RBI Decision Drives Gains

- 09th January 2025

Aaj Ka Bazaar

The US headline indices reported little change on Wednesday as they struggled to find a definite momentum after investors priced in the impact of the two conflicting job data (lower jobless claims / slow growth in private sector employment). An element of concern was further added after President-elect Donald Trump’s consideration of declaring a national economic emergency to impose new tariffs. On the Asiatic front, the Nikkei opened lower, weighed down by the selling observed in its tech space, tracking its counterpart’s decline in the US bourses. Despite a weak start, Hang Seng recovered and continued to trade with a positive bias. On the domestic front, we expect the benchmarks to likely be under pressure, extending their losses today as well. As per the cues from GIFT Nifty, the benchmarks are expected to make a negative start, largely due to the pessimistic global sentiments. We also begin with the earnings season from today, with TCS reporting its earnings likely post-market hours. On the stock-specific front, Lupin received the Establishment Inspection Report (EIR) from the US FDA for its Pithampur Unit-1 manufacturing facility that manufactures both APIs and finished products.

Markets Around Us

BSE Sensex -77,909.91 (-0.31%)

Nifty 50 – 23,621.30 (-0.29%)

Bank Nifty – 49,681.75 (-0.31%)

Dow Jones – 42,503.79 (-0.32%)

Nasdaq – 19,457.93 (-0.07%)

FTSE – 8,251.03 (0.07%)

Nikkei 225 – 39,457.76 (-1.30%)

Hang Seng – 19,327.11 (0.24%)

Sector: NBFC

RBI Relief Boosts Manappuram Finance Shares

Manappuram Finance shares rose 6% to ₹191 on January 9 after the Reserve Bank of India (RBI) lifted restrictions on its microfinance arm, Asirvad Micro Finance. These restrictions were imposed in October 2024 due to non-compliance with pricing regulations. Asirvad, acquired by Manappuram in 2015, focuses on providing loans to low-income women and contributed 27% of the company’s revenue in FY24. Analysts view the RBI’s move as positive but note that challenges in the microfinance sector may keep disbursements slow in the near term. Jefferies increased its price target to ₹190 but retained a cautious outlook, while Morgan Stanley set a target of ₹175, awaiting clarity on loan policies. While the stock has risen 17% since the October drop, overall movement has been modest in recent months, with analysts suggesting short-term earnings could face pressure due to ongoing issues in the microfinance segment.

Why it Matters:

This matters because lifting the RBI restrictions boosts confidence in Manappuram’s compliance and operations, supporting its stock recovery. The microfinance segment is a key revenue driver, and regulatory clarity can stabilize investor sentiment. However, sector challenges may limit growth in the near term, impacting earnings potential.

NIFTY 50 GAINERS

KOTAKBANK – 1798.00 (1.66%)

BAJAJ-AUTO – 8771.00 (1.49%)

HINDALCO – 593.80 (1.22%)

NIFTY 50 LOSERS

LT – 3555.10 (-1.15%)

SBIN – 762.55 (-1.12%)

TRENT– 6632.25 (-1.00%)

Sector: Energy

Advait Energy Rises on Gujrat Lol

Advait Energy’s stock rose 1.5% to ₹1,552 on January 9 after receiving a Letter of Intent (LoI) from Gujarat Urja Vikas Nigam for a 50 MW/500 MWh portion of a 500 MW/1,000 MWh battery energy storage project under a competitive bidding process with funding support, to be completed in 18 months. The company also secured a contract to upgrade power lines in Surendranagar, including the 66KV Dhrangadhra and Viramgam lines, by installing high-capacity conductors. In December 2024, Advait received an order for fiber optic installations along a 400 KV transmission line. The stock is 31% below its 52-week high of ₹2,260 but 88% above its 52-week low of ₹825, reflecting strong momentum driven by new contracts and strategic projects.

Why it Matters:

This matters because Advait Energy’s new contracts, including a major battery storage project and power line upgrades, strengthen its growth prospects and market position. These strategic wins boost investor confidence in its operational capabilities. The stock’s recovery from its 52-week low highlights strong momentum driven by these developments.

Around the World

Most Asian stocks declined on Thursday as concerns grew over the slower pace of U.S. interest rate cuts this year, coupled with weak inflation data from China pointing to slowing growth. Chinese markets dropped slightly as consumer and producer inflation remained weak despite recent stimulus, while Japan’s Nikkei 225 fell 0.8% due to strong wage data fueling fears of higher inflation and potential rate hikes by the Bank of Japan. The yen strengthened, hurting export stocks. Broader Asian markets, including Australia and Singapore, also slipped on weak retail sales and trade data, though South Korea’s KOSPI gained 0.4% amid political uncertainty. Indian markets faced pressure from weak earnings ahead of a busy earnings season next week. Overall, concerns over inflation, slowing growth, and higher-for-longer interest rates weighed on investor sentiment.

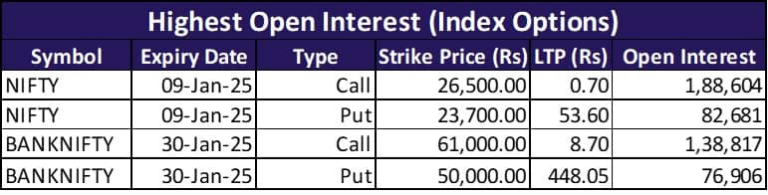

Option Traders Corner

Max Pain

Nifty 50 – 23,800

Bank Nifty – 51,200

Nifty 50 – 23,645 (Pivot)

Support – 23,539, 23,389, 23,283

Resistance – 23,795, 23,901, 24,050

Bank Nifty – 49,823 (Pivot)

Support – 49,400, 48,966, 48,543

Resistance – 50,258, 50,681, 51,115

Did you know?

2 Million Indian Travelled to USA

The number of Indians who travelled to the United States in the first 11 months of 2024, up 26% from the same period last year.