Understand the Way SIP works and how it helps in your investment process

Table of Contents

Are your financially savvy family or friends behind you to start an SIP? You might have heard of this investment tool quite often—and rightfully so—because it effectively helps you grow your wealth.

If you’re new to this and have no idea where to begin, we have you covered. We’ll take a look at what SIPs are, how to invest correctly, and how you can choose the right plan. Let’s dive in.

So, what is SIP?

SIP stands for Systematic Investment Plan. It is a smart investment strategy that allows individuals to invest a set amount of money into mutual funds at regular intervals—say monthly or quarterly. SIPs help investors build their wealth over time with relatively lower risks as compared to a big one-time investment.

How does SIP work?

When you invest in an SIP a set amount is automatically debited from your bank every month, and it is invested in a mutual fund of your choice. This process continues regularly, allowing you to buy units of the mutual fund based on whatever the current Net Asset Value (NAV) is. It is beneficial as it averages out the cost of acquisition and avoids the risks of market volatility.

Let’s look at an example of how SIP works.

Let’s say you decide to invest Rs 5,000 every month in a mutual fund via SIP. Here’s how it works over three months:

| Criteria | Month 1 | Month 2 | Month 3 |

|---|---|---|---|

| Investment Amount | Rs 5,000 | Rs 5,000 | Rs 5,000 |

| NAV | Rs 25 | Rs 20 | Rs. 30 |

| Units Acquired | Rs 5,000 / Rs 25 = 200 units | Rs 5,000 / Rs 20 = 250 units | Rs 5,000 / Rs 30 = 166.67 units |

Over the three months, you have invested a total of Rs 15,000 and acquired 616.67 units.

The average cost per unit would be Rs 15,000 / 616.67 = Rs 24.32.

What are the features and benefits of SIP?

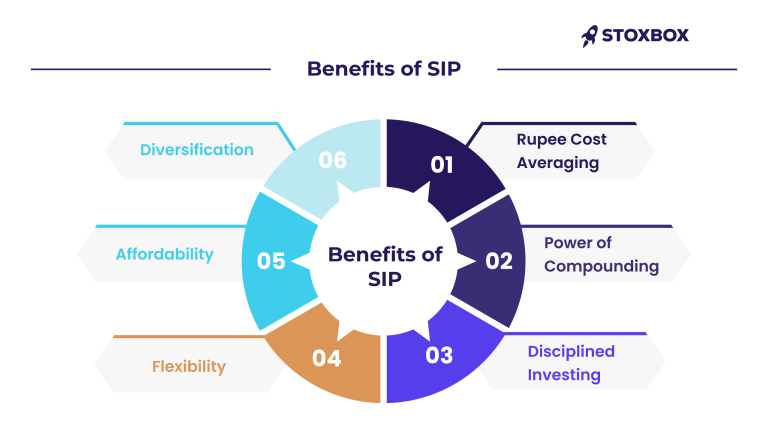

SIPs have quite a few interesting features that make them beneficial, and that’s why they make an attractive investment option for both novice and seasoned investors. Let’s take a close look at what these benefits are.

- Rupee Cost Averaging : You’re investing a fixed amount at regular intervals, regardless of the market conditions. Here’s why it can be beneficial.

- Market Fluctuations: The stock market is known to be volatile as the prices change all the time. When you invest a fixed amount through SIP, you end up buying more units when prices are low and fewer units when prices are high. The effect of the market volatility gets averaged out because of this kind of purchasing.If you invest Rs 5,000 each month, and the NAV of a mutual fund is Rs 20 in January, Rs 25 in February, and Rs 15 in March, you will acquire 250 units in January, 200 units in February, and 333.33 units in March. When you look at it over time, this averaging results in a lower average cost per unit compared to a big investment made at a single point in time.

- Power of Compounding : Compounding is the process wherein your investment generates returns that further earn returns. SIPs make proper use of the power of compounding by:

- Regular Investments: You allow your returns to compound because of regular investing. Even the smallest of amounts can grow significantly if invested consistently.

- Long-Term Growth: The more time you can stay invested, the better the compounding effect is. It simply means to begin as early as possible and remain invested for a long period of time because that will maximise the potential of your investments to grow exponentially. Assume you invest Rs 5,000 every month for 20 years in a mutual fund earning an average annual return of 12%. Over 20 years, you would have invested Rs 12,00,000, but because of the compounding effect, your investment may grow to about Rs 50,00,000.

- Disciplined Investing : SIPs enable automated investing, hence keeping investors disciplined with their money.

- Automation: In the case of SIPs, a specific amount is automatically deducted from your bank account and invested in the mutual fund. You can ensure that you are regularly investing without having to remember on your own.

- Avoiding Market Timing: Timing the market is one of the most common mistakes investors commit. Most often, it leads to buying high and selling low. SIPs keep such risks at bay by enforcing a fixed investment schedule irrespective of the trend in the market.

- Behavioural Benefits: SIPs inculcate the habit of saving and investing. It brings about financial discipline and reduces impulsive decisions.

- Affordability : SIPs are available to all, irrespective of income.

- Low Entry Point: You can start a SIP with an investment amount that is just about anything, the lowest being Rs 500 per month. This way, everyone, no matter where they may come from, could easily start investing.

- Gradual Investment: You do not have to wait for a big lump sum for making an investment. SIPs enable you to begin investing right away with the money that you can afford.

- Flexibility : SIPs offer significant flexibility in meeting diverse financial requirements and goals.

- Adjustable Amounts: You can increase or reduce the SIP amount according to your financial position. Say you receive a salary hike. You can increase your SIP contributions to boost your savings.

- Pause or Stop Investments: If you face financial constraints, SIPs allow you to pause or stop the investments without any penalties. You can easily manage your finances without any stress.

- Multiple Plans: You can invest in multiple SIPs across different mutual funds. It diversifies your entire portfolio and balances the risk too.

- Diversification : When you invest in SIPs, it provides diversification. It also reduces the risk associated with investing in individual stocks.

Types of SIP Investments

There are various types of SIPs available that can suit your needs and goals. A few very common types are:

- Regular SIP: A fixed investment amount is paid at regular, predetermined intervals.

- Top-up SIP: Allows you to increase the SIP amount periodically.

- Flexible SIP: Gives you the chance to alter the SIP amount based on your cash flow.

- Perpetual SIP: There is no end date, so it allows you to continue investing until you decide to stop.

- Trigger SIP: Investments are triggered based on certain set conditions or market levels.

There is another kind of SIP investing called goal-based SIP investing.

Goal-based SIP investment simply refers to the allocation of SIPs towards various financial goals that you may have. So, whether it is the education of a child, buying a home, or planning for retirement, SIPs may be planned to meet such goals.

Example of Goal-Based SIP

Child’s Education: If you want Rs 20 lakhs for your child’s higher education in 15 years, you can use online SIP calculators to find out how much is required monthly so that you can achieve this goal.

Retirement Planning: You can calculate the corpus needed at the time of retirement and start a SIP that will be accumulating over your working years.

Some key considerations before investing in SIP Mutual Funds:

Before you start investing in SIPs, consider the following factors to make an informed decision:

- Investment Horizon: Think about what you want to achieve financially and by when you want it. Then decide on your investment duration.

- Risk Appetite: Understand your risk-taking ability and then select funds that come under your risk profile.

- Fund Performance: Analyse past performance of the mutual fund and the fund manager’s track record.

- Expense Ratio: Check the expense ratio of the fund as it is likely to impact your returns.

- Fund Type: Based on risk appetite, one can choose equity, debt, or a hybrid fund.

Step-by-Step Guide to Investing in SIP

- Define Your Financial Goals: See what your short-term and long-term financial goals are.

- Choose the Right Mutual Fund: Guage your goals, risk appetite, and fund performance, and then choose the appropriate mutual fund scheme.

- Open a Demat and Trading Account: If you don’t already have one, open a Demat and trading account with a good brokerage.

- Complete KYC Process: Submit all relevant documents to fulfil the KYC requirements.

- Set Up SIP: Decide the SIP amount, frequency, and tenure, and set up the SIP either through your Demat account or directly on the website of the mutual fund.

- Monitor Your Investments: Review your SIP investments on a regular basis to ensure they continue to be on course.

How to Choose the Best SIP Investment Plan

Choosing the best SIP investment plans requires a lot of consideration about many factors. Here is how to choose the best SIP:

- Fund Performance: Look for a consistent performance record of 5–10 years.

- Fund Manager’s Track Record: Assess the qualification and experience level of the fund manager.

- Risk Profile: Identify the risk level of the fund and see whether it matches your risk profile.

- Diversification: Make sure the fund has proper diversification across sectors and asset classes.

Why Open a Demat & Trading Account?

A Demat and trading account is important for investing in mutual funds and stocks. It is like a digital wallet for your investments. It keeps your stocks and mutual funds safe and lets you buy or sell them easily. You can also get information about the market on the account and manage all your investments in one place.

How to Open a Demat & Trading Account?

- Choose a Broker: Go with a genuine brokerage firm that offers Demat and trading accounts.

- Fill Out Application: Complete the account opening form available on the broker’s website or office.

- Submit Documents: Provide identity proof, address proof, and PAN card.

- KYC: Complete your KYC by submitting the relevant documents along with in-person verification.

- Receive Account Details: After approval, you will receive your Demat and trading account details to start investing.

We’ve now learnt that SIPs are a smart and profitable way to achieve our financial goals, and they also keep our financial habits consistent. So, now when someone tells you about SIPs, you can have a meaningful conversation with them.

It’s time you incorporate SIPs in your investment strategy and watch your money grow over time!

Frequently Asked Questions

How do I start investing in a SIP?

To start investing in a SIP, choose a mutual fund scheme, decide the monthly investment amount, select a tenure, and set up an automated payment through your bank account.

What documents are required to invest in a SIP?

You will need identity proof (e.g., Aadhaar, PAN), address proof, and a bank account with KYC compliance to start a SIP.

Can I modify my SIP amount later?

Yes, most fund houses allow you to increase or decrease the SIP amount depending on your financial goals and budget.

Is there a minimum amount required to start a SIP?

The minimum amount to start a SIP varies by fund, but it usually starts as low as ₹500 per month.

What happens if I miss a SIP installment?

Missing a SIP installment due to insufficient funds will not cancel your SIP, but repeated defaults could lead to termination by the fund house.

Are SIP investments safe during market volatility?

SIPs help mitigate market volatility through rupee cost averaging, ensuring you buy more units when prices are low and fewer when prices are high.

Can I stop my SIP anytime?

Yes, SIPs are flexible, and you can stop your investments anytime without incurring any penalty.

Your Wealth-Building Journey Starts Here