The only term you need to know is ‘long-term’

We live in an era of YOLO and FOMO. We are a click happy generation that only appreciates instant gratification. With such a mindset, if somebody tells you that the best way to benefit from equity investing is to stay invested for the long-term, what would your first reaction be?

You would most likely dismiss it. After all, who wants to wait for 7 to 10 years to make money when you can do the same in just 1 year? The thing about making money or growing your wealth is that it is extremely challenging to achieve success in the short-term. On the other hand, the chances of losing money in the short-term are very high. If you are still not convinced, then here are a few compelling reasons for you to invest for the long-term.

Reason #1: Market volatility can erode your capital in the short-term

Traditional economic theory assumes that all investors are rational and that they always make rational investment decisions. However, that is far from reality. In the short-term, there are a host of factors that impact stock prices. Company specific developments that only have near term impact, market sentiments, investor greed and fear, and transitory events. Due to these, stock prices tend to be more volatile in the short-term. Now, as a human being you can’t always be rational. There will be times when these transitory factors will impact you and influence you to make investment decisions that might not be optimal. Class example is of selling in fear when the markets are falling and not exiting an investment when an opportunity presents itself. However, what happens in the long-term is that the true value of the investment eventually emerges. Further, all these short-term movements also get smoothened out. So, when you become a long-term investor, you tend to ignore short-term movements and stay focused on realising the true value of your investment. As the legendary Warren Buffet put it, “Someone’s sitting in the shade today because someone planted a tree a long time ago.” All you need to do is sow the seeds of investment and then wait patiently for the tree to grow.

Reason #2: Compounding can exponentially grow your wealth

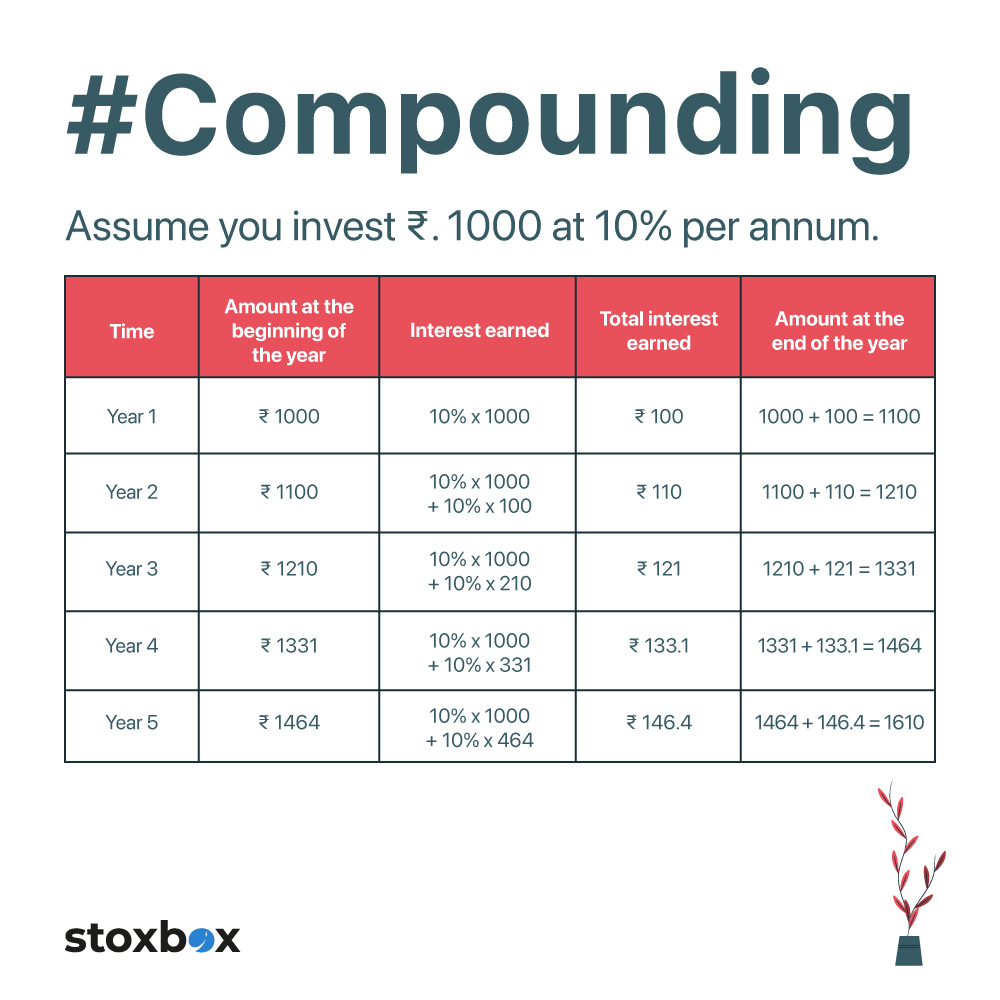

Compounding is a beautiful mathematical concept that can make your money work for you in such a way that over a period of time, you witness exponential growth. The compounding process ensures that when you invest money, both the principal invested and the returns generated, earn interest. Over a period of time, as the interest earned keeps increasing so do the returns generated.

Let’s explain this better with an example.

Assume you invest Rs. 1000 at 10% per annum.

Time | Amount at the beginning of the year | Interest earned | Total interest earned | Amount at the end of the year |

Year 1 | 1000 | 10% x 1000 | Rs. 100 | 1000 + 100 = 1100 |

Year 2 | 1100 | 10% x 1000 + 10% x 100 | Rs. 110 | 1100 + 110 = 1210 |

Year 3 | 1210 | 10% x 1000 + 10% x 210 | Rs. 121 | 1210 + 121 = 1331 |

Year 4 | 1331 | 10% x 1000 + 10% x 331 | Rs. 133.1 | 1331 + 133.1 = |

Year 5 | 1464 | 10% x 1000 + 10% x 464 | Rs. 146.4 | 1464 + 146.4 = 1610 |

The longer you stay invested, the higher the probability of witnessing exponential growth.

So, if you really want to benefit from the wealth creation potential of equities, then it is time to remove the myopic lens and think long-term.

Frequently Asked Questions

1. How does long-term investment help in wealth creation?

Long-term investments benefit from compound growth, allowing earnings to generate further returns over time, significantly increasing wealth.

2. Are long-term investments less risky compared to short-term investments?

While long-term investments are not risk-free, they often mitigate short-term market volatility and have the potential for better risk-adjusted returns over time.

3. What types of assets are suitable for long-term investments?

Assets like equities, mutual funds, fixed deposits, real estate, and retirement plans are well-suited for long-term investment strategies.

4. How important is goal setting in long-term investing?

Clear financial goals guide asset selection, risk tolerance, and investment horizon, making them crucial for a successful long-term strategy.

5. How do tax benefits impact long-term investment returns?

Certain long-term investments, like PPF or ELSS, provide tax benefits under Section 80C, which can enhance overall returns.

6. When should I consider rebalancing my long-term investment portfolio?

Rebalancing should be considered periodically or when there are significant changes in market conditions or personal financial goals.

7. Can long-term investing help in retirement planning?

Yes, long-term investments, particularly in equity and retirement-specific funds, can build a substantial corpus to support financial needs post-retirement.

You might also Like.

Double Top Pattern: The Ultimate Trading Guide

Have you ever witnessed a promising uptrend reverse on you...