As India’s interest in the stock market grows, Demat accounts have become essential for new and experienced investors alike. A Demat account, short for “Dematerialized account,” has streamlined the way individuals trade and hold shares electronically, eliminating the need for physical share certificates. This digital trend is driving millions toward exploring how to open a Demat account, making it a key entry point for anyone looking to invest in the share market.

Table of Contents

Definition

A Demat account is a digital storage account designed to hold various types of securities like stocks, bonds, mutual funds, and exchange-traded funds (ETFs) in electronic form. Just as a bank account stores money, a Demat account securely stores and tracks investments, making it easy to monitor, buy, and sell securities. This digital system has replaced the old physical certificates, eliminating many risks associated with traditional trading.

For example, when you buy shares in a company, those shares are automatically credited to your Demat account in electronic form. Conversely, if you decide to sell those shares, they are debited from your account and transferred digitally. By storing all investments in one account, a Demat account centralizes management and makes reviewing and adjusting portfolios easier.

Why Do You Need a Demat Account?

In today’s digital trading environment, a Demat account is essential for anyone interested in participating in the stock market. Here’s why it’s critical:

- Regulatory Requirement: The Securities and Exchange Board of India (SEBI) requires a Demat account for trading on most Indian stock exchanges. This mandate makes it nearly impossible to engage in stock trading without one.

- Streamlined Market Access: With a Demat account, investors can buy, sell, and transfer securities with ease, offering a straightforward way to participate in the stock market without handling physical certificates.

- Unified Investment Management: A Demat account holds more than just shares; it can securely store bonds, mutual funds, ETFs, and other securities. This all-in-one account feature helps investors organize and manage diverse assets, simplifying the portfolio management process.

Key Benefits

A Demat account provides several significant advantages that enhance the trading experience:

- Safe and Secure: Digital storage removes the risk of losing or damaging physical certificates, protecting investments from theft and forgery.

- Seamless Transactions: A Demat account allows for easy buying, selling, and transferring of securities. Transactions are completed faster with fewer steps compared to handling physical certificates.

- Faster Settlement Times: The process for transaction settlement is now T+2, meaning that a transaction is completed within two business days. This speeds up trading processes and enhances liquidity.

- Reduced Paperwork: All transactions are recorded digitally, allowing for easy access to the history of trades. This reduces paperwork, minimizes errors, and saves time on administrative tasks.

- Dividend and Interest Management: Dividends, interest and refunds are automatically credited to the linked bank account, simplifying financial management.

- Efficient Portfolio Management: With a consolidated view of all securities, a Demat account makes it easier to review, analyze, and adjust portfolios based on market trends and personal financial goals.

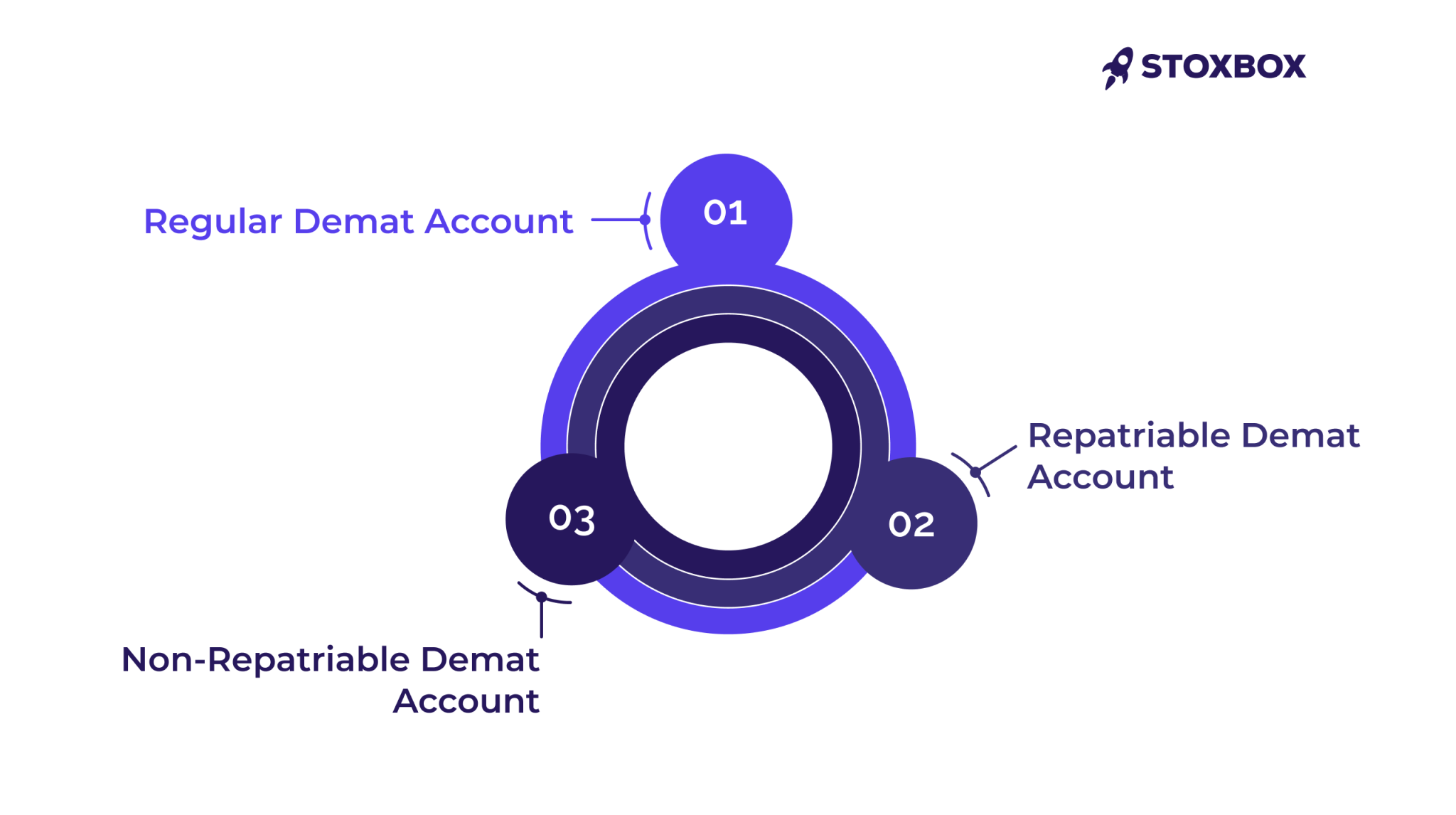

Types of Demat Accounts

Depending on residency status and fund repatriation requirements, there are three main types of Demat accounts. Each type is tailored to cater to specific investor needs.

Regular Demat Account

- For Indian Residents: This is the most common Demat account type, designed for residents of India.

- Non-Repatriable: This account type is used solely for investments within India and does not allow funds to be transferred internationally.

- Ideal for Investors in India: Suitable for investors looking to trade or invest within the country’s markets.

Repatriable Demat Account

- For Non-Resident Indians (NRIs): NRIs often require an account that allows them to repatriate (transfer abroad) any gains made within the Indian market.

- Enables International Transfers: With a repatriable account, NRIs can move funds internationally, but it must be linked to an NRE (Non-Resident External) bank account.

- Ideal for Overseas Investors: This account type is best for NRIs who wish to invest in India but may want to repatriate their returns.

Non-Repatriable Demat Account

- For NRIs (with Non-Repatriable Funds): This type is also for NRIs but doesn’t allow funds to be transferred outside India.

- Linked to NRO Account: It is connected to a Non-Resident Ordinary (NRO) account, which is used for managing income earned in India.

- Suitable for NRIs Investing Domestically: Ideal for NRIs who want to invest their India-based income and keep the proceeds within India.

How a Demat Account Works with a Trading Account

For a seamless stock market experience, a Demat account is typically paired with a Trading account. Here’s how the two work together:

- Trading Account: This account allows you to buy and sell securities on the stock market. Think of it as the interface through which you execute trades.

- Demat Account: After the transaction is completed via the Trading account, the purchased securities are deposited into or debited from the Demat account. It serves as the “storage” for the securities you hold.

For instance, if you buy 50 shares of a company, your Trading account facilitates the purchase, and the shares are then electronically stored in your Demat account. This integrated system streamlines the entire transaction process.

Requirements to Open a Demat Account

Documents Needed

When considering how to open a Demat account, several documents are required to verify identity, address, and financial details:

- PAN Card

- Aadhaar Card

- Bank Details (account statement, canceled cheque)

- Proof of Income (for trading derivatives)

Importance of the KYC Process

The Know Your Customer (KYC) process verifies the identity of potential account holders, enhancing security and compliance with regulations. In India, this process is mandatory and must be completed before opening a Demat account.

Eligibility Criteria

Most individuals can open a Demat account in India, including minors and students. However, for minors, a guardian is required to operate the account. Additionally, HUFs (Hindu Undivided Families) can open a Demat account to manage family investments.

Steps to Open a Demat Account

1. Choosing a Depository Participant (DP)

A Depository Participant (DP) is an institution that facilitates Demat account services on behalf of depositories like NSDL and CDSL. Selecting the right DP is crucial; consider factors such as brokerage fees, digital platform features, customer service, and ease of online support.

Popular DPs in India:

- StoxBox

- Zerodha

- ICICI Direct

- HDFC Securities

Comparison of Leading Brokers

2. Filling Out the Application Form

The next step in how to open a Demat account online is to complete the application form. This can be done online on the DP’s platform. The form will require basic details like name, address, PAN number, Aadhaar number, and bank details.

3. Document Verification (KYC)

Most DPs offer KYC verification online and offline. Through an online process, you simply upload copies of documents and undergo identity checks. This step ensures that all details are validated for compliance purposes.

4. In-Person Verification (IPV)

As part of the Demat account opening procedure, some DPs may require In-Person Verification (IPV), which can be done digitally or physically. It verifies the identity and physical presence of the account holder.

5. Access Your Demat Account

Once the documents are verified and IPV is complete, you’ll receive login credentials. With these credentials, you can access your account, manage transactions, and review your portfolio.

Account Activation Timeline

After completing all necessary steps, account activation typically takes between 1 to 3 business days. This timeline may vary slightly based on the DP and verification processes but gives a general idea of when you can begin using your Demat account for transactions.

Charges Associated with a Demat Account

Opening and maintaining a Demat account requires certain fees that investors should be aware of to manage costs effectively. These charges vary across Depository Participants (DPs) and are influenced by the services and features they offer.

- Account Opening Charges: Many DPs levy a fee to open a Demat account. This is a one-time fee for setting up the account, covering initial administrative tasks. However, some brokers offer free account openings to attract new customers, so it’s worth comparing options to find the best fit. Even when waived, it’s essential to review any other fees that might apply later.

- Annual Maintenance Charges (AMC): AMCs are recurring fees paid yearly to keep the account active. They vary depending on the DP, with premium service providers often charging higher fees. Some DPs offer discounts or waive AMCs for the first year, especially for high-value accounts. The AMC ensures you retain access to the DP’s services, including record-keeping and account security.

- Transaction Fees: These are charged each time you buy or sell securities, covering the cost of processing each trade. DPs charge a flat rate or a percentage-based fee on each transaction. For active traders, transaction fees can add up, so choosing a DP with competitive rates is essential to keep trading costs manageable. Some DPs offer reduced fees for specific types of transactions, such as bulk trades or intraday trading.

Understanding these charges helps investors evaluate the total cost of using a Demat account, enabling them to select a DP that aligns with their investment strategy and budget.

Tips for Maintaining Your Demat Account

Effective maintenance of a Demat account not only keeps it in good standing but also safeguards your investments. Here are some essential tips:

- Keep Contact Information Updated: Ensure your registered email and phone number are accurate and up-to-date. This is crucial for receiving transaction alerts, account statements, and notifications about changes to account terms or fees. Outdated contact information can lead to missed updates or potential security risks if your account information falls into the wrong hands.

- Review Account Statements Regularly: Make it a habit to check your account statements frequently. Reviewing these documents allows you to monitor all transactions and catch any unauthorized activity or discrepancies early. Most DPs send monthly statements, which can be accessed online. Taking a few minutes each month to review your statements is an effective way to stay on top of your investments and maintain transparency in your account activities.

- Use Strong Passwords and Enable Two-Factor Authentication (2FA): Security is paramount in financial accounts. Using strong, unique passwords minimizes the risk of unauthorized access. Additionally, enabling two-factor authentication (2FA) adds an extra layer of security by requiring a secondary form of verification, typically sent to your registered phone or email. Many DPs offer this feature, and it’s highly recommended to activate it for enhanced account protection.

By understanding associated charges and implementing best practices for account maintenance, investors can manage their Demat accounts effectively and securely. These steps help ensure a smooth trading experience while minimizing unnecessary costs and safeguarding investments from potential threats.

Conclusion

Opening a Demat account is essential for participating in India’s stock market, simplifying the buying, selling, and holding of securities in digital form. Choosing a suitable Depository Participant (DP) with secure, user-friendly features and fair fees ensures a streamlined trading experience. A well-chosen Demat account allows efficient portfolio management, easy tracking of investment performance, and flexibility for both short-term and long-term strategies. With everything consolidated in a single account, you can make informed, timely investment decisions. In today’s competitive market, having the right Demat account setup builds confidence and establishes a solid foundation for successful investing in India’s financial landscape.

Frequently Asked Questions

Can NRIs open a Demat account in India?

Yes, NRIs can open a Demat account in India. They can choose either a repatriable or non-repatriable Demat account, which must be linked to an NRE or NRO bank account, respectively.

What are the best Demat accounts for beginners?

The best Demat accounts for beginners typically offer low fees, an intuitive platform, and strong customer support. Popular choices include Zerodha, Upstox, and ICICI Direct.

How is a Demat account different from a trading account?

A Demat account holds securities in electronic form, while a trading account is used to buy and sell securities. The two accounts work together to facilitate stock market transactions.

How long does it take to open a Demat account?

Opening a Demat account typically takes 1-3 days if all documents are in order and the verification process is smooth.

What is the minimum balance required in a Demat account?

Most Demat accounts don’t require a minimum balance, but some Depository Participants may have annual maintenance charges (AMC).

Can I open more than one Demat account?

Yes, you can open multiple Demat accounts with different Depository Participants, but only one per DP.

How safe is my data with a Depository Participant?

Data with a Depository Participant is generally secure and protected by regulatory measures, encryption, and security protocols set by SEBI and NSDL/CDSL.

Your Wealth-Building Journey Starts Here