Start investing your money in SIP today to get betterreturn for future.

Table of Contents

What is a SIP?

A Systematic Investment Plan (SIP) allows investors to invest a fixed amount in mutual funds at regular intervals, typically monthly. This disciplined approach promotes consistent investing and takes advantage of rupee-cost averaging and compounding returns over time.

What is a SIP Calculator?

A SIP calculator is a digital tool designed to estimate the potential returns of your SIP investments based on factors like investment amount, expected rate of return, and duration. It simplifies financial planning by clarifying how much to invest to reach specific financial goals.

Benefits of Using a SIP Calculator

1. Accurate Projections

A SIP calculator provides precise estimates of future returns based on input parameters like investment amount, duration, and expected returns. This accuracy is crucial for planning significant financial goals like buying a house, funding education, or retirement. By using a SIP calculator, investors can avoid guesswork and base their decisions on reliable data. It helps anticipate the growth trajectory of your investments, ensuring that you set realistic expectations and align your SIP contributions accordingly.

2. Goal Alignment

Financial goals vary from person to person, and a SIP calculator helps determine if your current investment plan aligns with your objectives. Whether it’s saving for a dream vacation or building a retirement corpus, the calculator provides insights into whether your contributions are sufficient to achieve those goals. If the projected returns fall short, you can adjust your SIP amount, tenure, or expected returns to bridge the gap and stay on track.

3. Time Saving

Manually calculating SIP returns, especially for long-term investments with compounding effects, can be time-consuming and error-prone. A SIP calculator automates these computations, delivering instant results. Investors can see detailed projections with just a few inputs, enabling quicker decision-making. This feature is especially valuable for those comparing multiple investment scenarios or planning under time constraints.

4. Flexibility

SIP calculators offer the flexibility to test different investment scenarios. You can:

- Adjust the SIP amount to see how a higher or lower contribution impacts your goals.

- Incorporate step-up amounts, where SIP contributions increase annually to align with rising incomes.

- Factor in inflation using tools like an inflation-adjusted SIP calculator, ensuring your real purchasing power is maintained over time.

- Simulate different durations and return rates to understand the long-term effects of compounding.

This flexibility empowers investors to customize their investment strategies and make informed decisions tailored to their unique financial situations. For instance, an investor planning a 20-year SIP for retirement can test various combinations of monthly contributions and growth rates to find the optimal plan.

By leveraging these benefits, a SIP calculator becomes an indispensable tool for achieving financial discipline and clarity in investment planning.

How Does a SIP Calculator Work?

SIP calculators are simple tools that estimate the growth of investments in Systematic Investment Plans (SIPs) by simulating the effects of compounding. They offer a quick and clear way to visualize potential returns and plan your investments effectively.

Here’s how it works step by step:

Inputs You Provide:

- Monthly Investment: This is the amount you plan to invest each month.

- Expected Rate of Return: The annual percentage return you anticipate based on the mutual fund’s performance.

- Investment Duration: The period you intend to stay invested, usually in years.

Role of These Inputs:

- The monthly investment determines your regular contribution.

- The expected return shows potential growth due to compounding.

- The duration dictates how long your investment benefits from compounding.

The Calculation:

SIP calculators use a formula:

- FV=P×(1+r)^n−1/r×(1+r)

- FV: Future Value (your total wealth)

- P: Monthly investment

- r: Monthly return rate (annual rate divided by 12)

- n: Total number of investments (months)

Example Calculation:

Suppose you invest ₹5,000 monthly for 10 years with an expected annual return of 12%. Using the formula, the SIP calculator estimates your wealth at around ₹11.6 lakh.

Considerations and Limitations:

- SIP calculators assume consistent returns, which may not reflect actual market volatility.

- They don’t factor in external costs like taxes or fund management fees.

- Use these tools as a guide, not a guarantee.

With these features, SIP calculators empower you to make informed financial decisions and stay on track toward your goals.

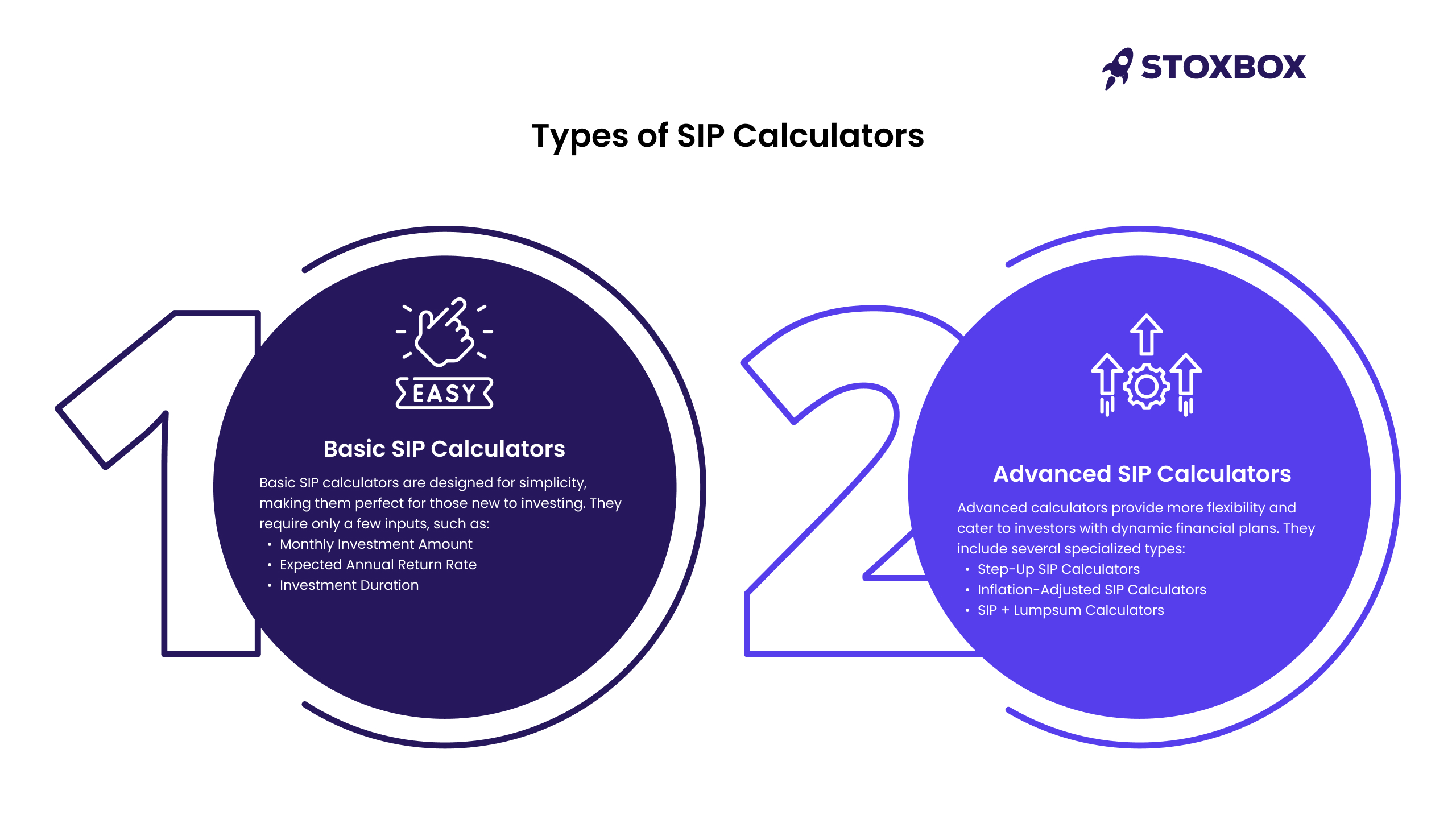

Types of SIP Calculators

SIP calculators come in various forms, catering to the diverse needs of investors. From simple tools for beginners to advanced calculators that account for inflation, step-up contributions, and one-time investments, each type serves a unique purpose. Choosing the right one can make financial planning more effective and personalized to your goals.

1. Basic SIP Calculators

Ideal for Beginners

Basic SIP calculators are designed for simplicity, making them perfect for those new to investing. They require only a few inputs, such as:

- Monthly Investment Amount

- Expected Annual Return Rate

- Investment Duration

- Calculates Returns Based on Fixed Contributions

These calculators assume that the same amount is invested every month throughout the investment period. They don’t account for variations like step-up increases or inflation adjustments, focusing solely on straightforward, fixed investments.

Simple Example:

If you invest ₹10,000 monthly for 10 years at an annual return rate of 12%, a basic SIP calculator will estimate your total corpus at approximately ₹23.23 lakh.

When to Use:

- Beginners seeking straightforward projections.

- Investors with a fixed budget and no plans to increase contributions over time.

2. Advanced SIP Calculators

Advanced calculators provide more flexibility and cater to investors with dynamic financial plans. They include several specialized types:

Step-Up SIP Calculators

These calculators account for periodic increases in your SIP contributions, reflecting income growth or changing financial goals.

- Benefit: Show how small, incremental increases can significantly enhance the final corpus without requiring drastic lifestyle changes.

- Example: Starting with ₹5,000 monthly and increasing contributions by 10% annually for 15 years at a 12% return rate yields a significantly higher corpus than a fixed SIP of ₹5,000 over the same period.

Inflation-Adjusted SIP Calculators

These tools factor in inflation, helping investors understand the real purchasing power of their future corpus.

- Benefit: Allows investors to set realistic goals by adjusting for the diminishing value of money over time.

- Example: To achieve ₹1 crore in today’s terms for retirement in 20 years, an inflation-adjusted calculator may show you need a higher future corpus if inflation averages 6% annually.

SIP + Lumpsum Calculators

These calculators combine regular SIP contributions with one-time lump sum investments, offering a comprehensive view of your potential growth.

- Benefit: Useful for investors who can supplement SIPs with surplus funds to accelerate wealth creation.

- Example: Investing ₹5 lakh as a one-time amount and contributing ₹10,000 monthly for 10 years at a 10% return rate generates a significantly higher final corpus than SIPs alone.

Choosing the Right SIP Calculator

Selecting the right SIP calculator depends on your financial goals and investment strategy:

- Use Basic SIP Calculators for fixed contributions and straightforward estimates.

- Opt for Step-Up SIP Calculators if you anticipate income growth or want to maximize returns with incremental investments.

- Choose Inflation-Adjusted SIP Calculators to ensure your goals are realistic and account for the reduced value of money over time.

- Leverage SIP + Lumpsum Calculators if you have additional funds to combine with regular SIPs.

Features to Look for in an Effective SIP Calculator

A Systematic Investment Plan (SIP) Calculator is a vital tool for investors to estimate potential returns and plan their investments effectively. Choosing the right SIP calculator can make a significant difference in your financial planning journey. Here are key features to look for:

- User-Friendly Interface: An effective SIP calculator should have a simple and intuitive design, making it easy for beginners and seasoned investors to navigate.

- Customizable Inputs: Look for calculators that allow you to enter varied monthly SIP amounts, investment duration, and expected annual return rates.

- Step-Up SIP Option: Advanced calculators include the option to factor in periodic increments in SIP amounts, aligning with income growth.

- Inflation Adjustment: A calculator that accounts for inflation provides realistic projections of purchasing power in the future.

- Combination of SIP and Lump Sum: Some calculators enable you to calculate returns for both SIP and one-time investments, offering a holistic financial forecast.

- Real-Time Results: Instant calculations with clear breakdowns of total investment, estimated returns, and corpus value help investors make quick decisions.

- Mobile and Desktop Accessibility: A responsive design ensures you can use the calculator across devices conveniently.

An ideal SIP calculator empowers investors with accurate insights, flexibility, and ease of use, enabling smarter financial planning.

Strategic Financial Planning Using SIP Tools

Strategic financial planning is the cornerstone of wealth creation, and Systematic Investment Plans (SIPs) play a crucial role in achieving long-term financial goals. By leveraging SIP tools like calculators, investors can plan, monitor, and optimize their investments effectively. SIP tools provide valuable insights into projected returns, helping investors align their investment strategies with their life goals, such as retirement, education, or homeownership.

- SIP calculators simplify complex calculations, offering a clear picture of future corpus, total investments, and earnings based on factors like monthly contributions, tenure, and expected returns.

- Tools like step-up SIP calculators allow investors to adjust their contributions as income grows, ensuring that their financial plans remain scalable and adaptable.

- Inflation-adjusted SIP tools provide realistic projections, helping investors prepare for future purchasing power challenges.

Moreover, these tools aid in portfolio diversification by analyzing the impact of varying returns across asset classes. With real-time data and customization options, SIP tools enable investors to make informed decisions and stay disciplined in their investment approach.

Popular SIP Calculators Available Online

Several online SIP calculators cater to diverse investor needs, offering basic and advanced features. Here’s an overview:

Options to Explore

Basic Tools

- These calculators provide simple projections and are ideal for beginners.

- Examples include SIP calculators available on AMFI’s website, mutual fund company websites, and financial news portals.

Advanced Tools

- Step-Up SIP Calculator with Table: This calculator allows you to simulate annual increases in your SIP contributions, showing how incremental investments can enhance your returns.

- SIP Calculator with Expense Ratio: This tool considers the expense ratio of mutual funds, helping you understand net returns after deducting fund management costs.

About Stoxbox SIP Calculator

At Stoxbox, our SIP calculator is designed to simplify your investment planning with accurate projections based on monthly investments, annual interest (%), and tenure (in years). It empowers investors with clarity, precision, and insights to align with their financial goals.

Conclusion

A SIP calculator simplifies the complex process of financial planning by providing accurate, instant projections. Tools like the mutual fund SIP calculator, sip calculator lump sum, and sip compounding calculator empower investors to align investments with their goals.

Whether you’re a beginner or a seasoned investor, tools like the sip calculator online or monthly sip calculator ensure disciplined investing. They enable better decision-making, allowing you to adjust SIPs dynamically for inflation, income changes, or market conditions.

Incorporate SIP calculators into your planning toolkit to unlock the full potential of mutual fund investments and pave the way toward achieving your financial aspirations!

Frequently Asked Questions

How accurate is a SIP calculator?

SIP calculators provide reliable estimates based on the inputs and assumptions provided, such as expected annual return and investment tenure. However, they cannot account for market volatility, fluctuating returns, or other unforeseen factors, which may cause actual returns to differ from the projections.

Can a SIP calculator guarantee returns?

No, a SIP calculator cannot guarantee returns. It provides an estimate based on historical or assumed return rates. Mutual fund investments are subject to market risks, and actual returns can vary depending on market performance and fund management.

How often should I adjust my SIP using a calculator?

You should review your SIP investments periodically, typically every 6-12 months, using a SIP calculator. Adjustments may be needed to align with changing financial goals, income levels, or market conditions. For example, using a step-up SIP calculator allows you to increase contributions over time.

Is a SIP calculator useful for short-term investments?

Yes, a SIP calculator can be helpful for short-term investments, but the accuracy might be limited due to the higher impact of market fluctuations in shorter durations. For long-term goals, the calculator provides more consistent and meaningful projections.

Can the SIP amount be changed?

Yes, SIP amounts can be changed. Many mutual fund platforms offer flexible options to increase or decrease contributions. Using a step-up SIP calculator can help you simulate the impact of increasing your SIP amount annually, aligning with income growth or changing financial priorities.

Your Wealth-Building Journey Starts Here