Technical analysis is the study of charts, price movements, and other technical indicators. However, this study can be put to proper use if applied correctly. It is a study of demand and supply in the market, support and resistance, and various other factors affecting the market.

Experts of technical analysis believe that the charts have all the information and data required for trading and analysis. However, many believe that the charts do not help in predicting the market correctly.

Do you doubt the efficacy of technical analysis? Do you think it is just an irrelevant study of charts and indicators? If so, let us debunk some of the biggest myths regarding technical analysis for you.

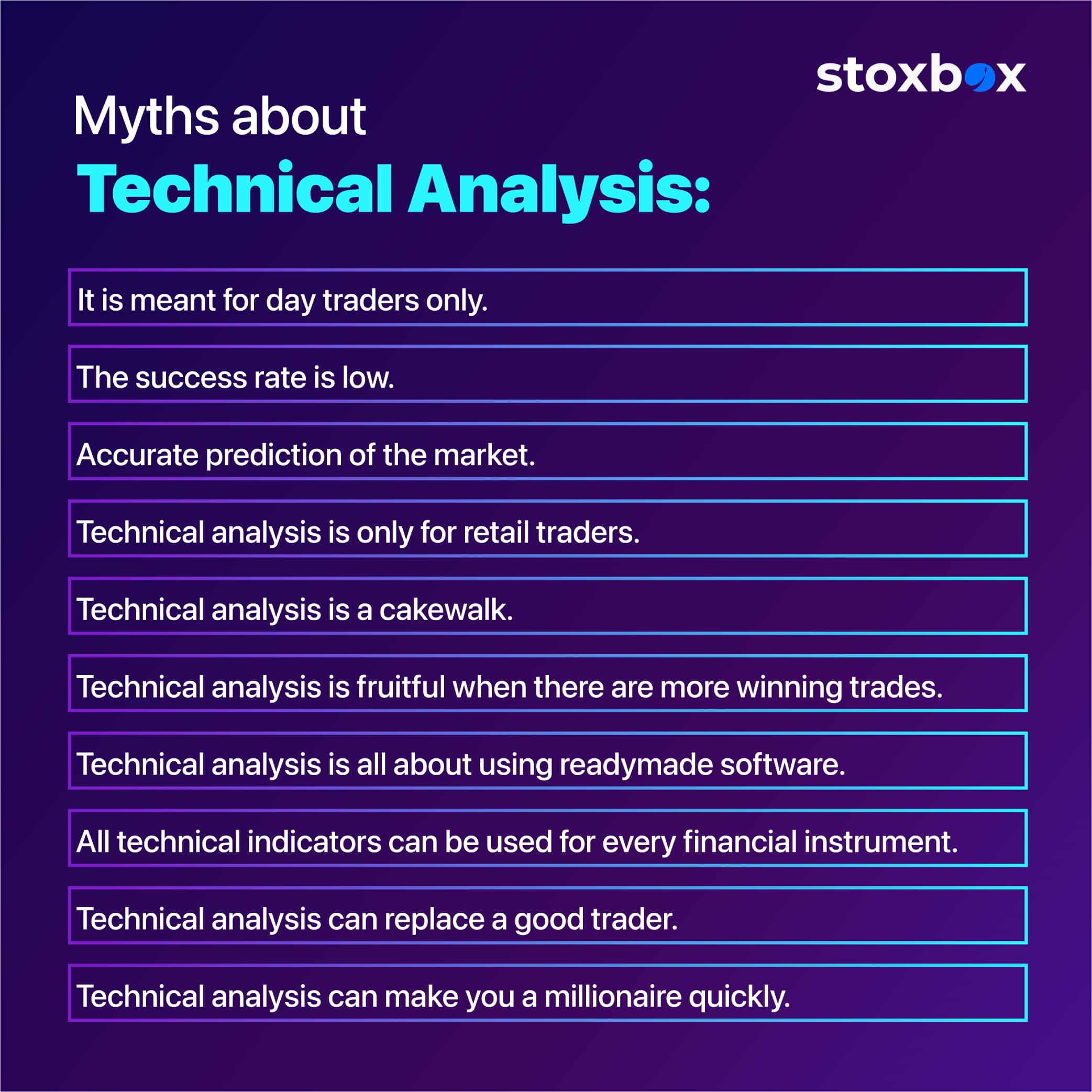

Myths about Technical Analysis:

You need to understand that no one can predict the market entirely, no matter what they do. Technical analysis is just a strategy that you can use to your advantage. However, there are multiple myths around it, which need to be clarified:

- Myth #1: It is meant for day traders only: Many people think that technical analysis is only for day trading. However, it is not the case. Truth: Technical analysis of stocks can be used by investors too. It can accompany the fundamental analysis of stocks.Logic: Technical analysis started way before computers came into the picture. So investors, as well as traders, traditionally relied on technical analysis charts for their investment decisions and speculation. Anyone can use these charts to understand the right time to enter and exit the market and make the most of their investment.

- Myth #2: The success rate is low: Another big myth about technical analysis is that many people believe its success rate is low. People have a misconception that technical analysis yields poor results. However, that is not the truth at all. Truth: If you follow eminent traders, technical analysts, and investors from across the globe, you will find that many have made fortunes using technical analysis.Logic: Often, people lose money due to greed in the stock market. If you have the proper knowledge of technical analysis and trade in the market practically, then you can easily use technical analysis to make profits.

- Myth #3: Accurate prediction of the market: There are again a bunch of traders, technical analysts who think they can predict the market appropriately with the help of technical analysis. Truth: The market can never be 100% predicted. There is always a scope for error.Logic: No one can predict the market exactly. Technical analysis can, however, provide a range of predictions along with profit margins. But there is no exact number or prediction. Your profits will depend upon your skills and ability to understand and evaluate risks. You need to understand the reward ratio and then invest accordingly.

- Myth #4: Technical analysis is only for retail traders: Another misconception about technical analysis is that it is meant for retail traders. Truth: However, in reality, hedge funds, investment banks, and institutional traders, and investors also use technical analysis. They even have a dedicated team of professional experts in technical analysis, and institutes employ them to analyze stocks and financial instruments using technical analysis.Logic: The high-volume traders use technical analysis all the time as it is more convenient and the scope for error is small.

- Myth #5: Technical analysis is a cakewalk: Often people think that technical analysis is too simple and easy. There is no in-depth understanding required. Truth: Of course, this is not true. You need to spend quite a lot of time understanding technical analysis and its application to real-life trading. Acquiring textbook knowledge will not be as tricky as its application. You need to learn the basics and an advanced form of technical analysis to do different kinds of trades and investments.Logic: Technical analysis is only one tool out of many analytical tools, and you need to associate each of them to get the best possible results.

- Myth #6: Technical analysis is fruitful when there are more winning trades: It is a complete misconception. A trader can earn more by having fewer winning trades as well. Truth: Technical Analysis and Winning Trade have no correlation. Let us understand this with an example.Say, Akshay made 4 winning trades out of 10 trades while Babil made 7 out of 10 winning trades by using better technical analysis charts. However, it doesn’t indicate that Babil is more successful or made higher profits.Babil may have a lesser profit margin in each of his 7 trades, while Akshay could have a higher profit margin in each of his 4 winning trades.Logic: So, the success of technical analysis has no connection with the number of winning trades and should (NOT) be confused.

- Myth #7: Technical analysis is all about using readymade software: It is one of the biggest myths about technical analysis is that is completely automated. Truth: Technical analysis is obviously about using technical indicators, charts, technical tools, but it is not just that. If it was only about ready-made technical software, then traders couldn’t have used technical analysis before the development of computers.Logic: Technical analysis is all about charts, patterns, and numbers, and in the age of technology, all these are made in a digitized format for ease of use.

- Myth #8: All technical indicators can be used for every financial instrument: If you are thinking that the technical indicator you are using for currencies, you can also use it for stocks, then you can be wrong. Truth: The financial instruments are different, so the type of indicator requirement will also be different.Logic: You need to choose the right technical indicator for the right financial instrument. (All technical Indicators can be used in every Financial instrument)Top 10 Myths Technical analysis

- Myth #9: Technical analysis can replace a good trader: If automation and technology can do everything, then humankind would have gone extinct.Truth: Some inexperienced traders and haters of technical analysis say that technical analysis is done with automation and can replace good traders. They forget that technical analysis, evaluation of risk and reward ratio, and other associated factors require the human brain.Logic: The way a good trader can evaluate the risk and reward ratio, no automatic software can.

- Myth #10: Technical analysis can make you a millionaire quickly: There are no free lunches, and we must remember that. Truth: There is no free lunch anywhere. So, technical analysis can help you earn, but only if you use it properly.Logic: It is not a magic wand that can make you a millionaire within a blink of an eye.

You might also Like.

No posts found!