HUL Strengthens Skincare Game

- 18th March 2025

Aaj Ka Bazaar

US stocks saw gains on Monday, with the S&P 500 rising 0.44%, the Dow Jones adding 0.85%, and the Nasdaq climbing 0.3%. The rally was driven by strong US retail sales data, easing recession concerns and boosting investor sentiment. Despite US President Donald Trump’s comments on reciprocal tariffs set to take effect in April 2025, global markets continued their positive momentum. In Asia, stocks traded higher on Tuesday, influenced by the Wall Street performance and renewed optimism around China’s economy. This positive trend is also reflected in the GIFT Nifty, suggesting a strong start for Indian benchmarks. In stock-specific news, Bajaj Finserv surged as Allianz SE announced the sale of its 26% stake in Bajaj Allianz General Insurance and Bajaj Allianz Life Insurance to Bajaj Group for approximately €2.6 billion. Market participants are now focusing on the upcoming interest rate decisions by the US Federal Reserve and the Bank of Japan, expected on March 19.

Markets Around Us

BSE Sensex – 74,948.02 (1.05%)

Nifty 50 – 22,735.80 (1.01%)

Bank Nifty – 49,959 (1.25%)

Dow Jones – 41,745.98 (-0.23%)

Nasdaq – 17,808.66 (0.31%)

FTSE – 8,680.29 (0.55%)

Nikkei 225 – 37,916.84 (1.39%)

Hang Seng – 24,580.78 (1.77%)

Sector: Diversified FMCG

HUL shares rise after CCI clears acquisition

Hindustan Unilever Limited (HUL) shares gained over 1% on March 18 after the Competition Commission of India (CCI) approved its acquisition of a 90.5% stake in Uprising Science Pvt Ltd, Minimalist’s parent company, for ₹2,670 crore. The deal, announced in January 2025, will be completed in two phases: first through a capital infusion and later through a buyout at a pre-money valuation of ₹2,955 crore. HUL plans to integrate Minimalist into its Beauty & Wellbeing segment, aiming to expand its reach from 2,000 to 20,000 stores in two years. The company had closed 0.44% lower on March 17 but saw early gains post-approval. CCI confirmed that HUL will acquire the remaining 9.5% stake within two years. Minimalist’s leadership expects no major changes in brand positioning post-acquisition. This strategic move strengthens HUL’s presence in the premium skincare market while offering significant growth potential for Minimalist.

Why it Matters:

This acquisition strengthens HUL’s position in the premium skincare market, expanding Minimalist’s reach from 2,000 to 20,000 stores in two years. For traders, it signals growth potential for HUL’s Beauty & Wellbeing segment, impacting stock performance. Investors should watch how this deal drives revenue and market share in the competitive skincare industry.

NIFTY 50 GAINERS

ICICIBANK– 1301 (2.52%)

SHRIRAMFIN– 637.5 (2.29%)

HINDALCO – 695.5 (2.17%)

NIFTY 50 LOSERS

BAJAJFINSV – 1845.2 (-1.41%)

BPCL– 260.54 (-0.34%)

ONGC – 229.38 (-0.16%)

Sector : Financial Institution

IREDA shares rise after increasing borrowing limit

IREDA shares rose over 4% on March 18, breaking a six-day losing streak, after the company increased its FY25 borrowing limit by ₹5,000 crore to ₹29,200 crore. This will be done through bonds, bank loans, and external borrowings. The stock had recently declined near its 52-week low of ₹124, down 56% from last year’s high, amid concerns over worsening asset quality. In Q3, gross NPAs increased by 30.4%, and net NPAs jumped 53.75% to ₹1,024 crore. Despite this, IREDA’s net interest income grew 39% year-on-year, and net profit rose 27% to ₹425.4 crore. In February, the company approved a ₹5,000 crore fundraising plan via QIP, which may reduce government shareholding by up to 7%. Additionally, its inclusion in the NSE’s F&O segment has given traders more opportunities. Investors should watch how the increased borrowing impacts growth and financial stability in the coming months.

Why it Matters:

IREDA’s higher borrowing limit boosts liquidity, helping fund growth despite rising NPAs. The stock’s rebound and F&O inclusion create trading opportunities, but financial stability remains a concern. Investors should watch how the raised funds impact profitability and asset quality in the coming months.

Around the World

Most Asian markets rose on Tuesday, led by Hong Kong, which surged nearly 2% as investors cheered optimism over more Chinese stimulus and growing confidence in the country’s AI sector. Baidu jumped 10% after unveiling new AI models, while Alibaba gained over 4%, highlighting its focus on AI-driven growth. BYD also hit record highs after introducing new fast-charging EV technology. Japan’s Nikkei 225 rose 1.6%, fueled by Warren Buffett’s Berkshire Hathaway increasing its stake in the country’s top five trading houses. Broader regional markets followed Wall Street’s overnight gains, but U.S. stock futures slipped in Asian trading due to concerns over trade tariffs, recession risks, and an upcoming Federal Reserve meeting. Meanwhile, geopolitical tensions in the Middle East, with Israel’s renewed strikes on Hamas, dampened risk appetite. Investors are also awaiting the Bank of Japan’s policy decision, where rates are expected to remain unchanged, but with a potential hawkish stance on inflation

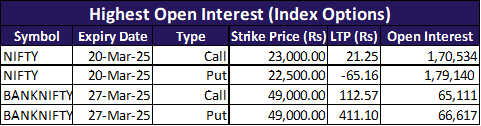

Option Traders Corner

Max Pain

Nifty 50 – 22752.10

Bank Nifty – 49005.25

Nifty 50 – 22479 (Pivot)

Support – 22,382, 22,255, 22,158

Resistance – 22,606, 22,703, 22,829

Bank Nifty – 48343 (Pivot)

Support – 48,206, 48,058, 47,921

Resistance – 48,491, 48,629, 48,776

Have you checked our latest YouTube Video

Did you know?

India’s Retail Investor Surge: Market Participation Hits Record Highs in 2024

India’s stock market has seen a 36% rise in retail participation, with over 50 million investors active by 2024. This surge is driven by increased financial literacy, digital trading platforms, and government initiatives. Systematic Investment Plans (SIPs) have also gained popularity, with monthly contributions hitting ₹14,000 crore in early 2025. These trends reflect growing confidence in India’s equity markets.