Microfinance Loan Auction News

- 27th December 2024

Aaj Ka Bazaar

Wall Street indices ended mixed on Thursday in subdued trading volumes. The Dow Jones Industrial Average rose by 0.06%, while the S&P 500 and Nasdaq edged down by 0.04% and 0.05%, respectively. In the Asia-Pacific region, markets also traded mixed, with some reopening after the Boxing Day holiday. Japan’s Nikkei and China’s CSI 300 were trading higher, whereas the Hang Seng and Shanghai Composite saw declines. Based on global cues and GIFT Nifty indications, Indian indices are expected to open on a flat note today. On stock-specific news, Gensol Engineering has secured an EPC contract worth ₹897 crore from NTPC Renewable Energy for developing a 225 MW grid-connected solar PV project at GSECL Solar Park in Gujarat. This partnership underscores confidence in Gensol’s expertise in project management and renewable energy.

Markets Around Us

BSE Sensex –78,743.71 (0.35%)

Nifty 50 – 23,801.40 (0.22%)

Bank Nifty – 51,268.20 (0.19%)

Dow Jones – 43,234.55 (-0.19%)

Nasdaq – 20,227.11 (-0.22%)

FTSE – 8,136.99 (0.00%)

Nikkei 225 – 40,110.63 (1.37%)

Hang Seng – 20,101.19 (0.03%)

Sector: Banking

Indusland Bank Shares Gain Momentum

IndusInd Bank’s shares rose 1.4% in early trade on December 27 after the bank announced plans to sell Rs 1,573 crore worth of non-performing microfinance loans. These loans, which represent 4.8% of its microfinance portfolio, will be auctioned through a public bidding process with a reserve price of Rs 85 crore, amounting to just over 5% of the total principal. The bank’s microfinance portfolio was valued at Rs 32,723 crore as of September 30, with Rs 2,259 crore identified as bad loans. Despite this sale, IndusInd Bank faces challenges, as its Q2FY25 results showed a 39.5% drop in net profit and an 87% rise in provisions due to stress in its microfinance book. Analysts expect continued pressure on profitability in the near term, with slippages likely to increase and loan growth slowing in the microfinance sector.

Why it Matters:

The auction of Rs 1,573 crore in microfinance NPAs signals IndusInd Bank’s efforts to manage rising bad loans and improve asset quality. This move highlights ongoing stress in the microfinance sector, which impacts the bank’s profitability and growth. Investors are closely watching the outcome as it could influence the bank’s future financial stability.

NIFTY 50 GAINERS

BAJAJAUTO – 9097.60 (2.27%)

TRENT – 7218.55 (2.19%)

BAJAJFINANCE – 6930.05 (1.68%)

NIFTY 50 LOSERS

APOLLOHOSP – 7193.95 (-0.93%)

HCLTECH – 1886.70 (-0.74%)

TCS – 4151.55 (-0.42%)

Sector: Cement

UltraTech Cement Buys Star Cement Stake

UltraTech Cement has acquired an 8.69% stake in Star Cement for Rs 851 crore, purchasing up to 3.7 crore shares at Rs 235 per share. This investment reflects a strategic move to secure a minority position in Star Cement, aligning with UltraTech’s growth plans in the cement sector. Following the transaction, Star Cement saw a large block deal with 3.36 crore shares worth Rs 766 crore changing hands, driving its stock up by over 7% to Rs 247.30. Earlier this year, UltraTech acquired a significant stake in India Cements to strengthen its presence in the southern market. The cement industry is undergoing consolidation, with companies focusing on demand recovery, improved margins, and growth fueled by government infrastructure projects. Analysts remain optimistic about cement demand in the second half of FY25 and FY26, with UltraTech emerging as a preferred choice for its strategic investments and market positioning.

Why it Matters:

UltraTech’s acquisition of an 8.69% stake in Star Cement strengthens its strategic position in the competitive cement industry. This move aligns with its broader growth plans amid ongoing industry consolidation. Investors see it as a signal of confidence in future demand recovery and sector expansion.

Around the World

Asian stocks saw mixed performance on Friday, with Japan leading gains as inflation in Tokyo outpaced expectations, raising chances of a near-term Bank of Japan rate hike. The Nikkei 225 climbed 1.5%, buoyed by auto stocks like Toyota amid a weaker yen, while the TOPIX rose 1%. Despite weaker-than-expected factory output in November, Japanese equities gained on optimism about monetary policy. Chinese markets also edged higher as industrial profits contracted at a slower pace in November, while investors awaited details on Beijing’s fiscal stimulus plans. The Hang Seng gained 0.2%, and the Shanghai Composite added 0.3%. Meanwhile, South Korea’s KOSPI slid over 1.5% due to political turmoil as the acting president faces an impeachment vote, adding uncertainty to the nation’s economic outlook. Elsewhere, Australia’s S&P/ASX 200 rose 0.4%, Malaysia’s FTSE KLCI jumped over 1%, and Singapore’s Straits Times Index edged up 0.2%.

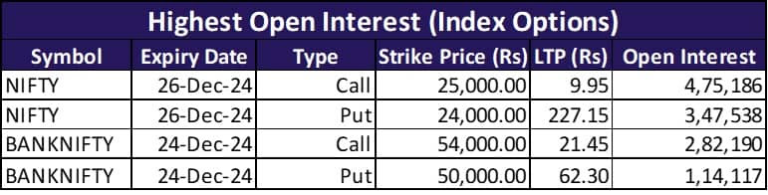

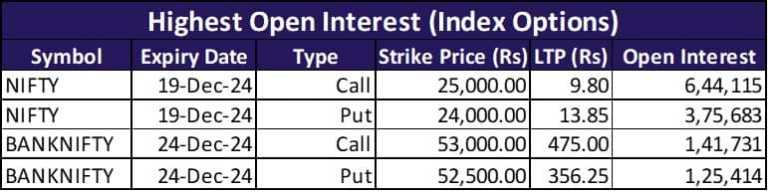

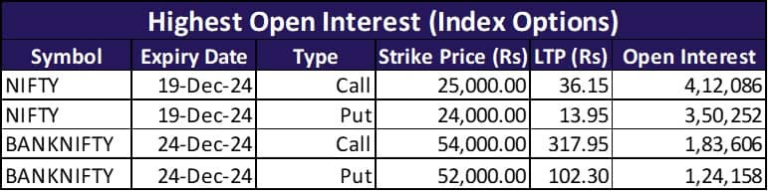

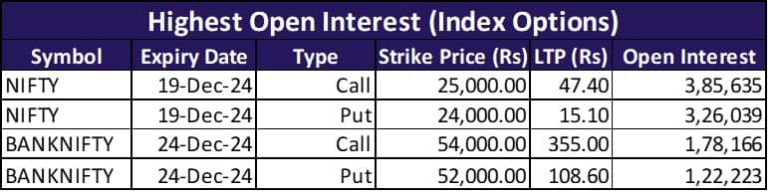

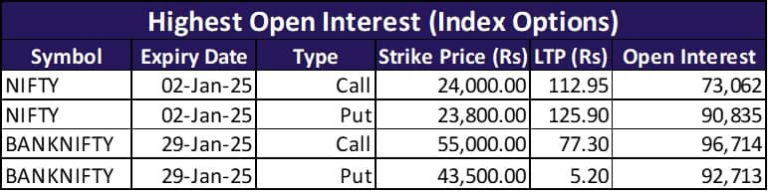

Option Traders Corner

Max Pain

Nifty 50 – 23,800

Bank Nifty – 52,000

Nifty 50 – 23,752 (Pivot)

Support – 23,651, 23,551, 23,450

Resistance – 23,851, 23,953, 24,052

Bank Nifty – 51,287 (Pivot)

Support – 50,835, 50,499, 50,446

Resistance – 51,623, 52,076, 52,411

Did you know?

Indian Digital Milestone Achieved

India has generated over 138 crore Aadhaar numbers, transforming digital identity verification. DigiLocker now serves 37 crore users, securely storing 776 crore documents. The DIKSHA platform has facilitated 556 crore learning sessions and achieved nearly 18 crore course enrollments.