Plan your investment with StoxBox to have a secured future ahead

Table of Contents

A Primer on Investments in Share Market

When Ankit’s father retired at 60, from his position as a professor in a government college, he received provident fund returns of 1 crore rupees, along with a monthly pension of over 1.25 lakh rupees. As an employee at a private firm, Ankit will not have the option of a pension to fall back on, upon retirement. His PF amount will also depend on how much he and his employer are willing to part with. While he is only 26 at present, Ankit understands that he must create a corpus for his retirement, failing which he will be forced to continue working or depend on his family. He is also aware of the fact that simply saving a portion of his monthly income will not suffice – given the high rate of inflation, and the low real returns on bank savings or fixed deposits, his money will lose value if he does not invest it. This brought him to the aspect of investments in the share market. Excited about the possibilities, and with his savings in hand, along with an additional 5 lakh rupees gifted by his father, Ankit decided to pursue investments in the share market to protect his future.

The Indian share market has grown tremendously since its inception, with the Sensex touching a low of 113 points and rising to 62245 points, between 1979 and 2022. Currently, the index is trading around 59K, and despite its spikes and slumps, if there is one thing, we can be certain of, it is the fact that, over some time, it will move inexorably higher and touch new highs. Does that mean investments in the share market are secure and without potential loss? Absolutely not! Investments in share markets are one of the riskiest investment options as they are fraught with a variety of macro and micro triggers, from geopolitical unrest and change in governments to a rise in inflation or the repo rate. So, what does that mean for an investor? For individuals like Ankit, who are keen on leveraging the stock market for potential returns, it is important to focus on risk mitigation and invest wisely.

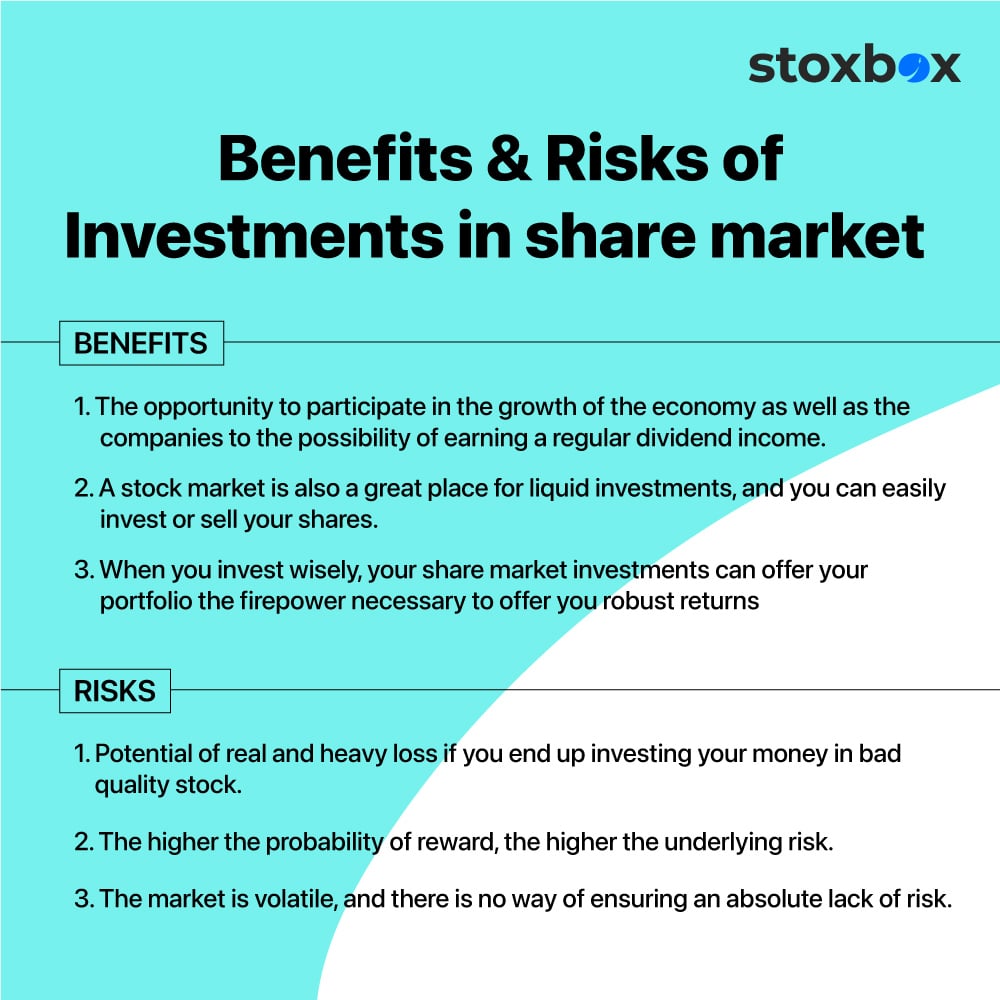

Investments in share market – Benefits and Risks

The stock market is a trading platform that brings together buyers and sellers who trade publicly listed shares, during specific hours of the day. A multitude of companies, belonging to various categories and sectors, are listed on the stock market, and the investor must decide which companies to invest in, based on their risk appetite, return requirements, financial goals,and time horizon. For instance, Ankit plans to invest for the long term, and, since he is in his 20s, he can take on high risks. Therefore, small-cap companies with a strong management structure and robust potential for returns can be one of the segments he invests in. Separately, since every portfolio requires a minimal amount of security, at the very least, Ankit’s investments in the share market should also include safe large capitalization companies which have been known to offer stable returns.

Investments in the share market offer individuals several benefits, from the opportunity to participate in the growth of the economy as well as the companies to the possibility of earning a regular dividend income. A stock market is also a great place for liquid investments, and you can easily invest or sell your shares, as long as you select stocks that are traded in high volumes. As a part of your portfolio, investments in the share market will also allow you the advantage of diversification, which involves distributing your money into different asset categories, for risk mitigation and return accrual. When you invest wisely, your share market investments can offer your portfolio the firepower necessary to offer you robust returns.

While there are many benefits to investments in the share market, you should be aware of several risks. One of the biggest risks of investing in the market is the potential for real and heavy losses – if you end up investing your money in bad quality stock, there is no estimating the amount of loss you will sustain. Further, since risk and reward have a directly proportional relationship, the higher the probability of reward, the higher the underlying risk. This is why investors are advised to allocate only a portion of their corpus to the share market, rather than investing the whole amount. The market is volatile, and there is no way of ensuring an absolute lack of risk.

Risk Mitigation in Share Market

Ankit had heard of many people who ended up making major losses in the share market, and this was one concerning issue. While he did want to earn good returns and create a nest egg for himself, he was worried about losing everything he had saved, along with the money his father had gifted him. Add to it the fact that he did not have much knowledge of the market, and Ankit was confused about how to proceed with his investments in the share market. That is when a friend suggested that he try out trading apps and curated portfolios wherein he would receive a portfolio suggestion based on his profile. Given the expert advice available, as well as the ability to undertake investments without worrying about his faulty judgment, Ankit found that this option worked the best. If you are also new to the market and want to start your investing journey, you should opt for trading apps and curated portfolios which will help you along the way and pave your path to success.

Your Wealth-Building Journey Starts Here

You might also Like.

No posts found!