Table of Contents

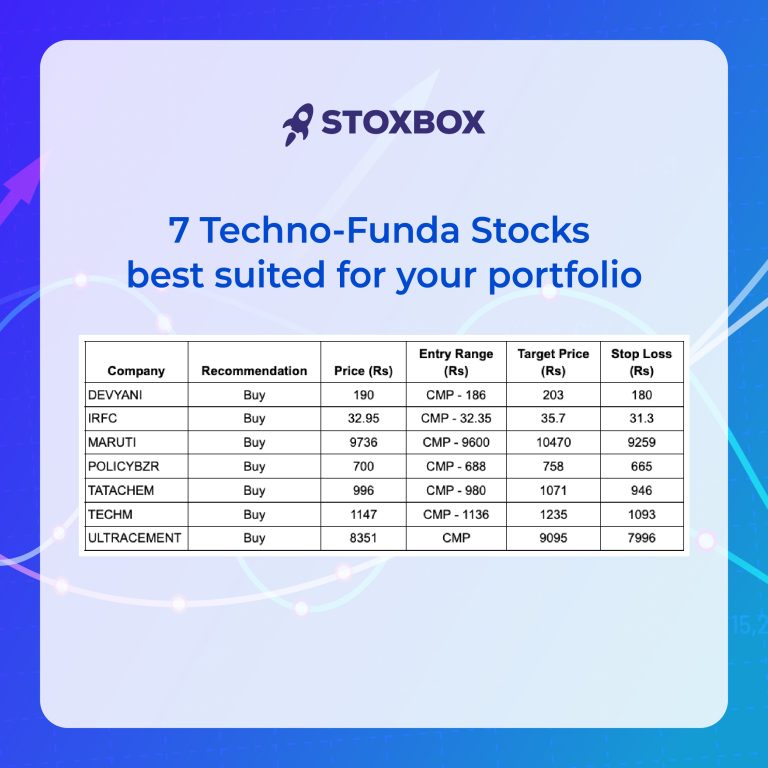

Devyani International Ltd.

Devyani International Ltd. (DIL) has demonstrated strong growth momentum and has crossed significant milestones in terms of revenue of Rs. 3,000 crores backed by store additions across brands and continued healthy performance from its existing stores. The company currently operates 1,243 stores across its portfolio of countries and brands and has managed to more than double its store count over the last three years. Both KFC and Pizza Hut crossed important store milestones of 500 stores each, and Costa Coffee has crossed 100 stores as of March 31, 2023.

The launch of KFC Lunch and Rolls which provide great value to its customers has seen strong initial traction. Premium products like the Chizza and the Peri-Peri chicken at KFC have been equally well received. They continue to actively pursue new trade areas in metro cities and upcoming locations. This will help the company to take the brand closer to its customers and give them a better experience.

Indian Railway Finance Corporation

Indian Railway Finance Corporation (IRFC) plays a strategic role in supporting the Indian Railways infrastructure development plan and is the sole market-guarding arm of Indian Railways to meet their entire extra budgetary resource requirements for CAPEX funding. There has been a big government push for infrastructure development, which resulted in railway capex also increasing over the years.

In the Union Budget for FY 2023-24, the railways got a very high budgetary allocation of Rs. 2.4 lakh crores, which is an all-time high. The focus areas of investments are the construction of new railway lines, doubling, and tripling of track, electrification, station redevelopment, freight corridors, the introduction of new next-gen trains, and setting up of Gati-Shakti terminals, and all the investments which are required to meet the Indian Railway target to become net zero carbon emission network by 2030. IRFC has a mandate (MoA) to finance projects which have a backward and forward linkage with railways and accordingly, they are very actively looking at funding such projects in the entire railway ecosystem, apart from funding Indian Railways.

Maruti Suzuki Ltd.

The company recently launched two new SUVs, Jimny and Fronx at the Auto Expo 2023. With this initiative, it is aiming for the leadership position in the SUV segment. In September 2023, the company started retailing its newest flagship offering from NEXA, the Grand Vitara. With over 75,000 bookings in a short period, the customer response to Grand Vitara is overwhelming. On the growth front, the organisation has already commenced work at the new facility in Kharkhoda in Haryana. The plant is expected to be operational by 2025 with an installed production capacity of 2.5 lakh units in the first phase.

In the past few quarters, there has been a systematic easing of commodity prices which will help Maruti to improve its margins going ahead. Also, the persistent issue of semiconductor chip shortages that the overall automobile industry was facing is fading which will help the automaker to increase its production output. With a robust order backlog by the end of Q4FY23, the company finds itself in a sweet spot to boost its business performance going forward.

PB Fintech Ltd.

PB Fintech has an annual run rate of about Rs. 14,000 crores insurance premium and the premium per inquiry which stands at Rs. 1,754 which is the highest ever for the company. The company offers consumers many insurance products, such as health and motor insurance, where renewals are common and the company is able to benefit from long-term retention and visibility of business from existing consumers with negligible marginal Customer Acquisition Cost (CAC).

Their credit business continues to grow quite decently and has been EBITDA positive now since December 2022. The company stands at a run rate of about Rs. 15,000 crores disbursal and more than 0.5 million credit card issuances on an annualised basis. Approximately 35 million customers have accessed the credit score platform.

Tata Chemicals Ltd.

Tata Chemicals is the third largest producer of Soda Ash globally with installed capacities of 4.36 million MT. While, overall, long-term growth (CAGR) is projected at ~3% globally and ~6% in India, new application segments fuelling faster growth are Solar Glass and Lithium Carbonate. These new segments are likely to grow faster than the industry and increase their share in Soda Ash consumption going ahead. Thus, the business aims to invest future cash flows in expanding Soda Ash as well as Bicarb and Silica capacities.

Tata Chemicals delivered another strong set of numbers annually and channelled the benefit of improved realisations despite facing uncertain global macro challenges and largely impacted by energy costs. Moreover, the Basic Chemistry portfolio led by Soda Ash grew 35% on the back of robust demand across geographies and application sectors including demand from solar glass and lithium carbonate. Further, the company believes that a healthy outlook for cash flows is likely to aid repay debt across geographies.

Tech Mahindra Ltd.

Tech Mahindra Ltd. (TechM) is making significant investments in technology and upskilling. The company has made fruitful investments in Quantum Computing Metaverse, Blockchain, Web 3.0, Cloud and Customer Experience Management that are yielding good results. Alongside its clients, it is ready to become agile and relevant when it comes to the adoption of next-generation technologies.

TechM and Microsoft have joined hands to bring “Network Cloudification as a Service” and AIOps to telecom operators for their 5G core networks. The 5G core network transformation will help telecom operators to develop 5G core use cases and meet their customers’ growing technological requirements such as Augmented Reality, Virtual Reality, Internet of Things, and edge computing. Alongside, the company has partnered with Retalon to jointly provide the full spectrum of digital solutions for the retail and consumer packaged goods (CPG) industry.

Ultratech Cement Ltd.

In Q4FY23, UltraTech’s net sales grew by around 20.2% QoQ and 18.3% YoY, mainly driven by volume growth in grey cement sales. The capacity utilisation improved to 84% in Q4FY23 and the management expects it to go up further in the forthcoming quarters. As per past trends, the company expects capacity utilisation to improve going further for Q1FY24. Given the government’s focus on infrastructure growth and the consequent rise in demand for urban housing, the company is poised for solid growth in the coming years.

With cement being a cost-sensitive product, its strategic manufacturing location places a vital role in determining its margin profile. One of the major costs for cement manufacturers is the logistics cost. Thus, Ultratech is at an advantage mainly due to its 23 integrated manufacturing units, 29 grinding units, one clinkerisation unit and 8 Bulk Packaging Terminals spread across various parts of India. Thus, its installed capacity spread across the country will help to minimise the transportation/freight costs and thus improve the margins. Further, with its existing white cement manufacturing capacity in India and its investment in Ras Al Khaimah Company for white cement and construction material in the UAE, UltraTech is strategically positioned to cater to the white cement and wall care putty market.

Click here to view the detailed report.

You might also Like.

Godrej Agrovet Ltd – Q4FY25 Result Update

Sector Outlook: Neutral Subdued performance, better recovery expected ahead Godrej...

Auto Wholesales Update – May 2025

Export momentum continues to remain strong despite domestic softness The...