Looking for best stock to invest in Long term. Check the details below.

Table of Contents

Investing in stocks is one of the most reliable ways to grow wealth over time. However, the approach you take can significantly impact the outcome. While some prefer day trading or short-term investments, many successful investors advocate for long-term investment strategies. This method leverages the power of compound growth, mitigates the effects of market volatility, and aligns well with a wealth-building mindset.

For investors in India, long-term investment is becoming increasingly popular, especially as the Indian economy continues to grow and stabilise. If you’re wondering which share to buy today for the long term or looking for the best long-term stocks in India, this guide will walk you through the essential strategies, advantages, and potential risks involved in long-term investing.

Understanding Long-Term Investment

Long-term investment typically refers to holding assets such as stocks for a period of five years or more. This strategy focuses on capital appreciation and income generation over an extended time frame. Instead of chasing short-term market movements, long-term investors aim to benefit from the sustained growth of quality companies.

In the context of India, where the economy is poised for steady growth, long-term investment in the stock market has the potential to yield significant returns. Historically, Indian stock indices such as the Nifty 50 and BSE Sensex have delivered impressive returns to investors who stayed committed for the long haul.

The objective is to identify the best share for long-term investment and hold it through market fluctuations.Investing in long-term stocks today requires a thorough understanding of a company’s fundamentals, market position and future growth prospects.

Key Characteristics of Long-Term Stocks:

- Strong Fundamentals: Companies with robust financial health, sustainable competitive advantages, and strong management teams tend to be good candidates for long-term investments.

- Growth Potential: Look for companies in industries with long-term growth prospects, such as technology, renewable energy, and healthcare.

- Consistency: Firms that consistently grow their revenue, profits, and dividends over time are ideal for long-term investments.

Advantages of Long-Term Investment

Long-term investing provides several advantages that can significantly benefit your financial goals. Below are some of the key advantages:

1. Compounding Returns

One of the most powerful advantages of long-term investing is compounding. Over time, the returns earned on your investments can be reinvested, generating more returns. The longer you stay invested, the more exponential the growth. For example, investing in the best long-term stocks today can double or triple your investment over a decade.

2. Reduced Impact of Market Volatility

Stock markets are inherently volatile, with prices fluctuating daily due to various factors. However, short-term volatility becomes less significant when you adopt a long-term strategy. For instance, an investor who bought shares of Tata Consultancy Services (TCS) or HDFC Bank a decade ago would have seen their investment grow significantly, despite periodic dips in the market.

3. Lower Transaction Costs

Frequent buying and selling of stocks incur transaction costs such as brokerage fees and taxes. Long-term investment reduces these costs, as fewer trades are made. This cost savings can compound over time, adding to the overall returns.

4. Tax Benefits

In India, long-term capital gains (LTCG) tax applies at a lower rate compared to short-term gains. For stocks held for more than a year, the LTCG tax is 10% on gains exceeding ₹1 lakh. This is significantly lower than the 15% tax on short-term gains, making long-term investing more tax-efficient.

How to Choose the Best Stocks for Long-Term Investment

Selecting the right stocks is crucial for a successful long-term investment strategy. Here’s how you can identify the best stocks for long term investment:

1. Analyse the Fundamentals

Fundamental analysis is the cornerstone of selecting the shares for long term investment. Focus on companies with solid financial statements, low debt levels, strong cash flows, and profitability. Key ratios to consider include:

- Price-to-Earnings (P/E) Ratio: A low P/E ratio relative to the industry can indicate that a stock is undervalued.

- Debt-to-Equity Ratio: A low ratio suggests the company is not heavily reliant on debt to finance its operations.

- Return on Equity (ROE): A high ROE indicates that the company efficiently generates profits from shareholders’ equity.

2. Evaluate Industry Trends

Choose companies in industries that are poised for growth. In India, sectors such as technology, financial services, pharmaceuticals, and renewable energy are expected to see long-term growth. For instance, Infosys and Reliance Industries have been among the best long-term stocks in India due to their strong positions in high-growth sectors.

3. Check the Company’s Competitive Advantage

Invest in companies that have a sustainable competitive advantage, such as strong brand recognition, patented technology, or a unique market position. A company like Asian Paints, which dominates the paint industry, is a good example of this.

4. Management Quality

A company with experienced and transparent leadership is more likely to succeed in the long run. Assess the management’s track record in terms of business strategy, financial discipline, and stakeholder engagement.

Potential Risks of Long-Term Investment Stocks

Although long-term investing is a robust strategy, it does come with certain risks:

1. Market Risks

Even the best stocks for long term investment are subject to market risks. Economic downturns, geopolitical instability, or changes in government policies can negatively impact stock performance.

2. Business-Specific Risks

While selecting long-term stocks to buy, it’s important to consider business-specific risks like management changes, product recalls, or increased competition. For instance, if a key product line underperforms, it could significantly affect a company’s profitability.

3. Inflation Risk

Over time, inflation can erode purchasing power. If your long-term investments don’t grow at a rate higher than inflation, you may end up with diminished real returns.

4. Overvaluation Risk

At times, even the best shares to buy for the long term can be overvalued. Purchasing an overvalued stock can result in lower returns as the market corrects itself over time.

Common Mistakes to Avoid in Long-Term Investment

Many investors, despite good intentions, make mistakes that can hinder their long-term investment success. Here are common pitfalls to avoid:

1. Overreacting to Market Fluctuations

One of the biggest mistakes is panicking during market downturns. For long-term investors, short-term market fluctuations are inevitable. Selling during a downturn locks in losses, whereas holding the stock can allow for eventual recovery.

2. Lack of Diversification

Concentrating your investments on a single stock or sector can be risky. Instead, diversify your portfolio across multiple sectors and asset classes. This reduces the impact of a poor-performing stock on your overall portfolio.

3. Chasing Quick Returns

Investing in stocks based on the promise of quick gains can backfire, especially if those stocks don’t have strong fundamentals. Avoid speculative stocks and stick to long term stocks to buy with a proven track record.

4. Not Rebalancing the Portfolio

Failing to rebalance your portfolio can lead to skewed asset allocation. Periodically review your portfolio and make adjustments to ensure it aligns with your long-term goals.

The Role of Index Funds and ETFs in Long-Term Investment

Index funds and Exchange-Traded Funds (ETFs) are excellent options for long-term investors, especially if you’re unsure about picking individual stocks.

1. Index Funds

Index funds aim to replicate the performance of a specific index, such as the Nifty 50 or Sensex. These funds provide broad market exposure and have lower expense ratios compared to actively managed funds. Investing in an index fund is a good way to gain exposure to the best stocks for the long term without having to pick individual shares.

2. ETFs

ETFs are similar to index funds but trade like stocks on the exchange. They offer flexibility, liquidity, and lower costs, making them an attractive option for long-term investment in India. ETFs such as the Nifty ETF or the Bharat 22 ETF provide a diversified portfolio of long-term stock investment.

Advantages of Index Funds and ETFs:

Advantages of Index Funds:

- Diversification across the market.

- Lower fees due to passive management.

- Simplicity and ease for long-term investors.

Advantages of ETFs:

- Flexibility to trade like stocks during the day.

- Liquidity and lower costs for frequent traders.

- Ability to target specific sectors, countries, or asset classes.

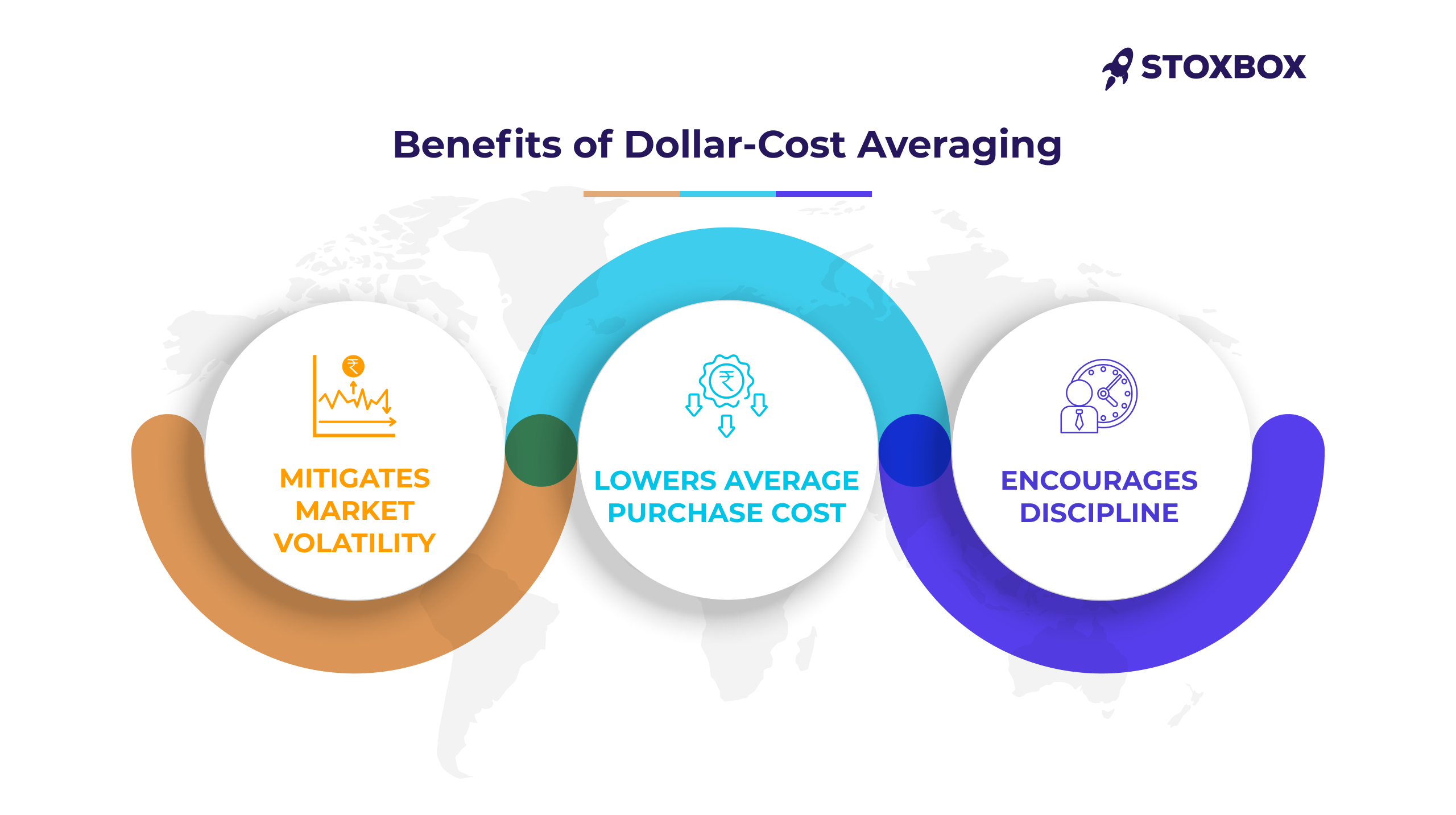

The Importance of Dollar-Cost Averaging in Long-Term Investing

Dollar-cost averaging (DCA) is a powerful strategy for long-term investing, especially in volatile markets. It involves investing a fixed amount of money at regular intervals, regardless of the stock price.

Benefits of Dollar-Cost Averaging:

- Mitigates Market Volatility: DCA reduces the risk of making a large investment at the wrong time. By spreading out your purchases, you avoid the dangers of market timing.

- Lowers Average Purchase Cost: Over time, the average cost of your investment will be lower compared to lump-sum investing, as you’ll buy more shares when prices are low and fewer when prices are high.

- Encourages Discipline: DCA encourages a disciplined investment approach, which is key to long-term success.

For Indian investors, Systematic Investment Plans (SIPs) offered by mutual funds are an example of DCA. Investing in SIPs regularly allows you to accumulate units over time, regardless of market conditions.

How to Monitor and Rebalance Your Long-Term Investment Portfolio

Even in long-term investing, regular monitoring and rebalancing

are essential to ensure your portfolio stays aligned with your financial goals.

1. Set Investment Goals

Clearly define your long-term financial objectives, such as retirement savings or wealth accumulation. Regularly monitor your portfolio’s performance to ensure it aligns with these goals.

2. Periodic Review

Review your portfolio at least once or twice a year. Check if any long-term stocks in your portfolio need to be replaced due to changes in the company’s fundamentals or market conditions.

3. Rebalance the Portfolio

Over time, the value of certain stocks or asset classes may increase disproportionately, leading to an unbalanced portfolio. Rebalancing involves selling overperforming assets and buying underperforming ones to maintain your desired asset allocation.

4. Use Technology

Several apps and platforms are available in India to help you monitor your portfolio and receive alerts on stock performance. Platforms like Zerodha, Groww, and Upstox can assist in tracking your best stocks for long-term investment and making informed decisions.

Let us sum it up

Successful long-term investing requires a combination of patience, research, and a strategic approach. Patience allows investors to ride out market volatility, while thorough research helps identify the best long-term stocks by analyzing fundamentals like revenue, market share, and management quality. A strategic approach, including portfolio diversification and dollar-cost averaging, mitigates risk and ensures consistent growth. Regular monitoring and rebalancing are essential to keeping the portfolio aligned with financial goals. By following these principles, investors can build substantial wealth over time through the power of compounding, as seen in the performance of stocks like HDFC Bank and Infosys.

Frequently Asked Questions

How much should I invest in long-term stocks initially?

The amount you should invest in long-term stocks depends on your financial goals, risk tolerance, and time horizon. Ideally, start with an amount that you can comfortably invest without needing immediate access to the funds. Financial experts recommend investing at least 10-20% of your income in shares for long-term investment. If you’re new to investing, consider starting small and gradually increasing your investments as you gain more confidence and experience.

What is the difference between growth stocks and value stocks for long-term investment?

Growth stocks are companies expected to grow at a higher-than-average rate compared to others in the market. These are typically more volatile but can offer significant capital appreciation over time. Examples in India include technology firms like Infosys and Wipro.

Value stocks, on the other hand, are shares of companies that are trading below their intrinsic value. These stocks are often undervalued by the market and are considered less risky but may offer slower, more steady returns. Examples of value stocks might include large, established companies like ITC or Tata Steel. Investors looking for the best stocks for long-term investment often blend both growth and value stocks in their portfolios for balanced growth.

How can I stay updated on my long-term investments?

To stay updated on your long-term investment stocks, you can:

- Use mobile apps and platforms like StoxBox to track the performance of your portfolio.

- Subscribe to financial news services and newsletters, or follow market analysts to receive regular updates on the best stocks to buy today for the long term.

- Set up alerts for important financial news regarding the companies you have invested in, including earnings reports and major market shifts.

- Regularly review your portfolio, at least once or twice a year, to ensure it aligns with your long-term goals.

What is the impact of inflation on long-term investments?

Inflation erodes the purchasing power of your money over time. However, long-term stocks can act as a hedge against inflation since companies often pass on higher costs to consumers, increasing their revenues. Stocks, especially those of companies with pricing power, tend to outpace inflation over the long run. For example, investing in the best share for long-term investment like Hindustan Unilever or Reliance Industries can help maintain purchasing power even in inflationary periods. However, it’s important to ensure that the growth of your investments exceeds the inflation rate to maintain real returns.

Can I invest in international stocks for long-term growth?

Yes, you can invest in international stocks for long-term growth. Many platforms now allow Indian investors to buy international stocks directly or through mutual funds and Exchange-Traded Funds (ETFs) that track foreign indices. Investing in international long-term stocks allows for geographical diversification, reducing the risk associated with a single market. For instance, you could invest in global giants like Apple, Amazon, or Tesla for exposure to markets outside India. However, keep in mind currency risk and international market fluctuations when diversifying globally.

Your Wealth-Building Journey Starts Here