Dabba trading, also known as box trading or bucket trading, is an illegal practice where trades happen outside official stock exchanges like the NSE or the BSE. Instead of placing trades through a registered broker, the transactions are recorded in an operator’s own ledger, completely bypassing the regulated system.

The word “dabba” literally means box in Hindi, symbolizing the hidden and off-the-books nature of this activity. Since these trades never actually hit the market, there’s no real settlement, no investor protection, and no regulatory oversight.

While it might look attractive due to lower margins or the promise of quick profits, dabba trading comes with serious risks, including total loss of capital and legal consequences. In India, it’s strictly banned by SEBI, and anyone found involved can face hefty penalties or even imprisonment.

If you’re trading outside the official system, you’re not just risking your money, you’re breaking the law. Knowing how dabba trading works helps you steer clear of illegal routes and make smarter, safer investment choices.

Table of Contents

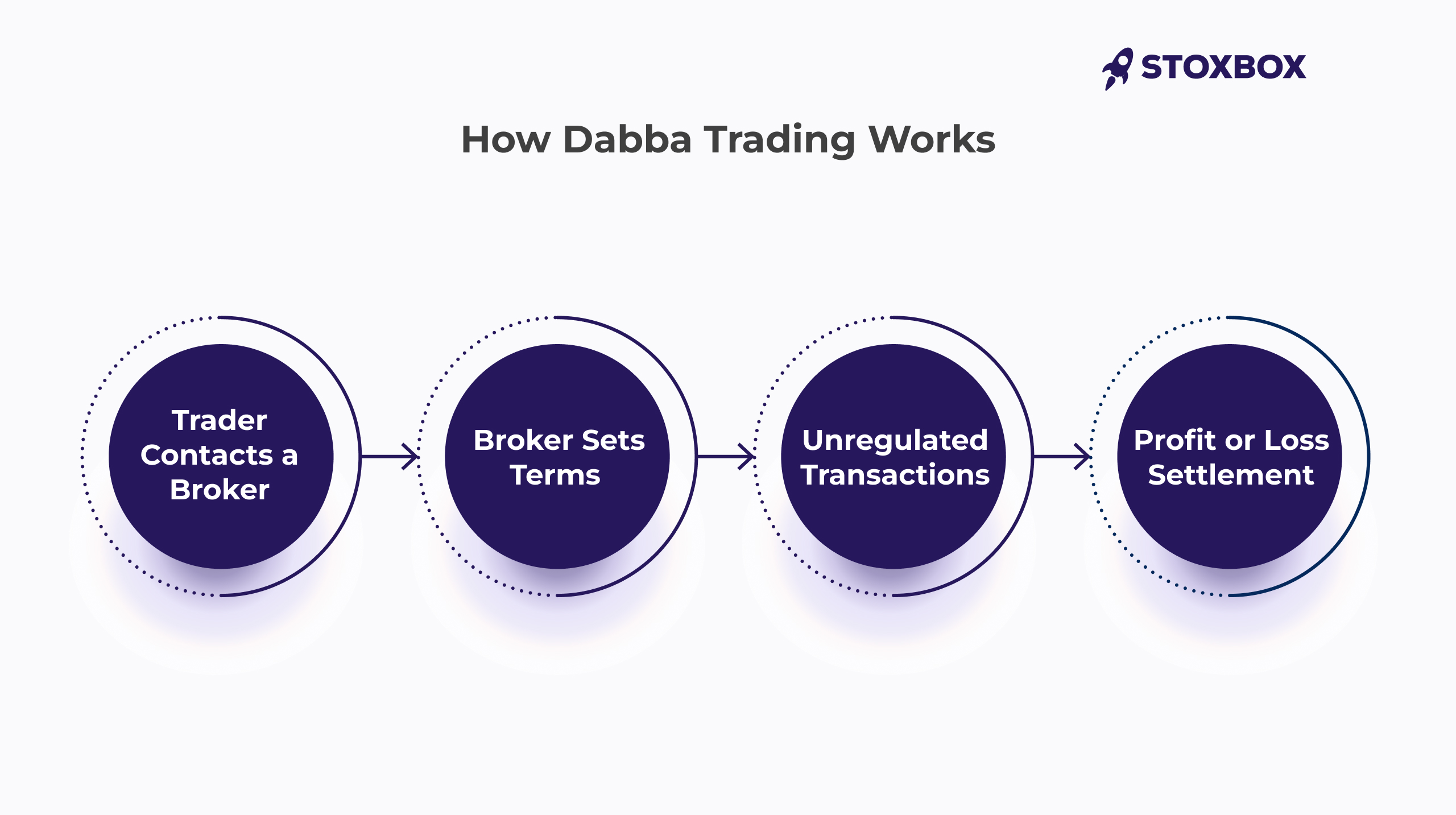

How Dabba Trading Works

Dabba trading doesn’t involve real trades on NSE, BSE, or any SEBI-recognized platform. Instead, it’s an underground setup where traders bet on stock prices through unregistered brokers called dabba operators. There’s no actual buying or selling of shares – just a private deal based on market movements.

Step-by-Step Process

1. The Trader Contacts a Dabba Operator

The process starts when a trader reaches out to a local unregistered broker. These brokers offer a cheaper, faster alternative to official platforms, but it comes at the cost of legality and safety. The main appeal? Lower margins, no tax, and fewer formalities.

2. The Broker Sets the Rules

The broker decides everything – from the margin amount to how much commission to charge. These terms aren’t regulated, which means they’re completely arbitrary and often skewed in favor of the broker.

3. Placing the Bet (Not a Trade)

Here’s the twist: no shares are actually bought or sold. Instead, you’re betting on the direction of a stock’s price, similar to gambling. If your prediction is right, the broker owes you money. If not, you owe them.

They usually track real-time prices from the official market, but the entire transaction happens off the record.

4. Cash Settlement Happens Privately

Profits and losses are settled in cash or via untraceable digital methods. There’s no paper trail, no tax record, and no legal safety net. If the broker refuses to pay, you have no legal ground to fight back.

Key Players

- Brokers: Facilitate illegal trades and manage settlements.

- Traders: Individuals seeking shortcuts to reduce costs or evade taxes.

- Intermediaries: Act as conduits, connecting traders to online Dabba Trading platforms.

Legal Implications and Risks of Dabba Trading

Dabba trading may look like a shortcut to quick profits, but it’s a legal and financial landmine. Since it runs outside official exchanges like NSE or BSE and bypasses SEBI oversight, it violates multiple Indian laws.

Legal Consequences You Can’t Ignore

Dabba trading isn’t just unethical, it’s a criminal offense under several Indian laws, including the Securities Contracts (Regulation) Act, 1956, the Indian Penal Code, and even the Information Technology Act, 2000 (when conducted online).

Here’s what you risk if you get involved:

- Heavy Fines: SEBI can impose steep penalties on those participating in or facilitating dabba trades. The fines often wipe out any supposed “savings” from avoiding official channels.

- Imprisonment: You could face up to 10 years in prison, depending on the offense and the laws invoked during prosecution.

- Trading Bans: Individuals caught may be permanently banned from trading in the regulated market, effectively locking them out of legitimate investment opportunities for life.

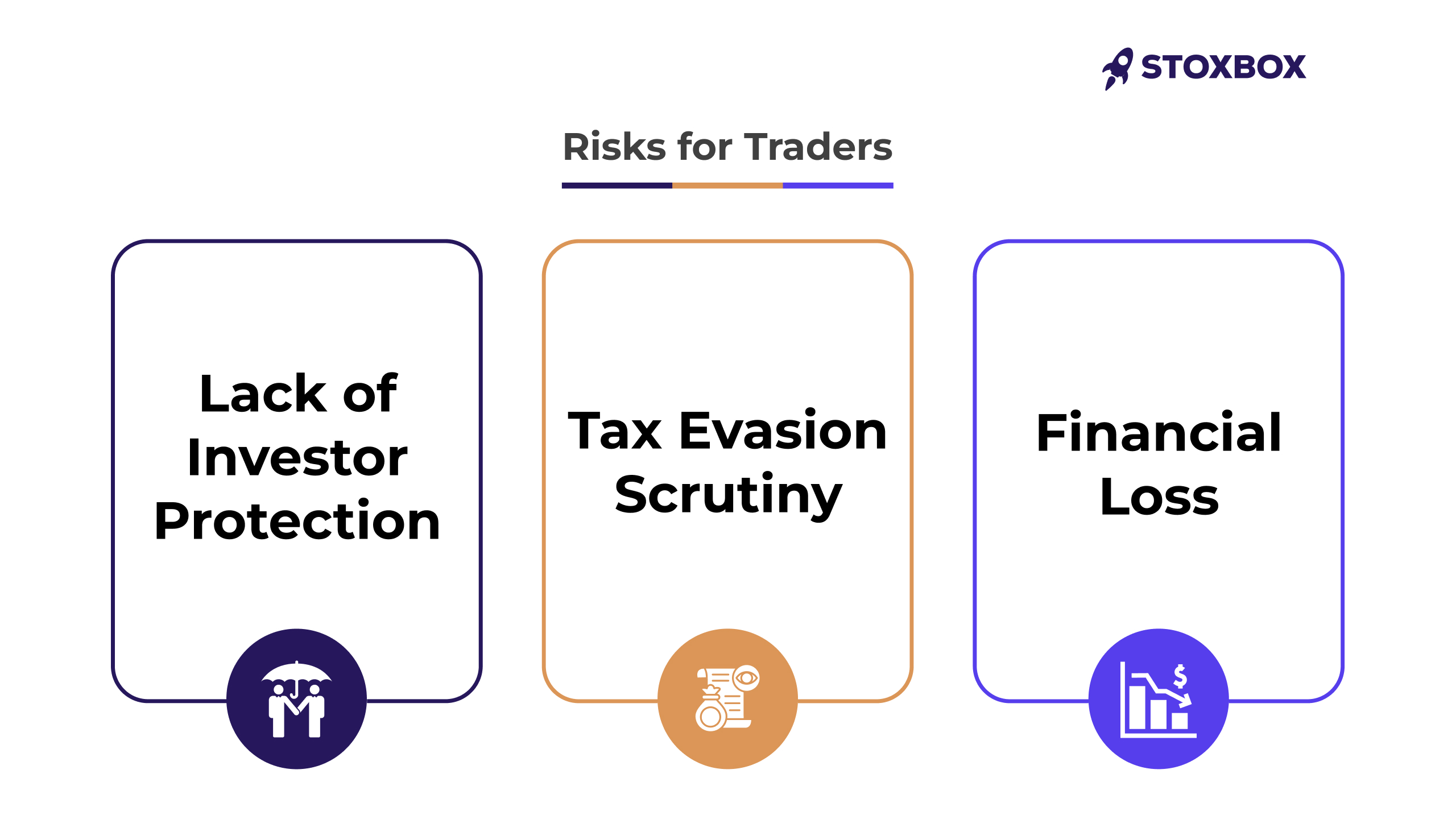

Risks for Traders

Even if you avoid legal trouble for a while, dabba trading carries high personal financial risk:

- No Safety Net: Unlike regular stockbrokers registered with SEBI, dabba operators don’t offer investor protection. If they disappear with your money, you’re stuck with no refund and no legal recourse.

- Complete Lack of Transparency: These trades aren’t monitored. There’s no audit trail, no grievance cell, and often no clarity on how prices or settlements are determined.

- Tax Evasion Penalties: Since dabba trades are usually settled in cash or unofficial digital payments, they evade taxes like STT and Capital Gains Tax. But tax authorities can catch on, leading to audits, back taxes, and penalties.

- Market Manipulation & Fraud: Without oversight, dabba operators can easily manipulate prices, turning the system against you. Many traders lose everything without realizing how rigged the setup actually is.

- Links to Illegal Activity: Because it’s all cash-based and off-the-books, dabba trading can unknowingly connect you to money laundering, hawala, or other illicit financial flows, making it even more dangerous.

Dabba trading is a high-risk gamble with serious consequences. What seems like a tax-free, cost-saving opportunity can quickly turn into legal trouble, financial loss, or both.

If you’re serious about trading, always stick to SEBI-registered brokers and official platforms like NSE or BSE. It’s the only way to stay protected and stay legal.

Dabba Trading vs. Official Market Trading

Comparison of Practices

| Aspect | Dabba Trading | Official Market Trading |

|---|---|---|

| Regulation | Unregulated | Regulated by SEBI |

| Transparency | Low | High |

| Investor Protection | Absent | Robust |

| Risk Level | High | Moderate (with due diligence) |

Why Regulated Markets Are Safer

Trading in regulated markets offers a secure and transparent environment, ensuring the safety and reliability of investments. Regulated markets, such as those governed by SEBI (Securities and Exchange Board of India), provide a structured and accountable trading platform compared to unregulated practices like Dabba Trading. Here’s why they are safer:

Investor Protection

One of the most significant advantages of regulated markets is the comprehensive investor protection framework. SEBI enforces strict rules to protect traders and investors from fraud, manipulation, and malpractices. If disputes arise, investors have access to grievance redressal mechanisms through established bodies like stock exchanges and arbitration panels. Moreover, regulations require brokers to segregate client funds, ensuring that investor money is not misused.

Transparency

Regulated markets operate with complete transparency. All trades are recorded and auditable, creating a reliable trail of transactions. This transparency ensures that market participants cannot manipulate prices or engage in fraudulent activities without detection. Investors can monitor their trades through depository statements and exchange platforms, enhancing trust in the system. Furthermore, price discovery in regulated markets is driven by supply and demand dynamics, offering fair valuations for securities.

Reliable Brokers

In regulated markets, brokers must be licensed and comply with SEBI’s stringent guidelines. This ensures that brokers are accountable and maintain ethical standards. Investors can trade with confidence, knowing their broker is monitored and audited regularly. Licensed brokers also offer value-added services like research reports, risk management tools, and advisory support, contributing to better investment decisions.

Curbing Dabba Trading, an illegal trading practice, requires a multi-pronged approach involving regulatory bodies, government agencies, and financial institutions. Each entity plays a crucial role in detecting, preventing, and penalizing such unregulated activities.

SEBI (Securities and Exchange Board of India)

SEBI is the primary regulatory body responsible for maintaining transparency and fairness in the Indian stock market. It has a proactive role in identifying and penalizing brokers engaged in Dabba Trading. SEBI enforces stringent regulations to ensure that trading activities are conducted through authorized channels, such as the NSE and BSE, to protect investors from financial fraud. The organization works closely with stock exchanges and depositories to monitor unusual trading patterns and discrepancies. SEBI’s surveillance systems help flag suspicious trades, while its enforcement arm takes punitive actions, such as imposing fines, canceling licenses, or banning brokers involved in Dabba Trading.

Government Agencies

Tax authorities and law enforcement agencies play a pivotal role in combating Dabba Trading. The Income Tax Department tracks financial irregularities, focusing on cash-intensive transactions that often accompany shadow market operations. These activities bypass official channels, leading to tax evasion. Law enforcement agencies conduct raids on suspected brokers and trading setups based on intelligence gathered through financial audits and whistleblower reports. These operations aim to dismantle illegal trading networks and hold perpetrators accountable.

Financial Institutions

Banks and payment service providers act as gatekeepers in identifying and flagging unregulated financial activities. Unusual cash deposits or transfers, often associated with online Dabba Trading, are monitored under anti-money laundering (AML) regulations. Banks collaborate with regulatory bodies to report such transactions, aiding investigations into illegal trading practices.

The Technology Behind Dabba Trading

Role of Messaging Apps and Private Networks

Dabba Trading often leverages platforms like WhatsApp and Telegram to facilitate transactions. Private networks make it difficult for regulators to track these trades.

Challenges of Tracking

- Anonymity: Digital platforms mask user identities.

- Advanced Tools: Brokers use encrypted systems, complicating detection.

Financial and Social Impact of Dabba Trading in India

Economic Impact

Dabba Trading has profound negative implications for India’s economy. One of the most significant consequences is the loss of tax revenue due to unreported and unregulated transactions. Trades conducted outside official exchanges bypass the Securities Transaction Tax (STT) and other applicable levies, depriving the government of essential funds for public welfare and infrastructure development. Additionally, this parallel system undermines the credibility of the financial markets, eroding trust among legitimate investors. When such practices become prevalent, they threaten the integrity of the Indian financial system and deter potential domestic and foreign investments.

Social Implications

The social impact of Dabba Trading is especially pronounced in smaller towns and rural areas, where regulatory enforcement is less stringent. These regions often become hotspots for such activities, exposing unsuspecting traders to high risks. Community members, lured by the promise of quick profits, may invest their savings in these unregulated trades, only to suffer significant financial losses. The ripple effect of such losses can lead to financial instability for families, causing debt cycles and social strain.

Speculative Trading vs. Dabba Trading

While speculative trading involves high-risk investments based on market forecasts, it operates on regulated platforms like NSE and BSE. In contrast, Dabba Trading occurs outside these legal systems, exposing traders to financial, legal, and reputational risks.

Common Terms in Dabba Trading

Understanding the terminology associated with Dabba Trading is crucial for recognizing its nature and risks. Here are three key terms commonly linked to this illegal trading practice:

Shadow Trading

Shadow Trading refers to unregulated trading activities that occur outside the official frameworks of recognized stock exchanges like NSE and BSE. These trades are executed privately through Dabba Trading brokers, bypassing the legal systems. The transactions are hidden from regulatory oversight, which poses a significant risk to traders as they lack any legal recourse. Shadow Trading often thrives on informal agreements and cash-based settlements, exposing traders to fraud and financial losses.

Bucket Shops

Bucket Shops are operations or brokers who facilitate Dabba Trading by engaging in speculative, unregulated trades. These brokers take bets on stock prices without actually executing trades on recognized exchanges. They rely on their own private setups, often manipulating prices to their advantage. Traders dealing with bucket shops are vulnerable to exploitation as these brokers operate outside the jurisdiction of regulatory bodies like SEBI, making it nearly impossible to claim compensation in case of disputes or defaults.

Underground Markets

Underground Markets describe the broader ecosystem where illegal trading, including Dabba Trading, occurs. These markets use technology, such as encrypted messaging apps, to evade detection by regulators. They foster a parallel financial system, leading to tax evasion and financial irregularities.

Understanding these terms helps traders identify illegal practices and prioritize regulated, secure trading platforms.

Examples of Dabba Trading in the Indian Context

Dabba Trading, an illegal and unregulated trading practice, has surfaced in various forms across India. Here are some notable examples and scenarios to help understand how it operates:

1. Dabba Trading Network in Gujarat (2021)

- Incident: Gujarat has long been a hotspot for Dabba Trading, with several raids conducted on illegal setups. In 2021, SEBI identified a significant Dabba Trading network operating in Ahmedabad, where brokers used private messaging apps like WhatsApp to execute trades outside formal exchanges.

- Operation: The network involved brokers placing bets on stock price movements without executing actual trades on NSE or BSE. Settlements were conducted in cash, avoiding Securities Transaction Tax (STT) and other levies.

- Outcome: SEBI collaborated with local law enforcement to shut down the operation, leading to hefty fines for those involved.

2. Mumbai’s Dabba Trading Syndicates

- Incident: Mumbai, being India’s financial hub, has seen multiple Dabba Trading rings. Brokers often target small traders promising low fees and quick settlements.

- Operation: These setups bypassed official exchanges and used encrypted communication tools for order placement. Payments were often made through untraceable channels, including hawala systems.

- Outcome: SEBI and Mumbai Police have conducted numerous raids, resulting in arrests and the seizure of illegal assets.

3. Use of Telegram for Dabba Trading in Small Towns

- Incident: In towns like Surat and Rajkot, Dabba Trading thrives due to lower awareness of legal trading mechanisms. Telegram channels have become a popular medium for brokers to connect with traders.

- Operation: Traders are lured into betting on price movements without owning actual shares. Brokers provide real-time updates on these channels but evade taxes and regulatory scrutiny.

- Outcome: While enforcement agencies are aware of these activities, the decentralized nature of messaging apps makes it challenging to track and prosecute.

4. Case of Agricultural Belt in Punjab (2020)

- Incident: In rural Punjab, farmers and small traders were drawn into Dabba Trading schemes, believing it was a quick way to earn money. Brokers used local networks to operate these unregulated systems.

- Operation: Trades were based on speculations in commodities and stocks, with settlements in cash. Many participants faced significant losses when brokers defaulted.

- Outcome: Awareness campaigns by SEBI highlighted the risks, reducing participation in such activities.

5. Raids in Bengaluru Targeting Online Dabba Trading

- Incident: In 2022, Bengaluru authorities busted a Dabba Trading network that operated through WhatsApp groups and private trading apps.

- Operation: The brokers offered “low-cost trading” services, promising higher returns by bypassing exchange mechanisms. The system relied on manual recording of trades, often leading to disputes and defaults.

- Outcome: The crackdown resulted in the closure of the trading setup and penalties for those involved.

6. Hawala Transactions in Dabba Trading

- Scenario: Dabba Trading often integrates with hawala networks to handle settlements. For instance, in Delhi, investigations revealed that brokers used hawala channels to route payments, making it harder for authorities to track financial transactions.

- Operation: Traders participated in unregulated trades while brokers facilitated cash settlements through hawala operators, avoiding banking systems entirely.

Conclusion and Takeaways

Dabba Trading may promise lower costs and quick returns, but the risks far outweigh the benefits. Legal repercussions, financial losses, and lack of investor protection make it a high-stakes gamble. Traders are better off sticking to regulated markets, which offer transparency, security, and reliable mechanisms for resolving disputes. By choosing authorized brokers and platforms, investors can safeguard their portfolios and contribute to a healthier financial ecosystem.

Additional Resources

Frequently Asked Questions

How can one identify a Dabba Trading operation?

Look for brokers operating outside official exchanges and offering suspiciously low fees.

What is the main reason people get involved in Dabba Trading?

Many traders are lured by the promise of quick profits and lower transaction costs.

What are the penalties for participating in Dabba Trading?

Participants can face hefty fines, legal action, and bans from trading.

What are the risks of using digital platforms like WhatsApp for Dabba Trading?

Transactions on unregulated platforms lack transparency, making them prone to fraud.

Your Wealth-Building Journey Starts Here