which stabilizes market expectations about inflation.

The economy experiences growth through lower interest rates because they lower business loan expenses, boost capital spending, reduce consumer financing costs, and enhance corporate profitability from decreased interest expenses.

Each sector within the economy displays different reactions to monetary policy adjustments. The banking industry faces narrower profit margins from interest rate decreases but simultaneously experiences increased loan expansion. The combination of extended low interest rates makes infrastructure projects financially accessible and boosts automobile sales due to reduced consumer financing expenses.

The difference in interest rates between India and other nations drives significant changes in foreign portfolio investments, rupee value, company borrowing behavior, and national balance of payments.

The Indian rupee experiences strengthening when foreign investment increases as a result of higher Indian interest rates, while lower interest rates lead to capital outflows.

Common Myths and Misconceptions

The following misconceptions about bank rate and repo rate continue to affect Indian investors and borrowers, who make poor financial choices because of their unrealistic expectations.

Myth 1: All Loans Feel the Effect of Rate Changes Immediately

The repo rate transmission process has both delayed and partial effects on lending interest rates. Banks need between two and three months to modify their interest rates because they base their changes on their funding sources and market competition forces.

Myth 2: All Banks Adjust Rates Uniformly

The RBI rate adjustments affect banks through distinct operational conditions that determine their deposit holdings, asset health, and business planning strategies.

Myth 3: Rate Cuts Guarantee Stock Market Gains

The belief that interest rate reductions automatically lead to positive stock market performance is inaccurate. The positive impact of reduced interest rates on the stock market can be surpassed by other market factors. Economic growth concerns may persist despite rate cuts, and global market sentiment can influence Indian markets regardless of domestic rate policies.

Myth 4: Fixed Deposits Always Mirror Repo Rates

The value of fixed deposits is not always affected by repo rate movements because the rates are determined by banking requirements and market competition.

The period from 2019-2021 illustrates these complexities well. The RBI cut its repo rate by 250 basis points, but borrowers saw their loan rates decrease only by 100-150 basis points, thus proving the need for understanding rate change transmission.

Monitor Rate Changes with StoxBox

StoxBox offers investors a wide range of tools to monitor monetary policy effects on the market through its complete set of analytical resources.

- StoxCalls: Access expert sector and stock recommendations regarding RBI rate adjustments during rate cycle periods.

- StoxBot: Get instant WhatsApp alerts when the RBI makes policy announcements, with AI-based sector and market effect assessments.

- Trading platform: Perform quick trades on rate announcement days through our platform, which offers sector monitoring features and real-time market data.

- Investment Utilities: Access tools that allow users to calculate how interest rate fluctuations affect their loan EMI payments, fixed deposit yields, and investment portfolio values.

- Download mobile app to implement rate-sensitive investment tools made for the Indian market.

Frequently Asked Questions

1. What is the current repo rate in India?

The RBI repo rate currently stands at 6.00%. In April 2025, Governor Sanjay Malhotra and the MPC team adopted an accommodative stance and reduced interest rates. The RBI Annual Report indicates that the monetary policy will maintain growth-friendly measures according to ECONOMIC TIMES ARTICLE, while the market predicts future interest rate reductions. The current rates and policy decisions can be accessed at RBI MONETARY POLICY PAGE.

2. How does the bank rate in India impact my mortgage?

The bank rate does not directly impact mortgage interest rates, but it indirectly affects them through its role in establishing the monetary policy direction. The majority of home loans in India follow either MCLR or external benchmark systems, which base their rates mainly on the repo rate. Bank rate changes trigger potential repo rate adjustments, which lead to delayed impacts on mortgage interest rates during a time span of 1 to 3 months.

3. Why does the RBI change the repo rate in India?

The RBI controls the repo rate to achieve price stability and support economic growth. The RBI implemented the 6% repo rate reduction in April 2025 to achieve accommodative monetary policies because of decreasing inflation rates. The RBI takes action on four key fronts: controlling inflation rates when they exceed targets, supporting economic expansion, managing currency exchange fluctuations, and reacting to international economic factors that impact Indian financial stability.

4. How can I track changes in the bank rate and repo rate in India?

You can monitor rate changes through multiple channels: RBI OFFICIAL WEBSITE publishes monetary policy decisions immediately, financial news websites like BUSINESS STANDARD provide real-time updates and analysis, StoxBot offers instant WhatsApp notifications with market impact analysis, and banking apps update rates within hours. RBI DATABASE provides historical data for trend analysis.

5. What is the relationship between repo rate and inflation in India?

The Reserve Bank of India uses the repo rate as its main tool to regulate inflation. The RBI generally raises repo rates to reduce inflation and decrease the rate of price increases when the inflation rate exceeds the 4% ± 2% target range. Low interest rates from the RBI promote borrowing and spending, which can boost prices when the economy reaches its full potential. The transmission of repo rate changes to the economy takes 6 to 18 months because of delays in the banking system and the wider economy.

6. Do repo rate changes affect my existing loans immediately?

The impact on existing loans depends on their structure. Floating rate loans that use MCLR or external benchmarks take 1-3 months to reflect changes in the repo rate, but they experience less change than the full repo rate movement during this period. Fixed-rate loans are not affected by rate changes during their fixed-rate period. Banks can delay the rate adjustment of credit cards and personal loans, and they are not obligated to pass all the rate change to their customers.