26 Investment Terms

When investing your hard-earned money, you should have sufficient awareness and knowledge about how investments work and what you can expect from them. After all, you invest to earn maximum returns, so shouldn’t you know how and where to invest money?

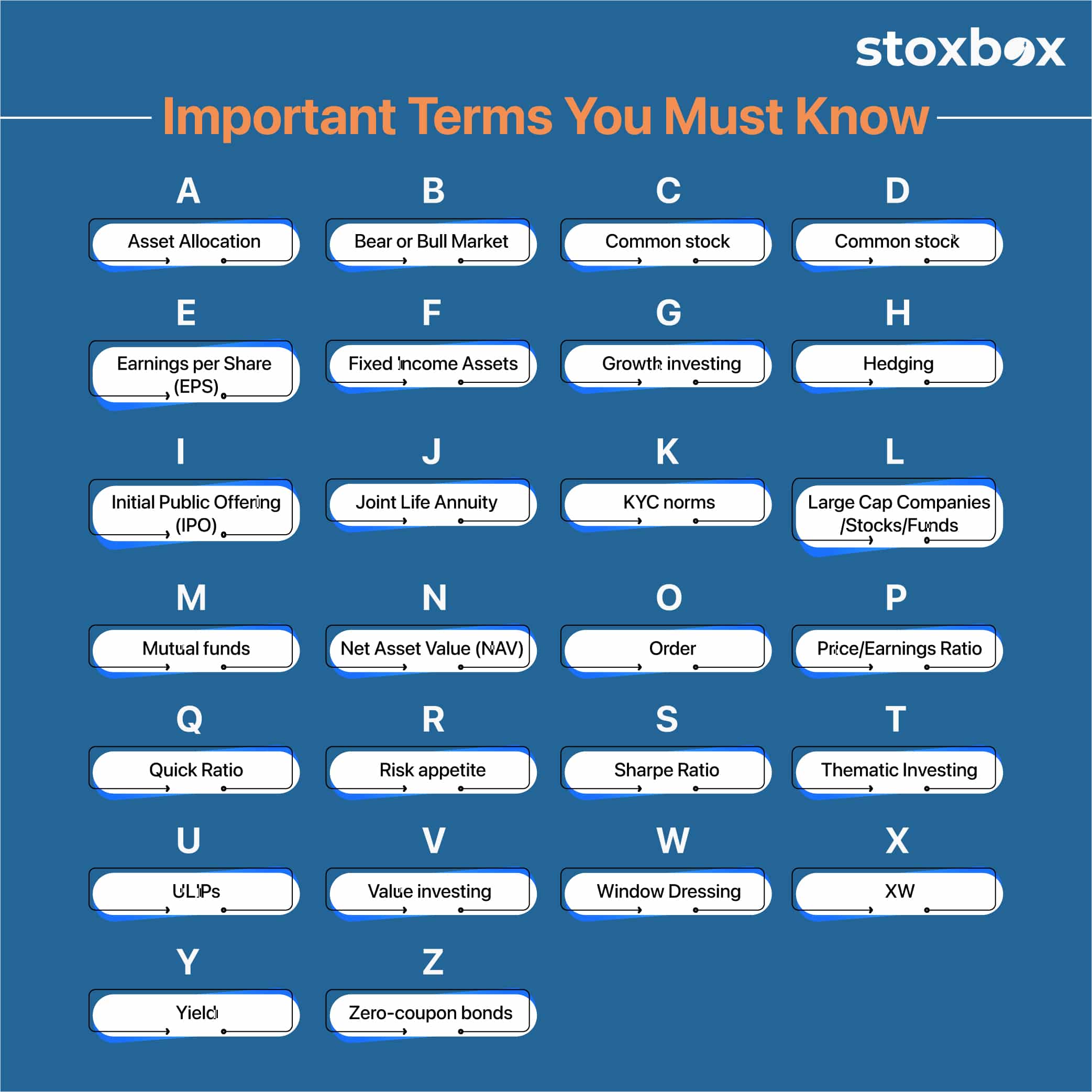

For all investors out there, here is a list of important 26 investment terms in India, that you should know before you embark upon your investment journey –

A – Asset Allocation

Asset allocation means segregating your investments into different investment avenues to earn maximum returns. Just like you select different food items in your meal, asset allocation means selecting different investment avenues in your portfolio.

B – Bear or Bull Market

When the stock markets fall consistently, it is called a bear market. Alternatively, when the stock markets rise continuously, it is called a bull market.

Bull and bear markets are two important concepts when you invest in the stock market. You should learn the rules of stock trading before you start stock investing so that you know how and where to invest.

26 Investment Terms

C – Common stock

Common stock is the stock of a company that is available for investment. It is also commonly called shares. So, when you buy shares of a company, you invest in the company’s common stock and become its part-owner.

If you want to invest in stocks, understand the basics of investing in the stock market, and then start your investment journey.

D – Diversification

Diversification is the act of spreading the investment risk over different investment avenues. Diversification helps you choose different types of investments so that you have a versatile portfolio that can withstand market sentiments.

Stoxbox offers you the benefit of a diversified portfolio of investment options in India, which are curated based on qualitative and quantitative analysis. Through Stoxbox you can get the benefit of diversification and ready-made portfolios which are expertly assessed.

E – Earnings per Share (EPS)

EPS shows the profitability of a company. It is the amount of money that you can earn per unit of a company’s stock.

26 Investment Terms

F – Fixed Income Assets

Fixed-income assets are those investment avenues that yield a fixed rate of return periodically. These assets, therefore, are not exposed to equity risk and market fluctuations.

G – Growth investing

Growth investing is an investment strategy wherein you pick stocks of growing companies that are expected to yield attractive returns on your investments.

H – Hedging

Hedging is the act of managing investment risks by investing in alternate avenues which do not move in tandem with the market. For example, gold is an excellent hedging tool. When the stock market falls or becomes volatile, gold prices usually rise. So, by investing in gold, you can hedge against volatility risks.

26 Investment Terms

I – Initial Public Offering (IPO)

IPO is the process by which an unlisted company offers its shares to the public for subscription. By launching an IPO, the unlisted company seeks to become listed on the stock exchange.

J – Joint Life Annuity

A joint-life annuity is a type of annuity payment wherein two or more lives receive annuity payments. The annuity is first paid to the primary annuitant. Thereafter, if the primary annuitant dies and the secondary annuitant is alive, the annuity continues to be paid to the surviving annuitant for his/her lifetime.

K – KYC norms

Know Your Customer (KYC) norms are those that you need to fulfil before you invest in any avenue. You are required to submit KYC documents which include your identity proof, bank details, and photographs. KYC is a step by the government to prevent money-laundering activities.

L – Large Cap Companies/Stocks/Funds

Large-cap companies are those which have the largest market capitalization. Such companies are established companies that can weather out market fluctuations and provide stable returns. Large-cap stocks are shares of large-cap companies. Mutual funds that invest primarily in stocks of large-cap companies are called large-cap funds.

M – Mutual funds

Mutual funds are professionally managed schemes that allow you to invest in a diversified portfolio for risk minimization and growth potential.

N – Net Asset Value (NAV)

The NAV is the per-unit price of a mutual fund scheme. Since the mutual fund scheme invests in a variety of avenues, the NAV is calculated by dividing the market value of the investments by the number of assets that the portfolio has bought. When you invest in a mutual fund scheme, the NAV determines the number of units that you can buy with a given amount of investment.

O – Order

In stock trading, the order is when you place your intention to buy or sell stocks at a given rate and at a given time.

P – Price/Earnings Ratio

Called the P/E ratio, in short, it shows the profit expectations from a company. The ratio measures the amount of money that you are willing to pay for each rupee that a company earns. So, if the company’s profit per share is Rs.10 and its market value is Rs.100, the P/E ratio is 100/10 = 10. The higher the P/E ratio, the popular the company is perceived to be.

Q – Quick Ratio

To assess the liquidity of a company, you can calculate its quick ratio. The ratio is calculated by dividing the current assets (excluding inventory) by the current liabilities.

R – Risk appetite

Risk appetite is your capacity to handle investment risks. Before investing, you should assess your risk appetite to find out whether you are risk-averse or a risk-taker. Investment avenues should always be selected depending on your risk appetite.

S – Sharpe Ratio

The Sharpe Ratio measures the reward that you earn per unit of the risk that you take. A high ratio is beneficial as it shows that by taking a small investment risk, you can stand to gain attractive returns from the investment.

T – Thematic Investing

Thematic investing means investing as per a particular theme. You identify macroeconomic trends and then invest as per such trends to generate returns based on changing market dynamics. For example, the theme of environment safety and protection is gaining traction in recent times. As per this theme, you can invest in stocks and securities of companies that are engaged in environment protection or that use clean energy.

U – ULIPs

Unit Linked Insurance Plans (ULIPs) are life insurance policies that allow you to invest in the capital market for maximum returns and also enjoy life insurance coverage.

V – Value investing

Contrary to growth investing, value investing is also an investment strategy wherein you choose stocks of companies that, you believe, are undervalued. Thus, as the companies realize their true potential and are recognized by the market, their value increases thereby providing attractive returns on your investments.

W – Window Dressing

In investment terms, window dressing means to make the financial statements of a company look attractive for potential investors. You should check the financial statements of a company before you invest in its stocks and look beyond the window dressing to see whether they are safe investments or not.

X – XW

XW is a symbol that can be seen against stock on the ticker. It shows that the stock is trading ex-warrant. In this context, warrants are securities that give their holders the right to buy a specific number of stocks at a specific price before a specific date.

Y – Yield

Yield, in simple terms, is the return that you can earn from an investment.

Z – Zero-coupon bonds

Zero-coupon bonds are bonds that do not carry any interest rate. However, the bonds are issued at a discount by the company and then redeemed at their face value thereby giving a profit to investors.

How many of these terms did you know about?

You shouldn’t play blind when it comes to your investments, should you?

So, always remember to look out for these terms to get a grip on important investment knowledge before you start your investments in India.

You might also Like.

No posts found!