Index funds and ETFs have some similarities, but they are pretty different from one another at the same time. Let’s understand these similarities and differences.

If you want to invest in a portfolio of stocks listed on a particular index, there are two options that you can choose from – Index funds and Exchange Traded Funds. Both these investment avenues, though somewhat similar, are pretty different fundamentally. So, let’s understand what these avenues are, their similarities, their differences, and which one is right for you.

What are Index Funds?

Index funds are open-ended, usually equity-oriented mutual funds, that invest the portfolio in securities of a particular index. Up to 95% of the portfolio is invested in securities of an index which the fund tracks.

For example, if an index fund tracks the Nifty 50 index, at least 95% of the portfolio would be invested in the securities of that index. The remaining fund is then invested in debt instruments for stable returns.

What are Exchange Traded Funds?

Exchange-Traded Funds (ETFs) are those that also track a particular index or a commodity. ETFs pool together the investors’ money in a corpus, and then that corpus is invested in assets belonging to the index or commodity which the ETF tracks. The ETF mirrors the index and invests in securities in the same proportion as listed on the index. For example, if the ETF tracks the Nifty 50, its portfolio would be invested in all Nifty 50 and in the same ratio that the stocks are listed on the index.

Similarities Between Index Funds and ETFs

- They are pooled investment avenues wherein the investors pool their money in a corpus, and the corpus is then invested in different securities.

- Experienced fund managers manage both.

- Both are passively managed funds where the fund managers do not actively buy or sell the portfolio’s securities.

- Both can track a particular index.

- A part of both index funds and ETFs are invested in debt securities for stable returns.

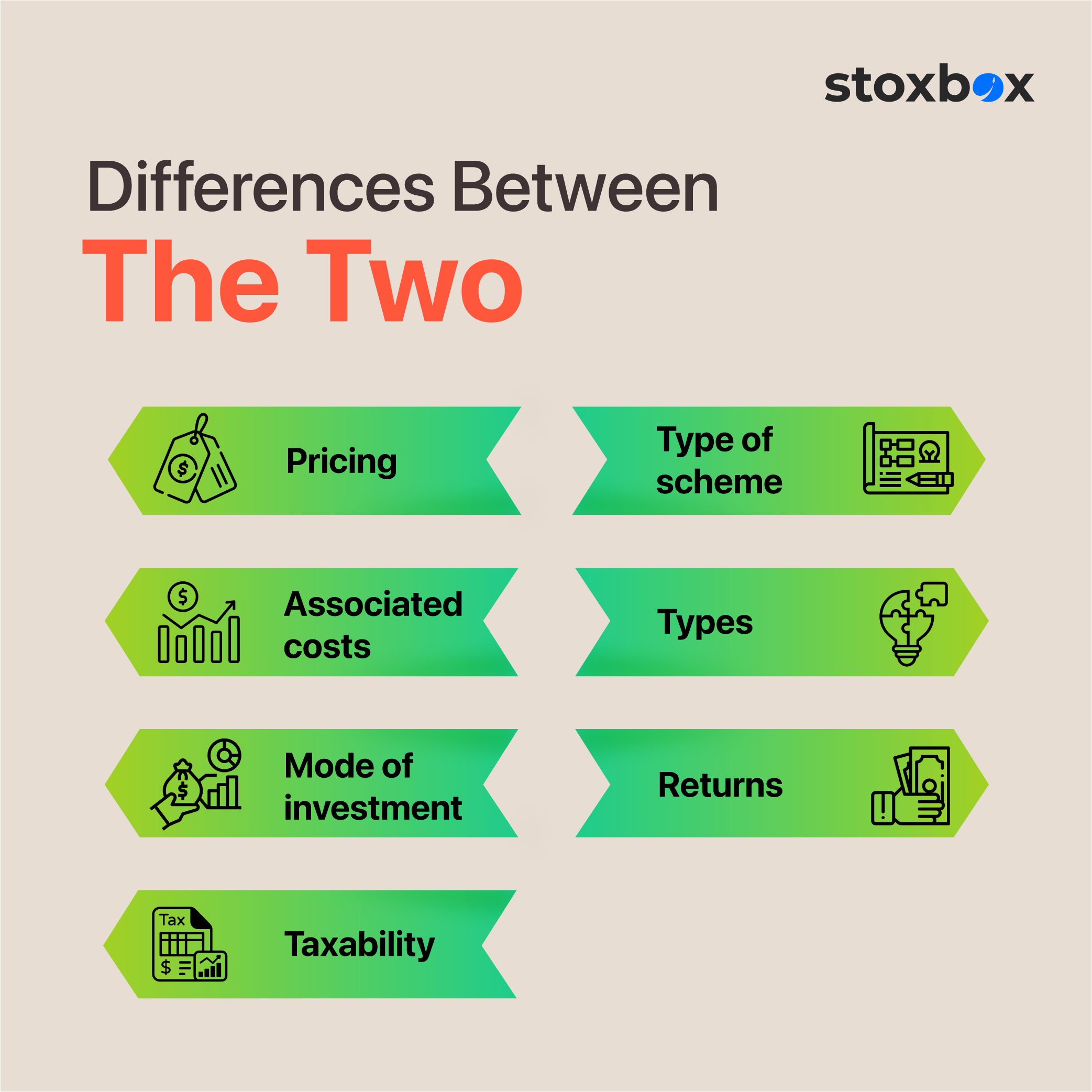

Besides the similarities mentioned above, index funds and ETFs are pretty different from one another. Let’s analyse such differences –

- Type of scheme

Index funds are mutual funds that you can buy from mutual fund houses, brokers, or R & T agents.

ETFs, on the other hand, are not mutual fund schemes. They are an independent type of investment avenue that is listed on the stock exchanges. Thus, you can buy and sell ETFs from any stock exchange in India on which such ETFs are listed. You would need an active Demat account for buying ETFs, which is not needed for index funds.

- Pricing

The cost of one unit of the index fund depends on its Net Asset Value (NAV). This value is calculated regularly depending on the market value of the underlying securities divided by the number of securities in the portfolio.

The cost of one unit of an ETF depends on the demand and supply mechanisms of the stock exchange. Since the ETF is listed on the exchange, its value depends on market sentiments.

- Types

Index funds do not come in any different types. They vary depending on the benchmark index that they follow.

ETFs, come in different types. These include the following –

- Index ETFs – they invest as per a particular index

- Gold ETFs – they invest in gold

- International ETFs – they invest in international funds

- Sectoral or thematic ETFs – they invest in securities belonging to a particular sector or theme

- Associated costs

Index funds involve different types of costs:

- The Total Expense Ratio (TER) of the mutual fund which involves fund management charge, administrative charge, etc.

- There is a transaction fee of Rs.100 if you invest more than Rs.10,000.

- There might be an exit load under some schemes, which is applicable if you redeem the fund before a specified period.

ETFs, however, have very minimal charges. There is only one transaction charge when you invest in the ETF. This charge is also limited to 5%. Besides this, you might have to pay the account maintenance charges of maintaining a Demat account every year. Even the expense ratio of the fund is lower than that of index funds. Thus, ETFs are more cost-effective than index funds.

- Returns

Though index funds mirror a particular index, there is a tracking error due to the portfolio’s debt holdings and if the fund manager does not maintain the allocation. So, in some cases, index funds might not give the same returns as yielded by the underlying benchmark index.

ETFs, more or less, match the index, and if there is a tracking error, it is quite low.

- Mode of investment

You can invest in index funds in a lump sum or through Systematic Investment Plans (SIPs). Thus, you have the flexibility of choosing the investment mode as per your suitability.

ETFs do not provide the SIP mode of investment. You have to buy in lump sum only.

- Taxability

Index funds are taxed as equity funds. This means that if you redeem the funds within a year, the returns would be taxed @ 15%. However, if you redeem the funds after a year, returns up to Rs.1 lakh would be tax-free. Returns exceeding Rs.1 lakh would be taxed @ 10%.

In the case of ETFs, taxability depends on the type of ETF you have invested in. Index and sectoral ETFs incur equity taxation and are taxed as index funds. However, gold and international ETFs incur debt taxation. This means that if you sell the ETF within 36 months, the returns earned would be clubbed with your income and taxed at your income tax slab rate. However, if you sell the ETF after 36 months, the returns earned would be taxed @ 20% with indexation benefit.

Here’s a quick look at the comparative differences between the two –

Points of difference | Index funds | ETFs |

Type of avenue | Mutual funds | Independent pooled investment avenues |

Variants | None | Four different variants |

Pricing | Based on the NAV of the fund | Based on the demand and supply of the ETF |

Underlying costs | Higher | Lower |

Returns | Similar to the underlying index but with a possibility of a tracking error | Almost similar. The chances of tracking error are low |

Investment mode | Lump-sum or SIP | Only lump sum |

How to buy | Like any other mutual fund scheme | Through a stock exchange. A Demat and trading account is a must. |

Taxability | Equity taxation | Equity or debt taxation depending on the ETF chosen |

Which one Should you Choose?

If you are a new investor and want passive investing, both avenues would do the needful. Index funds would be better if you’re going to systematically invest through SIPs as you benefit from rupee cost averaging. On the other hand, ETFs are more cost-effective and give you the benefit of trading on the stock exchange.

So, you can invest in either, depending on your investment needs. Alternatively, you can invest in both to create a diversified portfolio and bank on the benefits of both these schemes.

So, know what these avenues are and how they differ from each other and make an informed investment decision.

Frequently Asked Questions

How do index funds and ETFs differ in terms of investment flexibility?

Index funds are bought and sold at the end-of-day NAV, while ETFs trade throughout the day on stock exchanges, allowing investors to respond to market movements instantly.

Which is more cost-effective: index funds or ETFs?

ETFs typically have lower expense ratios than index funds, but investors should also consider transaction costs like brokerage fees for ETFs.

Are ETFs better suited for active traders compared to index funds?

Yes, ETFs are better for active traders due to their intraday trading capability, while index funds are more suitable for passive, long-term investors.

What role does liquidity play in choosing between index funds and ETFs?

ETFs generally require higher liquidity for smooth trading on stock exchanges, whereas index funds don’t rely on market liquidity as they are directly managed by the fund house.

Do index funds or ETFs have minimum investment requirements?

Index funds often have a minimum investment amount, while ETFs allow you to invest in single units, making them accessible even for small investors.

Which is better for systematic investing: index funds or ETFs?

Index funds are better suited for systematic investing plans (SIPs), as ETFs do not support SIPs directly.

What tax implications should investors consider for index funds and ETFs?

Taxation on both is similar for equity-based funds, but investors should check capital gains tax treatment based on their holding period (short-term vs. long-term).