EV Plans Drive Greaves

- 10th December 2024

Aaj Ka Bazaar

Wall Street indices closed lower on Monday as investors braced for a key inflation report expected later this week. The S&P 500 declined by 0.61%, while the Nasdaq fell by 0.62%, driven by weakness in technology stocks, including Nvidia, a leading player in AI. Nvidia shares dropped following news of an antitrust investigation by Chinese regulators over suspected violations of anti-monopoly laws. In contrast, most Asian markets traded in positive territory after China’s leadership indicated plans for more substantial economic stimulus in the coming year. Beijing announced intentions for more proactive fiscal measures and a moderately looser monetary policy to revive domestic consumption and support economic growth. The Indian benchmark indices are expected to open on a muted note, reflecting mixed global cues. The GIFT Nifty is trading flat, signaling a subdued start. On the corporate front, Tata Power disclosed plans to invest Rs. 1.2 lakh crore in Rajasthan’s renewable energy sector, focusing on initiatives such as rooftop solar installations and electric vehicle charging infrastructure. This investment aims to position Rajasthan as a power-surplus state through significant energy-related advancements.

Markets Around Us

BSE Sensex –81,481.84 (-0.03%)

Nifty 50 – 24,613.20 (-0.02%)

Bank Nifty – 53,422.95 (0.03%)

Dow Jones – 44,372.29 (-0.06%)

Nasdaq – 19,727.67 (-0.67%)

FTSE – 8,352.08 (0.52%)

Nikkei 225 – 39,286.94 (0.30%)

Hang Seng – 20,637.12 (1.09%)

Sector: Compressors, Pumps & Diesel Engines

Vijay Kedia's Bet Boosts Greaves

Greaves Cotton shares surged 9% to ₹232 in morning trade on December 10, continuing their upward momentum for the second day, as prominent investor Vijay Kedia purchased 12 lakh shares worth ₹25 crore in a block deal, representing 0.52% equity. This marks his first known investment in the company, coinciding with Greaves Cotton’s plans to list its electric vehicle (EV) subsidiary, Greaves Electric Mobility Ltd (GEML), through an IPO approved earlier this month. The stock hit a 52-week high of ₹215 on the NSE in the previous session, with trading volumes exceeding one crore shares. Greaves Cotton, which produces engines, power systems, and EVs, narrowed its Q2FY25 net loss to ₹14 crore from ₹375 crore last year, despite a 3% drop in revenue to ₹705 crore. The stock has gained 40% year-to-date, significantly outperforming the Nifty’s 13% rise over the same period.

Why it Matters:

Vijay Kedia’s investment signals strong market confidence in Greaves Cotton, boosting its stock performance. The planned IPO of its EV subsidiary, Greaves Electric Mobility, adds growth potential amid the EV sector’s rising prominence. With shares rallying 40% YTD, it showcases robust investor interest despite past financial challenges.

NIFTY 50 GAINERS

SHRIRAMFIN – 3150.50 (1.40%)

APOLLOHOSP – 7263.65 (0.97%)

WIPRO – 306.10 (0.77%)

NIFTY 50 LOSERS

M&M – 3013.25 (-1.25%)

ONGC – 256.75 (-0.83%)

AXISBANK – 1154.45 (-0.76%)

Sector: Pharmaceuticals

Biocon Stake Sale Boosts Syngene Shares

Shares of Syngene International rose 3% to ₹897.05 on December 10 after a block deal involving ₹706 crore worth of shares was executed, likely by promoter Biocon, which reportedly sold a 2% stake at ₹858.5 per share. This stake sale is expected to raise around ₹660 crore for Biocon, triggering a 60-day lock-in period for further sales. Despite Syngene’s shares falling 6% in the previous session due to concerns over the US Biosecure Act’s failure to pass, the market reacted positively to the block deal. The Act aimed to limit US-Chinese biotech partnerships and redirect contracts to Indian CDMO players, but its exclusion from a defense bill has softened investor sentiment. Biocon remains a key promoter of Syngene, holding a 54.45% stake. The stake sale and geopolitical developments underline Syngene’s potential and challenges in the CDMO sector.

Why it Matters:

Biocon’s stake sale in Syngene signals strategic capital allocation, boosting investor confidence. The failure of the US Biosecure Act highlights uncertainties for Indian CDMO firms in capturing redirected contracts. Syngene’s stock reaction reflects market optimism despite sector-wide geopolitical challenges.

Around the World

Asian stocks rallied on Tuesday, led by gains in Chinese markets as optimism grew over the government’s commitment to implement fiscal stimulus and adopt looser monetary policies in 2025, highlighted during a Politburo meeting. The Shanghai Composite rose 1.6%, while the CSI 300 jumped over 2%, lifting sentiment across Asia. Hong Kong’s Hang Seng gained 1.5%, while Japan’s Nikkei 225 and South Korea’s KOSPI rebounded 0.2% and 2.4%, respectively, despite political concerns in South Korea. Broader markets like Singapore’s FTSE Straits Times and the Philippine PSEi rose 0.6% and 0.5%, reflecting optimism that China’s stimulus measures could support global demand, even as U.S. markets struggled with tech stock losses. U.S. futures remained flat ahead of key inflation data, and concerns over a potential U.S.-China trade war lingered, adding a layer of caution for regional investors.

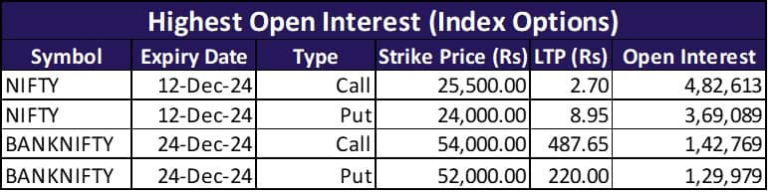

Option Traders Corner

Max Pain

Nifty 50 – 24,600

Bank Nifty – 53,300

Nifty 50 – 24,634 (Pivot)

Support – 24,564, 24,509, 24,439

Resistance – 24,689, 24,759, 24,814

Bank Nifty – 53,503 (Pivot)

Support – 53,231, 53,054, 52,782

Resistance – 53,679, 53,951, 54,128

Did you know?

Indian Digital Milestone Achieved

India has generated over 138 crore Aadhaar numbers, transforming digital identity verification. DigiLocker now serves 37 crore users, securely storing 776 crore documents. The DIKSHA platform has facilitated 556 crore learning sessions and achieved nearly 18 crore course enrollments.