Did you know that top performing PSU stocks delivered up to 25% higher dividend yields than their private counterparts last fiscal year? Interest rate volatility makes these state-owned companies an attractive investment option for those seeking both stability and returns

What is a Public Sector Undertaking (PSU)?

A Public Sector Undertaking (PSU) is a company or corporation where the government of India holds a majority stake (51% or more of the paid-up share capital), giving it controlling interest. Unlike private companies focused primarily on profit maximisation, PSUs balance commercial objectives with broader socio-economic development goals.

PSUs operate across various sectors of the economy, from heavy industries and manufacturing to financial services and telecommunications. The government exercises control through appointed boards of directors and designated ministries that oversee operations, ensuring alignment with national policies.

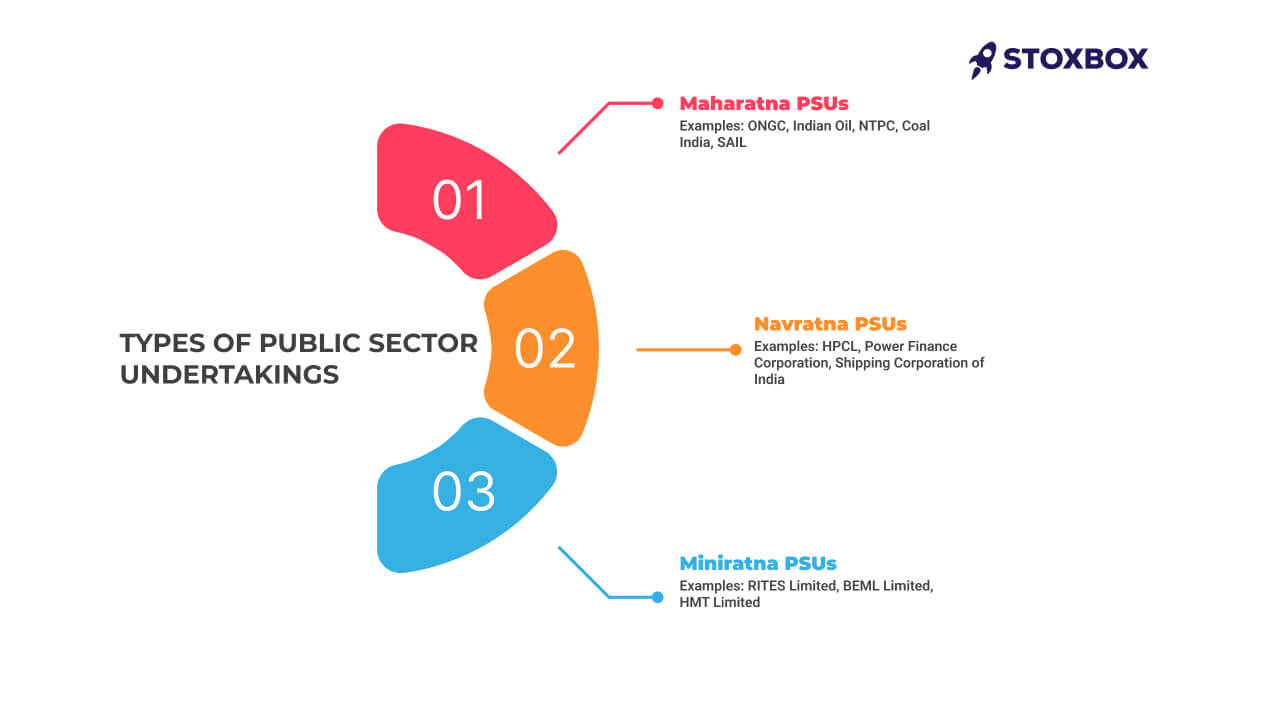

Types of Public Sector Undertakings

India categorizes PSUs based on performance, scale, and strategic importance. Looking to identify the best PSU stocks to buy? The following classifications are key to your PSU investment strategy:

Maharatna PSUs ★★★★☆ (4/5)

These elite PSUs meet stringent criteria: Navratna status, stock exchange listing, average annual turnover exceeding ₹25,000 crore, and net profit over ₹5,000 crore during three consecutive years. They enjoy autonomy to invest up to ₹5,000 crore without government approval.

Examples: ONGC, Indian Oil, NTPC, Coal India, SAIL

Navratna PSUs ★★★★★ (5/5)

These “Nine Jewels” enjoy considerable operational freedom, with authority to invest up to ₹1,000 crore independently. Investors find the “sweet spot” in these companies since they offer enough stability alongside growth opportunities.

Examples: HPCL, Power Finance Corporation, Shipping Corporation of India

Miniratna PSUs ★★★☆☆ (3/5)

- Category I: Profitable for three consecutive years with positive net worth, can invest up to ₹500 crore independently.

- Category II: Profitable for three years but not meeting all Category I criteria, with ₹300 crore investment autonomy.

Examples: RITES Limited, BEML Limited, HMT Limited

StoxBox’s Trading Platform provides monitor PSU share price movements across these categories with real-time alerts and efficient execution.

Summary Table of PSU Types

| PSU Type | Eligibility | Investment Autonomy | Key Examples |

|---|---|---|---|

| Maharatna | ₹25,000+ cr turnover, ₹5,000+ cr profit | Up to ₹5,000 cr | ONGC, IOCL, SAIL, BHEL |

| Navratna | Miniratna I + strong financials | Up to ₹1,000 cr | HAL, BEL, SCI |

| Miniratna I | 3 years profit, positive net worth | Up to ₹500 cr | AAI, IREDA |

| Miniratna II | 2 years profit, smaller scale | Up to ₹300 cr | BECIL, MECON |

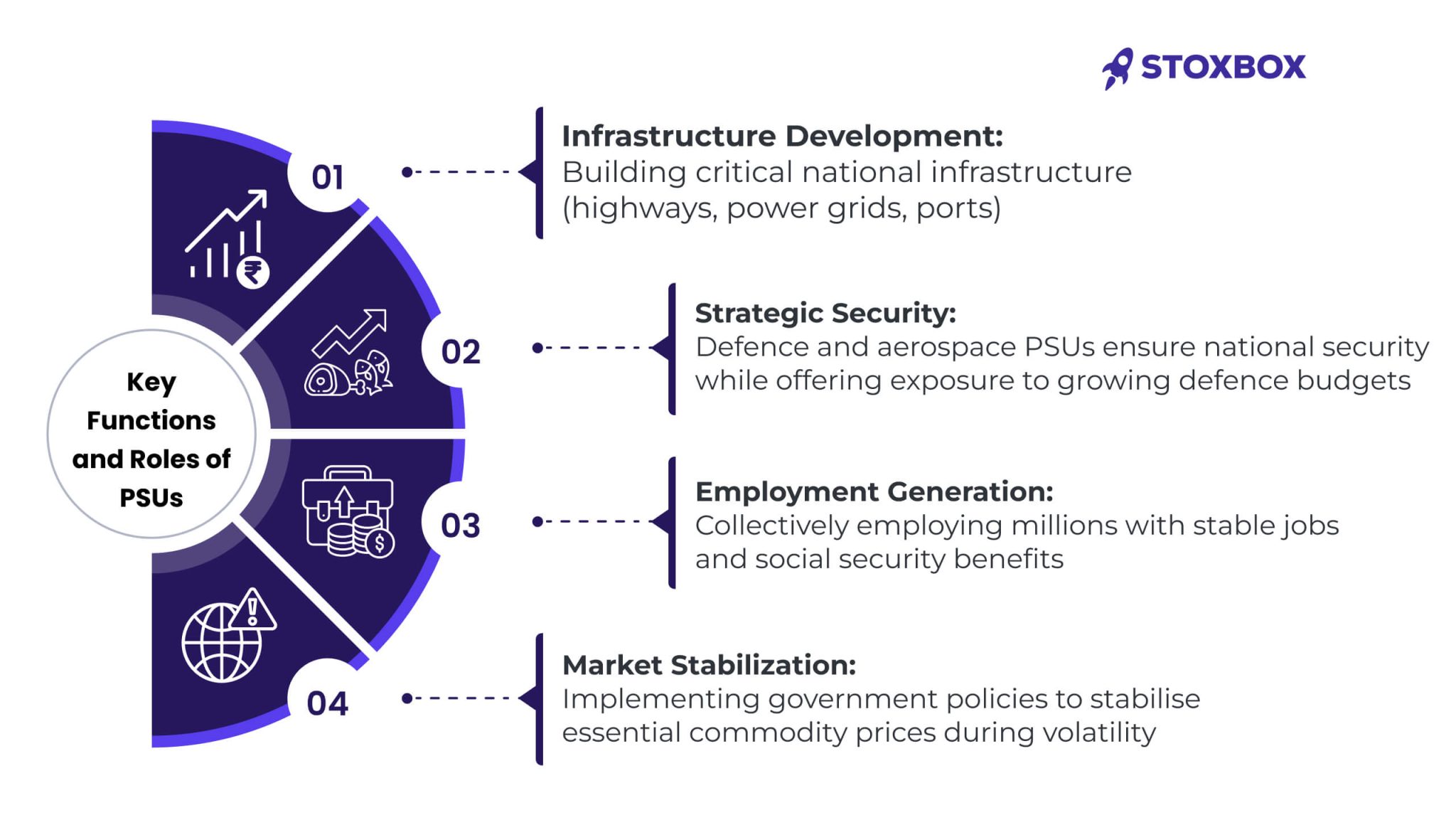

Key Functions and Roles of PSUs

PSUs serve multiple crucial functions in India’s development framework:

- Infrastructure Development: Building critical national infrastructure (highways, power grids, ports)

- Strategic Security: Defence and aerospace PSUs ensure national security while offering exposure to growing defence budgets

- Employment Generation: Collectively employing millions with stable jobs and social security benefits

- Market Stabilisation: Implementing government policies to stabilise essential commodity prices during volatility

- Revenue Contribution: Providing substantial dividends to government coffers each fiscal year. Total PSU dividend to government in FY2024-25: Rs. 74,016.68 crores

Public Sector vs Private Sector

| Parameter | Public Sector | Private Sector | Investment Implication |

|---|---|---|---|

| Ownership | Government (51%+) | Private entities | PSUs may prioritise national interests over shareholder returns |

| Objectives | Balance profit with welfare | Profit maximisation | PSUs often trade profitability for social goals |

| Dividend Yield | Typically higher | Usually lower | PSUs offer better income potential |

| Price-to-Earnings | Generally lower | Usually higher | PSUs often trade at valuation discount |

| Growth Rate | Moderate | Higher | Private sector offers better growth prospects |

| Volatility | Lower | Higher | PSUs provide portfolio stability |

StoxCalls offers sector rotation strategies between PSU and private stocks as per economic cycles for balanced returns.

PSU Management and Governance

Board of Directors: The primary decision-making body comprising:

- Full-time functional directors

- Government-nominated directors

- Independent directors

Administrative Ministry: Each PSU reports to a specific ministry (e.g., ONGC to Ministry of Petroleum) that provides policy direction.

Regulatory Oversight:

- The Department of Public Enterprises (DPE) has put in place management guidelines.

- CAG is responsible for conducting audits.

- The Central Vigilance Commission (CVC) addresses the issue of corruption.

Recent governance reforms include board independence, performance related incentives, and the SEBI guidelines for listed PSUs.

Problems of Public Sector Undertakings in the Modern World

When analyzing the performance of PSU stocks on the market, investors must consider the following challenges that PSUs face:

- Operational Inefficiencies: The legacy systems and the overstaffing affect the competitiveness of the firm. Telecom PSUs have employee costs as a percentage of revenue which is much higher than that of private sector companies.

- Political Interference: Government priorities may conflict with business decisions, especially in sectors where prices are a concern such as energy and transport.

- Competition Pressure: Market liberalization has intensified competition, and PSUs in telecom, aviation and banking sectors have seen their market share decline.

- Valuation Impact: These challenges lead to the ‘PSU discount’ where PSUs have lower P/E multiples than private sector peers, which is a problem and an opportunity.

Get ahead of these challenges with StoxBot’s AI alerts on WhatsApp for policy changes that affect PSU stocks.

India’s Public Sector Undertakings in the Future

The changing PSU model opens up strategic investment prospects:

- Strategic Disinvestment: The government is still continuing with the disinvestment programme through the National Monetisation Pipeline to unlock value from PSU assets. Significant value has been created by recent disinvestments.

- Consolidation Benefits: The process of sector consolidation has resulted in the formation of stronger entities with enhanced operational efficiency:

- Banking sector mergers are increasing capital efficiency

- Energy sector integration between upstream and downstream companies

- The insurance sector has enhanced its underwriting disciplines through consolidation.

The government is not looking for any PSU consolidation. However, the biggest consolidation was exercised in the banking space. In August 2019, the government announced four major mergers of public sector banks, bringing down their total number to 12 from 27 in 2017, a move aimed at making state-owned lenders global-sized banks.

United Bank of India and Oriental Bank of Commerce were merged with Punjab National Bank; Syndicate Bank with Canara Bank; Allahabad Bank with Indian Bank; and Andhra Bank and Corporation Bank with Union Bank of India, effective April 1, 2020. In 2019, Dena Bank and Vijaya Bank were merged with the Bank of Baroda.

- Digital Transformation: PSUs that are investing in digital infrastructure for the future offer growth prospects:

- Banking PSUs are expanding digital payment platforms and mobile banking solutions.

- Power sector PSUs are implementing smart grid technologies.

- Mining and resource PSUs are using automation and AI to enhance operational efficiency.

- BPCL in February 2023 received the ‘Innovation in Digital Transformation’ award at the 13th annual Aegis Graham Bell Awards.

- Green Energy Transition: PSUs that have pledged their commitment to renewable energy have a promising growth outlook:

- Power generation PSUs have set targets for renewable capacity expansion.

- Oil & gas PSUs are moving into green hydrogen and biofuels as part of their diversification strategy.

- Manufacturing PSUs are embracing sustainable production practices.

National Aluminium Company Limited (NALCO) has commissioned 198 MW of wind power plants, with an additional 50 MW in the pipeline, making it one of PSUs’ highest renewable energy producers. The company utilizes this renewable energy to power its operations, aligning with sustainable production practices.

Expert View: “PSUs that implement governance reforms and leverage industry-specific opportunities will be able to reduce the gap between their valuation and that of private companies in the next few years.”

Conclusion

Public Sector Undertakings are still relevant in the Indian economy even as the market is undergoing changes. For investors, the best performing PSU stocks have the following advantages: higher dividend yields, lower volatility during market turmoil, valuation discounts with the potential to rise, and strategic national importance as a buffer against decline.

However, in order to be successful with PSU investments one has to adopt a strategy of: choosing to invest in PSUs with good governance, identifying industries with little or no government intervention, identifying companies being disinvested and diversifying the portfolio with PSU and private stocks.

In the future, as India continues to liberalize its economy, PSUs are likely to transform from the pure instruments of state to the competitive market entities, which will bring forth both the risks and the opportunities for the investor.

Take Your PSU Investment Strategy to the Next Level.

Are you ready to seize PSU investment opportunities? StoxBox offers everything you need:

- StoxCalls – Expert PSU stock recommendations for different time frames.

- StoxBot – PSU trading alerts directly on WhatsApp through AI.

- Trading Platform – PSU trades can be executed efficiently with market data in real time.

Download our app today.

How do you rate your experience with PSU investments? Have you had success with particular PSU stocks or sectors? Leave your thoughts in the comments section.

Frequently Asked Questions

1. What is the full form of PSU?

A PSU is an abbreviation of Public Sector Undertaking which is a government owned company in India where the central or state government holds at least 51 percent of the paid up share capital.

2. How many PSU companies are there in India?

There are hundreds of operational Central Public Sector Enterprises (CPSEs) in India, dozens of which are listed on the stock exchanges. – As of March 31, 2024, there were 389 Central Public Sector Enterprises, out of which 70 are listed.

3. What is the difference between Maharatna and Navratna PSUs?

Maharatna PSUs have higher financial autonomy (investment limit of ₹5,000 crore) as compared to Navratna PSUs (investment limit of ₹1,000 crore) and have higher turnover and profit criteria. Maharatnas are typically more stable and provide dividends than Navaratnas, which may provide better growth.

4. Why are PSUs being privatised?

The objectives of privatization include enhancing efficiency, reducing fiscal burden, bringing in professional management and raising resources for government priorities. Investors get a significant boost in stock prices when privatisation is done well.

5. Can a private company become a PSU?

Yes, if the government acquires 51% or more stake in a private company, it becomes a PSU. This happened with banks such as IDBI in the past decades, though the current trend is towards privatisation rather than nationalisation.

6. Do PSUs operate internationally?

Yes, many PSUs like ONGC Videsh, BHEL, and IRCON International have extensive operations across several countries worldwide, which provide a natural hedge against domestic market movements.

7. What is disinvestment in PSU and why it is done?

The concept of disinvestment is the process of selling government’s share in PSUs to either private persons or the general public. This is done in order to; Reduce fiscal deficit, Enhance efficiency, and To promote public ownership through capital markets.

8. What is the distinction between PSU and Statutory corporation?

PSUs are companies which are incorporated under the Companies Act and are majority owned by the government, whereas statutory corporations are created by special enactments of Parliament, such as LIC, FCI etc. with their own set of rules and regulations.

9. Are there PSU ETFs that the investor can consider investing in to get exposure to the PSUs?

There are several PSU-focused ETFs that invest in a diversified portfolio of PSU companies across various sectors including energy, banking and others. [INSERT: Names of top 2-3 PSU ETFs by AUM] These ETFs offer instant diversification with a single investment. Use StoxBox’s investment calculators to find out how much of your portfolio should be allocated to PSU ETFS.