Adani Green Sees 40% Upside

- 13th March 2025

Aaj Ka Bazaar

The strength on Wall Street came following the release of a closely watched Labor Department report showing consumer prices in the US increased by slightly less than expected in February. The Labor Department said its consumer price index increased by 0.2% in February after climbing by 0.5% in January. Economists had expected consumer prices to rise by 0.3%. Asian markets were mixed this morning as US President Donald Trump escalated global trade tensions by threatening more tariffs on EU goods. Trump also hinted at financial repercussions if Russia rejects the Ukraine ceasefire proposal. Indian market looks set to open higher on Thursday as tamer-than-expected US CPI data led to some optimism about the Federal Reserve resuming interest rate cuts soon. Additionally, domestic industrial output and retail inflation data painted a positive picture of the economy. India’s industrial production growth accelerated at the start of the year. At the same time, consumer price inflation slowed to a seven-month low in February, raising expectations of interest rate cuts over the coming months.

Markets Around Us

BSE Sensex – 74,129.81 (0.14%)

Nifty 50 – 22,499.20 (0.13%)

Bank Nifty – 48,153.90 (0.20%)

Dow Jones – 41,313.92 (-0.08%)

Nasdaq – 17,648.45 (1.22%)

FTSE – 8,540.97 (0.53%)

Nikkei 225 – 36,993.71 (0.47%)

Hang Seng – 23,426.80 (-0.74%)

Sector: Power Generation

Adani Green Gains as Macquarie Backs

Macquarie has started covering Adani Green Energy with a positive outlook, setting a target price of ₹1,200—implying a 40% potential upside. The stock rose over 1.5% in early trading today. Adani Green leads India’s energy transition, aiming for 50 GW capacity by FY2030 (currently at 12 GW). Macquarie expects its EBITDA to grow at a 25% CAGR over the next five years, driven by strategic investments. While falling Power Purchase Agreement (PPA) tariffs posed challenges, a shift towards higher-priced merchant capacities is helping stabilize revenues. Meanwhile, Fitch Ratings recently gave Adani Energy Solutions a negative outlook due to governance concerns and US investigations, though risks related to liquidity have eased. Separately, Adani Green announced that its subsidiary, Adani Solar Energy, has commissioned a 250 MW solar project in Andhra Pradesh. These developments reinforce Adani Green’s strong growth trajectory despite market challenges.

Why it Matters:

Adani Green’s growth plans and Macquarie’s bullish outlook signal strong investor confidence, with a 40% upside potential. The company’s strategic shift to higher-priced merchant capacities helps offset pricing challenges, ensuring revenue stability. Meanwhile, Fitch’s concerns highlight governance risks, but Adani Green’s continued expansion, including its new 250 MW solar project, reinforces its leadership in India’s renewable energy sector.

NIFTY 50 GAINERS

BEL– 283.12 (2.27%)

ONGC – 228.81 (1.97%)

TATASTEEL – 152 (1.13%)

NIFTY 50 LOSERS

INDUSBANK – 673,3 (-1.66%)

SHRIRAMFIN– 628.5 (-1.33%)

APOLLOSHOP – 6093.15 (-0.82%)

Sector : Private Sector Bank

CLSA Backs IndusInd Bank for 31% Rally

IndusInd Bank shares have faced heavy losses, dropping over 60% from their 52-week high due to issues in its derivatives portfolio. Despite this, CLSA has maintained a positive stance but lowered its target price to ₹900, still implying a 31% upside. The Reserve Bank of India (RBI) approved only a one-year extension for CEO Sumant Kathpalia instead of the requested three years, raising concerns about leadership stability. Investors worry about further issues, management changes, and potential stock pledge invocations by lenders. However, CLSA believes the bank’s fundamentals will eventually drive recovery. Key positives include a rebound in the microfinance sector and improving banking margins due to better liquidity and RBI’s policy easing. While uncertainty remains, these factors could support IndusInd Bank’s long-term prospects, making it a stock to watch amid volatility.

Why it Matters:

IndusInd Bank’s sharp decline and leadership uncertainty have raised investor concerns, but CLSA sees a 31% upside potential. The bank’s recovery hinges on improving microfinance conditions and better banking margins from RBI’s policy easing. Despite short-term volatility, strong fundamentals could drive long-term stability and growth.

Around the World

Asian stocks mostly gained on Thursday, following a rebound in U.S. tech stocks after lower-than-expected inflation data. The Nasdaq surged 1.2% overnight as CPI growth slowed to 0.2% month-on-month, easing concerns about aggressive Federal Reserve rate hikes. Japan’s Nikkei 225 rose 1%, with SoftBank and Tokyo Electron gaining, while South Korea’s KOSPI climbed 0.5% as Samsung and SK Hynix advanced. Malaysia’s KLCI jumped 1.2%, and India’s Nifty 50 Futures edged up 0.2%. However, trade tensions remain a concern after President Trump threatened more tariffs on EU goods, escalating Western economic conflicts. This raised fears of weaker demand for Asian exports. China’s Shanghai Composite slipped 0.4%, while Hong Kong’s Hang Seng and Australia’s ASX 200 also dipped. Despite optimism from cooling inflation, market volatility could persist due to trade uncertainties and global economic risks. Investors remain cautious about future market movements.

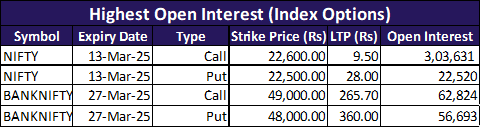

Option Traders Corner

Max Pain

Nifty 50 – 22527

Bank Nifty – 48318

Nifty 50 – 22459 (Pivot)

Support – 22,340, 22,211, 22,093

Resistance – 22,588, 22,707, 22,836

Bank Nifty – 48041 (Pivot)

Support – 47,860, 47,664, 47,483

Resistance – 48,273, 48,418, 48,614

Have you checked our latest YouTube Video

Did you know?

India’s Retail Investor Surge: Market Participation Hits Record Highs in 2024

India’s stock market has seen a 36% rise in retail participation, with over 50 million investors active by 2024. This surge is driven by increased financial literacy, digital trading platforms, and government initiatives. Systematic Investment Plans (SIPs) have also gained popularity, with monthly contributions hitting ₹14,000 crore in early 2025. These trends reflect growing confidence in India’s equity markets.