Korean Air Boosts Ramco

- 06th December 2024

Aaj Ka Bazaar

On Thursday, US benchmark equity indexes retreated from Wednesday’s record closing levels as investor parsed the latest labour market data ahead of the official jobs report for November. Investors reacted to comments from Department of Labour that weekly applications for unemployment insurance in the US rose, while continuing claims declined. Whereas, Asian stocks opened mixed as political ructions in South Korea. Moreover, Hong Kong stock market bouncing back from a weak session the prior day amid optimism that China’s central bank will deliver more monetary easing next year to spur growth and combat deflation. Considering the global market cues, the Indian benchmarks will likely have a positive start, extending a five-session winning streak, with the Sensex and Nifty closing at near two-month highs, with investors anticipating some form of policy easing from RBI after a sharp slowdown in economic growth. Indian investors increasingly believe the RBI will ease policy by lowering banks’ cash reserve ratio (CRR), which had sparked the rally in financials. On a stock-specific note, Canara Bank will be in focus as Canara Bank gets RBI’s approval to divest stake in Canara Robeco Asset Management and Canara HSBC Life Insurance through an initial public offering.

Markets Around Us

BSE Sensex –81,738.17 (-0.03%)

Nifty 50 – 24,700.00 (-0.03%)

Bank Nifty – 53,571.05 (-0.06%)

Dow Jones – 44,711.52 (-0.12%)

Nasdaq – 19,696.01 (-0.20%)

FTSE – 8,349.38 (0.16%)

Nikkei 225 – 39,039.74 (-0.91%)

Hang Seng – 19,873.09 (1.59%)

Sector: : Software Product

Ramco Systems Soars: Korean Aviation Deal

Ramco Systems shares surged over 7% on December 6 after announcing a partnership with Korea’s Hanjin Group to offer advanced maintenance software for aviation companies. The collaboration combines Hanjin’s advisory expertise with Ramco’s Aviation 6.0 software, helping Korean airlines streamline processes, optimize supply chains, and improve engine maintenance. Korean Air, South Korea’s national carrier, is adopting this software for the first time, marking a key milestone. The partnership is backed by a multi-million dollar deal, including a contract over $10 million to transform Korean Air’s new engine maintenance facility, set to be Asia’s largest. This strategic win boosts Ramco’s credibility in the aviation tech space, likely encouraging more global aviation companies to consider their solutions.

Why it Matters:

This partnership matters because it positions Ramco Systems as a leading aviation software provider, securing a significant $10M+ deal with Korean Air, South Korea’s national carrier. It boosts credibility and opens opportunities in the high-growth aviation tech market. Additionally, it supports the modernization of Asia’s largest engine maintenance facility.

NIFTY 50 GAINERS

TRENT – 7129.15 (2.28%)

BAJAJ-AUTO – 9054.00 (1.82%)

HEROMOTOCO – 4707.90 (1.37%)

NIFTY 50 LOSERS

TCS – 4427.90 (-0.81%)

WIPRO – 297.25 (-0.68%)

LT – 3805.95 (-0.67%)

Sector: Stockbroking

Angel One Slips On November Slowdown

Angel One shares dropped 4% on December 6 after the brokerage reported weaker business performance for November. Gross client acquisition declined to 0.6 million, down 14.6% from October and 11.9% compared to last year. Orders on the platform fell 23.5% month-on-month to 130.96 million but grew 22.2% year-on-year. The Average Daily Turnover (ADTO) was 12% lower overall compared to October, with the Futures & Options segment seeing a 12.5% decline. However, both metrics showed strong annual growth, up 24.1% and 23.3%, respectively. By 9:25 AM, Angel One’s stock was trading at ₹3,091, with a market cap of ₹27,800 crore.

Why it Matters:

This performance signals a slowdown in Angel One’s client acquisition and trading activity, impacting investor sentiment and causing a 4% drop in share price. While annual growth remains strong, the sequential decline raises concerns about short-term momentum. Investors will watch for recovery trends in coming months to assess growth sustainability.

Around the World

Asian stocks fell on Friday as markets awaited key U.S. jobs data, following overnight losses on Wall Street. South Korea’s KOSPI dropped 1.6%, driven by political turmoil after the president’s controversial martial law decision. Other regional markets like Japan, Singapore, and Australia also declined, while Chinese stocks surged on hopes of stimulus ahead of an economic meeting. U.S. futures traded slightly lower, with attention on nonfarm payrolls data for clues on interest rates, as the Fed is expected to cut rates in December. In India, cautious sentiment prevailed ahead of the RBI’s interest rate decision, where most expect rates to remain unchanged at 6.50% despite high inflation and slower growth. Next week, markets will focus on China’s economic conference and inflation data, as well as India’s CPI numbers and Australia’s rate decision.

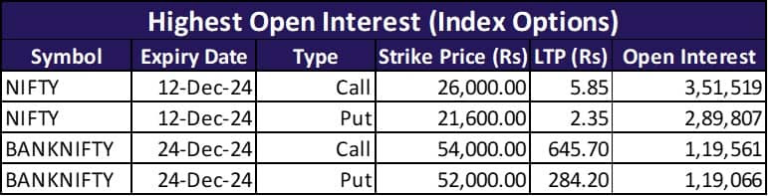

Option Traders Corner

Max Pain

Nifty 50 – 24,600

Bank Nifty – 54,000

Nifty 50 – 24,620 (Pivot)

Support – 24,383, 24,058, 23,821

Resistance – 24,945, 25,182, 25,507

Bank Nifty – 53,447 (Pivot)

Support – 53,006, 52,409, 51,968

Resistance – 54,044, 54,485, 55,082

Did you know?

FPI buying resumes strong

Foreign Portfolio Investors (FPIs) made net purchases of ₹10,000 crore in Indian equities, breaking a 36-session selling streak. The shift came amid positive market sentiment following the BJP-led alliance’s win in Maharashtra. This marks renewed foreign interest in India’s stock market.