Introduction: What is a SIP?

A systematic investment plan, or a SIP, is primarily a mutual fund instrument, where you have the option of investing small amounts periodically in the mutual fund. It is an attractive option for small investors who would like to see their money grow faster than other traditional savings instruments such as fixed deposits (FDs) or recurring deposits (RDs).

The SIP gives you the option of making your money grow through mutual funds without the hassle of putting large amounts of money upfront.

Investment in Mutual Funds through SIPs

Mutual funds are pooled investment instruments. That is, it pools together the funds collected from its investors and invests them in various instruments like stocks and bonds, which is clearly outlined in its prospectus. Therefore, as an investor, you would invest in a mutual fund based on its prospectus. The prospectus tells you the instruments the fund will invest in, the market risk involved (typically the more the risk, the higher the return), and other important parameters. The Securities and Exchange Board of India (SEBI) ensures that the mutual fund sticks to its prospectus while investing and does not invest haphazardly or outside the scope of the prospectus. Money managers at the fund are responsible for the investments and shepherd these investments so that investors get good returns.

In the case of a SIP, the mutual fund provides an affordable means to invest in it. It allows you the luxury of investing small sums periodically, usually monthly or quarterly. You reap the benefits of mutual fund investing without having to come up with a large sum of money upfront.

Clearly, if you have such funds, you can also invest lumpsum in such SIPs. However, the main attraction of SIPs is the periodic, affordable, fixed-sum investment option, especially for small investors and salaried people who might not always have lump sums to invest.

Growth in Mutual Funds through SIPs in 2021

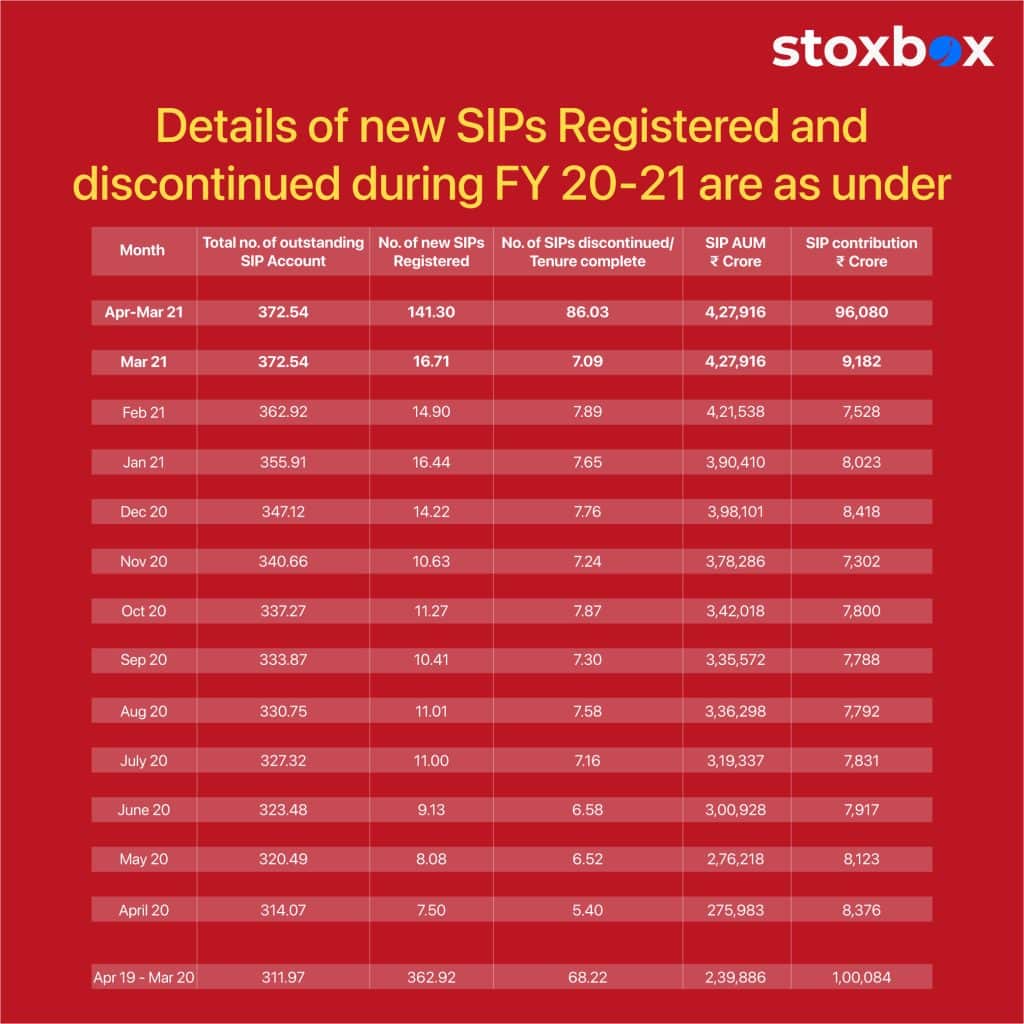

The SIP scene in India has been highly active these last few years. As per data provided by the Association of Mutual Funds in India (AMFI), over the last five years i.e., FY 2016-17 to FY 2020-21 (till Feb 2021), total SIP contributions have increased from Rs. 43,921 crores to Rs. 86,898 crores, almost doubling the amount of funds under such plans. FY 2019-20 saw SIP contributions cross the 1 lakh crore mark at Rs. 100, 084 crores. [https://www.amfiindia.com/mutual-fund]. Despite most of 2020 being affected by Covid-19 lockdowns and its subsequent effects on the economy, the FY 2020-21 figure is on track to get close to its preceding financial period.

Another sign of the demand for SIPs as an investment vehicle is the number of new SIPs registered in the April-December 2020 period, which stood at 93.25 lakh, an 8% increase over the 86 lakh registrations in the corresponding 2019 period. [https://cafemutual.com/news/industry/21172-93-lakh-new-sip-registrations-in-april-december-2020].

Here is another indicator of the robustness of SIPs. From April 2018 to December 2018, SIP growth fell 61%. In April 2018, there was a 4.81 lakh net addition of SIP accounts (newly registered SIPs minus discontinued/tenure completed SIPs). By December 2018, this had fallen to 1.87 lakh, as per data provided by the AMFI. This was mainly due to a year of negative returns and most importantly the uncertainty due to the upcoming April-May 2019 elections. This has been a feature of SIP investing in previous election years too. Surely enough, once the elections were done, investors started courting SIPs for their investing needs.

Should You Invest in SIPs?

When it comes to investments, India prefers mutual funds. In that domain, SIPs remain a preferred choice for retail investors, especially to take advantage of the stock market. Plus, with certain kinds of SIPs, you have the attraction of tax-free returns and tax-free capital gains. i.e., you get a tax rebate on the invested sum (up to a certain limit) and do not have to pay tax on your gains. This is applicable if you hold on to the fund for more than one year.

Equity-based mutual funds or balanced funds (a fund with each of an equity, bond and money market components) are the kinds of funds that provide these tax benefits. This is why Indian investors have facilitated a rise in SIP registrations.

Signing on to a SIP is hassle-free. You can set up standing instructions with your bank to transfer the monthly or quarterly amount to your SIP account. There are very few limitations on the amounts you can invest in SIPs.

SIPs also give you easy liquidity. You can opt out any time you want with minimum fuss.

Since 1987, BP Wealth has been delivering in-depth research and reports that give our investors the edge while investing their hard-earned money. Our fundamental equity investment calls have outperformed the NIFTY year on year consistently. So, when we say SIP Winning Streak, we mean it. With our 30+ years of research reports, 20+ dedicated team of analysts, we provide you with the insight for you to invest.

Take the case of our Stoxbox. The stoxbox is a goodie box comprising mutual funds, equities, and exchange-traded funds (ETFs) that you can invest in. Each stoxbox has a themed box reflecting its investment strategy. You choose according to your taste and watch your investments grow and multiply. Our most popular stoxboxes include the FMCG box, the Pharma box, the Momentum 500 box, the Digital box, and the Core box.

Conclusion

The key in investing in mutual funds and especially SIPs is to stick to it for the medium- to long-term. Let your profits make profits through the magic of compounding. This is what makes SIPs so attractive to an Indian investor. You get into the habit of investing a small portion of money every month and they accumulate to make profits and then those profits earn profits and so on and so forth.

You might also Like.

No posts found!