Titan Shines in Q3

- 06th January 2025

Aaj Ka Bazaar

US equity markets rebounded on Friday as the truncated week ended, with hopes of additional Fed rate cuts and easing regulatory policies from the upcoming administration. However, despite the rally, the three major indices registered modest weekly declines. On the Asian front, Nikkei made a tepid debut into the week, posting a decline in its indices led by the auto and steel sector. Meanwhile, Hang Seng continues to trade flat after indicating volatility in its early hours. The Indian benchmarks are expected to make a modest start into the week, as per the cue from GIFT Nifty. The stock in focus during today’s trading session would be HDFC Bank, followed by the robust Q3 business updates.

Markets Around Us

BSE Sensex –79,506.28 (0.36%)

Nifty 50 – 24,077.45 (0.30%)

Bank Nifty – 50,913.70 (-0.15%)

Dow Jones – 42,623.56 (-0.25%)

Nasdaq – 19,619.17 (1.75%)

FTSE – 8,223.98 (-0.44%)

Nikkei 225 – 39,282.45 (-1.51%)

Hang Seng – 19,271.05 (-0.27%)

Sector: Gems, Jewellery & Watches

Titan Shines with Robust Q3 Growth

Titan Company shares rose over 2% in morning trade, becoming the top gainer on the Nifty 50 index after reporting a 24% year-on-year (YoY) growth for Q3 FY25. The Jewellery segment led with a 25% YoY growth, driven by strong festive demand, higher gold prices, and wedding purchases. Titan expanded its retail network by adding 69 stores in Q3, reaching 3,240 outlets, including international stores in Seattle and Dubai. Gold coin sales jumped 48%, while studded jewelry grew 21%. Watches & Wearables saw mixed results, with analog watches growing 19% due to premium demand, but wearables declined 20% amid market challenges. The EyeCare segment grew 17% despite closing three stores. CaratLane grew 25%, adding 19 stores in India and its first outlet in New Jersey. Emerging businesses performed unevenly, with Fragrances up 27% and Fashion Accessories down 20%. Titan’s festive strength highlights its leading position across segments.

Why it Matters:

Titan’s strong Q3 growth reflects robust consumer demand during the festive and wedding seasons, boosting investor confidence in its market leadership. The expansion of its retail network, including international outlets, shows its focus on global growth. Mixed performance across segments highlights both opportunities and challenges in capturing diverse market trends.

NIFTY 50 GAINERS

NIFTY 50 GAINERS

BAJFINANCE – 7548.60 (1.91%)

TITAN – 3504.95 (1.54%)

BAJAJAUTO – 9090.00 (1.39%)

NIFTY 50 LOSERS

KOTAKBANK – 1812.00 (-1.45%)

INDUSINDBK – 986.50 (-1.14%)

BPCL – 293.35 (-1.03%)

Sector: NBFC

Bajaj Twins Lead Nifty on Growth

Shares of Bajaj Finance and Bajaj Finserv rose up to 2.5% on January 6 after Bajaj Finance reported a strong Q3 FY25 business update. Its assets under management (AUM) grew 28% year-on-year (YoY) to ₹3.98 lakh crore, while its deposit book increased 19% to ₹68,800 crore. The company also achieved its highest-ever quarterly new loan bookings at 12.06 million, up 22% from last year, and added 5.03 million new customers, expanding its base to 97.12 million. Brokerages responded positively: BofA and Citi reiterated “buy” ratings with target prices of ₹8,800 and ₹8,150, respectively, citing strong growth in loans and proactive risk management. JPMorgan maintained an “overweight” rating with a target of ₹7,300, forecasting 29% annual AUM growth over three years. Despite challenges in the broader market, Bajaj Finance’s solid performance and market leadership boosted investor confidence, with its shares gaining 10% over the past month.

Why it Matters:

Bajaj Finance’s strong Q3 performance highlights robust growth in assets, loans, and customer acquisition, reinforcing its leadership among financial stocks. Positive ratings from major brokerages indicate confidence in its future growth and risk management. This positions the company as a resilient performer despite broader market challenges.

Around the World

Asian stocks started 2025 on a weak note, with most markets trading flat-to-lower on Monday as investors grew cautious ahead of key economic data this week. Concerns over slower U.S. interest rate cuts following hawkish comments from the Federal Reserve weighed on sentiment. Japan’s Nikkei 225 and TOPIX indexes dropped 1.3% and 0.9%, respectively, in catch-up trade after the holidays, with auto stocks leading losses. Nippon Steel fell over 2% after a U.S. Steel acquisition was blocked by President Biden. Chinese markets remained steady, with focus on inflation data amid expectations of more government stimulus in 2025 to address deflation and a property slump. South Korea’s KOSPI surged 1.6% as investors saw buying opportunities after political turmoil last month. Taiwan’s Foxconn gained 2% on record Q4 revenues driven by AI demand, while India’s Nifty 50 futures hinted at a modest recovery after last week’s losses.

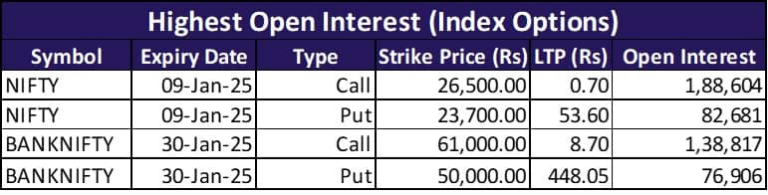

Option Traders Corner

Max Pain

Nifty 50 – 24,000

Bank Nifty – 51,700

Nifty 50 – 24,059 (Pivot)

Support – 23,921, 23,838, 23,701

Resistance – 24,142, 24,279, 24,362

Bank Nifty – 51,188 (Pivot)

Support – 50,704, 50,421, 49,937

Resistance – 51,472, 51,955, 52,239

Did you know?

2 Million Indian Travelled to USA

The number of Indians who travelled to the United States in the first 11 months of 2024, up 26% from the same period last year.