Know more about Extended Internal Rate of Return and learn eay steps to calculate it

Table of Contents

Understanding XIRR in Mutual Funds

When it comes to investing in mutual funds, one of the key objectives is to track and measure the returns on investments accurately. Traditional methods, such as CAGR (Compound Annual Growth Rate), work well for a lump sum investment made at a single point in time. However, for investments made at irregular intervals, such as SIP (Systematic Investment Plan) or multiple lump sum investments, a more precise method is required. This is where XIRR (Extended Internal Rate of Return) comes into play. What is XIRR in mutual funds? Simply put, XIRR helps investors calculate the annualised rate of return for investments made at different times.

Unlike CAGR, which assumes a single investment and provides a simplified picture, XIRR takes into account all the inflows and outflows, including investments and redemptions, and provides an accurate representation of returns over time. In this blog, we will explore XIRR meaning, its significance for mutual fund investors, the XIRR formula, and how you can calculate XIRR using Excel or an XIRR calculator. We will also cover the difference between XIRR vs. CAGR, common mistakes in XIRR calculation, and real-life examples of XIRR in action.

What is XIRR? An Overview

XIRR, or Extended Internal Rate of Return, is a method used to calculate the annualized return on investments when your cash flows don’t follow a regular pattern.

Let’s say you invest ₹5,000 one month, ₹3,000 another, and then withdraw ₹2,000 a few months later. Because the money moves in and out at different times and in different amounts, a simple return calculation or even CAGR won’t give you the full picture.

That’s where XIRR comes in, it accounts for each individual transaction, including the exact date it happened, to show your true investment performance over time.

In simple terms, XIRR gives you:

- A single percentage rate that reflects how much you’ve earned annually,

- While considering when you invested and when you took money out.

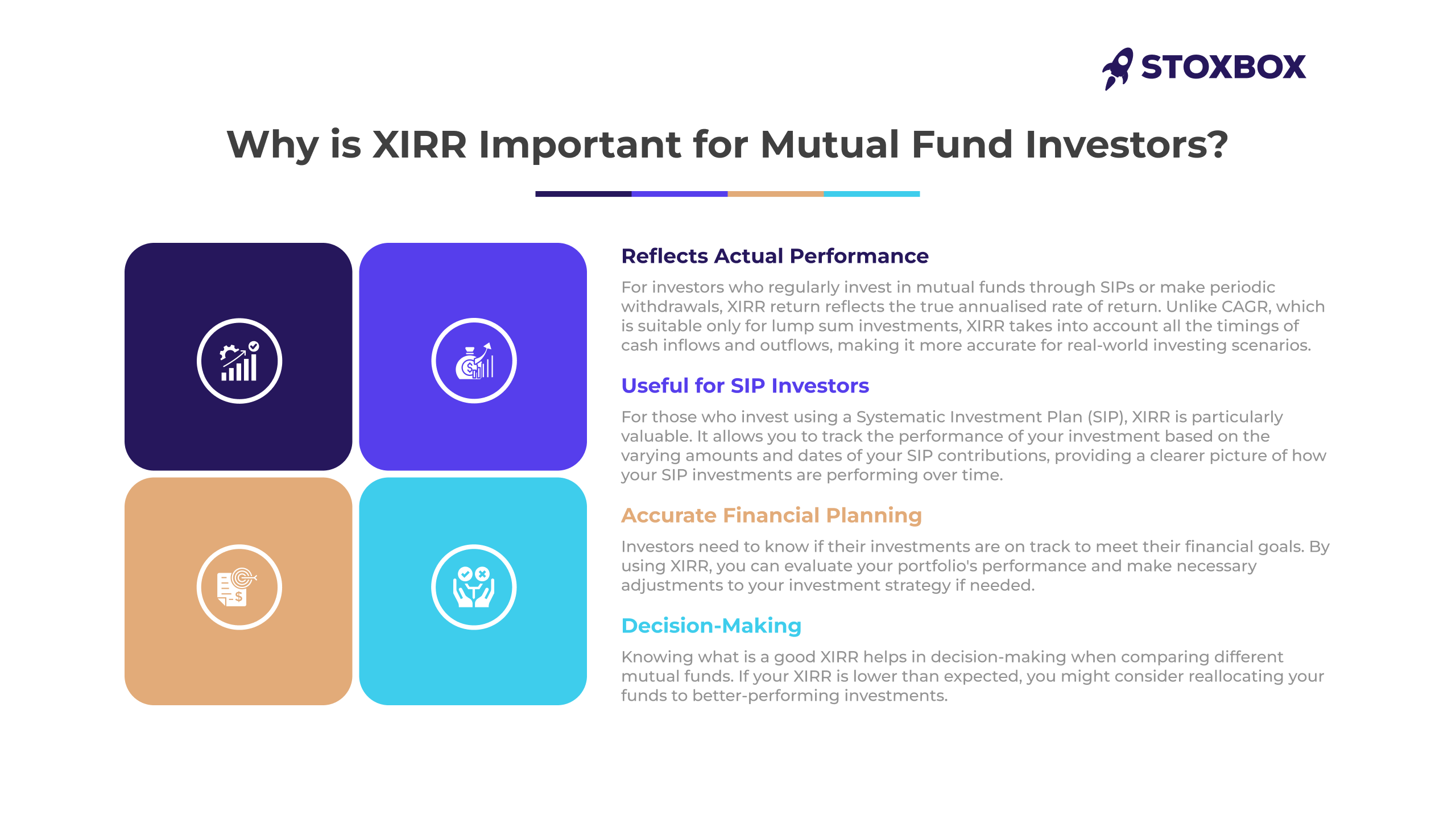

Why is XIRR Important for Mutual Fund Investors?

For mutual fund investors, XIRR is crucial because it offers a more accurate and reliable method for calculating returns on investments made at irregular intervals. Here’s why it’s so important:

1. Reflects Actual Performance: For investors who regularly invest in mutual funds through SIPs or make periodic withdrawals, XIRR return reflects the true annualised rate of return. Unlike CAGR, which is suitable only for lump sum investments, XIRR takes into account all the timings of cash inflows and outflows, making it more accurate for real-world investing scenarios.

2. Useful for SIP Investors: For those who invest using a Systematic Investment Plan (SIP), XIRR is particularly valuable. It allows you to track the performance of your investment based on the varying amounts and dates of your SIP contributions, providing a clearer picture of how your SIP investments are performing over time.

3. Accurate Financial Planning: Investors need to know if their investments are on track to meet their financial goals. By using XIRR, you can evaluate your portfolio’s performance and make necessary adjustments to your investment strategy if needed.

4. Decision-Making: Knowing what is a good XIRR helps in decision-making when comparing different mutual funds. If your XIRR is lower than expected, you might consider reallocating your funds to better-performing investments.

How to Calculate XIRR in Mutual Funds: A Step-by-Step Guide

Calculating XIRR may sound complex, but with the help of tools like Excel or an XIRR calculator, the process becomes manageable. Here’s a step-by-step guide to calculating XIRR for your mutual fund investments:

Step 1: List All Transactions

Record every cash inflow (investment) and outflow (withdrawal). For SIP investors, each monthly contribution counts as an inflow. When you redeem your mutual fund units, that’s considered an outflow. Don’t forget to include any dividends received, if applicable.

Example:

| Date | Cash Flow |

|---|---|

| 01/01/2021 | - ₹10,000 |

| 01/07/2021 | - ₹10,000 |

| 01/01/2022 | - ₹10,000 |

| 01/07/2022 | - ₹10,000 |

| 01/01/2023 | ₹50,000 (withdrawal) |

In this example, the investor made four investments of ₹10,000 each and then withdrew ₹50,000 at the end.

Step 2: Use Excel’s XIRR Function

Excel offers an easy way to calculate XIRR. To begin, organise your data in two columns, as shown in the table above:

- Column A: Dates of each transaction (e.g., the date of each SIP investment or redemption).

- Column B: Cash flows. Use negative values for investments (money going out) and positive values for withdrawals or dividends (money coming in).

Step 3: Apply the XIRR Formula in Excel

Once your data is organised, apply the formula in Excel:

Excel

=XIRR(B1:B5, A1:A5)

In this formula, B1:B5 refers to the cash flows, and A1:A5 refers to the corresponding dates. The result will be your annualised XIRR return.

Step 4: Interpreting the Result

The result provided by the XIRR formula is your annualised rate of return, expressed as a percentage. This number represents the true rate of return on your investments, accounting for the dates and amounts of all cash flows.

Example Output: The Excel XIRR formula may return something like 16.7%, indicating that the investor’s annualised return on the mutual fund investment is 16.7%.

Step 5: Using an Online XIRR Calculator

If you prefer not to use Excel, you can find various XIRR calculators online. Simply input the dates and cash flows, and the calculator will do the rest.

Mistakes in Calculating XIRR and How to Avoid Them

Even though calculating XIRR is relatively straightforward, there are a few common mistakes investors should avoid:

- Omitting Cash Flows: Ensure that all cash flows, including dividends, redemptions, and partial withdrawals, are accounted for. Missing even one cash flow can lead to inaccurate XIRR calculations.

- Incorrect Date Entries: XIRR is highly sensitive to the dates you enter. Make sure all the dates are accurate and correspond to the correct cash flows.

- Ignoring Expenses: If there are transaction costs, exit loads, or other expenses associated with your mutual fund investments, make sure to factor these into your cash flow calculations. Ignoring these expenses can overestimate the actual returns.

- Not Considering Dividends: Dividends can play a significant role in overall returns. Include dividends as cash inflows in your calculations to get an accurate measure of performance.

XIRR vs. CAGR: Key Differences and Use Cases

| Criteria | CAGR (Compound Annual Growth Rate) | XIRR (Extended Internal Rate of Return) |

|---|---|---|

| Definition | Calculates the annual growth rate assuming a single investment at the start. | Calculates the annualised return, considering multiple cash flows over time. |

| Assumptions | Assumes a one-time lump sum investment. | Accounts for investments made at irregular intervals (e.g., SIPs). |

| Cash Flow Handling | Only works with a single investment and redemption. | Handles multiple cash flows, including investments and redemptions. |

| Use Case | Best for evaluating lump sum investments over a fixed period. | Best for investments made at different times (e.g., SIP or multiple investments). |

| Accuracy of Returns | Provides a simplified return over the investment period. | Offers a more accurate return by considering the timing of cash flows. |

Benefits of Using XIRR in Financial Planning

XIRR offers several advantages for investors looking to plan their finances effectively:

1. More Accurate Planning: XIRR takes into account the exact timing of investments, providing a more accurate measure of your returns. This precision helps in determining whether you are on track to meet your financial goals, especially when your investments have irregular cash flows.

2. Flexible Comparison: XIRR allows investors to compare returns across different investment types, including those with irregular cash flows, such as real estate or private equity. This flexibility helps investors make better decisions when evaluating a diverse portfolio.

3. Better Portfolio Management: By calculating XIRR regularly, you can better manage your portfolio and make informed decisions about reallocating funds to optimise returns. It also allows you to identify underperforming investments and take corrective actions in a timely manner.

Real-Life Examples: Calculating XIRR for Different Mutual Fund Investments

XIRR’s true power comes into play when used in different investment scenarios. Below are two real-life examples that show how XIRR works:

Example 1: SIP in a Mutual Fund

You’ve been investing Rs 5,000 every month into a mutual fund SIP for three years. At the end of three years, your investment is worth Rs 2,20,000. By applying the XIRR formula, you can calculate the annualised return, considering the timing of each monthly SIP contribution and the final withdrawal. This provides a clear picture of the real return on your SIP over time.

Example 2: Lump Sum Investment and Partial Redemptions

You invested Rs 2,00,000 in a mutual fund five years ago. After two years, you withdrew Rs 50,000, and later added Rs 1,00,000. At the end of five years, your investment is worth Rs 3,20,000. XIRR will accurately calculate your return, considering each investment, withdrawal, and final fund value, showing how it handles more complex cash flows.

Conclusion: The Significance of XIRR in Mutual Fund Investments

XIRR is an essential tool for mutual fund investors who want to accurately track their returns over time, especially when making investments at irregular intervals. Whether you’re investing through SIP, making multiple lump sum investments, or withdrawing funds periodically, XIRR provides an accurate and annualised return calculation that reflects the true performance of your investments. Additionally, when considering mutual fund risk, it’s crucial to understand how XIRR can help you assess returns in relation to the risks involved.

For those wondering, what is a mutual fund exactly? It’s an investment vehicle that pools money from multiple investors to invest in stocks, bonds, or other assets. Using a reliable mutual fund platform can help you track these investments efficiently and ensure you’re getting the most accurate performance reports. By regularly calculating XIRR, investors can make informed decisions, plan their financial goals more effectively, and ensure they are on the right track to achieving long-term wealth growth.

Frequently Asked Questions

Can XIRR be used for comparing different mutual funds?

Yes, XIRR is a useful tool for comparing returns across different mutual funds, especially when investments have been made at irregular intervals.

Why might my calculated XIRR differ from the fund's reported returns?

Your personal XIRR reflects your individual investment dates and amounts, which may differ from the general returns reported by the mutual fund. Mutual funds typically report average returns over standard periods, not accounting for personalised cash flow timings.

Why is XIRR a better indicator than Absolute Return for long-term or irregular investments?

XIRR provides a more comprehensive view by considering the timing of each investment or withdrawal. This makes it especially useful for mutual fund investments like SIPs, where you invest at different times, or when there are multiple cash flows involved.

Is XIRR suitable for short-term investments?

XIRR is better suited for long-term investments as it calculates annualised returns. For short-term investments, Absolute Return might be a more relevant metric.

Should I be concerned if my XIRR is negative?

A negative XIRR is usually a red flag, but context matters. Short-term market fluctuations or the timing of investments can temporarily result in negative returns. However, if it persists over time, it may indicate poor performance, and you should consider reassessing your investment strategy.

Your Wealth-Building Journey Starts Here