Equity mutual funds are a popular choice for investors seeking long-term wealth creation. By investing primarily in stocks, these funds offer the potential for high returns while diversifying risk. In this blog, we’ll explore the best equity mutual funds in India, their types, benefits, and how to choose the right one for your financial goals.

What Are Equity Mutual Funds?

Equity mutual funds invest predominantly in stocks of companies across various sectors and market capitalizations. Their primary goal is capital appreciation over the long term. These funds are categorized based on the type of companies they invest in, such as large-cap, mid-cap, small-cap, or sector-specific.

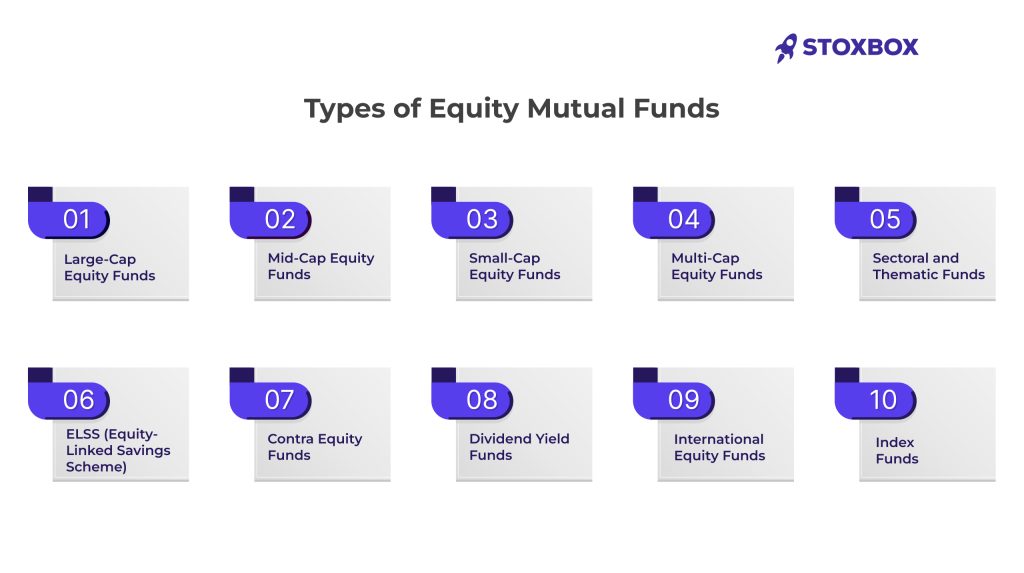

Types of Equity Mutual Funds

1. Large-Cap Equity Funds

These funds invest in the top 100 companies by market capitalization, focusing on well-established, financially stable businesses.

Example: SBI Bluechip Fund

Key Feature: Lower risk and stable returns, suitable for conservative investors.

2. Mid-Cap Equity Funds

These funds focus on companies ranked 101-250 by market capitalization. They invest in growing businesses with the potential for substantial returns over time.

Example: Axis Midcap Fund

Key Feature: Higher growth potential with moderate risk, ideal for medium-term goals.

3. Small-Cap Equity Funds

Small-cap funds target companies ranked beyond 250 by market capitalization, offering exposure to high-growth businesses in their early stages.

Example: Nippon India Small Cap Fund

Key Feature: High risk and high reward, suited for aggressive investors with a long-term horizon.

4. Multi-Cap Equity Funds

These funds invest across large-cap, mid-cap, and small-cap companies, ensuring diversification within a single fund.

Example: Motilal Oswal Flexi Cap Fund

Key Feature: Balanced risk-return profile, suitable for investors seeking moderate growth with diversification.

5. Sectoral and Thematic Funds

Sectoral funds focus on specific industries like IT, Pharma, or Banking, while thematic funds invest based on broader themes like ESG (Environmental, Social, and Governance).

Example: ICICI Prudential Technology Fund

Key Feature: High risk as returns depend heavily on the performance of the chosen sector or theme.

6. ELSS (Equity-Linked Savings Scheme)

ELSS funds offer tax benefits under Section 80C of the Income Tax Act, with a mandatory lock-in period of three years. They invest predominantly in equities, making them a dual-purpose investment for tax saving and wealth creation.

Example: Mirae Asset Tax Saver Fund

Key Feature: Combine tax savings with long-term growth potential.

7. Contra Equity Funds

These funds follow a contrarian investment strategy, focusing on stocks that are undervalued or out of favor but have potential for future growth.

Example: SBI Contra Fund

Key Feature: High-risk, long-term strategy designed for experienced investors with high-risk tolerance.

8. Dividend Yield Funds

Dividend yield funds primarily invest in companies with a history of paying regular dividends, offering a mix of steady income and capital appreciation.

Example: ICICI Prudential Dividend Yield Equity Fund

Key Feature: Lower volatility, ideal for conservative investors looking for stable returns.

9. International Equity Funds

These funds provide exposure to global companies by investing in foreign markets, offering geographical diversification to your portfolio.

Example: Motilal Oswal Nasdaq 100 ETF

Key Feature: Reduce country-specific risks and benefit from opportunities in international markets.

10. Index Funds

Index funds are passively managed funds that replicate the performance of a specific stock market index, such as Nifty 50 or S&P BSE Sensex.

Example: UTI Nifty Index Fund

Key Feature: Lower expense ratio and minimal management risk, suitable for first-time investors or those seeking cost-efficient investments.

Benefits of Investing in Equity Mutual Funds

1. High Returns Potential

Equity mutual funds are designed for long-term growth by investing in stocks. While large-cap funds provide stable returns, small-cap and mid-cap funds have the potential to deliver substantial gains due to their exposure to emerging businesses. Over a long-term horizon, these funds can significantly outperform fixed-income instruments and inflation, making them an attractive choice for wealth creation.

For instance, Historical data shows funds like Axis Midcap Fund and Nippon India Small Cap Fund delivering high returns over a 5-10 year period.

2. Professional Management

Equity funds are managed by skilled fund managers with expertise in analyzing market trends, stock selection, and risk management. These managers use comprehensive research and data to make informed decisions, ensuring investors don’t need in-depth knowledge about the stock market.

Consider a well-managed fund like HDFC Flexi Cap Fund leverages market opportunities while minimizing risks.

3. Diversification

Equity mutual funds inherently diversify investments by allocating assets across various stocks, industries, and sectors. This diversification reduces the risk associated with the underperformance of any single stock or sector, ensuring a

A multi-cap fund like SBI Equity Hybrid Fund invests across large-cap, mid-cap, and small-cap stocks, offering exposure to a broad range of companies.

4. Tax Efficiency

Certain equity mutual funds, such as Equity-Linked Saving Schemes (ELSS), offer tax benefits under Section 80C of the Income Tax Act. Investors can claim deductions of up to ₹1.5 lakh annually, while also enjoying the growth potential of equity investments.

A case in point is ELSS funds like Mirae Asset Tax Saver Fund combine wealth creation with tax-saving benefits.

5. Liquidity

Equity mutual funds provide high liquidity, allowing investors to redeem their investments at any time. This feature makes equity funds an excellent choice for both short-term and long-term goals, with easy access to funds in case of emergencies.

Note: ELSS funds are an exception as they come with a mandatory 3-year lock-in period.

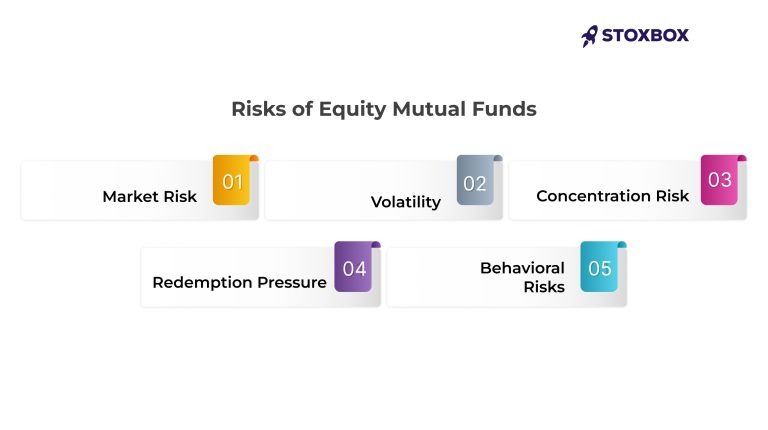

Risks of Equity Mutual Funds

1. Market Risk

Equity mutual funds are directly linked to stock market performance, making them susceptible to market fluctuations. Economic changes, geopolitical events, and global market trends can impact returns, especially during market downturns.

For instance, during the COVID-19 pandemic, even top-performing funds experienced temporary losses due to global market uncertainty

2. Volatility

Small-cap and mid-cap equity funds, while offering high returns, are more volatile compared to large-cap funds. These funds can experience significant price swings, making them suitable for investors with a high-risk tolerance and a long-term investment horizon.

Small-cap funds like Nippon India Small Cap Fund may show sharp movements, reflecting the performance of smaller, high-growth companies.

3. Concentration Risk

Sectoral and thematic funds focus on specific industries or themes, making them highly dependent on the performance of that sector. While these funds can deliver exceptional returns if the sector performs well, a downturn can lead to significant losses.

A case in point is a fund focused on the technology sector, which might suffer losses during a downturn in global IT spending.

4. Redemption Pressure

In times of extreme market downturns, mutual funds may face redemption pressure as many investors withdraw their money. This can affect the fund’s ability to manage its portfolio efficiently, potentially leading to losses for remaining investors.

Pro Tip: Avoid panic withdrawals and stick to your long-term investment strategy.

5. Behavioral Risks

Investors may succumb to emotional decisions, such as selling during market downturns or chasing funds with recent high performance. This behavior often leads to suboptimal returns.

By understanding the benefits and risks, investors can make informed decisions about equity mutual funds, aligning their choices with financial goals and risk tolerance.

How to Choose the Best Equity Mutual Funds?

Selecting the right equity mutual fund is crucial to achieving your financial goals. Here’s an in-depth guide to help you make an informed decision:

1. Define Your Financial Goals

Your investment goals dictate the type of equity mutual fund you should choose.

- Short-Term Goals: If you’re saving for immediate needs like buying a car or funding a vacation, consider funds with lower volatility, such as large-cap equity funds.

- Long-Term Goals: For goals like retirement or children’s education, funds with higher growth potential, such as mid-cap and small-cap funds, are suitable. These funds thrive over an extended horizon, leveraging the power of compounding.

Pro Tip: Ensure your selected fund aligns with the time frame and risk level of your financial objectives.

2. Analyze Fund Performance

Understanding a fund’s historical performance helps gauge its ability to deliver consistent returns.

- Look at the 3-year, 5-year, and 10-year returns to assess how the fund has performed across different market cycles.

- Compare these returns against its benchmark index (e.g., Nifty 50 or S&P BSE Sensex) and other funds in the same category.

Example: A fund like SBI Bluechip Fund consistently outperforming its benchmark over the years indicates strong management and a solid investment strategy.

3. Consider the Expense Ratio

The expense ratio represents the annual fee charged by the mutual fund for managing your investments. This fee directly impacts your net returns.

- Low Expense Ratio: Opt for funds with a lower expense ratio to maximize gains.

- High Expense Ratio: Avoid funds with unnecessarily high fees unless their performance justifies the cost.

Example: A fund with an expense ratio of 1% will take ₹1 for every ₹100 invested annually, reducing your overall returns.

4. Assess Risk Tolerance

Your ability to handle market fluctuations plays a vital role in fund selection:

- Conservative Investors: Prefer stability? Opt for large-cap funds that invest in well-established companies offering steady returns.

- Moderate Risk Takers: Choose mid-cap funds, which balance risk and reward by investing in growing companies with significant potential.

- Aggressive Investors: If you can endure market volatility, small-cap or sectoral funds provide opportunities for higher growth.

Example: Small-cap funds like Nippon India Small Cap Fund offer excellent returns but come with higher risk.

5. Fund Manager’s Track Record

A skilled and experienced fund manager can significantly impact the fund’s performance, especially during volatile markets.

- Check Tenure: Look at the fund manager’s experience in managing the fund and their track record in delivering consistent returns.

- Management Style: Understand whether the manager follows an active or passive approach.

Example: A fund consistently outperforming its peers during market downturns indicates effective management.

By carefully evaluating these factors, you can select the best equity mutual funds that align with your financial goals, risk appetite, and investment horizon. Remember, a disciplined approach and periodic review of your investments are key to long-term wealth creation.

Top Performing Equity Mutual Funds in India (2025)

| Fund Name | Category | 3-Year Return | 5-Year Return | Expense Ratio |

| SBI Bluechip Fund | Large-Cap | 18.2% | 15.4% | 0.97% |

| Axis Midcap Fund | Mid-Cap | 20.5% | 17.6% | 0.73% |

| Nippon India Small Cap Fund | Small-Cap | 23.8% | 19.2% | 1.01% |

| Motilal Oswal Flexi Cap Fund | Multi-Cap | 19.3% | 16.1% | 0.85% |

| ICICI Prudential Technology Fund | Sectoral (Technology) | 25.4% | 21.7% | 1.12% |

| Mirae Asset Tax Saver Fund | ELSS | 17.8% | 15.9% | 0.78% |

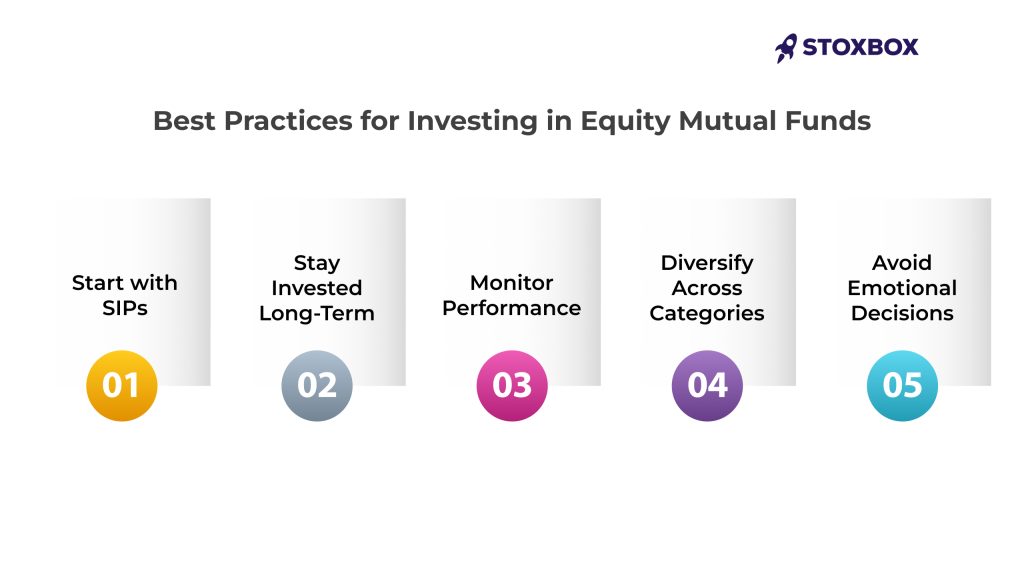

Best Practices for Investing in Equity Mutual Funds

1. Start with SIPs

A Systematic Investment Plan (SIP) is an excellent way to start investing in equity mutual funds. SIPs allow you to invest a fixed amount at regular intervals, reducing the risk of investing a lump sum during market highs. This approach benefits from rupee cost averaging, where you purchase more units when prices are low and fewer units when prices are high, resulting in a lower average cost per unit.

Example: If you start a monthly SIP of ₹5,000 in a mid-cap fund like Axis Midcap Fund, you can accumulate wealth over time, even in volatile markets.

2. Stay Invested Long-Term

Equity mutual funds are best suited for long-term goals, as they have the potential to generate significant returns over a 5-10 year horizon. Short-term market volatility can lead to fluctuations in returns, but staying invested helps you ride out these cycles and benefit from the compounding effect.

Example: A 10-year investment in funds like HDFC Flexi Cap Fund has historically delivered robust returns, showcasing the importance of patience in equity investing.

3.Monitor Performance

While it’s crucial to review your portfolio periodically, avoid over-monitoring or frequent switching between funds. Focus on consistent performance relative to benchmarks and peers over different market cycles. Too much churning can lead to unnecessary costs and tax implications.

Tip: Check your fund’s performance every six months or annually to ensure it aligns with your financial goals.

4. Diversify Across Categories

Diversification is key to reducing risks. A well-balanced portfolio includes large-cap funds for stability, mid-cap funds for growth, and small-cap funds for higher returns potential. This spread ensures that if one category underperforms, others may compensate.

Example: A diversified portfolio could include:

- Large-cap fund: SBI Bluechip Fund

- Mid-cap fund: Axis Midcap Fund

- Small-cap fund: Nippon India Small Cap Fund

5. Avoid Emotional Decisions

Market corrections and downturns are inevitable in equity investing. Reacting emotionally by panic selling during a market dip often locks in losses and misses out on potential recovery gains. Similarly, investing based on short-term trends can lead to suboptimal results.

Advice: Stick to your investment plan and focus on long-term goals. If needed, consult a financial advisor during volatile times to avoid making hasty decisions.

By following these best practices, you can make equity mutual fund investing more effective, ensuring you maximize returns while managing risks efficiently.

Tax Implications of Equity Mutual Funds

| Investment Period | Tax Type | Rate |

| Short-Term (<1 Year) | Short-Term Capital Gains (STCG) | 15% |

| Long-Term (>1 Year) | Long-Term Capital Gains (LTCG) | 10% (above ₹1 lakh gains) |

Conclusion

Equity mutual funds are a robust investment option for wealth creation, offering high returns and diversification. Whether you’re a conservative investor looking for stability or an aggressive one seeking high growth, there’s a category of equity mutual funds for everyone. By selecting funds that align with your goals and following disciplined investing strategies, you can maximize your financial growth. Always research thoroughly and consult with a financial advisor if needed.

FAQs on Equity Mutual Funds

1. Which are the best equity mutual funds for long-term investment?

Top funds like SBI Bluechip Fund, Axis Midcap Fund, and Mirae Asset Tax Saver Fund are excellent options for long-term goals.

2. How much should I invest in equity mutual funds?

It depends on your financial goals, risk tolerance, and investment horizon. Start with SIPs to spread your investment over time.

3. Are equity mutual funds risky?

Yes, they are subject to market volatility. However, long-term investments often mitigate risks and deliver higher returns.

4. What is the minimum amount needed to invest in equity mutual funds?

You can start investing with as little as ₹500 through SIPs.

5. Can I save taxes with equity mutual funds?

Yes, ELSS funds allow tax deductions of up to ₹1.5 lakh under Section 80C.

6. How do I choose between large-cap, mid-cap, and small-cap funds?

Choose based on your risk appetite:

- Large-cap: Stable returns, lower risk.

- Mid-cap: Moderate risk, higher returns.

- Small-cap: High risk, highest growth potential.

Your Wealth-Building Journey Starts Here