If you’re an active trader in Indian markets, you’ve probably heard analysts mention “SGX Nifty” during morning market discussions. This offshore derivative instrument has been a crucial indicator for Indian market sentiment for over two decades. But what exactly is SGX Nifty, and how can it help you make better trading decisions?

Table of Contents

What Is SGX Nifty?

SGX Nifty is a derivative contract based on India’s Nifty 50 index, traded on the Singapore Exchange (SGX). It allows global investors to take positions on Indian equity markets outside Indian trading hours, providing a window into potential market direction before NSE opens.

Key Technical Details:

- Underlying Asset: NSE Nifty 50 index

- Trading Hours: 9:00 AM to 6:15 PM Singapore time (6:30 AM to 3:45 PM IST)

- Settlement: Cash-settled based on Nifty 50 closing value

- Currency: US Dollars

- Contract Size: Similar to NSE Nifty futures but denominated in USD

Unlike the actual Nifty index traded on NSE, SGX Nifty is a futures contract that derives its value from the underlying Nifty 50 index but trades on a foreign exchange with different participants, timings, and settlement mechanisms.

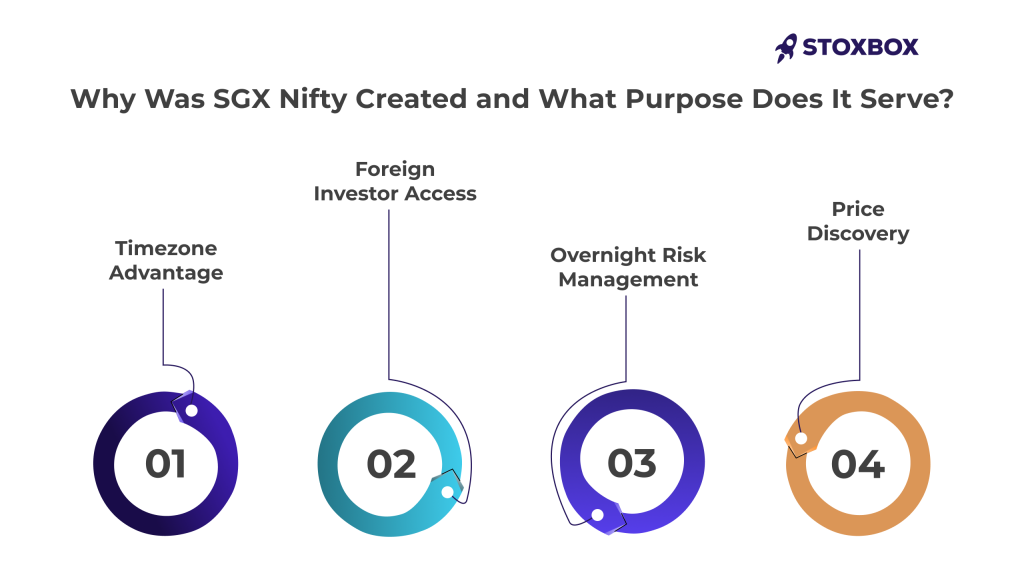

Why Was SGX Nifty Created and What Purpose Does It Serve?

SGX Nifty was introduced to address several market needs:

Timezone Advantage: Singapore’s time zone allows global investors to trade Indian market exposure during Asian trading hours when NSE is closed, providing continuous price discovery.

Foreign Investor Access: International funds and institutional investors could hedge their Indian equity positions or gain exposure without navigating Indian market regulations and operational complexities.

Overnight Risk Management: Global portfolio managers needed instruments to hedge overnight risks in their Indian equity holdings, especially during volatile periods.

Price Discovery: SGX Nifty helps incorporate global events, overnight news, and international market movements into Indian market expectations before NSE opens.

This offshore instrument became particularly valuable for Foreign Institutional Investors (FIIs) who needed efficient hedging mechanisms and continuous access to Indian market exposure across different time zones.

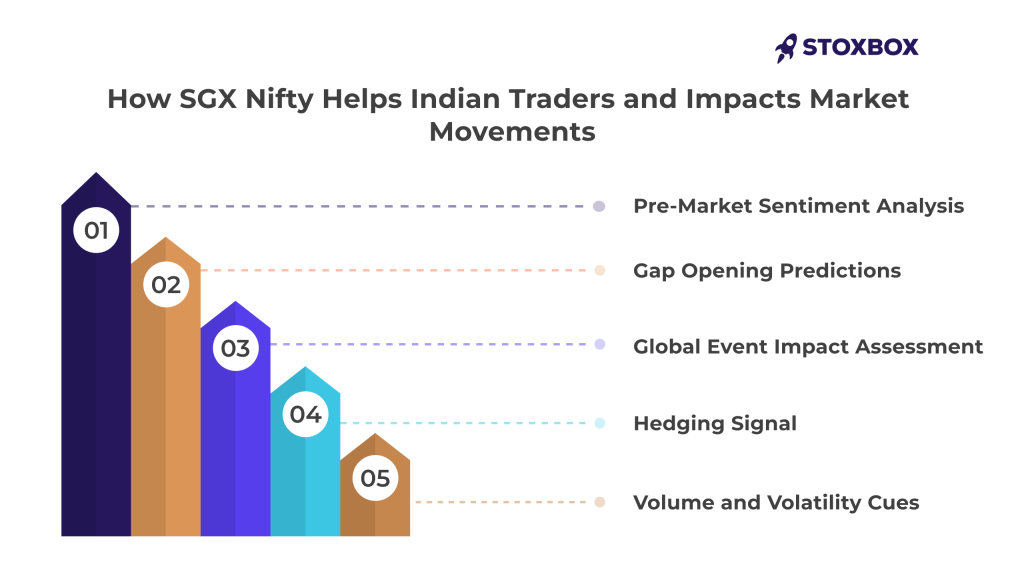

How SGX Nifty Helps Indian Traders and Impacts Market Movements

SGX Nifty serves as a crucial early indicator for Indian traders in several ways:

Pre-Market Sentiment Analysis: By tracking SGX Nifty movements from 4:00 AM IST onwards, traders can gauge market sentiment before NSE opens at 9:15 AM.

Gap Opening Predictions: Significant moves in SGX Nifty often translate to gap openings in Indian markets, helping intraday traders prepare their strategies.

Global Event Impact Assessment: When major global events occur after Indian market closure, SGX Nifty reflects their potential impact on Indian equities.

Hedging Signal: Large institutional players’ hedging activities in SGX Nifty can signal potential moves in underlying Indian stocks and sectors.

Volume and Volatility Cues: Unusual trading volumes or volatility in SGX Nifty can indicate heightened market interest and potential volatility in Indian markets.

For active traders, SGX Nifty provides a valuable head start in understanding market dynamics, though it should be combined with other indicators for comprehensive market analysis.

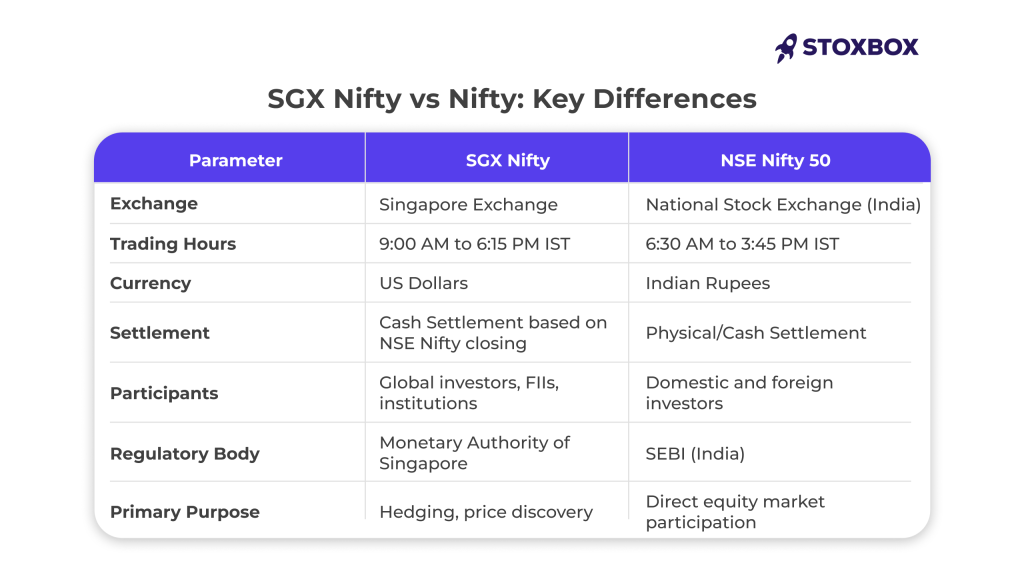

SGX Nifty vs Nifty: Key Differences

Important Note: SGX Nifty is not a replacement for NSE Nifty but rather a derivative instrument that provides early market cues. Its movements are generally correlated with NSE Nifty but can sometimes diverge due to different participant behaviour and market dynamics.

The Shift to GIFT Nifty: What Changed in 2023

In July 2023, a significant change occurred in the offshore Nifty trading landscape with the launch of GIFT Nifty at GIFT City, Gujarat.

GIFT Nifty Introduction: NSE launched GIFT Nifty (NSE IFSC) to provide similar offshore trading capabilities while keeping the activity under Indian regulatory oversight.

Strategic Benefits:

- Regulatory Control: Brought offshore Nifty trading under SEBI’s purview

- Revenue Retention: Trading fees and taxes now benefit the Indian economy

- Enhanced Oversight: Better monitoring of large institutional positions affecting Indian markets

Market Transition: While SGX Nifty continues to operate, many institutional players have gradually shifted trading volumes to GIFT Nifty due to regulatory preferences and operational advantages.

Current Status: Both SGX Nifty and GIFT Nifty operate simultaneously, with GIFT Nifty gaining increasing market share among institutional participants.

This development represents India’s effort to maintain greater control over derivatives based on its domestic indices while providing global investors with necessary trading infrastructure.

Should You Use SGX/GIFT Nifty in Your Trading Strategy?

The utility of SGX/GIFT Nifty depends on your trading approach and style:

Day Traders: Highly beneficial for understanding potential market opening directions, gap predictions, and early sentiment analysis. Most professional day traders incorporate these indicators into their pre-market preparation.

Swing Traders: Useful for understanding overnight developments and global sentiment shifts that might affect medium-term positions.

F&O Participants: Valuable for hedging strategies and understanding institutional positioning before market hours.

Long-term Investors: Limited direct utility, but can help with timing entry and exit decisions around major global events.

Limitations to Consider:

- False Signals: SGX/GIFT Nifty movements don’t always translate accurately to NSE opening moves

- Low Correlation Days: During highly India-specific events, correlation with SGX movements may weaken

- Volume Considerations: Lower volumes compared to NSE can sometimes create misleading price signals

StoxBox platform users can access SGX/GIFT Nifty data and analysis through comprehensive market intelligence tools, helping them integrate these indicators effectively into their trading strategies.

SGX Nifty and its newer counterpart GIFT Nifty serve as valuable early warning systems for Indian market participants. They provide insights into global sentiment, overnight developments, and potential market direction before domestic exchanges open.

However, these instruments should be viewed as strategic tools rather than prediction engines. Successful traders combine SGX/GIFT Nifty signals with domestic market data, global market trends, and fundamental analysis to make well-rounded trading decisions.

The transition to GIFT Nifty represents India’s growing sophistication in financial markets and desire for greater regulatory control. For traders, this means more options and potentially better integration with domestic market infrastructure.

Remember, no single indicator guarantees market direction. Use SGX/GIFT Nifty as part of a comprehensive analysis framework, always combined with proper risk management and position sizing strategies.

StoxBox’s advanced analytics help traders interpret these early market signals effectively, providing the context needed to make informed decisions before markets open.

Frequently Asked Questions

What time does SGX Nifty open and close?

SGX Nifty trades from 9:00 AM to 6:15 PM Singapore time, which corresponds to 6:30 AM to 3:45 PM Indian Standard Time. This allows for trading during most Asian market hours and provides overlap with both European opening and NSE closing times.

Is SGX Nifty reliable for intraday trading in India?

SGX Nifty is a useful indicator but not always reliable for precise intraday predictions. It’s most accurate for understanding general market sentiment and potential gap openings. Professional traders use it as one input among many, not as a standalone trading signal. Correlation with NSE Nifty is typically high but can break down during India-specific events.

What makes SGX Nifty different from other global market indicators?

Unlike broad global indices (like S&P 500 or Hang Seng), SGX Nifty is directly based on Indian equities, making it specifically relevant for Indian market predictions. It incorporates both global sentiment and India-specific positioning by international investors, providing more targeted insights than general global market movements.

Can retail investors in India trade SGX Nifty directly?

No, Indian retail investors cannot directly trade SGX Nifty due to regulatory restrictions and capital controls. However, they can use SGX Nifty movements as information for their NSE trading strategies. GIFT Nifty offers some additional access options, but primarily for institutional participants rather than retail investors.

Is SGX Nifty useful for long-term investors or only day traders?

While primarily valuable for short-term traders, long-term investors can benefit from SGX Nifty during periods of high market volatility or major global events. It can help with timing investment decisions, understanding institutional sentiment shifts, and gauging the immediate impact of overnight global developments on Indian markets. However, its utility decreases for investors with horizons beyond a few weeks.

How has GIFT Nifty affected SGX Nifty's relevance?

GIFT Nifty has gradually captured market share from SGX Nifty, particularly among large institutional participants. However, both continue to operate and provide valuable market insights. Traders now monitor both instruments, with GIFT Nifty gaining preference due to regulatory alignment with Indian authorities and operational advantages for India-focused strategies.

Your Wealth-Building Journey Starts Here