Investors often wonder how to transfer shares from one Demat to another. Whether you’re consolidating multiple accounts, switching brokers, or moving to a more efficient platform, transferring shares is essential to managing your portfolio effectively. This guide provides detailed insights into the process, addressing both offline and online methods.

Table of Contents

Understanding Demat Transfers

What is a Demat Account?

A Demat account holds securities in electronic form, enabling seamless trading and investment in the Indian stock market. It is crucial for buying, selling, and holding shares.

Types of Demat Transfers

Intra-depository Transfers:

Intra-depository transfers refer to the movement of shares between two Demat accounts held within the same depository, such as NSDL (National Securities Depository Limited) or CDSL (Central Depository Services Limited). These transfers are generally more straightforward as they occur within a single depository system. Since the shares remain within the same ecosystem, the processing time is shorter, and fees are often lower compared to inter-depository transfers.

For example, if you have two Demat accounts under different brokers but both are linked to NSDL, an intra-depository transfer allows you to consolidate your holdings efficiently. The process typically involves submitting a Delivery Instruction Slip (DIS) to the broker of the source account, detailing the target account and the securities to be transferred.

Inter-depository Transfers:

Inter-depository transfers occur when shares are moved between Demat accounts linked to different depositories, such as transferring shares from an NSDL account to a CDSL account or vice versa. These transfers are slightly more complex, as they require coordination between the two depositories. As a result, the processing time may be longer, and the associated charges can be higher compared to intra-depository transfers.

Such transfers are common when investors switch brokers, especially when the new broker is affiliated with a different depository. To initiate an inter-depository transfer, the DIS form must be filled out with precise details, including the ISIN of the securities and the target account’s DP ID and client ID.

Key Considerations

- Confirm the type of accounts (NSDL/CDSL) and compatibility for transfers.

- Be aware of transfer fees, which may vary based on the type of transaction.

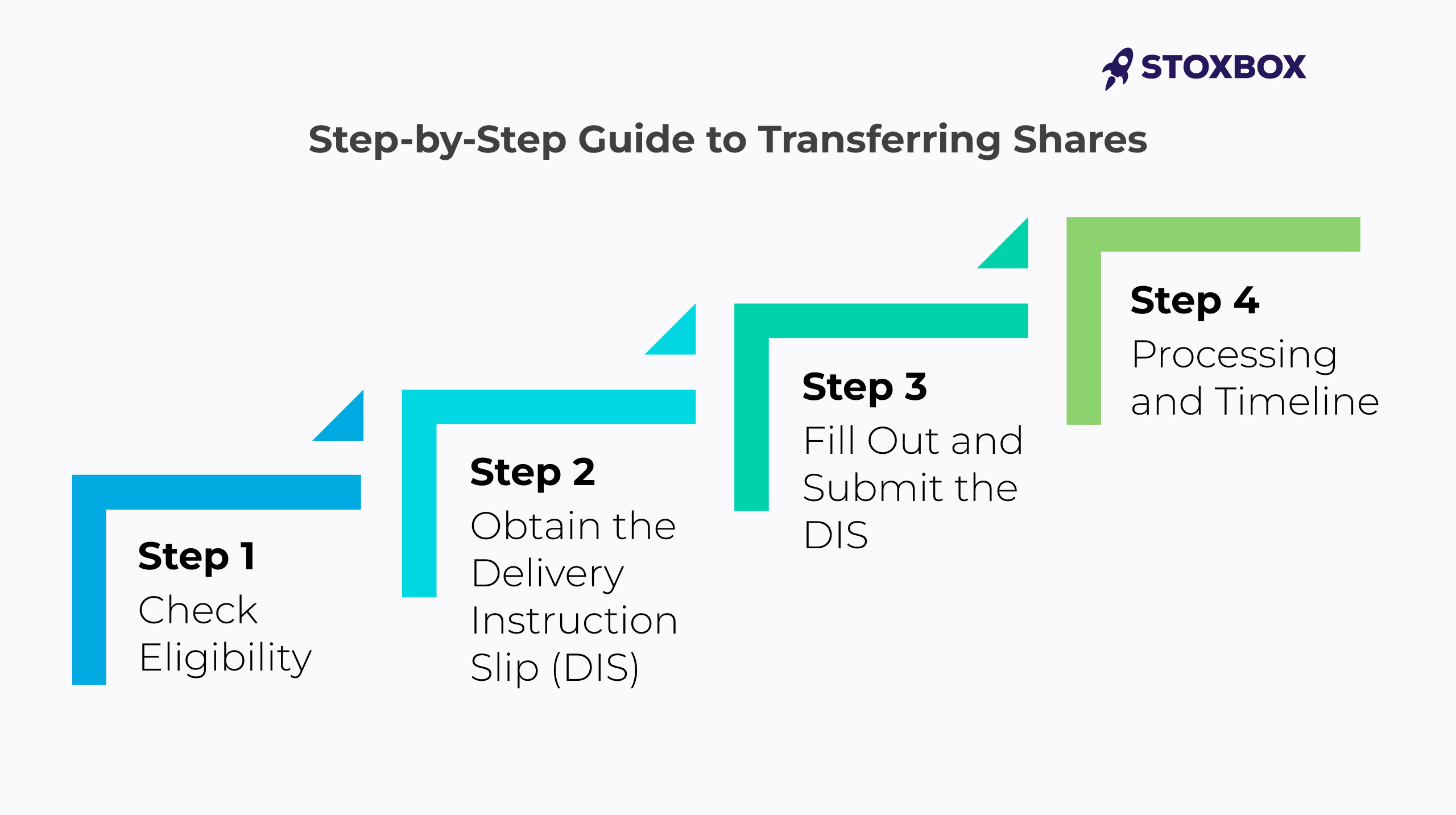

Step-by-Step Guide to Transferring Shares

Step 1: Check Eligibility

Ensure that both Demat accounts are active and capable of receiving and transferring shares. Verify whether the accounts are linked to the same depository (NSDL or CDSL) for intra-depository transfers or different depositories for inter-depository transfers.

Compatibility is crucial, as any mismatch in account details or depository systems may result in delays or errors in the transfer process. Confirm that both accounts have sufficient permissions for share transfers.

Step 2: Obtain the Delivery Instruction Slip (DIS)

Request the Delivery Instruction Slip (DIS) form from your current broker. This essential document enables you to initiate the transfer process.

The form includes specific fields to detail the recipient Demat account and the securities you wish to transfer.

Ensure you have the correct DIS format for intra-depository or inter-depository transfers, as applicable. Obtaining this slip is the first step toward formally starting the share transfer process.

Step 3: Fill Out and Submit the DIS

Carefully fill out the DIS form, including critical details like the ISIN (International Securities Identification Number) of the securities, the quantity of shares to be transferred, and the recipient Demat account number.

Double-check all information to avoid rejection due to inaccuracies. Once completed, submit the form to your broker either in person or online, depending on your broker’s procedures.

Step 4: Processing and Timeline

After submission, the broker processes the DIS, and the transfer typically takes 1-3 business days to complete. The exact timeline depends on whether the transfer is intra-depository or inter-depository.

Track the progress of your transfer using your broker’s online platform or the depository’s tracking tools. Timely follow-up ensures smooth and error-free completion of the process.

Important Considerations and Requirements

Documentation:

- Valid DIS form.

- Proof of identity for verification, if required.

Fees and Charges:

- Charges for transfer of shares from one Demat to another vary based on the broker and type of transfer.

- Always check for additional costs like stamp duty.

Accuracy:

- Double-check recipient details to avoid failed transfers.

Types of Transfer: Off-Market and Online Transfer Methods

Off-Market Transfers

- Off-market transfers are used for transferring shares directly between Demat accounts without involving stock exchanges.

- These transfers are typically used for non-trading purposes such as gifting, inheritance, or family settlements.

- In an off-market transfer, the shares are moved directly from one account to another without a sale or purchase taking place on the market. This method requires the use of a Delivery Instruction Slip (DIS) form, where details such as the recipient’s Demat account, ISIN, and quantity of shares must be accurately entered.

- Off-market transfers may take longer to process compared to online transfers, as they often involve manual handling and additional scrutiny to ensure compliance with regulatory guidelines. Despite the longer processing time, this method is ideal for personal or non-commercial share transfers.

Online Transfer Methods

- Online transfer methods provide a faster and more efficient way to transfer shares. CDSL account holders can use the CDSL Easiest platform, which enables the seamless transfer of shares through an online interface. This service allows users to authorize transactions digitally, ensuring speed and accuracy.

- For NSDL users, NSDL Speed-e is the preferred platform. It facilitates secure and convenient online share transfers, eliminating the need for physical forms. Both platforms significantly reduce processing times and offer user-friendly interfaces for managing transactions effectively.

Pros and Cons

| Type | Pros | Cons |

|---|---|---|

| Off-Market | Suitable for non-commercial transfers | Manual process, longer processing time |

| Online Transfer | Quick and convenient | May require registration and setup |

Fees in India

Understanding the share transfer charges is crucial:

- Intra-depository transfers typically incur lower fees.

- Inter-depository transfers may include additional costs due to increased processing.

Factors Influencing Charges

- Broker Fee: Each broker has a different fee structure.

- Type of Transfer: Online transfers are often cheaper than manual off-market transfers.

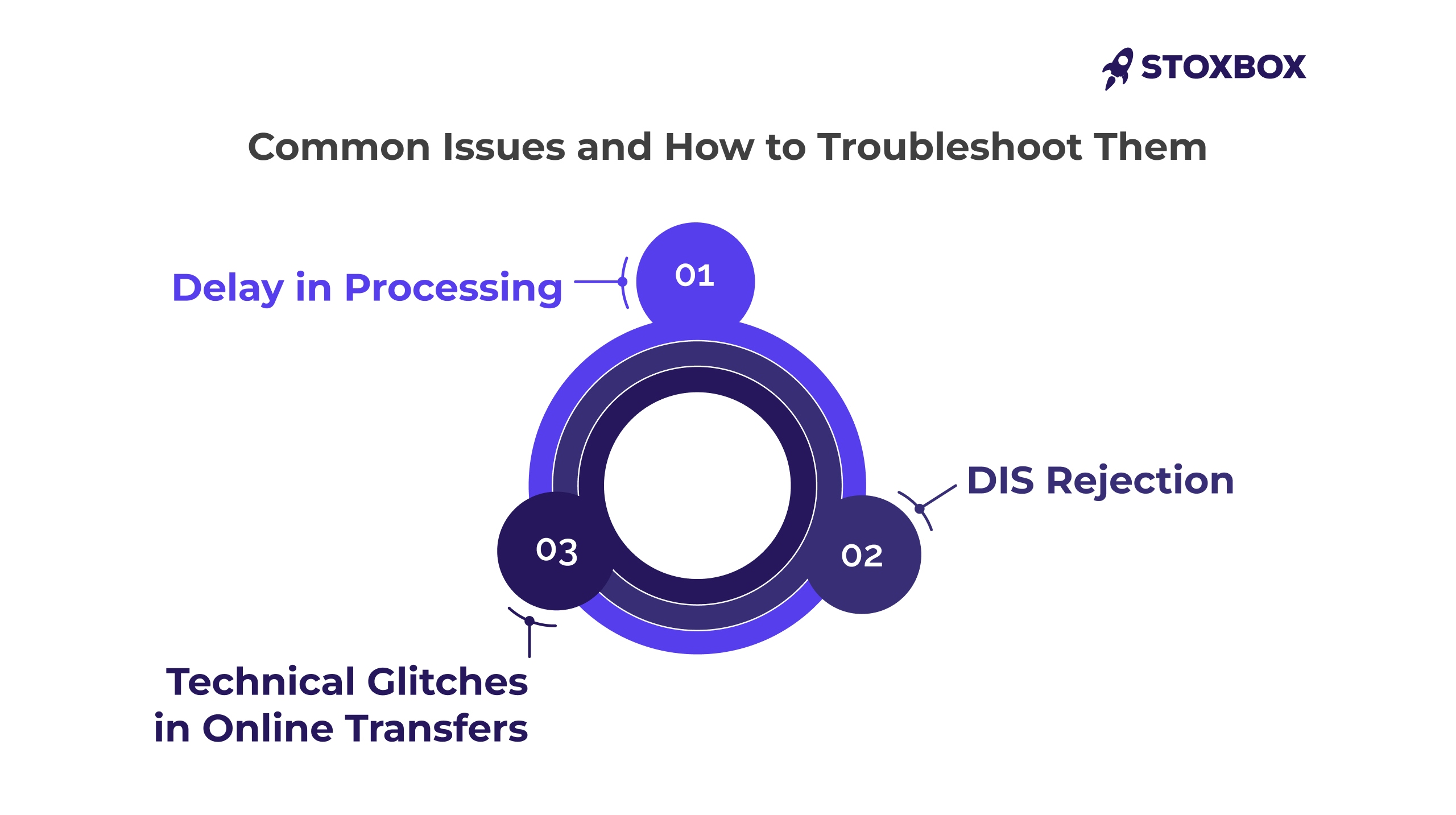

Common Issues and How to Troubleshoot Them

Delay in Processing:

Delays in processing share transfers can occur due to various reasons, including incomplete forms, incorrect details, or operational inefficiencies at the broker or depository level.

To resolve delays, start by contacting your broker immediately to identify the root cause.

Ensure all required documents, such as the Delivery Instruction Slip (DIS), are correctly filled out and submitted. Check for compliance with the broker’s guidelines and confirm that the transaction request has been forwarded to the depository.

Regularly track the status of your transfer through the broker’s platform or depository portal to monitor progress and take timely action if needed.

DIS Rejection:

A Delivery Instruction Slip (DIS) rejection typically happens due to errors such as incorrect ISIN (International Securities Identification Number), mismatched Demat account details, or incomplete information.

To avoid this, double-check all entries on the DIS form before submission. Make sure the ISIN and Demat account numbers are accurate and correspond to the shares and accounts involved in the transfer.

If the rejection occurs despite careful preparation, promptly correct the errors and resubmit the form to minimize further delays.

Technical Glitches in Online Transfers:

Technical issues can disrupt online share transfers, causing frustration and delays. Ensure you use a stable internet connection to prevent interruptions during the process.

If you encounter persistent problems, reach out to the customer support team of the respective depository (NSDL or CDSL) or your broker for assistance.

Depositories typically have dedicated helplines to guide users in resolving issues efficiently.

Legal and Compliance Aspects of Demat Transfers in India

Regulatory Oversight:

- The process is regulated by SEBI, ensuring transparency and investor protection.

Tax Implications:

- Share transfers are non-taxable events unless sold. Capital gains tax applies only upon selling.

Advantages of Using Online Transfer Services

Benefits of CDSL Easiest and NSDL Speed-e

- The CDSL Easiest and NSDL Speed-e platforms offer significant advantages for investors looking to transfer shares seamlessly between Demat accounts.

- One of the most notable benefits is the quick processing time, with many transfers being completed within a single business day. This efficiency helps investors save time and provides the convenience of real-time tracking.

- Both platforms are designed with user-friendly interfaces that include step-by-step instructions, ensuring even novice investors can navigate the transfer process without difficulty.

- Another key advantage is the reduced paperwork compared to traditional offline methods.

- By digitizing the share transfer process, these platforms eliminate the need for physical Delivery Instruction Slips (DIS), making transactions less cumbersome and more eco-friendly.

- This convenience is particularly valuable for high-frequency traders or investors managing multiple portfolios.

Features

- Accessibility: Both platforms are available 24/7, offering unmatched flexibility for investors to initiate transactions at their convenience, whether during market hours or after.

- Cost-Effectiveness: Compared to traditional methods, these platforms often have lower fees for transferring shares. This cost-saving benefit makes them especially attractive to retail investors and those seeking to optimize their investment returns.

Overall, CDSL Easiest and NSDL Speed-e represent modern, efficient tools that simplify the share transfer process, making it faster, cheaper, and more accessible for investors.

Conclusion: Key Tips for Seamless Transfers

Transferring shares between Demat accounts need not be complex. By understanding the demat to demat share transfer process, preparing the required documentation, and choosing the right method (offline or online), investors can ensure a smooth transfer experience. Always verify details and stay informed about fees and timelines.

Frequently Asked Questions

How long does it take to transfer shares from one Demat to another?

Transfers typically take 1-3 business days, depending on the type of transfer and broker.

Can we transfer shares from one Demat account to another?

Yes, shares can be transferred between accounts using a DIS form or online platforms like CDSL Easiest.

What are the charges for transferring shares from one Demat to another?

Charges vary by broker and depository. Intra-depository transfers generally cost less than inter-depository ones.

Can I transfer shares from one broker to another?

Yes, share transfer online services or the DIS form can facilitate the process when changing brokers.

Is there a limit on the number of shares that can be transferred?

No specific limit exists, but high-value transactions may require additional verification.

How can I transfer shares from one Demat to another online?

Use platforms like CDSL Easiest or NSDL Speed-e for quick and efficient online transfers.

Is the transfer taxable?

No, transferring shares is a non-taxable event unless sold, in which case capital gains tax may apply.

Your Wealth-Building Journey Starts Here