See the Top investment strategies for mutual fund and learn about the plans

Table of Contents

Investing in mutual funds has become a popular choice for both new and seasoned investors due to its versatility, accessibility, and potential for high returns. Mutual funds offer a way to diversify your portfolio, manage risks, and achieve financial goals. In this comprehensive guide, we’ll explore everything you need to know about mutual fund investment plans, top funds, strategies, and tools. Whether you’re just starting or looking to optimize your investments, this guide has something for everyone.

What are Mutual Funds?

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. Managed by professional fund managers, these funds allow individuals to invest in a broad range of assets without the need for extensive knowledge or large capital.

How do Mutual Funds Work?

Investors purchase units or shares of the mutual fund, which represent a portion of the fund’s holdings. The value of these units fluctuates based on the performance of the underlying assets. Fund managers make decisions about buying and selling securities within the fund to meet the fund’s objectives, such as growth, income, or capital preservation.

Key Components of Mutual Funds

1. Fund Manager: The professional who manages the fund’s portfolio, making decisions on asset allocation, security selection, and timing.

2. NAV (Net Asset Value): The per-unit price of the fund, calculated daily based on the total value of the fund’s assets minus liabilities.

3. Expense Ratio: The annual fee charged by the fund, expressed as a percentage of the fund’s average assets.

Why Invest in Mutual Funds?

Investing in mutual funds offers several benefits that make it an attractive option for investors. Here’s why you should consider mutual funds as part of your investment strategy.

1. Diversification

Mutual funds provide diversification by investing in a wide range of securities. This spreads risk across different assets, reducing the impact of poor performance by any single investment.

2. Professional Management

With mutual funds, your money is managed by experienced fund managers who have the expertise to make informed investment decisions. This is particularly beneficial for investors who lack the time or knowledge to manage their portfolios.

3. Liquidity

Most mutual funds offer high liquidity, meaning you can buy or sell your units on any business day at the current NAV. This flexibility allows you to access your money when needed.

4. Accessibility

Mutual funds are accessible to a wide range of investors, with many funds requiring a relatively low initial investment. This makes it easier for individuals to start investing with a small amount of capital.

5. Variety of Choices

There are mutual funds available to suit different investment goals, risk appetites, and time horizons. Whether you’re looking for growth, income, or capital preservation, there’s a mutual fund to match your needs.

Advantages of Investing in Mutual Funds

Investing in mutual funds comes with several advantages that make them a preferred investment option for many. Below are some of the key benefits:

1. Risk Reduction

The primary advantage of mutual funds is risk reduction through diversification. By spreading investments across various securities, the risk of significant loss is minimized.

2. Cost Efficiency

Mutual funds can be more cost-effective than buying individual securities, thanks to economies of scale. The expense ratio, which covers the cost of managing the fund, is often lower than the costs associated with managing a portfolio of individual stocks or bonds.

3. Systematic Investment Plan (SIP)

SIPs allow you to invest a fixed amount regularly (monthly, quarterly) in a mutual fund. This approach is ideal for long-term wealth creation, as it takes advantage of rupee cost averaging and the power of compounding.

4. Tax Benefits

Certain types of mutual funds, such as Equity Linked Savings Schemes (ELSS), offer tax benefits under Section 80C of the Income Tax Act. Investing in ELSS can help reduce your taxable income while building wealth over time.

5. Flexibility and Customization

Mutual funds offer a range of options to customize your portfolio based on your financial goals, risk tolerance, and investment horizon. You can choose from various funds, including equity, debt, hybrid, and sectoral funds.

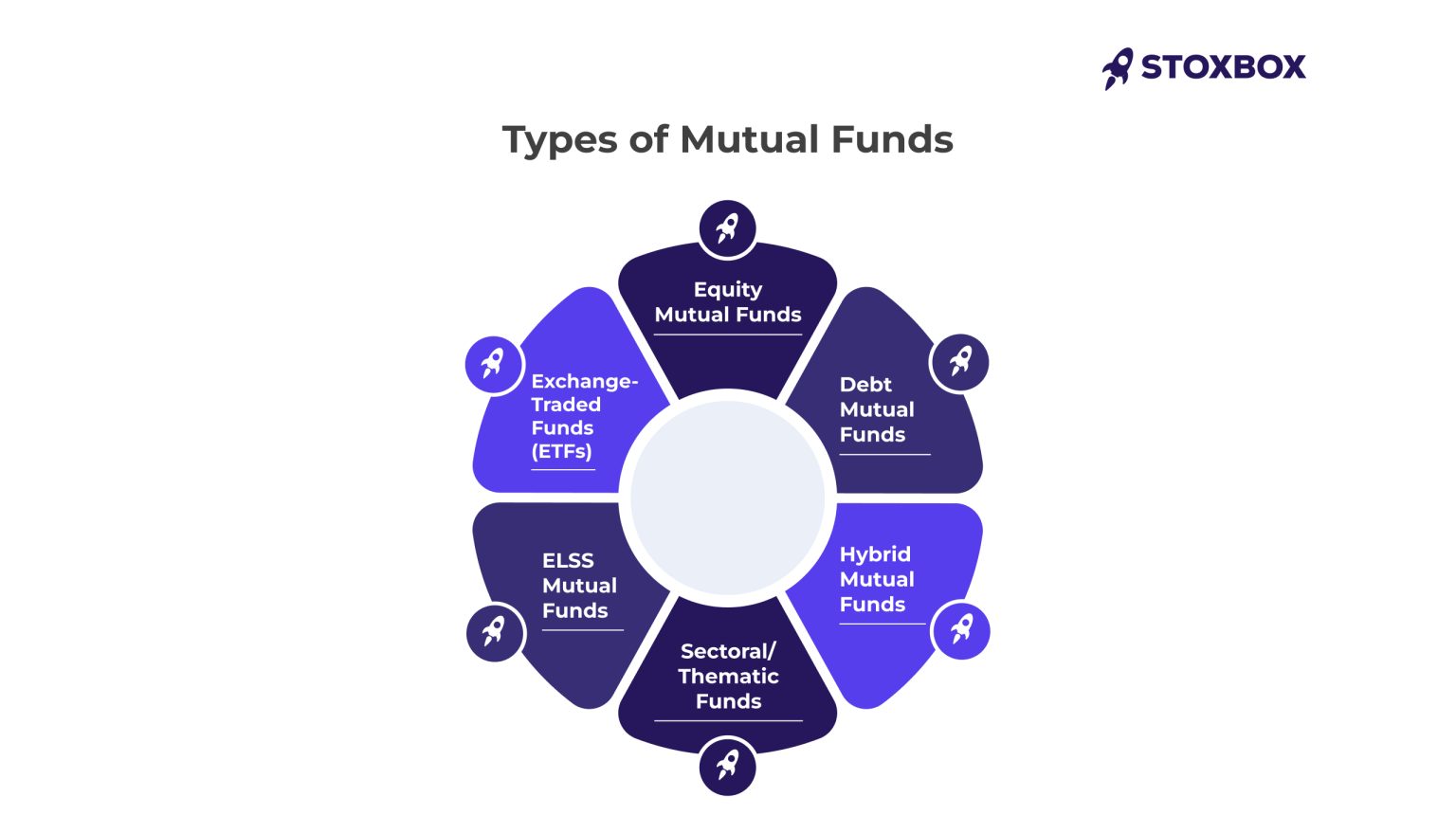

Types of Mutual Funds Based on Asset Class

Mutual funds are classified based on the type of assets they invest in. Understanding these categories will help you choose the right fund for your investment goals.

1. Equity Mutual Funds

Equity mutual funds invest primarily in stocks, aiming for long-term capital appreciation. They are further divided into sub-categories:

- Large Cap Mutual Funds: Invest in large, established companies with a strong track record. These funds are considered relatively safe but offer moderate returns.

- Mid Cap Mutual Funds: Invest in mid-sized companies with the potential for higher growth. These funds are riskier than large-cap funds but offer higher return potential.

- Small Cap Mutual Funds: Invest in small companies with significant growth potential. These funds are high-risk but can deliver substantial returns.

- Index Mutual Funds: Track a specific market index, such as the Nifty 50 or Sensex. These funds are passively managed and have lower expense ratios.

2. Debt Mutual Funds

Debt mutual funds invest in fixed-income securities like bonds, treasury bills, and government securities. They are suitable for investors seeking stable returns with lower risk.

- Liquid Funds: Invest in short-term money market instruments and provide high liquidity with minimal risk.

- Short-Term Funds: Invest in debt instruments with a maturity period of 1-3 years, offering moderate returns with relatively low risk.

- Long-Term Debt Funds: Invest in bonds with longer maturity periods, suitable for conservative investors looking for steady income.

3. Hybrid Mutual Funds

Hybrid mutual funds invest in a mix of equity and debt instruments, providing a balanced approach to risk and return.

- Balanced Funds: Invest in a mix of equity and debt, aiming for moderate growth with reduced risk.

- Aggressive Hybrid Funds: Allocate a higher percentage to equity, targeting higher returns with increased risk.

- Conservative Hybrid Funds: Focus more on debt, offering stability with lower growth potential.

4. Sectoral/Thematic Funds

These funds focus on specific sectors or themes, such as technology, healthcare, or infrastructure. They are suitable for investors with a strong belief in a particular industry’s growth potential.

5. ELSS Mutual Funds

Equity Linked Savings Schemes (ELSS) are tax-saving mutual funds that invest primarily in equities. They offer tax benefits under Section 80C and have a lock-in period of three years.

6. Exchange-Traded Funds (ETFs)

ETFs are similar to index funds but are traded on stock exchanges like individual stocks. They offer the flexibility of intraday trading with lower expense ratios.

Ways to Invest in Mutual Funds

There are several ways to invest in mutual funds, each offering different levels of convenience, control, and cost.

1. Direct Investment

Investing directly with the mutual fund company can save you the commission that intermediaries charge. This is often done online through the fund’s website or through physical submission of application forms.

2. Through a Financial Advisor

A financial advisor can help you choose the right mutual funds based on your financial goals, risk tolerance, and time horizon. They may charge a fee for their services but can offer valuable guidance.

3. Online Platforms

Many online platforms allow you to invest in mutual funds conveniently. These platforms often provide tools, calculators, and research reports to help you make informed decisions.

4. Through Banks

Banks often offer mutual fund investment services. While this is a convenient option, it may come with higher fees compared to direct investments.

5. Systematic Investment Plan (SIP)

A SIP allows you to invest a fixed amount regularly in a mutual fund. This method is particularly useful for building wealth over time without requiring a large initial investment.

How To Start Your Mutual Fund Investing Journey?

Starting your mutual fund investment journey requires careful planning and informed decision-making. Here’s how to get started:

1. Set Your Financial Goals

Identify your short-term and long-term financial goals. Are you saving for a home, your child’s education, or retirement? Knowing your goals will help you choose the right mutual funds.

2. Assess Your Risk Tolerance

Understand your risk appetite. Are you willing to take on more risk for higher returns, or do you prefer a more conservative approach? This will guide your choice of mutual funds.

3. Choose the Right Type of Mutual Fund

Based on your goals and risk tolerance, choose the type of mutual fund that suits your needs. For example, if you’re looking for long-term growth, equity mutual funds might be ideal.

4. Research and Compare Funds

Use online tools, calculators, and research reports to compare different mutual funds. Look at past performance, expense ratios, and fund manager expertise.

5. Open an Investment Account

You’ll need to open an account with a mutual fund company or an online platform to start investing. This usually involves providing identification, financial details, and setting up payment methods.

6. Start with a SIP

Consider starting with a Systematic Investment Plan (SIP) to invest regularly without worrying about market timing. This approach can help you build wealth steadily over time.

7. Monitor Your Investments

Regularly review your mutual fund portfolio to ensure it aligns with your goals. Make adjustments as needed, but avoid frequent trading, as it can erode returns.

Top Mutual Fund Companies to Consider

When investing in mutual funds, it’s essential to choose companies with a strong track record, reliable management, and a variety of fund options. Here are some top mutual fund companies in India:

1. HDFC Mutual Fund

HDFC Mutual Fund is one of India’s largest and most trusted mutual fund houses. It offers a wide range of funds, including equity, debt, hybrid, and ELSS mutual funds. Known for its strong performance and experienced fund managers, HDFC Mutual Fund is a popular choice among investors.

2. SBI Mutual Fund

SBI Mutual Fund is backed by the State Bank of India and offers a diverse portfolio of mutual funds. It is known for its stability and long-term performance, making it an excellent choice for conservative investors.

3. ICICI Prudential Mutual Fund

ICICI Prudential Mutual Fund is a leading player in the Indian mutual fund industry, offering a wide range of funds across various categories. It is known for its innovation and strong risk management practices.

4. Aditya Birla Sun Life Mutual Fund

Aditya Birla Sun Life Mutual Fund is another top player in the industry, offering a mix of equity, debt, and hybrid funds. The fund house is known for its disciplined investment approach and consistent performance.

5. Nippon India Mutual Fund

Nippon India Mutual Fund, formerly known as Reliance Mutual Fund, offers a broad range of mutual funds with a focus on delivering consistent returns. It is particularly popular for its small-cap and mid-cap funds.

6. Axis Mutual Fund

Axis Mutual Fund is known for its customer-centric approach and strong performance in equity funds. The fund house has gained a reputation for delivering high returns, particularly in the large-cap and mid-cap categories.

7. UTI Mutual Fund

UTI Mutual Fund is one of the oldest and most reputable mutual fund companies in India. It offers a wide range of funds with a focus on delivering stable returns and preserving capital.

Top Performing Mutual Funds by Category

Choosing the right mutual fund is crucial for achieving your financial goals. Here are some of the top-performing mutual funds in India by category:

1. Best Large Cap Mutual Funds

- Mirae Asset Large Cap Fund: Known for its consistent performance and strong fund management, this fund is ideal for conservative investors looking for steady growth.

- Axis Bluechip Fund: This fund has a strong track record of outperforming its benchmark and is suitable for long-term investors.

2. Best Mid Cap Mutual Funds

- DSP Mid Cap Fund: This fund offers exposure to mid-sized companies with high growth potential, making it suitable for aggressive investors.

- HDFC Mid-Cap Opportunities Fund: Known for its disciplined approach, this fund is ideal for investors looking for long-term capital appreciation.

3. Best Small Cap Mutual Funds

- Nippon India Small Cap Fund: This fund focuses on small-cap stocks with significant growth potential, making it suitable for high-risk, high-reward investors.

- SBI Small Cap Fund: Known for its strong performance in the small-cap segment, this fund is ideal for investors with a long-term investment horizon.

4. Best Tax Saving Mutual Funds (ELSS)

- Axis Long Term Equity Fund: This ELSS fund is known for its strong performance and tax-saving benefits under Section 80C.

- Mirae Asset Tax Saver Fund: Offering a good balance of growth and tax savings, this fund is suitable for investors looking to build wealth while reducing their tax liability.

5. Best Debt Mutual Funds

- ICICI Prudential Corporate Bond Fund: This fund offers a good mix of safety and returns, making it suitable for conservative investors.

- HDFC Short Term Debt Fund: Ideal for investors looking for stable returns with lower risk, this fund invests in high-quality short-term debt instruments.

6. Best Index Mutual Funds

- UTI Nifty Index Fund: This fund tracks the Nifty 50 index and offers low-cost exposure to the top 50 companies in India.

- HDFC Index Fund – Sensex Plan: This fund tracks the Sensex and is ideal for investors looking for passive exposure to the Indian equity market.

7. Best Hybrid Mutual Funds

- ICICI Prudential Equity & Debt Fund: This aggressive hybrid fund offers a good balance of equity and debt, making it suitable for moderate-risk investors.

- HDFC Hybrid Equity Fund: Known for its consistent performance, this fund is ideal for investors looking for a mix of growth and stability.

Successful Strategies from Top Mutual Fund Investors

Learning from successful mutual fund investors can provide valuable insights into building and managing a robust investment portfolio. Here are some strategies that have proven effective:

1. Long-Term Perspective

Successful investors like Warren Buffett emphasize the importance of a long-term perspective. By staying invested through market cycles and avoiding the temptation to time the market, you can benefit from compounding returns.

2. Diversification

Diversification is a key strategy used by successful investors to reduce risk. By spreading investments across various asset classes, sectors, and geographies, you can minimize the impact of poor performance in any single area.

3. Regular Monitoring and Rebalancing

Top investors regularly monitor their portfolios and rebalance them to maintain the desired asset allocation. This ensures that the portfolio remains aligned with their financial goals and risk tolerance.

4. Focus on Quality

Investing in high-quality funds with strong management teams, consistent performance, and low expense ratios is a common strategy among successful investors. Quality investments tend to perform well over the long term, even in volatile markets.

5. Systematic Investment Plan (SIP)

Many successful investors use SIPs to build wealth over time. By investing regularly, they take advantage of rupee cost averaging and the power of compounding, reducing the impact of market volatility.

6. Tax Efficiency

Tax efficiency is an important consideration for successful investors. By investing in tax-saving mutual funds like ELSS and holding investments for the long term, they minimize tax liabilities and maximize returns.

Essential Mutual Fund Tools & Calculators

Using the right tools and calculators can help you make informed investment decisions. Here are some essential tools for mutual fund investors:

1. SIP Calculator

A SIP calculator helps you determine the future value of your SIP investments. By entering the monthly investment amount, expected rate of return, and investment duration, you can estimate how much your investment will grow over time.

2. Lump Sum Calculator

A lump sum calculator helps you calculate the future value of a one-time investment. This tool is useful for investors who prefer to invest a large sum of money at once rather than through SIPs.

3. Mutual Fund Return Calculator

This calculator allows you to calculate the returns on your mutual fund investments over a specific period. It helps you compare the performance of different funds and make informed decisions.

4. Expense Ratio Calculator

The expense ratio calculator helps you understand the impact of expense ratios on your investment returns. By comparing funds with different expense ratios, you can choose the most cost-effective option.

5. Asset Allocation Calculator

An asset allocation calculator helps you determine the optimal mix of assets (equity, debt, and cash) based on your risk tolerance and investment goals. This tool ensures that your portfolio is well-balanced and aligned with your financial objectives.

6. Tax Saving Calculator

A tax-saving calculator helps you estimate the tax benefits of investing in Equity Linked Savings Scheme (ELSS) mutual funds. By entering your income, investment amount, and other details, you can calculate the potential tax savings under Section 80C of the Income Tax Act, which is especially useful for tax planning.

Conclusion

Investing in mutual funds offers a versatile and accessible way to build wealth, achieve financial goals, and manage risks. Whether you’re a novice investor or an experienced one, understanding the various types of mutual funds, the benefits they offer, and the strategies to maximize returns is crucial for success.

By choosing the right mutual fund investment plans, leveraging tools and calculators, and following the strategies of successful investors, you can create a well-balanced and profitable investment portfolio. As the Indian mutual fund industry continues to grow, staying informed and making smart investment choices will help you navigate the markets and achieve long-term financial success.

Whether you’re looking to invest in equity mutual funds, debt mutual funds, or hybrid funds, the options available in India cater to a wide range of investment needs and preferences. With the right approach, mutual funds can be a powerful tool for building wealth and securing your financial future.

At Stoxbox, we make it easy for you to navigate the complexities of mutual fund investments. Our platform offers comprehensive tools, expert insights, and personalized recommendations to help you choose the right mutual fund investment plans that align with your financial goals.

Frequently Asked Questions

What are the top mutual funds to invest in India for 2024?

The top mutual funds for 2024 may vary depending on your investment goals, but some consistently high-performing funds include:

- Axis Bluechip Fund (Equity): Known for its stable returns and focus on large-cap stocks.

- Mirae Asset Emerging Bluechip Fund (Equity): A strong performer in the mid-cap and large-cap space.

- HDFC Hybrid Equity Fund (Hybrid): A balanced fund offering a mix of equity and debt.

- ICICI Prudential Corporate Bond Fund (Debt): Ideal for conservative investors seeking steady income.

- SBI Small Cap Fund (Equity): Suitable for aggressive investors with a long-term horizon.

It’s important to review the fund’s past performance, expense ratio, and investment strategy before making a decision.

What are the different strategies for investing in mutual funds in India?

Several strategies can be employed for mutual fund investments in India:

Systematic Investment Plan (SIP): This involves investing a fixed amount regularly, such as monthly, which helps in rupee cost averaging and disciplined investing.

Lump Sum Investment: Investing a large amount at once, ideal when market conditions are favourable or if you have a substantial sum to invest.

Goal-Based Investing: Selecting funds that align with specific financial goals, such as retirement, buying a house, or children’s education.

Asset Allocation: Diversifying investments across various asset classes (equity, debt, gold) to balance risk and return.

Sectoral/Thematic Investing: Investing in funds focused on specific sectors like technology, healthcare, or infrastructure for targeted exposure.

How do i chose the best mutual fund investment plans?

To choose the best mutual fund for your investment goals:

- Define your financial goals and risk tolerance to determine the type of mutual fund that suits you (e.g., equity, debt, hybrid).

- Evaluate the fund’s historical performance and compare it with its benchmark and peers.

- Check the fees and expense ratio to ensure they are reasonable, as high costs can impact returns.

- Review the fund manager’s track record and experience in managing similar funds.

- Diversify across different fund types to balance risk and potential returns.

What are the best tools to track and manage my mutual fund investment plans in India?

There are several tools and apps available in India to help you track and manage your mutual fund investments:

- MyCAMS: Allows you to manage investments across multiple mutual fund houses in a single app.

- KFinKart: Provides portfolio access, enables transactions, and offers comprehensive reports and statements.

- Moneycontrol: A widely-used platform for tracking investments, featuring portfolio management and fund comparison tools.

- ET Money: Offers investment tracking, portfolio management, and personalized fund recommendations.

Are there tax benefits associated with investing in mutual funds in India?

Yes, there are tax benefits associated with certain types of mutual funds in India:

- Equity Linked Savings Scheme (ELSS): Investments in ELSS funds qualify for tax deductions under Section 80C of the Income Tax Act, up to ₹1.5 lakh per year. These funds have a lock-in period of three years.

- Capital Gains Tax on Equity Funds: Equity funds held for more than one year are subject to long-term capital gains (LTCG) tax at 10% on gains exceeding ₹1 lakh per year. Short-term capital gains (STCG) on equity funds are taxed at 15%.

- Debt Funds: Long-term capital gains on debt funds (held for more than three years) are taxed at 20% with indexation benefits, while short-term gains are taxed according to your income tax slab.

Understanding these tax implications can help you plan investments more effectively and maximize post-tax returns.

How often should I review my mutual fund investments?

It’s advisable to review your mutual fund investments at least every six months. During these reviews, you should:

- Evaluate Performance: Compare the fund’s performance against its benchmark and similar funds to ensure it meets your expectations.

- Rebalance Your Portfolio: If certain funds have significantly outperformed or underperformed, consider rebalancing to maintain your desired asset allocation.

- Assess Changes in Goals: Adjust your investments if there have been any changes in your financial goals or risk tolerance.

- Monitor Fund Changes: Stay informed about any changes in the fund’s management, strategy, or expense ratio, as these could impact future performance.

What are the risks involved in mutual fund investments?

Like any investment, mutual funds come with certain risks:

- Market Risk: The value of equity mutual funds can fluctuate with market conditions, posing a risk of capital loss.

- Credit Risk: In debt funds, there is a risk that bond issuers may default on payments, which could negatively impact the fund’s returns.

- Interest Rate Risk: Debt funds are affected by changes in interest rates; for example, when interest rates rise, bond prices usually fall, impacting the fund’s NAV.

- Liquidity Risk: Some funds invest in assets that are not easily sold, which may cause delays in redeeming your investment.

- Inflation Risk: If your mutual fund returns do not keep pace with inflation, your purchasing power may decrease over time.

Understanding these risks can help you choose funds that align with your risk tolerance and financial goals.

Your Wealth-Building Journey Starts Here