IndiGo Stock Hits New High

- 24th February 2025

Aaj Ka Bazaar

Wall Street plunged on Friday when the Dow Jones Industrial Average posted its worst day of 2025. The sell-off came after the University of Michigan released a report showing consumer sentiment in the US deteriorated by much more than previously estimated in February. Asian markets traded mixed this morning, with upcoming quarterly results from AI darling Nvidia and the Federal Reserve’s preferred readings on consumer price inflation in focus. Indian market looks set to open on a sluggish note Monday after US markets crashed on Friday amid economic slowdown worries. As we advance, continued foreign fund outflows and concerns over US President Donald Trump’s tariff stance in his second term in office may also keep investors on edge in a holiday-shortened week. On stock-specific news, Coal India has executed a non-binding shareholders’ agreement (SHA) term sheet with EDF India to form a joint venture to undertake PSP projects and other renewable energy projects in India and neighboring countries.

Markets Around Us

BSE Sensex – 74,568.86 (-0.99%)

Nifty 50 – 22,573.90 (-0.97%)

Bank Nifty – 48,432.25 (-1.12%)

Dow Jones – 43,617.47 (0.44%)

Nasdaq – 19,533.49(-2.15%)

FTSE – 8,659.37 (-0.04%)

Nikkei 225 – 38,776.94 (0.00%)

Hang Seng – 23,289.17 (-0.81%)

Sector: Airline

InterGlobe Aviation Shares Rally Continues

InterGlobe Aviation (IndiGo) shares continued their upward streak for the sixth day, rising to ₹4,543, marking a 7% gain. Citi analysts raised their target price to ₹5,200 and maintained a positive outlook due to rising air traffic and IndiGo’s strong market share. Increased passenger traffic to Uttar Pradesh airports for Maha Kumbh has boosted demand. Despite Q3 profit falling 18% YoY to ₹2,449 crore, revenue grew 14% to ₹22,111 crore, driven by a 12% rise in available seat kilometers and a 13.5% increase in revenue passenger kilometers. Higher operational costs pushed up non-fuel costs by 23.1% YoY, impacting margins, though EBITDAR grew 10.7% to ₹6,059 crore. Jefferies also raised its target price to ₹5,260, citing IndiGo’s dominant 60% market share and capacity expansion while competitors face constraints. This, along with rival airlines’ higher cost structures, strengthens IndiGo’s market position and pricing power.

Why it Matters:

IndiGo’s strong market position and rising air traffic demand make it a key player in the aviation sector, attracting positive outlooks from analysts. Despite cost pressures, its capacity expansion gives it an edge over competitors, supporting long-term growth. The stock’s upward momentum and revised target prices indicate strong investor confidence.

NIFTY 50 GAINERS

DRREDDY– 1167 (1.32%)

EICHERMOT – 5013.75 (1.03%)

M&M – 2689.75 (0.76%)

NIFTY 50 LOSERS

WIPRO – 296.45 (-3.23%)

HCLTECH – 1652.1 (-2.86%)

INFY – 1773.45 (-2.29%)

Secto: IT Enabled Services

IT Stocks Drop on US Slowdown Fears

IT stocks fell sharply on February 24 as concerns over a slowing US economy led to heavy selling, particularly in export-dependent firms like L&T Technology Services and Persistent Systems, which dropped up to 5.5%. US consumer sentiment hit a 15-month low, inflation expectations rose due to proposed tariffs, and business activity declined, raising fears of stagflation—slow growth with rising prices. This weak outlook impacts Indian IT companies, which rely on the US for a major share of revenue. By 10:45 AM, the Nifty IT index was down 2.5%, making it the worst-performing sector. Global uncertainty has also triggered foreign investors to pull out ₹36,977 crore from Indian equities in February, though domestic institutional investors have stepped in, buying ₹42,601 crore worth of shares. With fears of stagflation reducing foreign investment appeal, Indian IT firms face short-term pressure despite their long-term growth potential.

Why it Matters:

A weakening US economy and rising inflation fears could slow demand for Indian IT services, impacting revenue and profitability. Stagflation concerns make emerging markets like India less attractive to foreign investors, leading to potential outflows. This puts pressure on IT stocks in the short term, affecting market sentiment and valuations.

Around the World

Most Asian stocks fell on Monday, tracking Wall Street’s decline due to concerns over a slowing U.S. economy and new trade tariffs. Tech stocks in Hong Kong paused their rally ahead of Nvidia’s key earnings, with major suppliers like SK Hynix and TSMC dropping. Alibaba limited losses after announcing a $52 billion AI investment. Australia’s ASX 200 struggled after five losing sessions but saw some recovery in bank stocks. Software firm Wisetech plunged 23% after board resignations, while Block Inc dropped 10% on weak earnings. Falling commodity prices dragged down BHP and Rio Tinto. Japan’s markets were quiet due to a holiday, but Nikkei 225 futures rose 0.4%. China’s stocks dipped slightly after strong AI-driven gains last month. Meanwhile, India’s Nifty 50 futures pointed to a positive start, as local stocks looked set for bargain buying after a prolonged selloff. Markets remain cautious ahead of key economic data and Nvidia’s earnings.

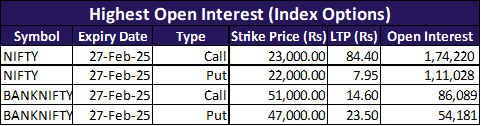

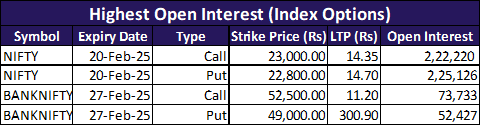

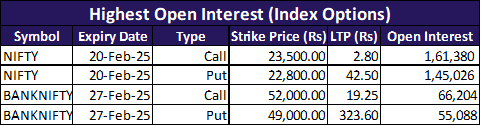

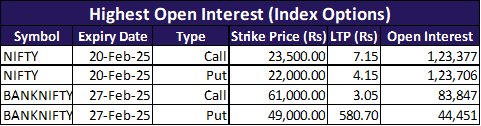

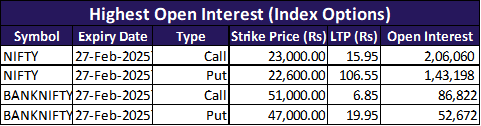

Option Traders Corner

Max Pain

Nifty 50 – 22578.25

Bank Nifty – 48427.15

Nifty 50 – 22812.4 (Pivot)

Support – 22703, 22,611, 22,503

Resistance – 22,904, 23,013, 23,105

Bank Nifty – 49017.25 (Pivot)

Support – 48,727, 48,474, 48,185

Resistance – 49,270, 49,559, 49,813

Have you checked our latest YouTube Video

Did you know?

India's Mutual Fund Industry Sees 40% Growth

The total equity assets under management of India’s domestic mutual fund industry reached ₹33.4 trillion in 2024, marking a 40% increase compared to the previous year, according to Motilal Oswal’s Fund Folio Report.