As we step into 2025, global markets find themselves at the crossroads of recovery, innovation, and shifting dynamics. With economic policies stabilizing and industries adapting to transformative trends, the investment landscape demands a closer look at key indicators and underlying forces.

Here’s a detailed market oversight for 2025, covering anticipated shifts, and challenges on the horizon.

Table of Contents

Economic Recovery and Stabilization

2025 is expected to mark a period of measured recovery for both global and domestic markets. Central banks worldwide are easing monetary policies, with interest rate cuts aimed at stimulating economic growth. Inflation levels, which peaked in recent years, are now aligning closer to central bank targets, providing a stable backdrop for investments. For emerging economies, this creates a dual opportunity: fostering local demand while remaining competitive on the global stage.

However, the path to recovery is not without its challenges. Global debt levels remain high, geopolitical uncertainties persist, and climate-related disruptions could impact sectors like agriculture and energy. Balancing growth with sustainability will be a critical theme for policymakers and businesses alike.

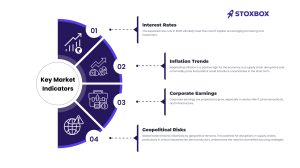

Key Market Indicators

1. Interest Rates

The expected rate cuts in 2025 will likely lower the cost of capital, encouraging borrowing and investment. However, this could also lead to volatility in currency markets as global funds seek higher returns elsewhere.

2. Inflation Trends

Moderating inflation is a positive sign for the economy, but supply chain disruptions and commodity price fluctuations could introduce uncertainties in the short term.

3. Corporate Earnings

Corporate earnings are projected to grow, especially in sectors like IT, pharmaceuticals, and infrastructure. Companies focusing on operational efficiency and innovation are likely to outperform.

4. Geopolitical Risks

Global trade remains influenced by geopolitical tensions. The potential for disruptions in supply chains, particularly in critical industries like semiconductors, underscores the need for diversified sourcing strategies.

Investor Strategies for 2025

1. Focus on Fundamentals

In an environment of changing macroeconomic dynamics, investors should prioritize companies with strong fundamentals, including healthy balance sheets and consistent earnings growth.

2. Diversification

Diversification across asset classes and geographies remains a key strategy to mitigate risks. Emerging markets, particularly in Asia, present attractive opportunities.

3. ESG Integration

Environmental, Social, and Governance (ESG) factors are no longer optional. Companies with strong ESG practices are likely to see better investor confidence and long-term value creation.

4 .Embrace Technology

Investors should consider exposure to sectors benefiting from technological advancements, including AI, fintech, and clean energy.

2025 is set to be a year of opportunities and challenges, shaped by economic stabilization, technological innovation, and evolving consumer behaviors. While the markets hold promise, a strategic and informed approach is essential for navigating the complexities of the year ahead. By focusing on fundamentals, embracing sustainability, and staying attuned to market trends, investors can position themselves for success in this dynamic environment.

Your Wealth-Building Journey Starts Here