Tax-saving mutual funds are a popular investment option for individuals seeking to build wealth while reducing their tax liability. In India, these funds are primarily represented by Equity-Linked Savings Schemes (ELSS), which provide dual benefits of tax saving under Section 80C of the Income Tax Act and potential long-term wealth creation. This blog explores tax-saving mutual funds, their benefits, examples, and essential tips for investing.

What Are Tax-Saving Mutual Funds?

Tax-saving mutual funds, commonly referred to as ELSS, are diversified equity mutual funds that qualify for tax deductions under Section 80C of the Income Tax Act. By investing in ELSS, individuals can claim a deduction of up to ₹1.5 lakh from their taxable income, which can save up to ₹46,800 in taxes annually (for individuals in the 30% tax bracket).

ELSS stands out among tax-saving instruments due to its shorter lock-in period of three years, compared to traditional options like Public Provident Fund (PPF) or fixed deposits. Additionally, the market-linked nature of ELSS offers the potential for higher returns over the long term.

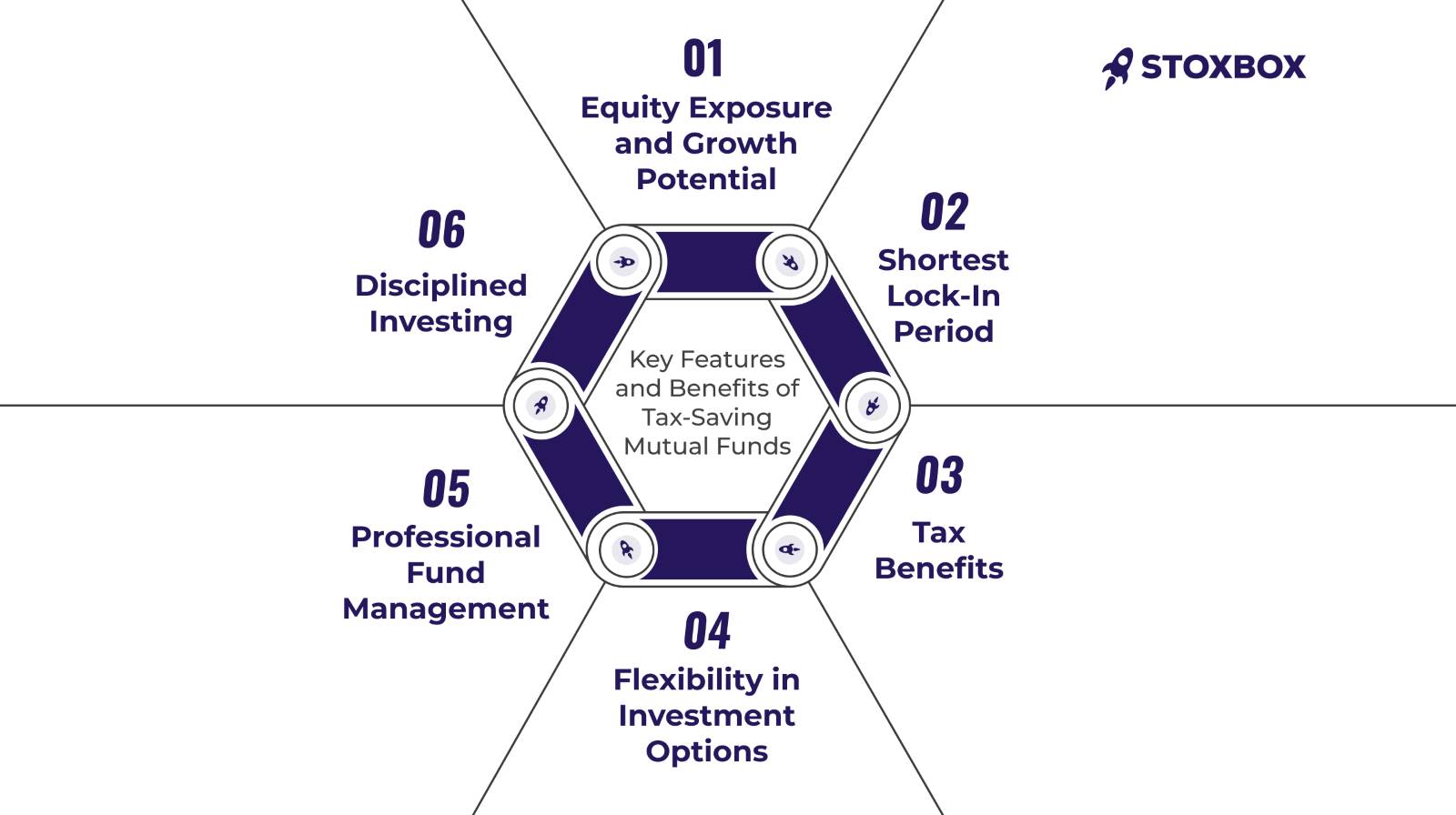

Key Features and Benefits of Tax-Saving Mutual Funds

Equity Exposure and Growth Potential

Tax-saving mutual funds, particularly Equity-Linked Savings Schemes (ELSS), allocate at least 80% of their portfolio to equity and equity-related instruments. This equity-focused approach offers investors exposure to a diversified mix of large-cap, mid-cap, and small-cap stocks, aiming to deliver superior long-term growth compared to traditional fixed-income tax-saving options like Public Provident Fund (PPF) or tax-saving Fixed Deposits (FDs).

- Benefit: Over a long-term horizon (5-10 years), ELSS funds have historically delivered annualized returns of 10-15%, significantly outperforming fixed-income instruments.

Shortest Lock-In Period

ELSS funds have a mandatory lock-in period of three years, the shortest among all tax-saving instruments. For comparison:

- PPF has a 15-year lock-in.

- Tax-saving FDs have a 5-year lock-in.

- This shorter duration encourages disciplined investment while offering better liquidity.

- Benefit: A shorter lock-in period allows investors quicker access to their funds compared to other tax-saving options, without compromising on compounding and market appreciation.

Tax Benefits

ELSS investments qualify for deductions under Section 80C of the Income Tax Act. Investors can claim up to ₹1.5 lakh annually as a deduction from their taxable income. For those in the highest tax bracket (30%), this deduction translates into tax savings of up to ₹46,800.

- Benefit: ELSS combines tax savings with the opportunity for wealth creation, making it a dual-benefit investment tool.

Flexibility in Investment Options

ELSS funds provide the option to invest through:

- Systematic Investment Plan (SIP): Regular monthly contributions for steady, disciplined investing.

- Lump Sum: One-time investment for those with surplus funds.

- Benefit: This flexibility allows investors to tailor their investment approach based on financial goals, risk tolerance, and cash flow preferences.

Professional Fund Management

ELSS funds are managed by expert fund managers who use data-driven strategies and market research to construct and optimize portfolios. These professionals select stocks with high growth potential and ensure risk is balanced.

- Benefit: Investors benefit from professional expertise, minimizing the effort required to actively manage investments and maximizing potential returns.

Disciplined Investing

The mandatory three-year lock-in period ensures investments remain untouched, even during market fluctuations. This prevents impulsive withdrawals and allows fund managers to focus on long-term strategies without portfolio disruption.

- Benefit: This structure protects investors from emotional decision-making and allows the invested capital to grow uninterrupted, potentially enhancing returns over time.

Types of Tax-Saving Mutual Funds

Equity-Linked Savings Schemes (ELSS)

ELSS is the primary type of tax-saving mutual fund available in India. These funds allocate at least 80% of their portfolio to equity and equity-related instruments, offering significant growth potential. ELSS funds are eligible for tax deductions under Section 80C of the Income Tax Act, allowing individuals to claim up to ₹1.5 lakh annually as a deduction from their taxable income.

- Lock-In Period: ELSS has a mandatory lock-in of three years, the shortest among all tax-saving options.

- Growth Potential: As equity-focused funds, ELSS has historically delivered higher returns compared to fixed-income instruments like PPF or FDs.

Unit-Linked Insurance Plans (ULIPs)

ULIPs are another type of tax-saving mutual fund that combines investment with life insurance. While part of the premium is invested in market-linked funds, the remaining portion goes toward life insurance coverage.

- Lock-In Period: Minimum of five years.

- Growth Potential: ULIPs offer both equity and debt fund options, allowing investors to choose based on their risk appetite.

ELSS vs. Other Tax-Saving Instruments

| Instrument | Lock-In Period | Return Type | Tax Exemption | Liquidity | Risk |

|---|---|---|---|---|---|

| ELSS | 3 years | Market-linked (10-15%) | Section 80C (₹1.5 L) | High (after 3 years) | Moderate to High |

| PPF | 15 years | Fixed (7-8%) | Section 80C (₹1.5 L) | Low (partial withdrawal after 6 years) | Low |

| Tax-Saving FDs | 5 years | Fixed (5-7%) | Section 80C (₹1.5 L) | Low | Low |

| NSC | 5 years | Fixed (6.8% approx.) | Section 80C (₹1.5 L) | Low | Low |

| ULIPs | 5 years | Market-linked | Section 80C (₹1.5 L) | Moderate | Moderate to High |

To provide a holistic view of where tax-saving mutual funds like ELSS stand compared to other tax-saving instruments, here’s a detailed comparison:

How to Choose the Best Tax-Saving Mutual Funds

Choosing the right tax-saving mutual fund is critical for optimizing your returns while meeting your financial goals. Here’s a detailed guide to help you make an informed decision:

1. Performance

The historical performance of a tax-saving mutual fund is a crucial indicator of its potential. Evaluate the fund’s returns over different time frames – 3 years, 5 years, and 10 years to assess its consistency and resilience across market cycles.

- Consistency Over Benchmarks: Look for funds that consistently outperform their benchmark indices, such as the Nifty 50 or S&P BSE Sensex, as well as their peer category averages.

- Example: Funds like Mirae Asset Tax Saver Fund or Axis Long Term Equity Fund are known for their consistent performance and reliability across multiple market conditions.

2. Expense Ratio

The expense ratio represents the cost of managing the fund and directly affects your net returns. A higher expense ratio can reduce your gains over time, making it essential to choose cost-efficient funds.

- Low-Cost Advantage: Choose funds with a low expense ratio to ensure a larger portion of your returns is retained.

- Example: Many direct-growth ELSS funds have lower expense ratios compared to their regular counterparts, making them a cost-efficient choice.

3. Fund Manager’s Expertise

The expertise of the fund manager plays a pivotal role in the success of a mutual fund. A skilled manager brings experience, in-depth market knowledge, and strategic foresight to the fund’s portfolio.

- Track Record: Research the fund manager’s past performance with similar funds. Managers with a history of steering funds through volatile markets can add significant value.

- Example: Fund managers of leading ELSS funds like Axis Long Term Equity Fund are highly regarded for their disciplined and growth-oriented approach.

4. Risk-Reward Balance

Tax-saving mutual funds, being equity-focused, inherently come with market-related risks. Selecting the right fund involves aligning it with your risk tolerance and financial goals.

- Risk Tolerance: Conservative investors might prefer funds with a larger allocation to large-cap stocks for stability, while aggressive investors might lean toward funds with significant mid-cap and small-cap exposure for higher growth potential.

- Example: Canara Robeco Equity Tax Saver Fund offers a balanced approach with lower volatility, making it ideal for moderate-risk investors.

5. Investment Horizon

Although ELSS funds have a mandatory lock-in period of 3 years, they are best suited for long-term wealth creation. Staying invested beyond the lock-in period allows you to leverage the power of compounding and benefit from market cycles.

- Long-Term Advantage: Investors with a 5-10 year horizon can maximize returns by allowing their investments to grow without interruption.

- Example: Staying invested in funds like Mirae Asset Tax Saver Fund for 7+ years has shown compounded returns significantly higher than traditional fixed-income instruments.

By carefully evaluating these factors, you can choose the best tax-saving mutual funds that not only provide substantial tax benefits but also align with your long-term financial goals.

Top Tax-Saving Mutual Funds in India (2024)

Here’s a list of some of the best-performing ELSS funds in India:

| Fund Name | 3-Year Returns | 5-Year Returns | Expense Ratio | AUM (₹ Cr) |

|---|---|---|---|---|

| Axis Long Term Equity Fund | 17.2% | 12.8% | 0.74% | 34,000 |

| Mirae Asset Tax Saver Fund | 19.6% | 14.2% | 0.47% | 12,000 |

| Canara Robeco Equity Tax Saver | 18.8% | 13.5% | 0.59% | 4,500 |

| DSP Tax Saver Fund | 16.5% | 12.0% | 0.80% | 8,900 |

| Kotak Tax Saver Fund | 15.8% | 11.7% | 0.82% | 3,800 |

Data as of 2024. Past performance is not indicative of future results.

Tax Implications of ELSS Investments

1. During Investment

- Investments in ELSS are eligible for tax deductions under Section 80C, up to ₹1.5 lakh annually.

2. At Redemption

- Short-Term Capital Gains (STCG): Not applicable due to the mandatory three-year lock-in period.

- Long-Term Capital Gains (LTCG): Gains above ₹1 lakh in a financial year are taxed at 10%.

Who Should Invest in Tax-Saving Mutual Funds?

1. First-Time Investors

ELSS is a great starting point for beginners due to its dual benefits of tax savings and equity market exposure.

2. Long-Term Investors

Those with a horizon of 5-10 years can benefit from compounding and potentially higher returns compared to traditional fixed-income instruments.

3. High-Income Earners

Individuals in the higher tax brackets can maximize tax savings while aiming for wealth creation.

4. SIP Investors

ELSS funds allow SIP investments, making them ideal for salaried individuals looking to invest regularly.

Tips for Investing in ELSS Funds

- Start Early: Begin investing early in the financial year to maximize the benefit of compounding.

- Opt for SIPs: Spread your investments across the year to average out market volatility.

- Review Periodically: Although locked in for three years, evaluate fund performance annually.

- Stay Invested Post Lock-In: To realize the full potential of equity growth, consider holding the investment beyond three years.

- Diversify: Combine ELSS with other tax-saving instruments to balance risk and returns.

Conclusion

Tax-saving mutual funds, particularly ELSS, provide a perfect blend of tax efficiency and long-term wealth creation. With their shortest lock-in period and potential for high returns, they stand out as an excellent investment option for tax-conscious individuals. By choosing the right fund and staying invested, you can maximize your financial benefits while securing your future. Always evaluate your risk tolerance and consult with a financial advisor before making investment decisions.

Frequently Asked Questions

How much tax can I save by investing in ELSS?

You can claim a deduction of up to ₹1.5 lakh under Section 80C, potentially saving up to ₹46,800 in taxes annually if you fall in the 30% tax bracket.

Can I redeem ELSS funds before three years?

No, ELSS funds have a mandatory lock-in period of three years, making premature withdrawals impossible.

Are returns from ELSS taxable?

Yes, long-term capital gains (LTCG) exceeding ₹1 lakh in a financial year are taxed at 10%.

Can I invest in ELSS via SIP?

Yes, ELSS funds allow SIP investments, and each SIP installment has its own three-year lock-in period.

How is ELSS different from other mutual funds?

Unlike regular mutual funds, ELSS offers tax benefits under Section 80C and comes with a three-year lock-in period.

Is ELSS suitable for short-term goals?

No, ELSS is ideal for long-term wealth creation due to its equity exposure and mandatory lock-in period.

Your Wealth-Building Journey Starts Here