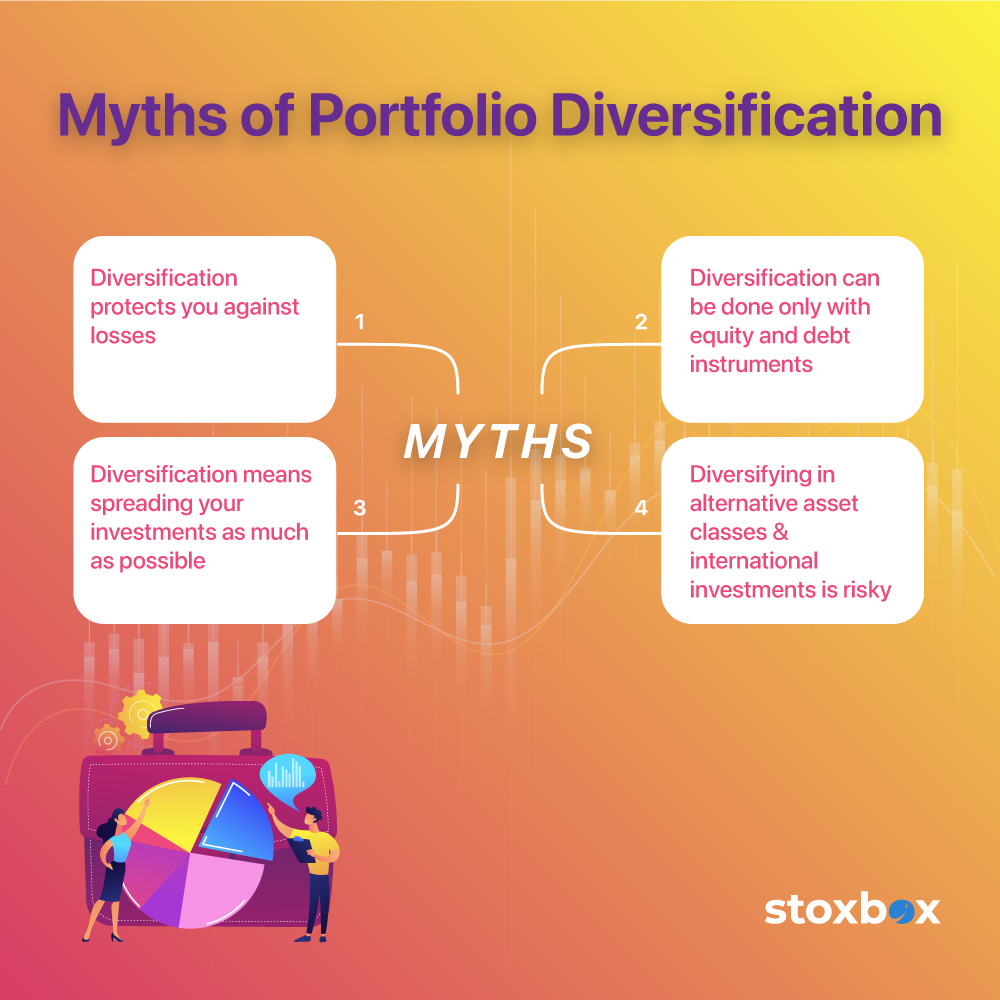

The true and false of portfolio diversification

The merits of portfolio diversification are well-known. However, the interesting thing about financial literature is that it can often leave doubts in the minds of the consumer and also create certain myths that can be detrimental to the portfolio management process. Here are a few common myths that we will seek to dispel about portfolio diversification.

Myth 1: Diversification protects you against losses

Diversification is often sold by financial experts as a way to protect your portfolio from losses. However, you cannot start diversifying your investment portfolio with the expectation that you will not make losses. In investing, there is no such thing as a certain bet. Hence, profit and loss are both an integral part of investing. What diversification essentially does is that it reduces the impact of loss on your portfolio. For example, assume that your portfolio holds a 50% allocation to equities, 35% allocation to debt, 15% allocation to gold ETFs. Now, if equity markets start going down and some of your equity investments start witnessing losses then only 50% of your portfolio gets impacted. Further, your debt and gold ETF investments might be witnessing gains and would further reduce the overall losses in your portfolio. On the other hand, imagine if you had a 100% equity portfolio. Then, in a downward moving equity market, your entire portfolio would suffer losses. Clearly, diversification cannot protect your portfolio from losses but it can reduce the impact of loss on your portfolio.

Myth 2: Diversification can be done only with equity and debt instruments

Another common belief is that if you want to diversify your portfolio then you can only invest in a combination of debt and equity instruments. The main logic behind diversification is that you invest in instruments that have very low to negative correlation with each other. What this essentially means is that their response to the same set of events or developments is not the same. For example, in periods of economic uncertainty, equity markets tend to be volatile and can fall. On the other hand, during such periods, gold prices usually increase since gold is viewed as a safe haven investment. Similarly, there are several alternative investments that have very low to negative correlation with traditional asset classes like debt and equity and should be considered from a diversification perspective.

Myth 3: Diversification means spreading your investments as much as possible

Not many of you might be aware that overdiversification is a term as well. It essentially means that you spread your investments across such a large number of investments that the profits you make in one investment are completely offset by the losses you make in another, thereby ending up as a zero sum game. When you diversify your portfolio across a select few investments the aim is to ensure that the profits that you make in 60 to 80% of your investments can more than make up for the losses that you incur in the balance of your investments. However, as you increase the number of investment products then this benefit starts reducing as you start tending towards the mean, i.e., a 50-50 chance of either making profits or losses.

Myth 4: Diversifying in alternative asset classes and international investments is risky

What we don’t know can often scare us. Today, as average investors with a relatively low investment ticket size, not many of us know or understand alternative or international investments. This makes us view them with a certain degree of skepticism. However, a small exposure to such investments can help you enhance the risk adjusted returns of your portfolio. Basically, these investments are impacted by a unique set of triggers that might be different from the factors that influence your traditional equity and debt investments. As a result, they can further reduce portfolio risk while creating new avenues of returns.

Frequently Asked Questions

1. How can over-diversification harm your portfolio?

Over-diversification can dilute returns as spreading investments across too many assets may lead to lower overall gains. It may also make monitoring and managing the portfolio cumbersome.

2. Is diversification necessary for short-term investment goals?

Diversification is less effective for short-term goals since the focus is typically on preserving capital rather than spreading risk. For short-term goals, safer instruments like fixed deposits or debt funds might be more suitable.

3. Can too much focus on diversification prevent wealth creation?

Excessive diversification might limit exposure to high-growth assets, potentially reducing the portfolio’s ability to generate significant wealth over time.

5. Should I diversify within the same asset class, like stocks or mutual funds?

Yes, diversification within an asset class can reduce risk. For instance, in equities, you can invest across sectors, geographies, and market capitalizations to avoid sector-specific downturns.

6. What role does time horizon play in diversification strategies?

Your investment horizon determines how you diversify. Long-term investors may opt for equity-heavy portfolios, while short-term investors may prefer safer assets like bonds or liquid funds.

7. How can rebalancing maintain effective diversification?

Periodic rebalancing ensures that your portfolio remains aligned with your risk tolerance and financial goals, as market movements can shift the original allocation.

8. Is it possible to diversify with limited funds?

Yes, products like mutual funds or exchange-traded funds (ETFs) allow diversification even with small capital, as they pool resources to invest across a variety of assets.

You might also Like.

Union Budget 2026-27 Impact on Sectors

Edit Announcement Companies Impact Rare earth permanent magnet manufacturing programme...