Table of Contents

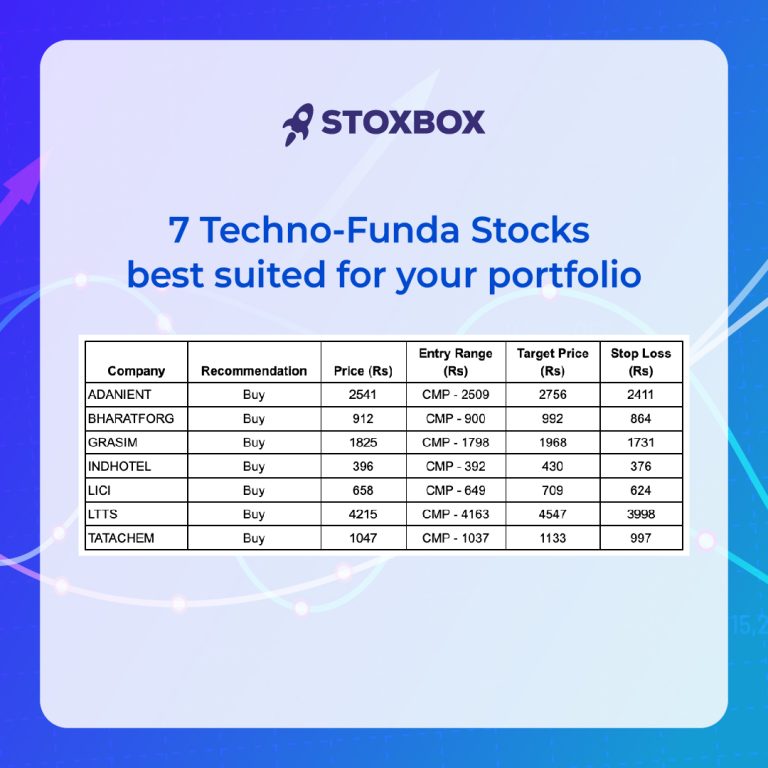

Adani Enterprises Ltd.

In Q1FY24, Adani Enterprises reported an EBITDA jump of 44.9% YoY to Rs. 2,524 crores led by inventory realisation at a higher rate. The EBITDA margin stood at 9.9% compared to 4.3% in Q1FY24. Meanwhile, Profit after Tax stood at Rs. 677 crores up 44.4% YoY in Q1FY24 whereas the PAT margin stood at 2.7% (up 17 bps QoQ / up 151 bps YoY) in Q1FY24. This was on account of robust performance and an increase in operational productivity by ANIL Ecosystem and Roads Business.

The business has diversified and strengthened its presence in core industries such as coal, power, steel, infrastructure, energy, logistics, and real estate which are key industries for the industrial development of the economy. Apart from this, the company is accelerating to unlock the growth potential of its incubating business which includes Adani Airports, Adani New Industries, Data Center, and Adani Roads. This segment recorded a 35% YoY revenue growth to Rs. 1,711 crores in Q1FY24 owing to an increase in pax movements in the quarter.

Bharat Forge Ltd.

Over the years, Bharat Forge has created an extensive defence product line and transformed itself from a component supplier to a system supplier. It has already bagged export orders for artillery systems and remains poised to win a robust order book from the Indian army for ATAGs. In the defence segment, Bharat Forge indicated a good response to its gun display at the recent defence exhibition, which helps in winning component and consumable export orders, and the company believes that it can help to ramp up defence product sales. The company’s defence revenue is expected to touch Rs. 10 billion over the next few years, from Rs .3-5 billion currently.

JS Auto Cast is a leading manufacturer of machined ductile iron castings, which finds applications in wind energy, hydraulics, automotive, and power generation sectors. It is a leader in small-sized turbine castings. About 50% of its products are exported and 100% machined in-house. The company has won an order of over 400 crores and expects this business to ramp up significantly over the next two years. Further, the company acquisition of the new unit in Coimbatore will triple capacity from 40,000 tons to 120,000 tons in the next two years. This will help to improve the company’s profitability and create a new solid vertical which will allow it to grow and service both new and existing customers and get into new products and segments as well.

Grasim Industries Ltd.

Grasim’s Viscose business achieved the highest-ever sales volumes in FY23 on the back of strong domestic demand and historically high realisations. VSF’s prices are showing signs of improvement globally and in India. Viscose is expected to grow at 8-10% CAGR p.a. over the long term outpacing cotton/synthetic fibres as its share in the global fibre market is just 6%. This will aid growth of the company’s revenue in the future.

Grasim’s R&D lab and pilot plant are fully operational and the plants’ construction progressing as per schedule for phase-wise commencement from Q4FY24. The building material industry’s growth is doubling in about a 7 to 8 years time period. But paint is growing almost at 1.6x the building material industry. With multiple changes entrenched in paint, we expect the market will continue to grow. There is a sufficient gap in the market for a strong national player, which can consistently supply materials as well as make sure its presence is not only in urban but in rural markets as well. Thus, we believe that Grasim will grow exponentially once its plants are commissioned.

The Indian Hotels Company Ltd.

IHCL has been consistently enjoying the structural upswing that is ongoing in the hotel business. It is interesting to note that the ARR increased to Rs. 9,128 in Q1FY24 compared to Rs. 8,315 in Q1FY23, leading to a 15.8% YoY revenue growth. Despite the first quarter being a weaker quarter for the business, the increase in overall occupancy and ARR affirms the strong demand dynamics of the industry. Assuming that FTAs revert to the pre-covid level in H2FY24, we expect higher pay rates in destinations like Rajasthan and Goa which are currently displaying tepid growth in ARR terms.

In Q1FY24, IHCL signed 11 new hotels and opened 5 new hotels, taking the total operational hotels to 191 across brands. Of the 11 new hotel signings, 7 hotels are expected to open in the next 24 months. Major events like G20 Summit and World Cup cricket along with higher benefits from the upgraded Ginger portfolio in the second half will add to the strong business performance for the company. In other ancillary business of the company, we saw TajSATS margins expanding to 24.5% in Q1FY24 compared to 14.5% in Q1FY23, thus reigning as a dominant player in airline catering with a market share of 59% in volume terms.

Life Insurance Corporation of India

The company is the largest life insurance provider in the fast-growing Indian insurance market space, giving it an edge over other competing organisations in the life insurance market. The market share of the company as of 31st March 2023 stood at 68.3%, higher than 63.3% as of 31st March 2022. For the half year ended 31st March 2023, the company sold 2.04 crores of policies. The company also leads in both individual and group policies, having a robust 42.3% and 80.3% market share, respectively, in the segments. Also, the company is the largest asset manager in India, with an AUM of Rs. 43,97,205 crores. as of 31st March 2023 which has grown 8% compared to the previous year.

The company has a long history of 66 years in the Indian insurance space. It was the only life insurance provider in the country from 1956 to 2000 which has enabled the brand to gain the trust of Indian customers. Furthermore, the Indian insurance market is highly under-penetrated with one of the highest insurance protection gaps in the Asia-Pacific region. This provides the company with significant room for expansion of the business and also helps in the acquisition of new business in the individual as well as group segments. Also, the company has the largest agent force in the industry with 1.34 million agents working exclusively with the organisation.

L&T Technology Services Ltd.

During the quarter, LTTS secured a major USD 50 million plus deal in its Hitech segment to enable new opportunities for digital video platforms for its customers. Additionally, the company also added other five deals with TCV of more than USD 10 million each in the quarter. This is in contrast to a slow pickup in deal wins in April, providing us with meaningful growth visibility in the near term. The company has also fully integrated the SWC business into its Telecom & Hitech organisation with targeted execution of these deals to commence in Q2FY24.

In its Q1FY24 update, the company has maintained its FY24 USD revenue growth guidance of 20%+ in cc terms and reiterated its aim to achieve a $1.5bn run rate in FY25. LTTS key verticals are all on strong footing, with the company’s continuous focus on investing in transportation capabilities for the future like software-defined vehicles (SDV), integration of SWC business in the Telecom & Hi-tech segment to provide benefits from Q2FY24 onwards, and strengthening its AI capabilities. Although the Plant Engineering segment was impacted in Q1FY24, the business expects a bounce-back in the next quarter with notable improvement in the pace of its decision-making from July onwards.

Tata Chemicals Ltd.

Tata Chemicals is the third largest producer of Soda Ash globally with installed capacities of 4.36 million MT. While, overall, the long-term growth (CAGR) is projected at ~3% globally and ~6% in India, new application segments fuelling faster growth are Solar Glass and Lithium Carbonate. These new segments are likely to grow faster than the industry and increase their share in Soda Ash consumption going ahead. Thus, the company aims to invest future cash flows in expanding Soda Ash as well as Bicarb and Silica capacities. Further, Soda Ash demand could also get a boost from the single-use plastic ban currently under discussion in India. This could potentially create additional demand for glass, which implies an additional path of growth for Soda Ash in the Container Glass segment.

Tata Chemicals delivered another strong set of numbers annually and channelled the benefit of improved realisations despite facing uncertain global macro challenges and largely impacted by energy costs. Moreover, the basic chemistry portfolio led by Soda Ash grew 35% on the back of robust demand across geographies and application sectors including demand from solar glass and lithium carbonate. Salt and Sodium Bicarbonate also witnessed steady demand. Further, the company believes that a healthy outlook for cash flows is likely to aid repay debt across geographies.

Click here to view the detailed report.

Your Wealth-Building Journey Starts Here

You might also Like.

Union Budget 2026-27 Impact on Sectors

Edit Announcement Companies Impact Rare earth permanent magnet manufacturing programme...