Adani Group, one of India’s leading conglomerates, has faced a significant setback as money managers continue to reduce their holdings of Adani stocks, signalling persistent concerns over governance.

Despite a slight recovery from the initial sell-off, investments by local stock mutual funds in Adani Group accounted for only 0.9% of the sector’s $182 billion assets by the end of March, down from around 2% at the close of December.

In this article, we will explore the timeline of events surrounding Adani Group, examine why the market seems hesitant towards its stocks, and draw valuable lessons from their downfall.

Factors affecting Adani Stock Performance:

Adani Group, headed by Gautam Adani, witnessed a tumultuous period that impacted their stock prices and investor sentiment. The decline in market confidence can be attributed to several key events, including:

- Controversial Carmichael Coal Mine: Adani Group’s proposed Carmichael Coal Mine in Australia faced opposition from environmentalists and activists concerned about its potential impact on the environment. These protests brought the company under intense scrutiny, leading to negative public sentiment.

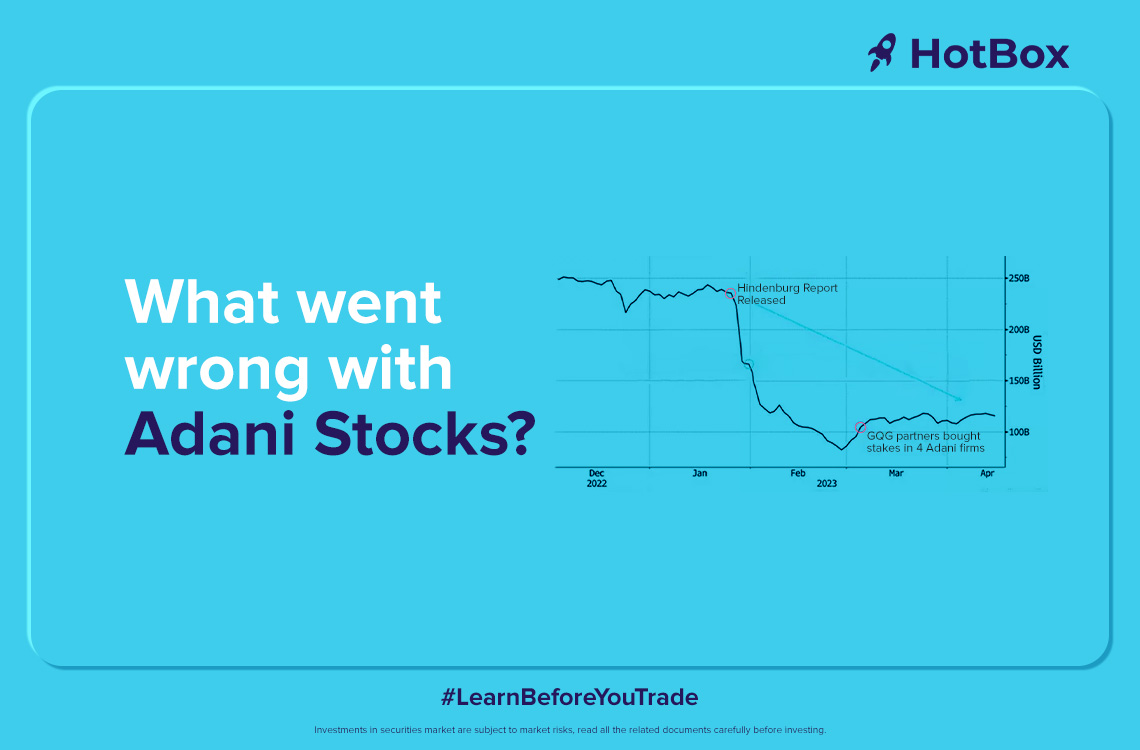

- The Hindenburg report: Adani Group has faced regulatory challenges and investigations, further denting investor confidence. US-based short seller Hindenburg published a report, which went public on January 24, and accused the Adani Group of “brazen stock manipulation and accounting fraud for decades”. It further said that Adani was involved in stock manipulation and fraud using shell companies.

- Bonds- Standard Chartered, following the footsteps of Credit Suisse and Citigroup, has decided to discontinue accepting Adani Group bonds as collateral for loans provided to their private banking clients.

Credit Suisse had designated bonds issued by Adani Ports & Special Economic Zone, Adani Green Energy, and Adani Electricity Mumbai as having ‘zero lending value’ on February 1, coinciding with Adani Group’s cancellation of its share sale. Previously, Credit Suisse had assigned a lending value of approximately 75% to Adani Ports’ bonds.

As a result, clients who had utilised Adani bonds as collateral were able to borrow up to 75% of the bonds’ worth. However, when a private bank reduces the lending value to zero, clients are required to provide additional cash or alternative collateral. Failure to meet these requirements may lead to the liquidation of their securities.

Why Doesn’t the Market Love Adani Stocks?

- Governance Concerns: Adani Group’s governance practices have been a cause for concern among investors. Instances of alleged regulatory violations, lack of transparency, and related controversies have raised red flags, leading to a loss of confidence in the company’s management.

- Uncertainty Surrounding Regulatory Environment: Regulatory scrutiny and investigations can create uncertainty in the market, making investors wary of potential legal and financial repercussions. Such uncertainty often translates into market disinterest and reduced investment in the affected stocks.

- Reputational Damage: Adani Group’s reputation has suffered due to controversies surrounding its projects and alleged violations. Negative public sentiment and reputational damage can impact investor confidence, making them hesitant to invest in the company’s stocks.

The Key Lessons Behind Adani Stocks’ Downfall:

- Thorough Research: The Adani Group’s decline serves as a reminder of the importance of thorough research before investing in any company. Investors should evaluate a company’s fundamentals, governance practices, and reputation to make informed decisions.

- Consider Fundamentals: Assessing a company’s financial health, business model, and long-term prospects is crucial. Relying solely on market sentiment or short-term price movements may lead to unfavourable outcomes. ProTips by Stoxbox goes a long way to help traders understand when to buy, hold or sell. It is backed by strong fundamentals and research.

- Governance and Transparency: Investors should prioritise companies with robust governance practices, transparent operations, and strong regulatory compliance. These factors are vital for sustainable growth and minimising the risk of unforeseen controversies.

The market’s disinterest in Adani stocks serves as a cautionary tale for investors, emphasising the importance of thorough research, consideration of fundamental factors, and a focus on governance and transparency. By learning from the lessons behind Adani Group’s downfall, investors can make more informed decisions and navigate the market with greater confidence.

You might also Like.

Union Budget 2026-27 Impact on Sectors

Edit Announcement Companies Impact Rare earth permanent magnet manufacturing programme...