MNC Investment

Back in the 70s, 80, and even 90s, if a company had an anglicized name, then the first reaction one would have would be of awe. An ‘English’ name often meant that it was a foreign company that offered international quality products. Not much has changed since then. Even today, global companies and global products hold a certain appeal and attract us with their promise of quality and ability to provide unique products that are otherwise not available in domestic markets. These are Multinational Companies (MNCs) or companies that in addition to operating in their domestic markets also operate around the world in several other countries with one or two central quarters.

Inarguably, MNCs give you access to global products and services. However, they have another distinctive benefit, i.e., they can also prove to be a great investment opportunity.

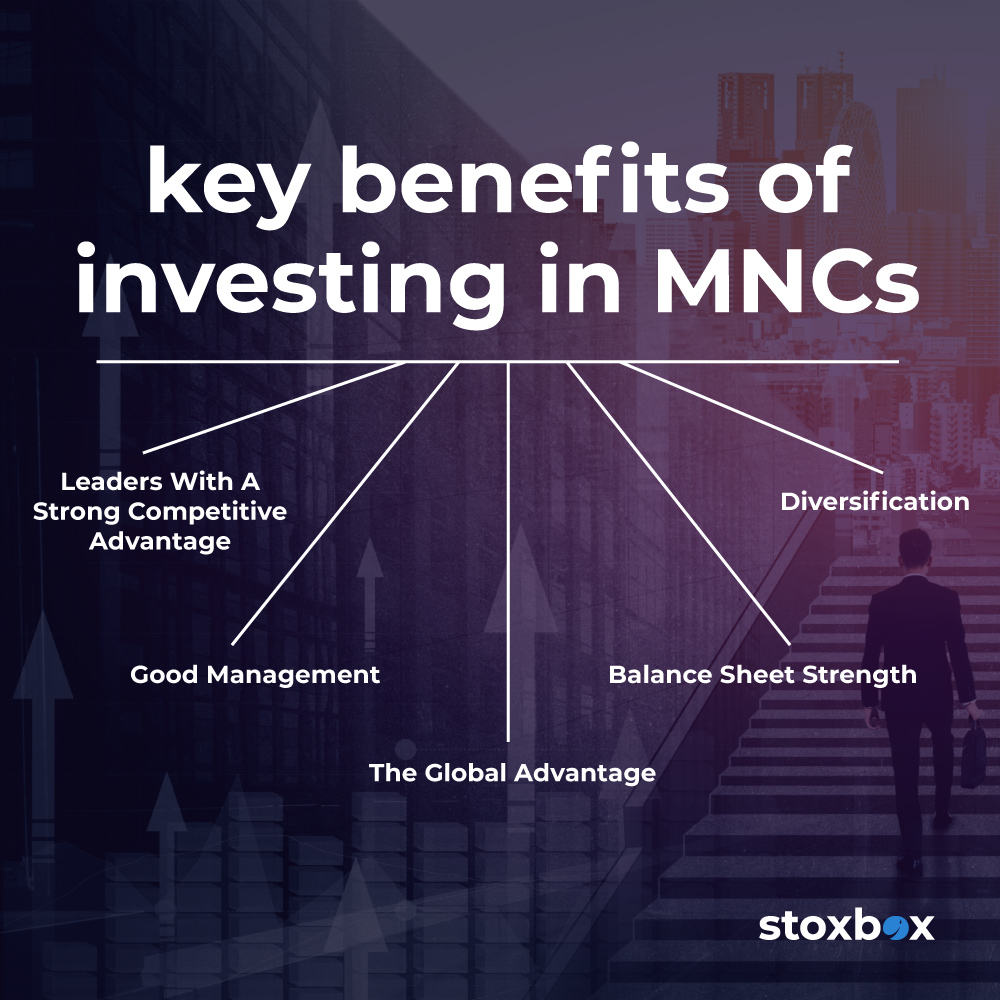

How you ask? Below, we list some of the key benefits of investing in MNCs.

- Leaders with a strong competitive advantage: MNCs are usually global giants that operate from a position of strength that has been established over a period of time. Further, many MNCs have weathered multiple business cycles and created formidable moats that have helped them secure their position in the marketplace and sustain their competitive advantage.

- Good management: MNCs are often helmed by strong senior management that is capable of drawing and achieving strategic goals that ensure sustainable growth for the firm. Further, MNCs have historically adopted robust corporate governance practices and demonstrated an ability to maximise shareholder wealth.

- The global advantage: MNCs have the unique advantage of global parentage. Their global lineage provides them with the necessary financial cushion and access to better technical know-how, new opportunities, and innovative engineering and production processes. All these things combined put MNCs at a distinct advantage to local companies.

- Balance sheet strength: A strong balance sheet indicates that a company either has no significant debt or has the ability to pay off its debt without any hardship. MNCs generally have strong balance sheets that empower them to easily fund operations, meet obligations, and optimally leverage new and emerging opportunities.

- Diversification: In general, MNCs are relatively less volatile when compared to most other thematic funds. This stems from the fact that many of them are usually cash rich and have historically survived several business cycles and thus, makes them less risky. Further, MNCs operate in several companies. This makes them a particularly good investment from the perspective of diversification.

You might also Like.

No posts found!