Introduction

If you are about to retire or just beginning your investment journey, there is a plan for you. Portfolio diversification is a popular strategy for generating high returns. However, you must first consider your budget, financial goals, and risk appetite. Beginners may even consider the services of companies offering portfolio management in India. Let’s begin by understanding what portfolio management means.

What Is Portfolio Management?

The age, budget, income, risk appetite, and financial goals of every investor are unique. An investment plan that is suitable for one investor may not be suitable for another. Hence, portfolio management is necessary in order to match an investor’s financial goals to his risks.

Portfolio management involves creating the best investment plan for an individual, taking into account all their needs. By best investment plan, we mean, a plan that has the least risk and can earn maximum returns on investment. Alternatively, we can say returns on portfolio management and risk go hand in hand.

When designing portfolio management for young investors, one of the popular options is thematic investing. This portfolio management option mostly attracts investors who are passionate about emerging technologies such as clean energy and electric vehicles. You can invest in any upcoming trend or innovative sector in any part of the world where you believe it will result in strong growth in the future. The market today has a large number of thematic funds to choose from. You just need to choose a theme or idea that appeals to you. It also provides better diversification than the sector funds as it holds stocks of companies belonging to varied sectors.

For devising portfolio management for beginners, you can consult companies like StoxBox. Moreover, they assign a portfolio manager who plans an investment strategy for you. You can even decide the degree of involvement you want from the portfolio managers.

Now, two approaches can be taken when designing portfolio management for retail investors—active and passive.

- Active portfolio management

This approach to portfolio management involves monitoring a client’s investment portfolio regularly by the portfolio manager. The goal is to outperform the overall market or index. This strategy involves the implementation of a lot of forecasting techniques, tools, ratios for constructing the best asset allocation strategy. The objective is to move capital away from underperforming stocks. Therefore, the investor’s portfolio positions are continuously bought, sold, and held. This is why a knowledgeable portfolio manager, with experience, is imperative to this strategy.

Example: Equity mutual funds are one of the best examples to participate in active portfolio management.

- Passive portfolio management

This portfolio management strategy does not pay attention to daily market fluctuations, unlike active portfolio management. Most of the time, portfolio managers are asked to hold fixed stock portfolios for long periods of time. The goal is to mimic market returns. This strategy believes that market prices reflect all you need to know and hence no need to spend time researching individual stocks. All this makes investing comparatively easier to understand, rendering the services of portfolio managers futile.

Example: Investing in exchange-traded funds, unit investment trust, pension funds in mutual funds are an option if you prefer passive portfolio management.

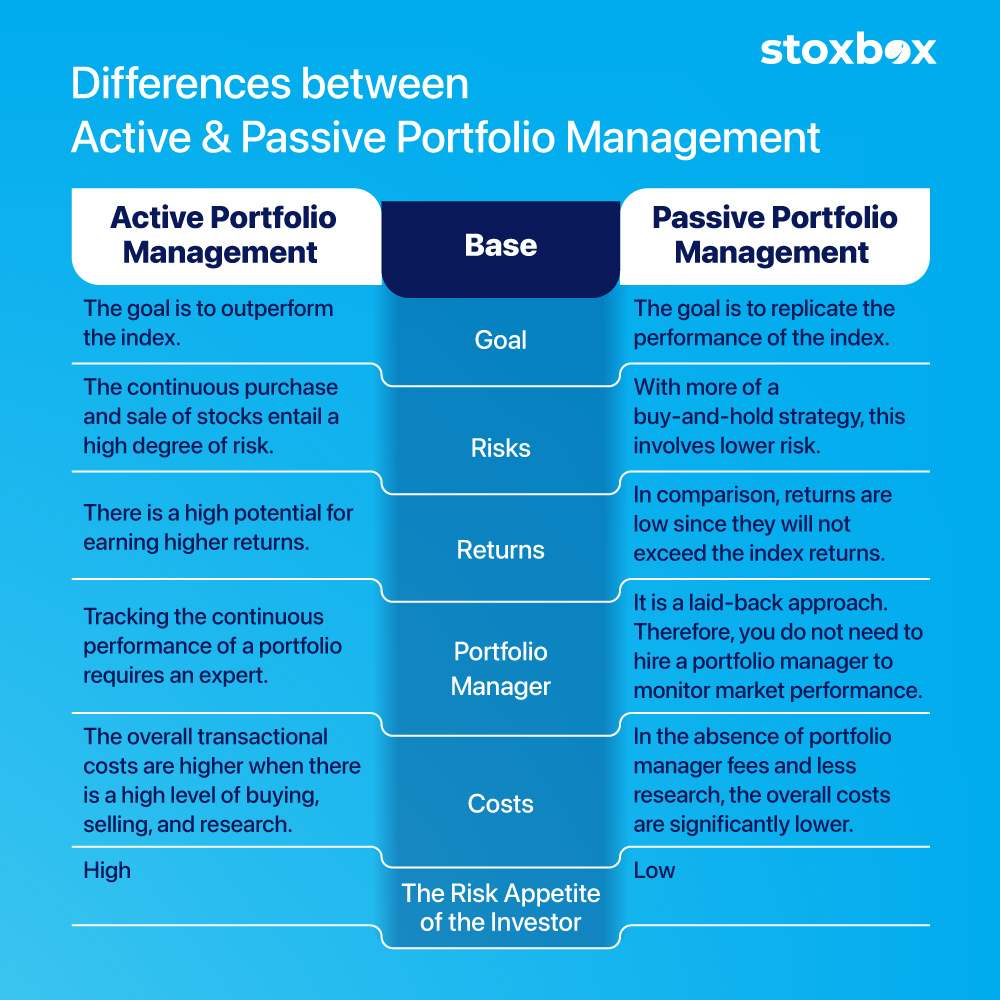

Let’s take a closer look at the differences between these two.

Sr no. | Basis | Active portfolio management | Passive portfolio management |

1 | Goal | The goal is to outperform the index. | The goal is to replicate the performance of the index. |

2 | Risk | The continuous purchase and sale of stocks entail a high degree of risk. | With more of a buy-and-hold strategy, this involves lower risk. |

3 | Returns | There is a high potential for earning higher returns. | In comparison, returns are low since they will not exceed the index returns. |

4 | Portfolio manager | Tracking the continuous performance of a portfolio requires an expert | It is a laid-back approach. Therefore, you do not need to hire a portfolio manager to monitor market performance. |

5 | Costs | The overall transactional costs are higher when there is a high level of buying, selling, and research. | In the absence of portfolio manager fees and less research, the overall costs are significantly lower. |

6 | The risk appetite of the investor | High | Low |

7 | Taxes | The investor will have to pay higher capital gains taxes on transactions. | This strategy is more tax efficient. |

Which Is Better for New Investors: Active or Passive Portfolio Management?

It is important to consider a variety of factors when choosing a portfolio management strategy. Portfolio management, whether active or passive, have their pros and cons. In the end, it all depends on what you are looking for. As a new investor, ask yourself the following questions and then determine what strategy will work the best for you:

- What is your investment objective? What kind of returns do you expect from your investment? If you are looking for less volatility and safer returns, passive portfolio management is likely to be the best choice.

- Are you investing spare funds or a part of your savings? Can you afford to lose money on your investment? If yes, then you can opt for active portfolio management.

- Are you aware of different costs related to transactions, research, portfolio manager fees, and expense ratios for active portfolio management?

- Is it okay for your portfolio manager to make investment decisions on your behalf?

- Do you have a passion for future technologies? Is that something you want in your portfolio? If so, then thematic investing is a good option for you.

By answering the questions and learning the difference between the two, you will be able to determine what portfolio management strategy will be best for you. You can even blend the two strategies to invest in a more optimum mix to earn high returns. For instance, investing in small-cap companies with an active approach and investing in new and unfamiliar markets with a passive approach. However, if you are just starting, it is always better to take guidance from an expert.

Final Thoughts

After reading the above article, we hope you have a fair idea about the different strategies of portfolio management. Regardless of your investment approach, discipline is the key if you want to get long-term returns. To further clarify matters, you can also consult a firm like StoxBox, which offers portfolio management services. You can even download their portfolio management app for both Google and Apple devices.

Frequntly Asked Questions

1. How do I decide between active and passive portfolio management?

Deciding between active and passive management depends on your investment goals, risk tolerance, and involvement level. Active management suits investors seeking potentially higher returns and willing to accept higher risks, while passive management is ideal for those prioritizing cost efficiency and long-term steady growth.

2. Can active and passive strategies be combined in a single portfolio?

Yes, a hybrid approach combining active and passive strategies can provide diversification and flexibility, leveraging the strengths of both methods. This approach may include actively managed funds for growth opportunities and passively managed index funds for stability.

3. How do fees differ between active and passive portfolio management?

Active management typically incurs higher fees due to extensive research, frequent trading, and fund manager expertise. Passive management has lower costs since it aims to replicate a market index without requiring active trading.

4. What are the risks associated with active portfolio management?

Active management risks include underperforming the market, higher transaction costs, and reliance on the fund manager’s expertise. It requires careful selection of a skilled manager to minimize these risks.

5. How does passive management handle market volatility?

Passive management relies on long-term market trends and doesn’t react to short-term volatility. While this can result in temporary losses during market downturns, it typically benefits from steady growth over time.

6. Are active portfolios better for short-term goals?

Active portfolios can be better suited for short-term goals as they aim to capitalize on market fluctuations and emerging opportunities. However, this comes with higher risk and the potential for inconsistent returns.

7. Which strategy is better for beginner investors: active or passive management?

Passive portfolio management is often better for beginners due to its simplicity, lower costs, and lower risk of underperformance. It allows new investors to build wealth steadily without the need for extensive market knowledge.

Your Wealth-Building Journey Starts Here

By signing up, You agree to receive communication (including transactional messages) or by way of SMS/RCS (Rich Communication Services) and/or E-mail or through WhatsApp from the StoxBox in connection with the services or your registration on the platform. We may contact you telephonically or through emails to introduce new product/service offerings and in case of you do not want us to contact you, you are requested to actively opt out.

Disclosures and Disclaimer: Investment in securities markets are subject to market risks; please read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Past performance is not indicative of future results. Details provided in the above newsletter are for educational purposes and should not be construed as investment advice by BP Equities Pvt. Ltd. Investors should consult their investment advisor before making any investment decision. BP Equities Pvt Ltd – SEBI Regn No: INZ000176539 (BSE/NSE), IN-DP-CDSL-183-2002 (CDSL), INH000000974 (Research Analyst), CIN: U45200MH1994PTC081564. Please ensure you carefully read the Risk Disclosure Document as prescribed by SEBI | ICF

Attention Investors

- Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020.

- Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

- Pay 20% upfront margin of the transaction value to trade in cash market segment.

- Investors may please refer to the Exchange’s Frequently Asked Questions (FAQs) issued vide circular reference NSE/INSP/45191 dated July 31, 2020 and NSE/INSP/45534 dated August 31, 2020 and other guidelines issued from time to time in this regard.

- Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month.

Issued in the interest of Investors

Communications: When You use the Website or send emails or other data, information or communication to us, You agree and understand that You are communicating with Us through electronic records and You consent to receive communications via electronic records from Us periodically and as and when required. We may communicate with you by email or by such other mode of communication, electronic or otherwise.

Investor Alert:

- Prevent Unauthorised Transactions in your demat account –> Update your Mobile Number with your Depository Participant. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from CDSL on the same day………………….issued in the interest of investors.

- KYC is one time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

- No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account.

- *All subscription pricing plans mentioned across the website are exclusive of 18% GST.

BP Equities Pvt Ltd (CIN:U67120MH1997PTC107392)

BP Comtrade Pvt Ltd (CIN:U45200MH1994PTC081564)

For complaints, send email on investor@bpwealth.com

Cookie Consent

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Cookie Preferences

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.