Railtel Secures ₹28 Cr Deal

- 10th March 2025

Aaj Ka Bazaar

Asian markets traded mixed this morning, with the Hang Seng slipping into negative territory, pressured by ongoing trade war concerns. In contrast, the Nikkei rebounded strongly after a flat opening. Initially, market sentiment was subdued due to worries over a stronger yen. However, optimism gradually returned, supported by positive cues from Western markets. On Friday, U.S. indices closed higher after Federal Reserve Chair Jerome Powell reaffirmed that the labor market remains strong and inflation is on track toward the Fed’s 2% target. Meanwhile, domestic indices are expected to open on a cautious note, reflecting the mixed global trends. Market participants are likely to remain cautiously optimistic following last week’s recovery.

Markets Around Us

BSE Sensex – 74,444.90 (0.15%)

Nifty 50 – 22,586.00 (0.15%)

Bank Nifty – 48,513.55 (0.03%)

Dow Jones – 42,656.97 (-0.34%)

Nasdaq – 18,212.81 (0.79%)

FTSE – 8,679.88 (-0.03%)

Nikkei 225 – 37,052.42 (0.46%)

Hang Seng – 23,783.28 (-1.84%)

Sector: Telecom

RailTel Surges 3% on ₹28.29 Cr Order

Railtel Corporation of India’s share price continued to rise for the fifth straight day, gaining 3% after securing a ₹28.29 crore work order from Northern Railway. By 9:18 AM, the stock was trading at ₹307.30, up 2.93% on the BSE. The order involves indoor and outdoor double distant signaling work, set to be completed by September 6, 2026. The company’s board will meet on March 12, 2025, to consider a second interim dividend for FY 2024-25 and set a record date for eligible shareholders. Recently, Railtel also secured major contracts, including a ₹262.33 crore project from Odisha’s State Transport Authority, a ₹19.08 crore order from the Border Security Force, and a ₹47.50 crore project from East Central Railway. In Q3 FY24, the company’s net profit grew 5% to ₹65 crore, while revenue increased 14.8% year-on-year to ₹767.6 crore.

Why it Matters:

Railtel’s continued stock rally reflects strong investor confidence, driven by a series of high-value contracts across railway and defense sectors. The company’s expanding order book strengthens its revenue potential, positioning it as a key player in India’s infrastructure growth. With an upcoming board meeting to decide on an interim dividend, investors have an additional incentive to stay invested, making Railtel a stock to watch in the coming months.

NIFTY 50 GAINERS

POWERGRID– 269.95 (2.53%)

BAJFINANCE – 8593.10 (2.24%)

BEL – 282.28 (1.91%)

NIFTY 50 LOSERS

INDUSINDBK – 904.15 (-3.48%)

M&M – 2674.00 (-1.97%)

BAJAJ-AUTO – 7452.95 (-1.61%)

Sector: Pharmaceuticals

Sun pharma Acquires Checkpoint for $335M

Sun Pharma, India’s largest pharmaceutical company by revenue, is acquiring Nasdaq-listed Checkpoint Therapeutics for $355 million (over ₹3,000 crore) in an all-cash deal at $4.10 per share, a 66% premium to Checkpoint’s last closing price. Checkpoint specializes in immunotherapy and oncology treatments, including UNLOXCYT, an FDA-approved drug for advanced skin cancer. This acquisition strengthens Sun Pharma’s oncology portfolio and expands its presence in the high-margin specialty pharma market, particularly in the U.S. market, a key revenue driver. The deal is pending shareholder and regulatory approvals and is expected to close by Q2 2025. Checkpoint reported a revenue of $0.04 million, a net loss of $27.3 million, and an R&D expense of $19.3 million for the nine months ending September 2024. This move follows Sun Pharma’s $576 million acquisition of Concert Pharma in 2023, reinforcing its expansion strategy in dermatology and oncology. Sun Pharma’s market cap stands at ₹3.86 lakh crore.

Why it Matters:

Sun Pharma’s acquisition of Checkpoint boosts its oncology portfolio and strengthens its foothold in the high-margin U.S. specialty pharma market. The 66% premium highlights its aggressive expansion strategy in cancer treatment. With regulatory approvals pending, this deal could enhance Sun Pharma’s long-term growth and market position.

Around the World

Asian stock markets showed mixed trends on Monday as investors remained cautious due to concerns over U.S. tariffs. President Trump imposed a 25% tariff on Canadian and Mexican goods and raised Chinese tariffs to 20%, though he later delayed some for four weeks. U.S. stock futures dropped after Wall Street ended lower last week. In Asia, South Korea’s KOSPI rose 0.6%, the Philippines’ PSEi gained 0.7%, and Japan’s Nikkei 225 added 0.7%, while China’s markets fell sharply. The Shanghai Composite dropped 0.6%, the CSI 300 fell 0.8%, and Hong Kong’s Hang Seng slumped 1.7%. New data showed China’s inflation is weakening, with consumer prices falling 0.7% in February, the first drop in 13 months, and producer prices declining 2.2%. These deflationary signs could push China’s policymakers to introduce more stimulus measures to boost economic growth and consumer spending, especially amid ongoing discussions at the National People’s Congress.

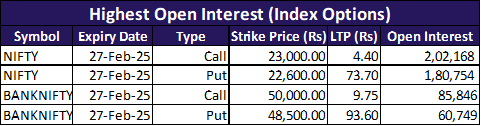

Option Traders Corner

Nifty 50 – 22550

Bank Nifty – 48900

Nifty 50 – 22550 (Pivot)

Support – 22,466, 22,381, 22,297

Resistance – 22,635, 22,719, 22,805

Bank Nifty – 48521 (Pivot)

Support – 48,334, 48,172, 47,985

Resistance – 48,684, 48,871, 49,034

Have you checked our latest YouTube Video

Did you know?

India’s Retail Investor Surge: Market Participation Hits Record Highs in 2024

India’s stock market has seen a 36% rise in retail participation, with over 50 million investors active by 2024. This surge is driven by increased financial literacy, digital trading platforms, and government initiatives. Systematic Investment Plans (SIPs) have also gained popularity, with monthly contributions hitting ₹14,000 crore in early 2025. These trends reflect growing confidence in India’s equity markets.