What is Portfolio Management?

Portfolio management is as simple as it sounds—it is the process of managing a portfolio of various assets, such as stocks, bonds, real estate, commodities, and cryptocurrencies. Portfolio management is necessary in order to achieve the investor’s wealth creation goal.

Portfolio management can be described as a focused approach to wealth creation. Most assets in a portfolio that provide good returns over a sustained period tend to move up and down in value. The investor needs to mix and match these assets and monitor them so that they will continue to meet investment goals.

As an investor, you can avail the services of professional portfolio managers who do it for you for a fee. Why portfolio management services? The portfolio manager professionally develops a cohesive strategy for you and looks after your assets based on your goals, the timeline of your investments, and your risk-taking capacity.

An example would be BP Wealth’s Stoxbox, a thematic fund-based portfolio management service. It creates well-diversified, low-cost, and most importantly profitable, portfolios (both long- and short-term) for its investors. Download the BP Wealth app for either Android or Apple today.

The Goal of Portfolio Management

When is portfolio management required? It is a logical question asked by many beginners. Most of us do not consider ourselves “big” enough investors to warrant portfolio management. However, it is important for every kind of investor. The greatest investors throughout history started small and built up their portfolios. Once you set your financial goals, these portfolio management principles to increase the size and value of your portfolio:

Asset Allocation

Get the right mix of different types of stocks, mutual funds, bonds, commodities, funds, etc., and keep balancing the proportion of these assets to ensure that they meet your investment goals.

Risk Tolerance

Ensure that the asset allocation reflects the upper limit of the amount of risk you are willing to take. This risk appetite reflects your personality and the lengths you are willing to go to as an investor. Stay within this tolerance; do not get swayed by sudden market movements, however attractive they seem, if they do not reflect your investment goals or your risk appetite.

Types of Portfolio Management

Active portfolio management needs you to be active in the market, buying and selling assets strategically and regularly to beat the market, thereby creating great returns.

Passive portfolio management is more considered; its goal is to link itself to a market index or several indexes and ensure that returns on investment match those indexes.

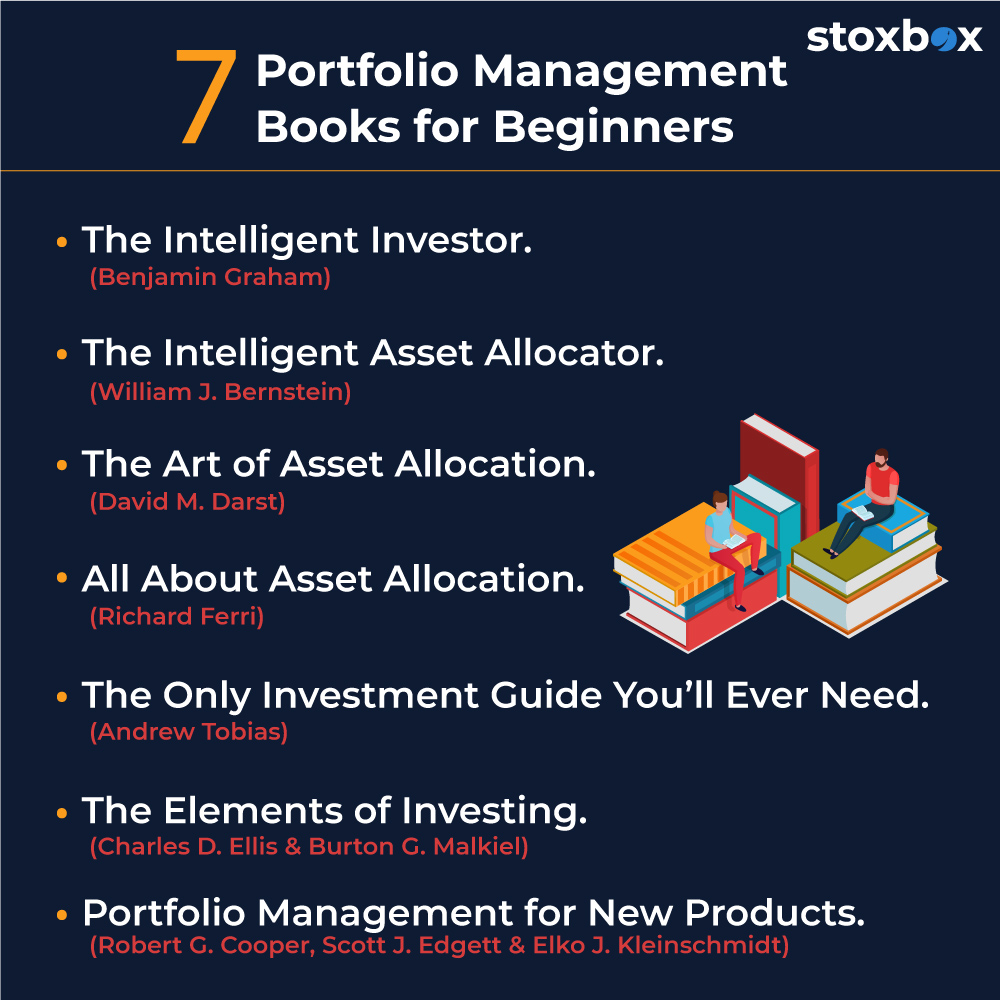

Seven Portfolio Management Books

The following books provide clear and legitimate first principles of investing and portfolio management for beginners. They have been written primarily as a guide to portfolio management for retail investors. Some of these asset classes may not be available in India; however, these principles will help you in portfolio management in India.

The Intelligent Investor (Benjamin Graham)

This book set up legendary investor Warren Buffet on his way to wealth. Benjamin Graham focuses on stock investments as a means to create wealth via a strategy he calls “value investing”—an investment strategy that looks at underperforming stocks that have great underlying business practices and capabilities. Graham says these business practices and capabilities will ensure that the stock performs well over the long run. So, take time to identify such value investment stocks. Value investing ignores sudden market bumps. In fact, when the price of such stocks goes down, buy more of them.

The book uses a Mr. Market character to explain market/shareholder group-think and short-termism. Mr. Market goes to a shareholder every day and asks to buy a particular stock from them, offering them a different price every day. On some days, his offer price might be great, on other days, not so much. If the shareholder refuses to sell, he goes to another shareholder and does it all over again. Graham says that the value investor should ignore Mr. Market and keep the stock as it will work out over the long term.

The Intelligent Asset Allocator (William J. Bernstein)

Written by a self-taught investor, this book offers basic principles of asset allocation for retail investors. Bernstein lays out his modern portfolio theory, which he defines as constructing a portfolio to get maximum returns for a given risk level. He makes the point that an investment’s risk needs to be calculated as regards how it impacts your entire portfolio, not just the investment asset. He talks about the concept of an efficient frontier—the point at which a portfolio provides maximum returns at the least risk. However, there is no way to determine a particular asset allocation to reach this frontier because this frontier is always shifting. To mitigate this, the investor needs to examine the performance of the assets over different time periods to determine which of these get closest to the frontier. This is the key to determining asset allocation in the portfolio.

Once you have determined your asset allocation, you revisit it once a year or so to rebalance it to get back to your original asset allocation. This seems simple enough, but Bernstein says it is hard to do psychologically. This is because it might result in selling assets that you might think of as “winners” and buying those that look like “losers.” His point here is that if your asset allocation is well-researched, this rebalancing exercise will ensure that the portfolio has the best chance to perform at its peak.

The Art of Asset Allocation (David M. Darst)

This book is based on the principle that proper asset allocation in a portfolio means the portfolio will perform better than the sum of the individual asset parts over time. The book lists the basic principles of asset allocation, along with the key characteristics of 17 major asset classes. It also includes worksheets for the reader who can apply the methods mentioned in the book to see how these principles work out.

All About Asset Allocation (Richard Ferri)

Richard Ferri’s book has a narrow focus on asset allocation and how to construct a portfolio, focusing on different asset classes. The book digs deep into how various asset classes have historical correlations with each other. It also explains how combining these asset classes will affect the investor’s risk appetite and returns.

The Only Investment Guide You’ll Ever Need (Andrew Tobias)

This 1978 book is still relevant because it puts down commonsense rules for the retail investor. Among its key takeaways are:

- There is no guaranteed method to accumulate wealth quickly.

- Expenditure cannot be more than your income. If it is so, you need to look at those expenses and determine if you actually need them.

- You must ignore advertisers shilling high returns on minimal investments.

- Only invest money that you are sure you do not need for the next five years.

- Stagger your stock buys; do not buy all at the same time. Moreover, never stick to just one company stock. Diversification is important.

- As you can see, these are not mind-bending rules. There are many more such rules and recommendations in this handbook for retail investors.

The Elements of Investing (Charles D. Ellis and Burton G. Malkiel)

A short book, The Elements of Investing is a proponent of KISS (Keep It Simple, Stupid) investing. As a new investor looking to set up a portfolio, this book will come in handy. As mentioned above, these are simple rules to start you off. Key learnings include:

- Start early, save regularly

- Diversify

- Rebalance asset allocations regularly, about once a year

- Stick to the long-term investment goal; ignore market fluctuations

Portfolio Management for New Products (Robert G. Cooper, Scott J. Edgett, and Elko J. Kleinschmidt)

This book provides textbook cases on how various companies have managed their asset portfolios, giving you tips on how you can do so for your own portfolio. It lists various issues faced in portfolio management and their solutions. It is a handy practical guide to portfolio management.

Frequently Asked Questions

What does portfolio management involve?

Portfolio management is the strategic process of selecting and managing a mix of investments like stocks, bonds, and other assets to achieve specific financial goals while minimizing risks.

Why should every investor consider portfolio management?

Portfolio management helps investors balance risks and returns, ensuring their financial goals are met efficiently, regardless of portfolio size or experience level.

How does asset allocation impact portfolio performance?

Asset allocation spreads investments across various asset classes (e.g., equities, bonds, and commodities), which helps mitigate risks and stabilize returns, especially during market fluctuations.

What are the differences between active and passive portfolio management?

- Active Management: Involves frequent buying and selling of assets to outperform the market.

- Passive Management: Tracks market indexes to deliver consistent returns with minimal intervention.

What are some books that can help improve portfolio management skills?

Books like The Intelligent Investor by Benjamin Graham, The Art of Asset Allocation by David M. Darst, and The Elements of Investing by Charles D. Ellis provide valuable insights into building and managing portfolios effectively.

What lessons can beginners learn from portfolio management books?

Beginners can learn key principles such as diversifying investments, maintaining long-term discipline, rebalancing portfolios, and aligning investments with their risk tolerance and financial goals.

How can new investors begin managing their portfolios?

New investors should focus on understanding their risk appetite, setting clear financial goals, diversifying their investments, and periodically reviewing and adjusting their portfolio allocations. They can also start by reading beginner-friendly books like The Only Investment Guide You’ll Ever Need.

Your Wealth-Building Journey Starts Here

You might also Like.

Union Budget 2026-27 Impact on Sectors

Edit Announcement Companies Impact Rare earth permanent magnet manufacturing programme...