When you hear market updates on news channels or check investment apps, two numbers dominate the conversation: Sensex and Nifty. These indices represent India’s stock market performance, but which one should you actually follow? Understanding the differences between these two benchmarks can help you make better investment decisions and track market movements more effectively.

Table of Contents

What is Sensex and Nifty?

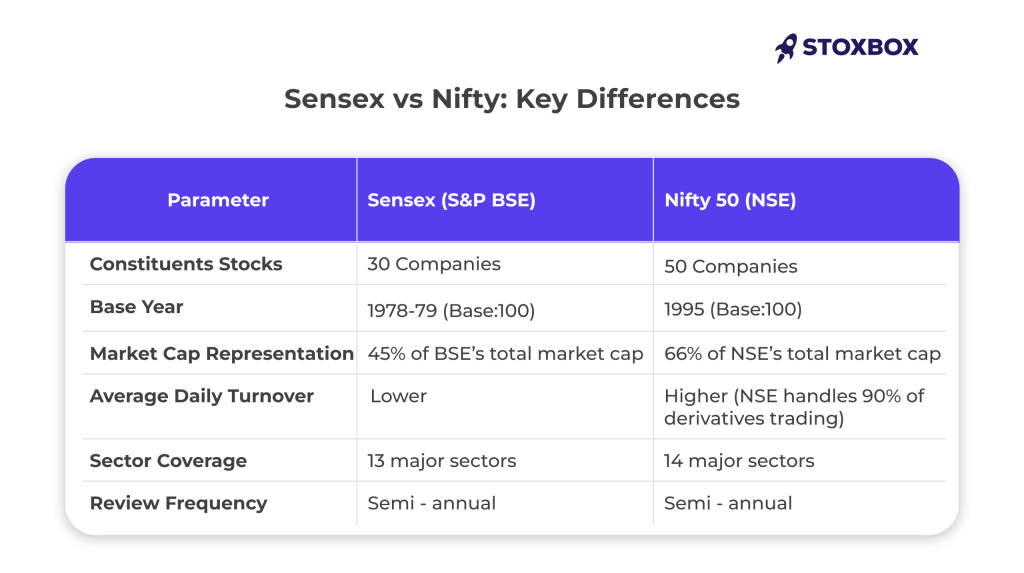

Sensex (S&P BSE Sensex) is India’s oldest stock market index, launched on 1st January 1986 by the Bombay Stock Exchange (BSE). It tracks the performance of 30 of the largest, most liquid, and financially sound companies across key sectors of the Indian economy.

Nifty 50 is the flagship index of the National Stock Exchange (NSE), launched on 22nd April 1996. It comprises 50 of India’s largest companies by free-float market capitalisation, representing approximately 55.48% as on March 28, 2025, of the total market capitalisation of all NSE-listed stocks.

Both indices use the free-float market capitalisation weighted methodology, where companies with larger freely tradeable market values have greater influence on index movements. They’re rebalanced semi-annually to ensure they remain representative of the Indian stock market.

Why Are They Important to Investors?

These indices serve multiple critical functions in India’s investment ecosystem:

Performance Benchmarks: Over ₹15 lakh crore in assets under management across mutual funds and ETFs use these indices as benchmarks. Fund managers are evaluated based on how well they perform against these indices.

Market Barometers: Government economic policies, RBI monetary decisions, and global events’ impact on India are often measured through Sensex and Nifty movements.

Investment Product Basis: Index funds and ETFs tracking these indices have become increasingly popular, with Nifty-based funds alone managing over ₹2 lakh crore in assets.

Economic Indicators: Both indices are used in academic research, policy-making, and economic analysis to understand India’s economic health and market efficiency.

Trading and Derivatives: NSE’s Nifty futures and options are among the world’s most actively traded index derivatives, while BSE offers Sensex-based derivative products.

Get real-time updates and expert analysis on both indices through StoxCalls’ market intelligence platform, which helps you understand market movements and their implications for your investments.

Sensex vs Nifty: Key Differences

Reliance Industries (highest weightage in both)

Tata Consultancy Services

HDFC Bank and ICICI Bank

Infosys and Hindustan Unilever

ITC and Bajaj Finance

Unique Constituents: Nifty 50 includes companies like Adani Enterprises, SBI Life, and HDFC Life that aren’t in Sensex, providing broader market representation.

Final Thought: Should You Focus on One or Both?

Modern investors should view Sensex and Nifty as complementary rather than competing benchmarks. Here’s a practical approach:

For Portfolio Tracking: Use Nifty 50 as your primary benchmark if you have diversified equity holdings, as it provides broader market representation and better correlation with overall market movements.

For Historical Context: Sensex offers longer historical data (since 1979) and remains culturally significant in Indian investing. Many traditional investors still prefer its 30-stock focused approach.

Investment Strategy Alignment: Choose index funds or ETFs based on your goals rather than index preference. Both have delivered strong long-term returns, with the Sensex generating approximately 13-14% CAGR over the past two decades.

Use Technology for Better Insights: Instead of manually tracking indices, leverage platforms that provide comprehensive analysis. StoxBot’s AI-powered alerts can keep you updated on significant index movements and their implications via WhatsApp.

Systematic Investment Approach: Whether you choose Sensex or Nifty-based products, consistency matters more than the specific index. Focus on regular investing through SIPs and maintaining proper asset allocation.

Remember, successful investing isn’t about predicting index movements but about building a diversified portfolio aligned with your financial goals, risk tolerance, and investment timeline. Both Sensex and Nifty serve as excellent tools for understanding market trends and building wealth over the long term.

Frequently Asked Questions

Do Sensex and Nifty include only Indian companies?

Yes, both indices include only Indian companies listed on their respective exchanges. Companies must be incorporated in India and have their primary listing on BSE (for Sensex) or NSE (for Nifty). However, many constituent companies have significant global operations and derive substantial revenue from international markets.

Do Sensex and Nifty follow the same calculation method?

Both use the free-float market capitalisation weighted method, but with slight variations in implementation. Sensex uses a divisor method for maintaining historical continuity, while Nifty uses a base year approach. Both adjust for corporate actions like stock splits, rights issues, and spin-offs to maintain index integrity.

Can a company be part of both Sensex and Nifty at the same time?

Yes, approximately 28 companies currently appear in both indices. These include major players like Reliance Industries, TCS, HDFC Bank, and Infosys. These overlapping stocks typically account for 70-80% of both indices’ movements, explaining their high correlation.

Can changes in government policy affect Sensex and Nifty differently?

While both generally move in the same direction, the magnitude can differ based on sectoral exposure. For instance, banking policy changes might affect Nifty more if it has higher banking sector representation. Similarly, policies affecting mid-cap companies might have less direct impact on Sensex’s 30 large-cap stocks compared to Nifty’s broader composition.

Is it possible for Sensex and Nifty to move in opposite directions?

Yes, but it’s uncommon and usually occurs during intraday trading when sector-specific news affects stocks unique to one index. Over daily or longer periods, they move in the same direction over 95% of the time due to their substantial overlap. When divergence occurs, it’s typically temporary and corrects within a few trading sessions.

Which index is better for long-term SIP investments?

Both have delivered similar long-term returns (13-14% CAGR over 20 years), so the choice should be based on fund quality, expense ratios, and tracking efficiency rather than the underlying index. Nifty-based funds generally offer more options and slightly better liquidity, making them popular among systematic investors.

Your Wealth-Building Journey Starts Here