The global semiconductor industry powers everything from smartphones to cloud computing, with the market expected to reach As India positions itself as a key player in this sector, investors are increasingly eyeing semiconductor-linked stocks. But what exactly are these companies, and do they deserve a place in your portfolio?

What Are Semiconductor Stocks?

Semiconductor stocks represent companies involved in the design, manufacturing, equipment supply, or testing of semiconductor chips, the tiny electronic components that function as the “brain” of modern electronic devices.

The semiconductor ecosystem includes:

- Chip Manufacturers: Companies that fabricate semiconductor chips

- Equipment Providers: Firms that make specialised chip production machinery

- Design Firms: Businesses that design chips but outsource manufacturing

- Testing/Packaging Companies: Organisations that test and package finished chips

From an Indian market perspective, most listed companies are not pure-play semiconductor manufacturers but have indirect involvement in the semiconductor value chain through design services, electronic manufacturing, or specialised components.

Why Semiconductor Stocks Matter in India's Growth Story?

Semiconductor stocks have become increasingly significant in India’s economic landscape due to:

Government-Backed Growth Trajectory

The Indian government has recognised semiconductors as a critical strategic sector. This recognition has materialised through flagship initiatives like:

- India Semiconductor Mission (₹76,000 crore outlay): This comprehensive programme aims to develop a complete semiconductor ecosystem, from design to fabrication, assembly, and testing.

- Production-Linked Incentive (PLI) Schemes: Offering financial incentives of up to 50% on eligible expenditures to attract semiconductor manufacturers.

- Design Linked Incentive (DLI) Programme: Supporting domestic companies in semiconductor design with financial incentives and technical assistance.

These initiatives aren’t mere policy announcements but are backed by substantial financial commitments, demonstrating India’s determination to become a semiconductor manufacturing hub.

Technology-Driven Demand Acceleration

India’s rapidly growing digital economy creates expanding domestic demand for semiconductor components across:

- Consumer Electronics: Smartphone adoption continues to rise, with India poised to have over 1 billion smartphone users by 2026.

- Automotive Evolution: The shift to electric vehicles and advanced driver assistance systems increases semiconductor content per vehicle by 40%.

- Industrial IoT Applications: Smart manufacturing, connected devices, and industrial automation create sustained demand.

- 5G Infrastructure: The ongoing 5G rollout requires specialised semiconductor components for network equipment.

StoxCalls sector reports provide detailed analysis of how government policies are impacting semiconductor-linked stocks.

Key Policy Developments (2020-2025)

Year Development

- 2021 India Semiconductor Mission announced with ₹76,000 crore outlay

- 2023 Additional incentives for chip design companies introduced

- 2025 First made-in-India commercial chip production began

Key Listed Semiconductor-Linked Companies in India

India doesn’t yet have full-stack semiconductor giants, but several public companies are connected to the value chain:

- Company Primary Semiconductor Connection

- Tata Elxsi Design services for semiconductor and automotive electronics

- Dixon Technologies Electronics manufacturing services, including PCB assembly

- SPEL Semiconductor Semiconductor packaging and testing services

- HCL Technologies Design services and embedded systems for chip companies

- Syrma SGS Technology Electronic manufacturing for semiconductor products

These companies contribute to the global semiconductor supply chain in various ways, from design services to manufacturing electronic products that incorporate semiconductors.

How to Analyse Semiconductor Stocks in India?

Evaluating semiconductor-linked stocks requires examining:

- B2B vs Consumer Orientation: Companies primarily serving business customers typically enjoy more stable revenue streams and longer contracts compared to consumer-facing businesses. Analyse what percentage of revenues comes from business clients versus consumer markets.

- Export vs Domestic Market Focus: Export-oriented companies benefit from global opportunities but face international competition and currency risks. Domestically-focused companies may have deeper market understanding but face a smaller addressable market. The ideal balance depends on a company’s competitive advantages in each arena.

- Revenue Predictability: Evaluate contract structures, recurring revenue percentages, and customer concentration. Companies with multi-year contracts, high recurring revenues (>50%), and diversified customer bases (no single customer >15% of revenue) typically offer more stable investment profiles.

StoxBox’s Trading Platform offers tools to screen and compare semiconductor stocks based on these criteria.

Pros and Cons of Investing in Semiconductor Stocks

Making informed semiconductor investment decisions requires balancing significant opportunities against inherent risks. This balanced assessment can help you determine if these stocks align with your investment objectives.

Pros: Growth Potential and Strategic Advantages

Exceptional Growth Trajectory

The Indian semiconductor market is projected to grow at a CAGR of 19% through 2030, substantially outpacing overall economic growth. This expansion is driven by:

- Digital India Initiatives: Government digitisation programmes creating sustainable demand

- Rising Electronics Manufacturing: India’s growing role as a global manufacturing hub

- Increasing Semiconductor Content: More chips in everyday devices from automobiles to appliances

Government Support Framework

Unlike many sectors, semiconductors enjoy unprecedented government backing:

- Financial Incentives: Direct subsidies covering up to 50% of project costs for qualifying companies

- Tax Benefits: Special Economic Zones offering tax holidays and import duty exemptions

- Infrastructure Development: Dedicated clusters with reliable power and logistics support

Cons: Industry Challenges and Investment Risks

Cyclicality and Demand Volatility

The semiconductor industry historically experiences pronounced boom-bust cycles:

- Capacity Overshoots: Industry-wide investment during boom periods often leads to overcapacity

- Inventory Corrections: Supply chain participants build and deplete inventory, amplifying cycles

- Demand Fluctuations: End-market volatility in consumer electronics and other sectors

4-5 Year Cycle Length: Typical period between peak and trough conditions

Semiconductor Stocks vs Other Investment Options

Vs. IT Services Stocks: Semiconductor-linked companies typically have higher capital requirements and R&D intensity than IT services firms. IT services generate steady cash flow with lower volatility whereas semiconductor stocks offer higher growth potential with increased risk.

Vs. Green Energy Stocks: Both sectors benefit from government initiatives, but semiconductor stocks have more diverse applications across industries.

Vs. Index Funds: Although the broad market index funds have lower volatility they provide more modest returns. These semiconductor stocks are suitable for investors with a higher risk tolerance and seeking sector-specific growth.

Stay updated on how these sectors compare with StoxBot’s AI-powered alerts delivered directly to your WhatsApp.

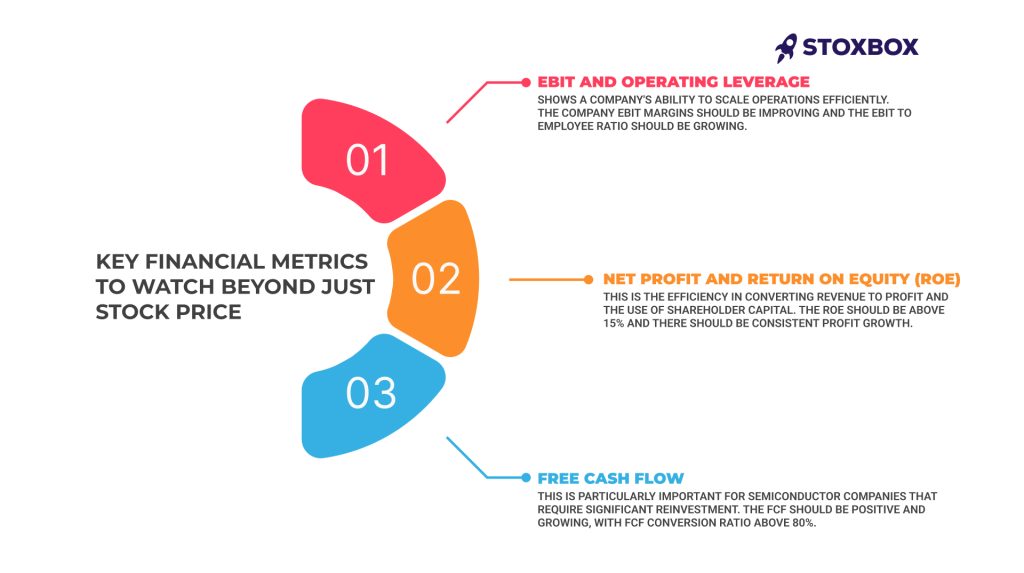

Key Financial Metrics to Watch Beyond Just Stock Price

EBIT and Operating Leverage: Shows a company’s ability to scale operations efficiently. The company EBIT margins should be improving and the EBIT to employee ratio should be growing.

Net Profit and Return on Equity (ROE): This is the efficiency in converting revenue to profit and the use of shareholder capital. The ROE should be above 15% and there should be consistent profit growth.

Free Cash Flow: This is particularly important for semiconductor companies that require significant reinvestment. The FCF should be positive and growing, with FCF conversion ratio above 80%.

Practical Tips for First-Time Investors in Semiconductor Stocks

- Start with Broader Exposure: For the first time investor consider technology focused mutual funds or ETFs that include semiconductor exposure while providing diversification.

- Diversify Across the Value Chain: To build a basket of stocks represent different parts of the semiconductor ecosystem.

- Follow Global Trends: Use industry reports to track global semiconductor demand and India’s electronics import/export data.

- Use Financial Filters:

- P/E ratio ~50x (P/E are typically high for such companies)

- Return on Capital Employed > 15%

- R&D spending > 5% of revenue

- Debt-to-Equity ratio < 0.5

StoxBox’s investment calculators can help you apply these filters to potential investments.

Conclusion

Semiconductor-linked stocks are a very compelling long-term opportunity in India’s evolving tech landscape. The sector’s growth is supported by government policy, global technology trends, and increasing domestic capabilities.

For most investors, semiconductor stocks should represent 5-15% of an equity portfolio, depending on risk tolerance. Companies that have a sustainable advantage, strong finances and a clear path to benefit from India’s semiconductor ambitions should be the focus.

As with any specialised investment, consider consulting with a financial advisor to ensure semiconductor investments align with your overall strategy and goals.

Take Your Tech Investing to the Next Level

Ready to explore semiconductor stock opportunities? StoxBox offers everything you need:

- StoxCalls: Receive expert analysis and recommendations on emerging semiconductor players.

- StoxBot: Receive AI-powered alerts on semiconductor industry developments.

- Trading Platform: Execute trades with precision in this high-potential sector.

- Investment Calculators: Analyse semiconductor stocks with specialised screening tools.

Frequently Asked Questions

1. What are semiconductor stocks in India?

Semiconductor stocks in India are companies involved in the semiconductor value chain, including chip design services, electronic manufacturing services, testing and packaging services, and technology consulting. Unlike global markets, India currently lacks pure-play semiconductor manufacturers but has companies supporting the broader ecosystem.

2. Are semiconductor stocks a good investment in 2025?

Semiconductor stocks are a good investment opportunity in 2025 as a result of government initiatives, increasing domestic manufacturing and global technology trends. However, they are more volatile than established sectors and are best suited for investors with a long term horizon who can take some fluctuations.

3. Which is the best semiconductor stock in India?

The semiconductor market contains multiple companies which operate at different stages of the value chain with distinct risk-return potential. Companies that generate established revenue streams through global partnerships and diverse client bases typically demonstrate stable growth. Assess each company according to its financial strength and growth trajectory and its alignment with India’s semiconductor roadmap.

4. What’s the difference between semiconductor and IT stocks?

The main difference between semiconductor-linked stocks and IT stocks exists in their primary focus which includes hardware components and chip design versus software and digital service provision. Semiconductor companies need significant capital investment and R&D spending while IT companies operate with asset-light business models that have lower capital requirements but potentially limited growth potential.

5. Which specific factors help investors evaluate the fundamental health of semiconductor companies?

The evaluation of semiconductor companies requires analysing their revenue growth patterns together with their gross margins and operating margins and research and development investment rates and client base distribution across different regions and their global partnership strength and their ability to generate cash flow. Investors should also review how these companies benefit from the India Semiconductor Mission and their success in capturing new technology market opportunities.

6. Do semiconductor stocks in India pay dividends?

Most semiconductor-linked stocks in India prioritise using their profits to fuel growth instead of distributing significant dividend payments. Investors should prioritise semiconductor stocks for capital appreciation because established companies with mature business models typically provide modest dividend payments but not sufficient income generation.